[ad_1]

marketlan/iStock through Getty Photos

Introduction

Most of my articles are about “large image” developments. I am not solely doing this to make use of them as a basis for inventory picks but additionally as a result of I imagine that discussing main developments is usually extra vital than discussing particular person inventory picks.

I additionally wish to present worth for individuals who might not like my inventory picks to have information for their very own inventory choice.

Some big-picture developments we now have continuously mentioned are (some greater than others):

The power bull case. Synthetic intelligence. A top-heavy S&P 500. Inflation. Provide chain re-shoring. Biden/Biden picks. Inexperienced transition.

Evidently, a variety of these matters are ultimately associated. This contains the affect of synthetic intelligence on power demand and the composition of the S&P 500, which is one thing I wish to focus on on this article.

The S&P 500 simply exited the primary half of this 12 months. It returned 14%, which is the second-best first-half efficiency this century.

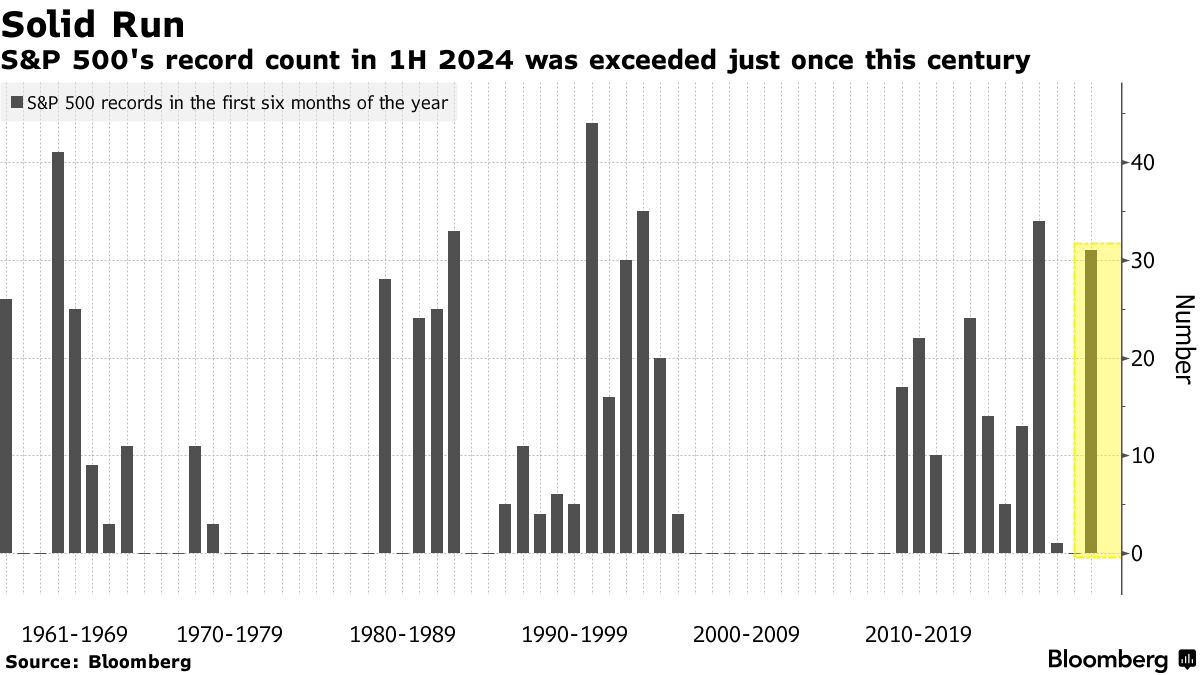

Talking of this century, the variety of report highs (31) within the first half of this 12 months can be the second-highest quantity this century.

Bloomberg

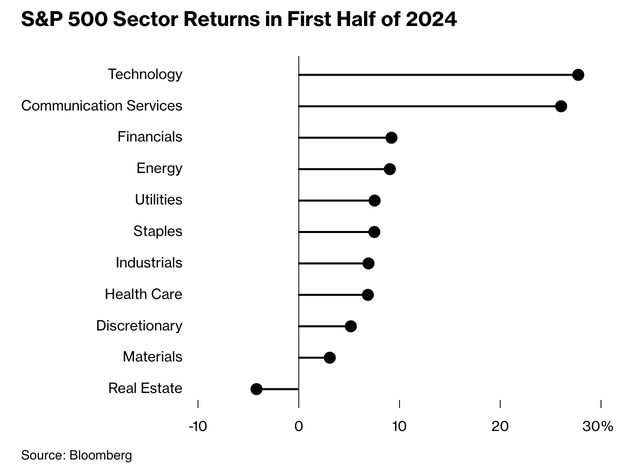

For the reason that lows on October 12, 2022, the market has added $16 trillion in worth, most of it coming from expertise and communications companies. The identical goes for the primary six months of this 12 months.

