[ad_1]

bluejayphoto/iStock by way of Getty Pictures

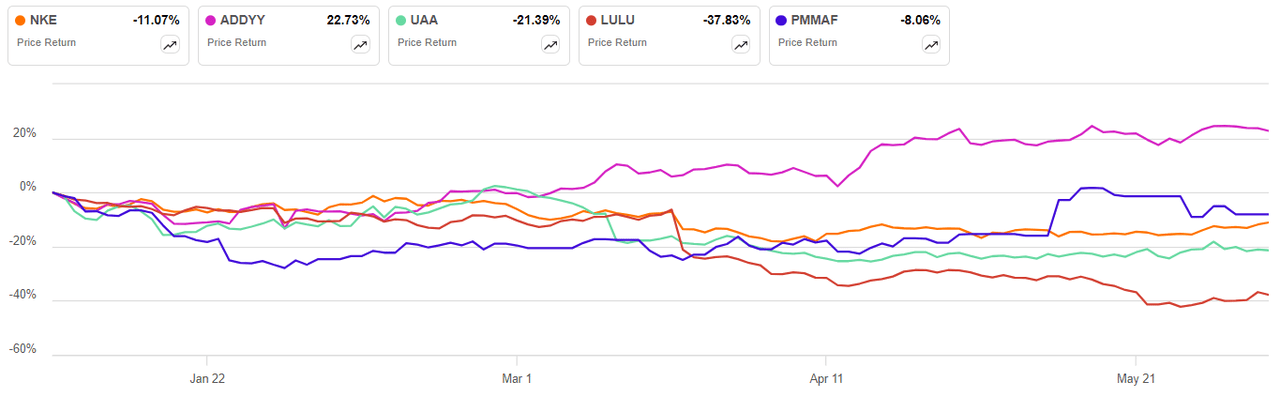

The European soccer championships will start on June 14 in Germany to kick off what might be an enormous summer time for main sports activities occasions in Europe, with the Paris Olympics set to begin on July 26. The timing of the Euros and the Olympics is essential for the sports activities attire sector, which has been struggling in 2024 with the notable exception of Adidas (OTCQX:ADDYY).

“The trade is closely depending on the economic system and consumption,” warned Baader Financial institution dealer Marc Richter. Luckily, the Euros and the Olympics have supplied financial and quarterly earnings boosts previously.

A powerful displaying by France in main tournaments previously has boosted Nike’s (NYSE:NKE) quarterly gross sales in Europe. For the 2024 Euros, Nike (NKE) is sponsoring France, Croatia, Slovenia, England, Turkey, Portugal, Slovakia, Poland, and the Netherlands. Adidas (OTCQX:ADDYY) is sponsoring host nation Germany, Scotland, Hungary, Spain, Italy, and Belgium. In the meantime, Puma (OTCPK:PMMAF) is sponsoring Switzerland, Serbia, Czech Republic, and Austria. If there may be to be a breakout sponsor star on the Euros, look ahead to Italian sportswear model Macron, Spanish sports activities model Joma Sport S.A., and German-Danish firm Hummel Worldwide. Macron is sponsoring Albania and Georgia, whereas Joma is sponsoring each Romania and Ukraine, and Denmark’s workforce will put on kits from Hummel. U.S. corporations Lululemon (LULU) and Below Armour (UAA) won’t have an enormous presence on the Euros, however have positioned their advertising and marketing campaigns strategically to remain related forward of the Olympics blitz. On Holding (ONON) will even be a serious participant this summer time and created some buzz final week by signing Zendaya as a model ambassador.

The Euros can have an effect on different corporations exterior the sports activities attire sector. Digital Arts (EA) has benefited previously from a burst of soccer curiosity within the U.S. throughout and following the event. Beer giants Heineken N.V. (OTCQX:HEINY), Carlsberg AS (OTCPK:CABGY) (OTCPK:CABJF), and Anheuser-Busch InBev (BUD) are all anticipated to see a summer time increase, particularly if the climate in the course of the Euros cooperates. “If you happen to get the type of Goldilocks situation of an exquisite summer time, England enjoying Italy within the finals, or England versus France, that may, in fact, be fairly useful to the trade,” acknowledged Barclays analyst Laurence Whyatt.

Sports activities betting corporations on either side of the Atlantic will even get an apparent increase as a result of Euros and Olympics being simply once-every-four 12 months occasions that may prop up the year-over-year income comparisons when earnings stories roll out. A number of the corporations that might profit from greater quantity, embrace Flutter Leisure (NYSE:FLUT), Entain (OTCPK:GMVHF), Evoke plc (OTCPK:EIHDF), Bettson (OTCPK:BTSBF), Bet365, Kindred Group (OTC:KNDGF), Tremendous Group’s (SGHC) Betway, DraftKings (DKNG), and BetMGM (MGM) (OTCPK:GMVHF). Aspect bets for buyers on sports activities betting embrace Genius Sports activities (GENI), Evolution AB (OTCPK:EVVTY), and Sportradar (SRAD). The Roundhill Sports activities Betting & iGaming ETF (BETZ) is a catch-all sports activities betting ETF.

What about Germany?

A key query with the Euros is all the time the financial affect of internet hosting the event. Deutsche Financial institution estimated that internet hosting is usually price a 0.1% proportion level increase to quarterly GDP, however the impact might be bigger and extra persistent this 12 months if Germany repeated one thing akin to the Sommermärchen story of the 2006 World Cup, when it hosted and made the semi-finals. “Importantly, nevertheless, the affect of a profitable sporting occasion might go effectively past the direct spending associated to the event itself if it boosts sentiment in a rustic, whether or not the host nation or some other collaborating nation,” highlighted DB analyst Robin Winkler. Presently, adjusted for some British bias with the most important bookmakers, Germany is given a roughly 15% to twenty% likelihood of constructing the ultimate and boosting native sentiment alongside the way in which. Some Germany-focused ETFs embrace iShares MSCI Germany ETF (NYSEARCA:EWG), New Germany Fund (GF), First Belief Germany AlphaDEX Fund ETF (FGM), First Belief Germany AlphaDEX Fund ETF(DAX), and Franklin FTSE Germany ETF (FLGR).

Extra on Euros-related shares

[ad_2]

Source link