[ad_1]

Matteo Colombo/DigitalVision through Getty Pictures

Funding Thesis

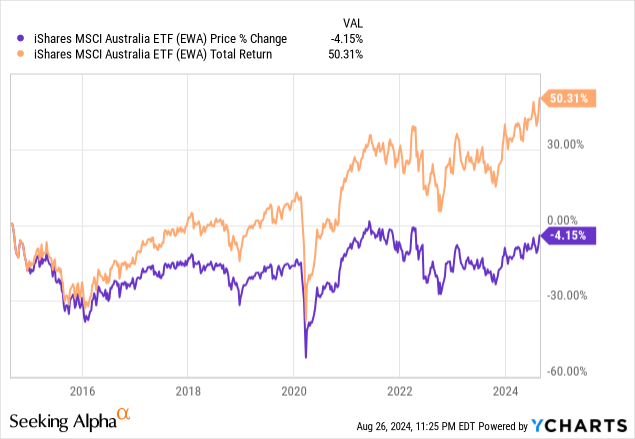

iShares MSCI Australia ETF (NYSEARCA:EWA) owns a portfolio of about 60 Australian shares. The fund mainly tracks the MSCI Australia index. The fund’s expense ratio of 0.5% is pricey relative to different ETFs that focuses on Australian market. For instance, Franklin FTSE Australia ETF (FLAU) solely has an expense ratio of 0.07%. EWA had lackluster efficiency up to now few years. Earnings development additionally doesn’t look like very robust. Given its wealthy valuation relative to its historic valuation, we expect traders might wish to wait on the sidelines.

YCharts

Fund Evaluation

Lackluster efficiency up to now 3 years

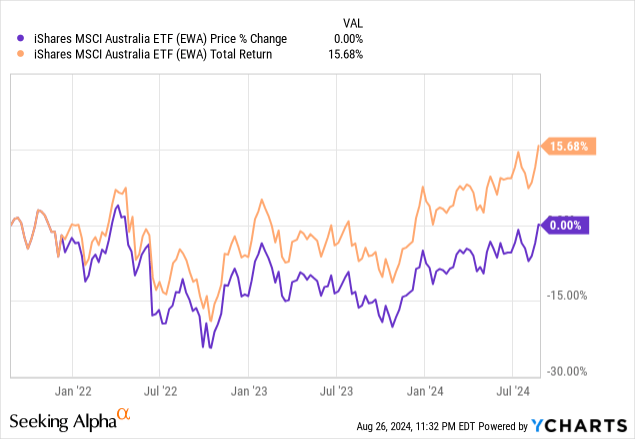

Allow us to first overview how EWA has carried out up to now few years. The fund has reached its cyclical excessive in mid-2021 and declined till it bottomed-out in October 2022. Its fund worth has since steadily walked out of the underside. Nonetheless, in contrast to the S&P 500 index that has surpassed its earlier excessive, EWA’s fund worth has but to achieve the cyclical excessive reached in mid-2021. Its return up to now 3 years was lackluster, delivering a worth return of 0%. Even when together with dividends, its whole return was solely 15.7%. This was a lot decrease than the S&P 500 index’s worth return of 25.7% and whole return of 32.1% up to now 3 years.

YCharts

Low publicity to expertise sector however increased publicity to supplies sector

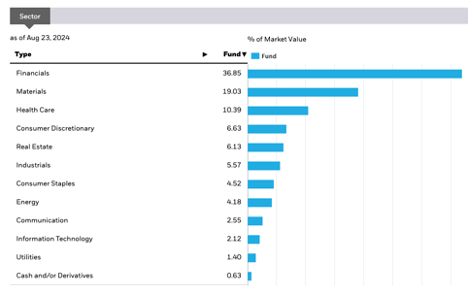

Allow us to now take a look at EWA’s sector allocation. The fund’s largest sector by weighting is the financials sector, which represents about 36.9% of the entire portfolio. That is adopted by supplies sector of 19.0%. In distinction, supplies sector solely represents about 2.2% of the S&P 500 index. EWA’s increased publicity to supplies sector is no surprise, as sources export symbolize about 62.5% of Australia’s whole exports.

iShares

EWA’s comparatively increased publicity to supplies sector is probably going going to face headwinds at the very least within the near-term. It’s because a big chunk of Australia’s pure sources exports to China. In actual fact, China is Australia’s largest market by export and represents about 32.4% of Australia’s export in accordance with Reserve Financial institution of Australia. As many might know, China’s economic system has been fairly weak up to now few years attributable to poor demand and housing bubble. Subsequently, the nation’s demand for pure sources is fairly weak now. It’s probably that Australia’s supplies sector will likely be closely impacted and will proceed to stay weak within the close to time period.

Apart from supplies sectors, EWA has a low publicity to fast-growing sectors equivalent to info expertise sector. As may be seen from the desk above, info expertise sector solely represents about 2.1% of EWA’s whole portfolio. In distinction, this sector represents about 31.5% of the S&P 500 index. That’s almost one-third of the index.