Bloomberg

What’s attention-grabbing is Nvidia (NVDA) was an enormous outlier, including greater than 200 factors to the S&P 500 within the first half, with various “large guys” including greater than 40% year-to-date.

Bloomberg

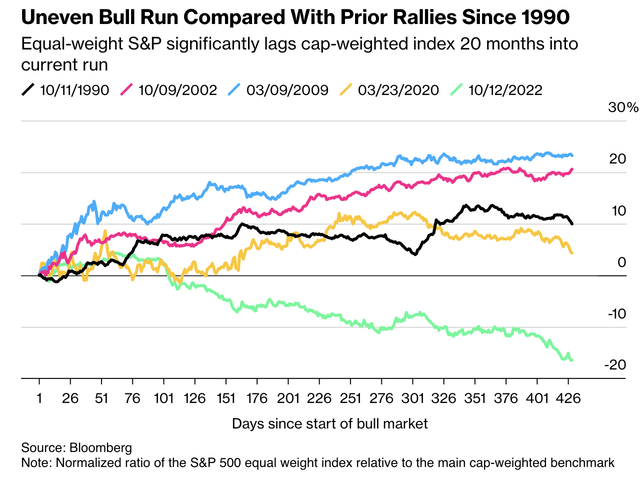

Whereas that is nice for individuals who merely personal the S&P 500, it has created a really uncommon scenario, because the equal-weight S&P 500 has underperformed the market-weighted S&P 500 (the “regular” S&P 500) by the widest margin within the first six months of a 12 months ever.

That is what the underperformance of the equal-weighted S&P 500 in comparison with the S&P 500 since October 12, 2022, seems to be like:

Bloomberg

As of June 27, the most important six corporations within the S&P 500 account for 31.4% of the S&P 500!

These corporations are Microsoft (MSFT), Apple (AAPL), Nvidia, Amazon (AMZN), Meta Platforms (META), and Alphabet (GOOGL).

What do these corporations have in widespread?

All of them have changed into AI performs.

Do not get me fallacious, I am not “hating” on these corporations. All of them have phenomenal merchandise, pristine steadiness sheets, and vibrant futures.

The issue I see is diversification. The S&P 500’s objective is to supply diversified publicity. Proper now, it has changed into an AI play, with most sectors lagging behind.

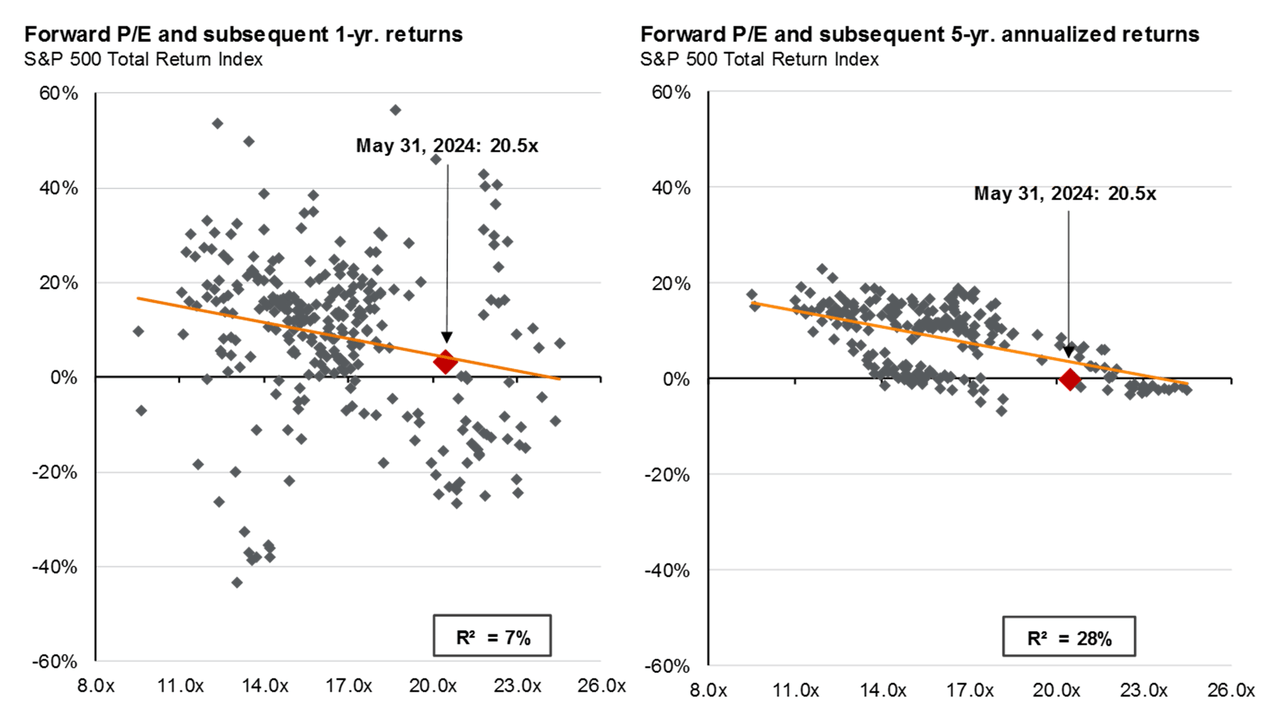

If the AI rally runs into bother, the S&P 500 is probably going poised to underperform – particularly as a result of it’s now valued at 21x earnings, indicating subdued returns within the years forward (see the chart under).

