[ad_1]

Editor’s notice: Searching for Alpha is proud to welcome Menlo Analysis as a brand new contributing analyst. You possibly can turn into one too! Share your finest funding concept by submitting your article for overview to our editors. Get revealed, earn cash, and unlock unique SA Premium entry. Click on right here to seek out out extra »

banjongseal324

Funding Thesis

I’m recommending a Maintain score for Quick Retailing Co. (OTCPK:FRCOY), which is the mother or father firm of Uniqlo. There are lots of tailwinds for Uniqlo on this present financial system, as the corporate is poised to profit from its means to supply prime quality/low value merchandise, in addition to its efficiencies from know-how and scale. The corporate has additionally carried out very effectively within the current quarter, with strong income progress alongside significant margin growth. Regardless of these positives, I discover that the inventory’s valuation is truthful based mostly alone DCF evaluation. Consequently, I like to recommend buyers to HOLD and wait till the valuation improves from present ranges.

Firm Overview

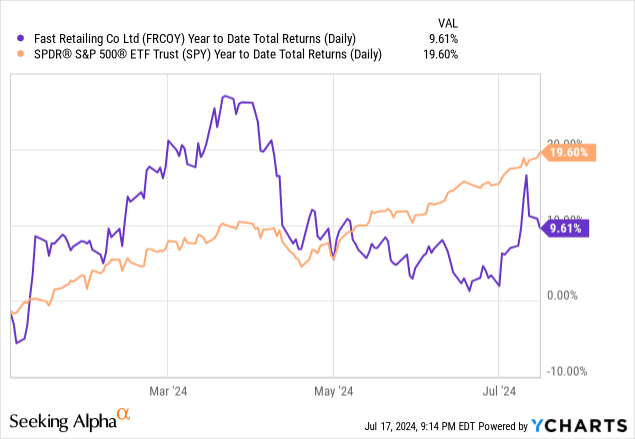

Quick Retailing’s Uniqlo is a Japanese clothes model launched by Tadashi Yanai on June 2nd, 1984 with the mission of constructing high-quality clothes extra sustainable. Uniqlo works in an area with different massive quick style retailers akin to Zara, Hole, H&M (OTCPK:HNNMY), Abercrombie & Fitch (ANF), and lots of extra. Quick Retailing sells a variety of clothes, together with shirts, shorts, pants, denims, outerwear, and so on. Uniqlo is now a global clothes model, with merchandise bought in lots of international locations all over the world. Quick Retailing has underperformed the S&P 500 index because it has solely returned ~9.6% YTD, whereas the general market has returned 19.6% in that time-frame.

Enterprise Drivers

The primary aggressive benefit of Quick Retailing is its value level. Quick Retailing has reasonably priced pricing in terms of the clothes they promote. The cheaper price level doesn’t point out low-quality clothes; slightly, it’s fairly the other – their shirts and denims are each 100% cotton, and a few denims are even prime quality Japanese selvedge. As mentioned on this article, Quick Retailing’s give attention to timeless classics which can be reasonably priced and have prime quality helps the corporate differentiate from a few of its competitor within the trade. In different phrases, Quick Retailing gives prime quality for a low value by its capability for mass manufacturing and product lineup that focuses on the fundamentals and minimalist designs.

Quick Retailing additionally does an important job in bettering the shopper expertise by know-how and innovation. For instance, Quick Retailing has a technologically superior product checkout, implementing RFID chips into their system. These chips velocity up the general course of to take a look at numerous gadgets. Together with the brand new RFID system, Quick Retailing can also be working towards attempting to make buying at their shops really feel like a well-recognized expertise, just like Costco (COST) or Ikea. Administration added a espresso store to their flagship Tokyo location and in Europe, sure shops promote garments which can be produced from pure supplies to adapt to the preferences of European prospects who favor extra pure and environmentally pleasant merchandise.

Quarterly Replace (i.e. Q3, 2024 Replace)

Q3 2024 Presentation

Quick Retailing lately introduced its FY2024 Q3 Outcomes, and its monetary efficiency was admirable as the corporate was capable of enhance its monetary efficiency on a year-over-year foundation. Evaluating “March – Could 2024” to “Could – March 2023”, Quick Retailing has grown their income at a good 13.5% YoY fee, however most notably, the corporate was capable of enhance its profitability much more as gross revenue soared at practically a 19.1% YoY fee. I discover that these outcomes are an indicator of Quick Retailing’s means to develop its backside line at a profitable fee regardless of a few of the unsure Japanese financial circumstances. As well as, this efficiency is a lot better than the typical progress fee anticipated within the U.S. quick style market (~5.5%). Given the corporate’s place within the high-quality/lower-price phase, my view is that the corporate might be protected towards an financial downturn and can profit from pricing energy/margins in an inflationary surroundings.

Enterprise Segments

Quick Retailing’s worldwide and Japan segments are fascinating tendencies to notice. Specifically, the Worldwide Division has seen a 28.5% YoY progress in its income, all whereas solely including ~3% extra shops (+49) in that very same time-frame. Now, gross sales in its Worldwide phase makes up greater than half of the corporate’s web gross sales, and this portion will possible proceed to extend because the variety of shops enhance and gross sales proceed to broaden at a better tempo.

Valuation

DCF Valuation Mannequin

I carried out a DCF valuation in Japanese Yen to derive the worth of the inventory after which decide the worth of the inventory again in USD. I conservatively based mostly my assumptions of money move progress fee to the 5 yr CAGR of money move progress (8.9%) prior to now 5 years. This progress fee appears cheap given the attractiveness of its prime quality, low value choices, enhancements in know-how, and the continual expansions in margins as mentioned above. A terminal progress fee of two% was chosen based mostly on a conservative assumption that the inventory will proceed to develop according to the anticipated long-term inflation purpose of two%. The upside potential is proscribed in comparison with its present share value.

Dangers

Foreign money Threat

As a Japanese inventory, Quick Retailing share value is topic to foreign money dangers as trade charges change with the USD and the Japanese Yen, which might impression Uniqlo’s monetary positive factors and losses. Most lately, the Yen strengthened unexpectedly as a result of BOJ resolution to hike charges, although now BOJ appears to be strolling again that assertion. Foreign money danger can go both means: if the Japanese Yen weakens then, Quick Retailing could make extra revenue in Yen from its exports and be extra aggressive overseas, and if the Japanese Yen strengthens, its Yen income will decline. Over the previous 3 years, the Japanese Yen has been declining in worth towards the greenback, and such tendencies stay possible for the foreseeable future and don’t pose instant danger to the enterprise.

Logistics Threat

One other danger that Quick Retailing faces is logistics danger that stems from fluctuations in costs of essential inputs due adjustments in manufacturing; for instance the manufacturing of cotton has been on the decline as a consequence of local weather change and drought and this has been pushing the costs of such vital inputs increased. Since cotton is such an vital a part of Quick Retailing’s clothes lineup, increased cotton costs will impression profitability or drive Quick Retailing to boost costs. I imagine that this danger can largely be mitigated by the truth that Quick Retailing is among the largest quick style retailers, and its scale will restrict the impression of upper enter prices in comparison with a few of the smaller corporations.

Suggestion / Conclusion

Regardless of the tailwinds, I like to recommend a “Maintain” to Quick Retailing Co. because the valuation stays truthful and higher danger/reward propositions will be discovered elsewhere. I imagine Quick Retailing is price watching because the enterprise is rising yearly, and Uniqlo is sort of effectively protected against potential dangers regarding logistics and foreign money. Appropriately, I’ll proceed to comply with any new updates concerning Quick Retailing, and can present readers rankings adjustments based mostly on them.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link