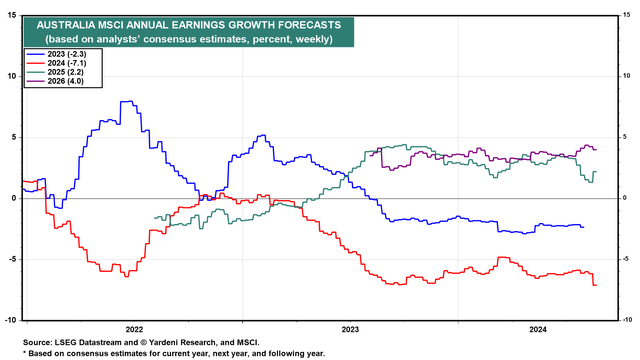

Low-single digit earnings development outlook

The consequence of EWA’s increased publicity to supplies sector and decrease publicity to info expertise sector has resulted in decrease earnings development forecasts. Under is a chart that exhibits the consensus earnings development forecasts for MSCI Australia index. Since EWA tracks this index, it provides us an excellent clue of the earnings development outlook for shares in EWA’s portfolio. As may be seen from the chart under, consensus earnings development for shares in EWA’s portfolio is predicted to say no by 7.1% this 12 months. The forecast for 2025 and 2026 are anticipated to be higher however nonetheless within the low-single digits, delivering constructive development of solely 2.2% and 4.0% respectively.

Yardeni Analysis

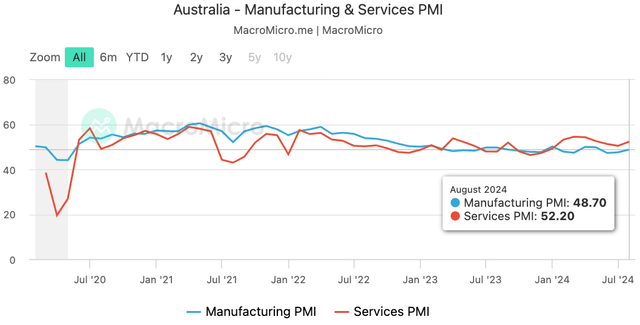

From a macroeconomic perspective, as may be seen from the chart under, Australia’s manufacturing PMI is now 48.7, and its companies PMI is 52.2. For reader’s info, PMI is a ahead main indicator of the economic system. A studying above 50 normally implies that the economic system will probably broaden within the subsequent few months to come back. In distinction, a studying under 50 implies that the economic system will probably contract. As may be seen within the chart under, again within the first half of 2021, Australia’s companies and manufacturing PMI had been effectively above 55. Subsequently, Australia’s economic system remains to be looking for its footing at this second.

MacroMicro

Valuation not low-cost

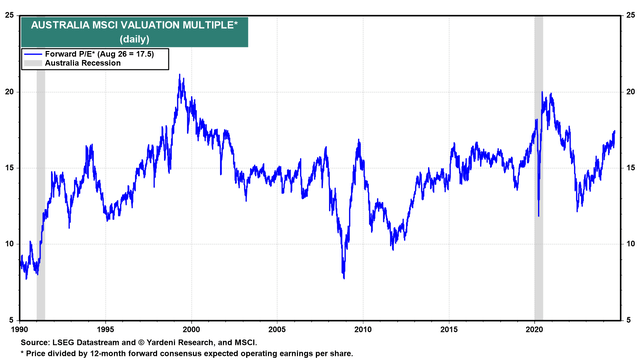

Allow us to now take a look at EWA’s valuation. The fund presently trades at a ahead P/E ratio of 17.5x. As may be seen from the chart under, EWA’s valuation a number of has sometimes commerce within the vary of 10x and 18x. The median valuation is round 14~15x. Subsequently, its present ahead P/E ratio of 17.5x is in direction of the excessive finish of the valuation vary. Subsequently, we expect EWA will not be low-cost however costly.

Yardeni Analysis

Watch out for forex danger

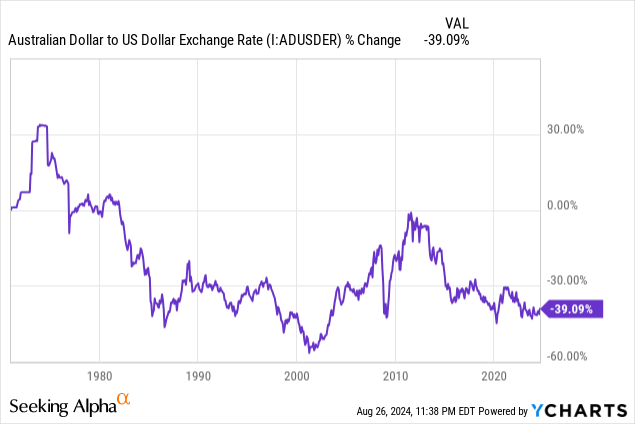

Buyers of EWA want to pay attention to overseas trade dangers as shares in EWA’s portfolio trades in Australia greenback. As may be seen from the chart under, the trade fee between Australian greenback and U.S. greenback can fluctuate fairly a bit. In actual fact, since 2011, Australian greenback has depreciated in worth by over 39%. This could impression EWA’s fund worth instantly.

YCharts

Investor Takeaway

Since EWA’s earnings development outlook is predicted to be within the low single-digits within the subsequent few years, we’re unable to grant it a purchase ranking. Buyers might wish to wait on the sidelines.

[ad_2]

Source link