JPMorgan

Once more, I am not making the case the AI rally is over. That is merely a danger/reward evaluation. As a lot as I imagine AI enthusiasm was justified, it is not one thing that may final without end, particularly as a result of expectations at the moment are sky-high.

Nonetheless, this doesn’t imply the common investor is now a excessive probability of subdued returns within the years forward.

As a result of the S&P 500’s surge was primarily fueled by tech, a variety of corporations have been left within the mud – typically with nice valuations and potential.

On this article, I will current three dividend shares that every one commerce at very enticing valuations, have nice enterprise fashions, and include both excessive revenue or constant dividend progress.

I personal certainly one of them and have the opposite two on my watchlist.

Norfolk Southern (NSC) – A Struggling Large With Super Potential

Norfolk Southern was one of many first dividend shares I purchased, as I wished to personal an organization with a great dividend progress observe report, an ultra-wide moat, and the flexibility to learn from secular progress like financial re-shoring.

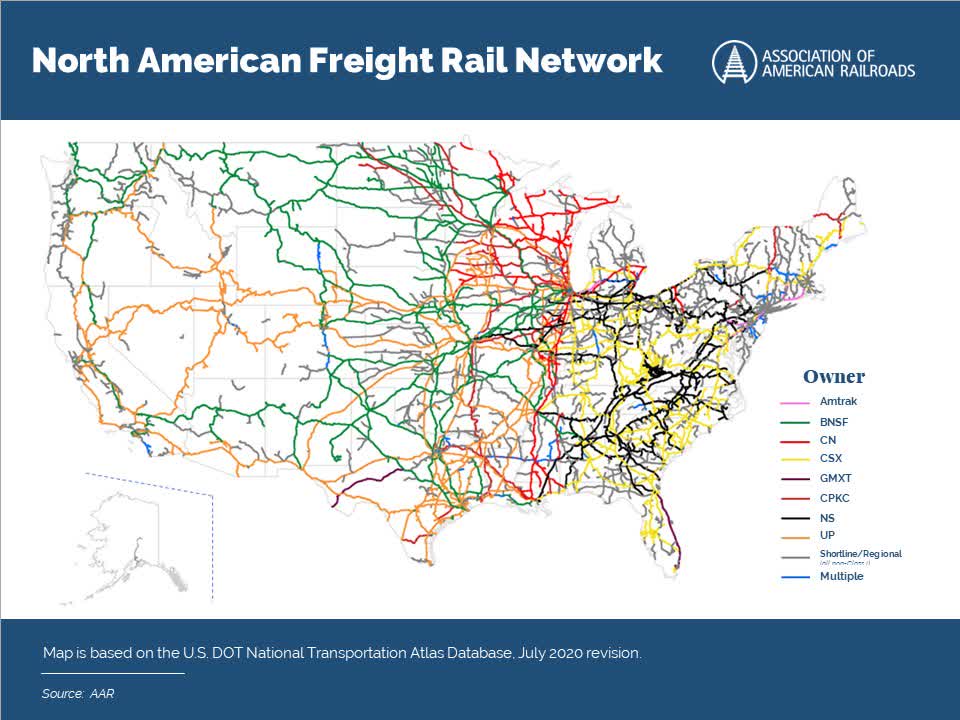

Concerning its moat, headquartered in Atlanta, Georgia, Norfolk Southern is certainly one of America’s largest Class I railroads, which enjoys a duopoly with its peer CSX Corp. (CSX) within the Jap third of america.

Affiliation of American Railroads

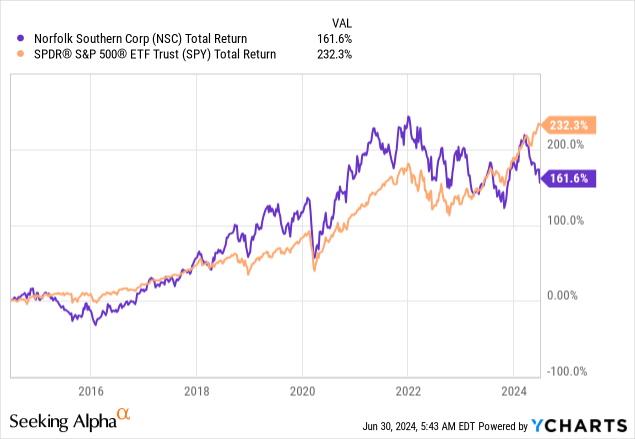

Due to its dominant place, it enjoys a really large moat, which is without doubt one of the explanation why it has persistently outperformed the S&P 500 and most non-rail transportation friends.

Sadly, the corporate’s inventory has been lackluster since early 2022, when it began to come across various headwinds, together with weaker financial progress, falling client sentiment (NSC is a serious intermodal railroad), a derailment in East Palestine, Ohio, and ongoing working challenges.

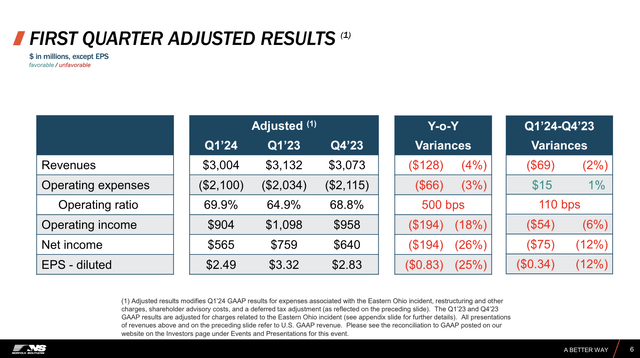

In different phrases, the corporate has considerably misplaced its approach, which was mirrored in poor 1Q24 earnings, when the corporate reported 2% decrease revenues, 1% increased bills, and 6% decrease working revenue – adjusted for the East Palestine derailment.

Norfolk Southern Company

It now has an working ratio of 69.9%, which is a horrible outcome.

With that mentioned, I’m a purchaser of NSC, as I’m a giant fan of shopping for undervalued shares with turnaround potential – particularly in essential provide chains.

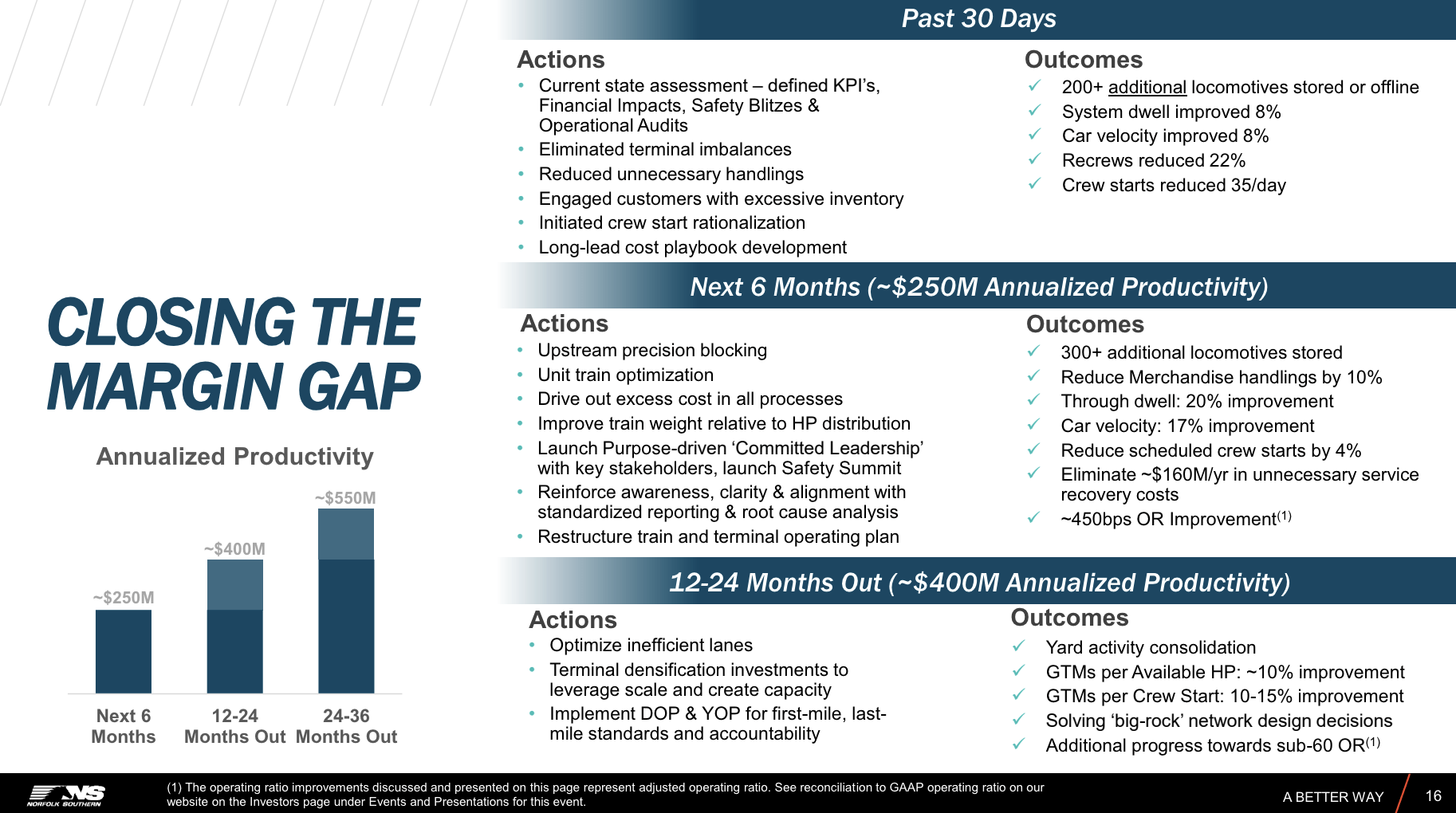

Pressured by activist traders, NSC is working exhausting to show its enterprise round, which incorporates reducing prices and enhancing rail operations.

Our technique is designed to reflect the nice success tales of the Canadian railroads who’ve acknowledged that PSR is about greater than tearing a railroad all the way down to its studs at slashing prices whatever the fallout. As our Board member, Claude Mageau demonstrated when he was CEO of Canadian Nationwide, a PSR working mannequin, when a part of a customer-focused balanced technique, can ship top-tier income progress and a sub-60 working ratio. – NSC 1Q24 Earnings Name

Norfolk Southern Company

If the corporate is ready to decrease its working ratio to 66% by the tip of this 12 months, it might massively enhance investor confidence.

As we flip to the steadiness of the 12 months, we are going to see our margins enhance materially from right here. We’re lastly beginning to see extra service prices unwind and they’re going to speed up downward in Q2. That trajectory, together with the discount in non-agreement headcount in addition to different productiveness initiatives depart us assured in a powerful productiveness story for Q2. – NSC 1Q24 Earnings Name

Whereas I look forward to this turnaround to get help from higher financial progress, I get pleasure from a 2.5% dividend. This will not be a juicy yield. Nonetheless, it comes with a 46% payout ratio and a five-year CAGR of 10.2%.

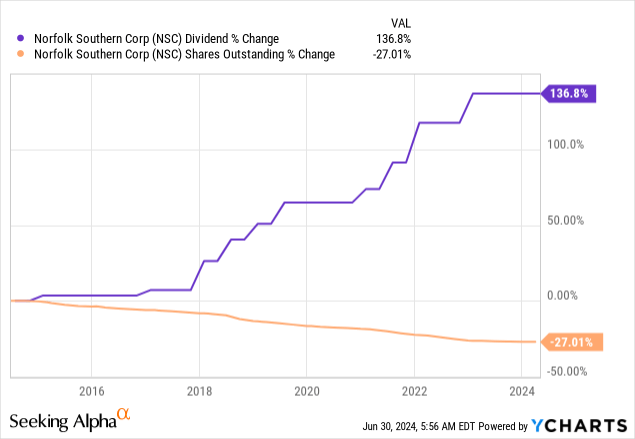

Over the previous ten years, this dividend has risen by 137%. The share rely has been lowered by 27%.

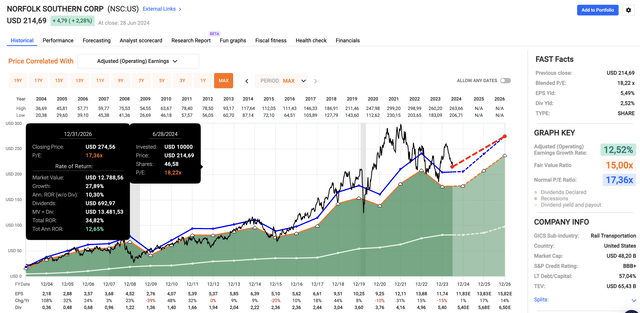

At the moment, NSC trades at a blended P/E ratio of 18.2x.

Analysts anticipate a 1% EPS restoration in 2024, doubtlessly adopted by 17% and 14% progress in 2025 and 2026, respectively.

FAST Graphs

This paves the best way for a good worth goal of $275, 28% above its present worth.

On a longer-term foundation, I am far more bullish, as I anticipate NSC to return to its outdated glory, particularly if it will get a much-needed tailwind from financial progress.

Whereas I’ve been shopping for step by step, I’ll be a way more aggressive purchaser *if* NSC drops to or under $200.

Zoetis (ZTS) – Undervalued Dividend Progress

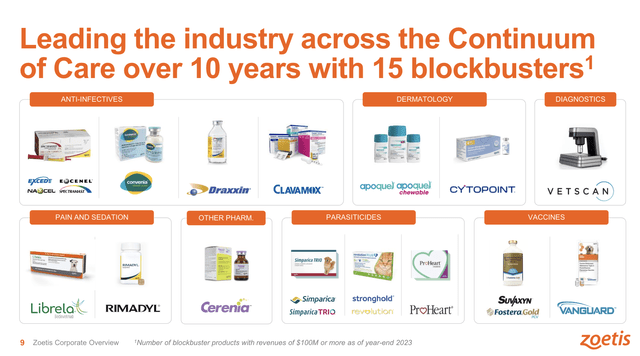

Zoetis has turn into certainly one of my favourite healthcare shares. The previous Pfizer (PFE) spin-off has turn into the world’s largest producer of vaccines, medicines, diagnostics, and comparable for animals.

Zoetis Inc.

The corporate’s portfolio covers eight core species and 7 therapeutic areas and holds 15 blockbuster medicine amongst roughly 300 product traces.

With regard to patent loss dangers, the common market lifetime of key manufacturers in its portfolio is 30 years, together with anti-infectives, dermatology, vaccines, ache and sedation, and others.

Zoetis Inc.

What issues is that the corporate holds the primary market share in:

North America, Latin America, and Asia. Dermatology and pet ache. Companion animals, cattle, and fish.

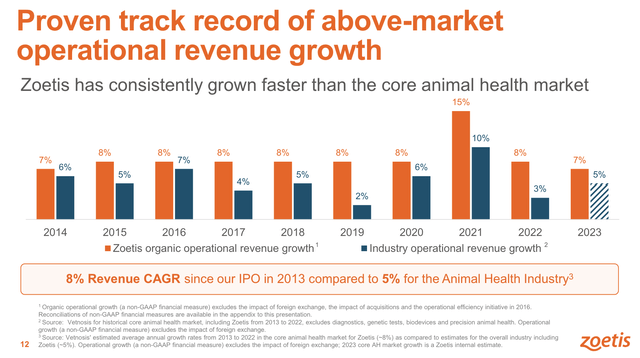

It has additionally persistently outperformed its friends, rising revenues by 8% yearly since its IPO in 2013.

Zoetis Inc.

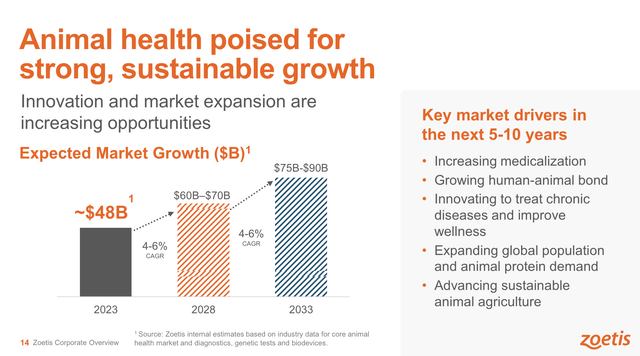

By way of 2033, the corporate expects to take care of constant progress, because it believes its whole addressable market will develop by 4-6% yearly to at the very least $75 billion by 2033.

Zoetis Inc.

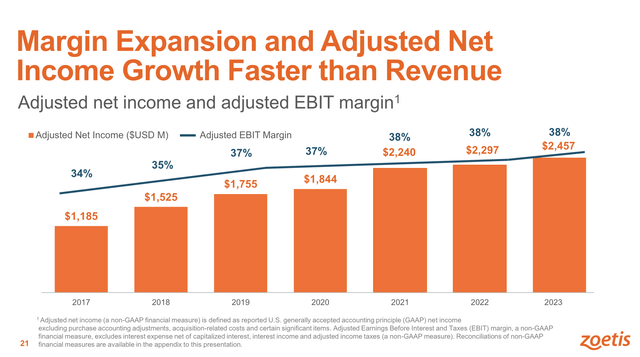

It additionally has persistently grown its margins, which boosted adjusted internet revenue by 109% within the 2017-2023 interval.

Zoetis Inc.

With that mentioned, ZTS is down 12% year-to-date, which was triggered by the information that its arthritis drug, Librela, could possibly be dangerous. I mentioned this in an article printed on April 14, once I went with the title “Regardless of Lawsuit Dangers: Why Zoetis Stays A Finishing Funding.”

Since then, shares have rebounded 15%, beating the 6% return of the S&P 500.

Whereas lawsuit dangers are all the time a difficulty in healthcare, I imagine these fears are overblown, permitting traders to purchase ZTS at enticing costs.

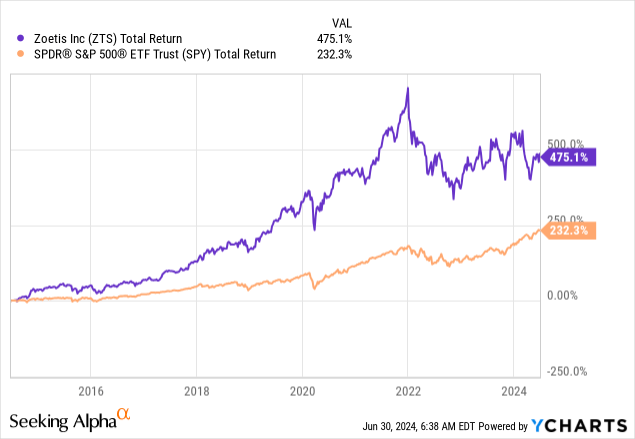

At the moment yielding 1.0%, Zoetis comes with a payout ratio of 29% and a five-year CAGR of twenty-two.7%. It additionally has outperformed the market by a large margin over the previous ten years.

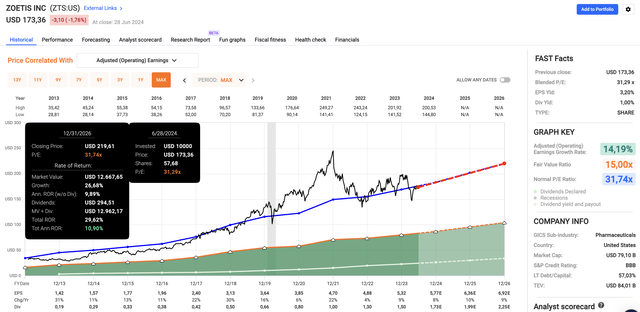

Furthermore, the corporate, which enjoys anti-cyclical demand, is presently buying and selling at a blended P/E ratio of 31.3x, which is barely under its normalized P/E ratio of 31.7x. Whereas this may occasionally seem to be a lofty valuation, analysts anticipate 8-10% annual EPS progress to final, doubtlessly paving the street for 10-11% annual returns.

FAST Graphs

As such, I keep on with my purchase ranking and imagine ZTS provides a terrific danger/reward for dividend progress traders in search of healthcare publicity in a market with sturdy long-term secular tailwinds.

With that mentioned, in the event you’re searching for a better yield, the subsequent decide could also be for you.

Suncor Power (SU) – A Filth-Low-cost Canadian Oil Play

Suncor is the most important peer of my funding in Canadian Pure Sources (CNQ). The corporate is without doubt one of the largest operators in Canada’s oil sands and certainly one of my favourite picks for revenue and capital positive aspects.

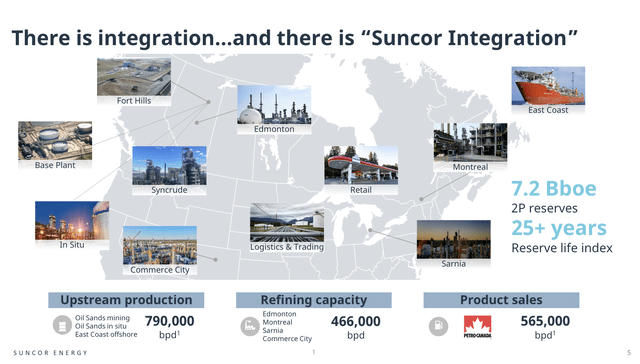

The corporate has an a variety of benefits that I am searching for in an oil firm, which embody deep reserves (greater than 25 years of low-cost reserves), environment friendly operations in oil sands, and an growing concentrate on shareholder distributions.

Suncor Power

My most up-to-date article on Suncor was written on Could 19, once I referred to as it “One Of My Finest Concepts In Power.” Since then, it held a particular name in Could when it offered its long-term outlook.

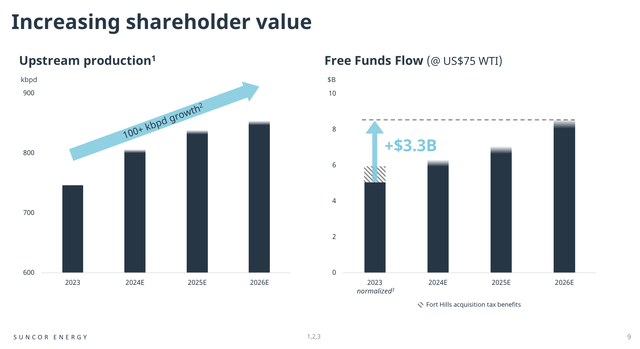

Throughout this name, it dedicated to an extra C$3.3 billion per 12 months in free money stream by the tip of 2026, which interprets to vital money technology and shareholder returns.

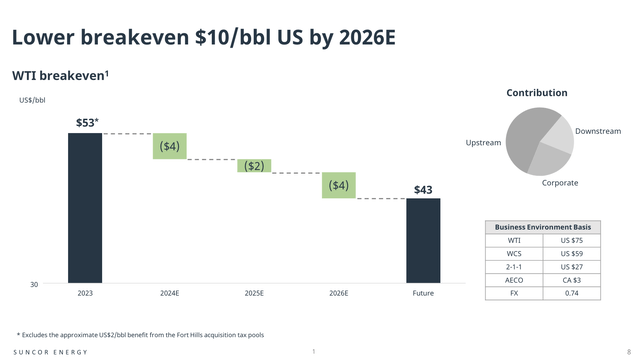

This enchancment comes with a focused discount within the firm’s WTI breakeven by $10 per barrel, which massively improves its free money stream potential.

Suncor Power

Furthermore, it has revised its internet debt goal for its 100% free money stream payout to C$8 billion. That’s down from C$9 billion. As I wrote in my prior article, expectations are for C$8.6 billion in internet debt by the tip of this 12 months, which makes it doubtless that Suncor will attain its debt goal subsequent 12 months.

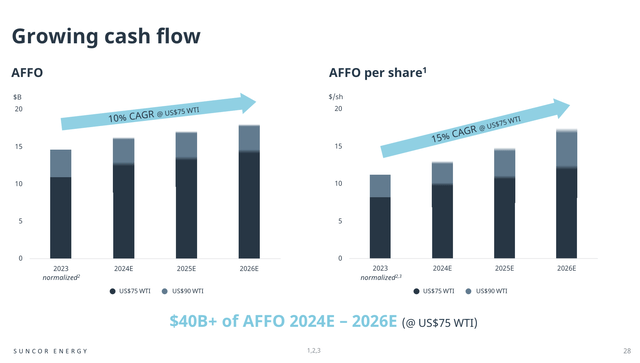

This bodes nicely for shareholders, as the corporate goals to ship over C$40 billion of AFFO (adjusted funds from operations) from 2024 to 2026, with a ten% compound annual progress charge, translating to a 15% progress charge on a per-share foundation.

Suncor Power

At the moment yielding 4.2%, the corporate goals to develop its dividend by 3-5% yearly, with most shareholder returns coming from buybacks.

Given the corporate’s favorable manufacturing outlook, in 2026, it might generate north of C$8 billion in free money stream at $75 WTI. That interprets to 12% of its market cap. This bodes very nicely for buybacks and whole returns!

Suncor Power

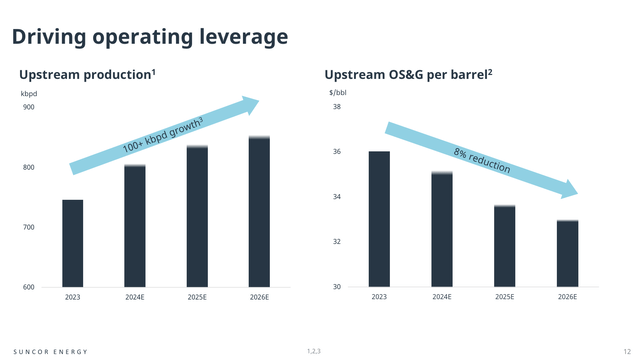

With regard to manufacturing, the corporate plans to extend upstream manufacturing by over 100,000 barrels per day whereas protecting controllable prices flat, which might doubtlessly lead to an 8% decline in working value per barrel over the subsequent three years.

Suncor Power

As I imagine oil has far more room to rise than $75 WTI, I contemplate Suncor to be a “hidden” Canadian gem, which is ideal for a variety of traders, together with revenue and buyback-focused traders.

Please word that Suncor is listed each in Toronto and New York.

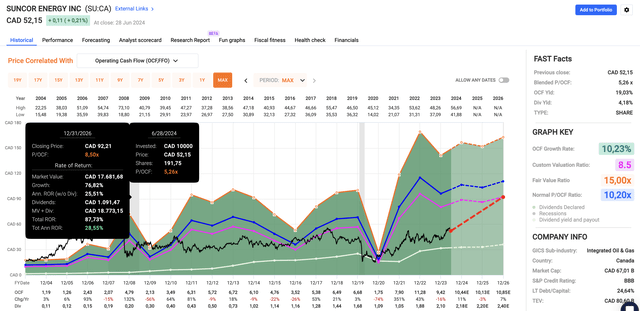

Valuation-wise, Suncor presently trades at a blended P/OCF (working money stream) ratio of simply 5.3x, making it one of many least expensive power shares on my radar.

Making use of an 8.5x a number of, the corporate has a good inventory worth of C$92 in Toronto, 76% above the present worth. The identical applies to New York-listed shares.

FAST Graphs

Evidently, I imagine SU has a variety of room to run the second power bulls return, making it certainly one of my high picks within the sector.

Takeaway

The S&P 500 has surged, primarily pushed by tech giants and AI enthusiasm. This focus poses a danger if the AI growth slows.

It additionally left different promising sectors undervalued.

On this article, we mentioned three compelling dividend shares: Norfolk Southern, Zoetis, and Suncor Power.

Every provides distinctive benefits, from Norfolk’s potential turnaround within the rail business and Zoetis’s management in animal healthcare to Suncor’s huge potential within the power sector.

I imagine these picks present a terrific danger/reward within the dividend (progress) area and supply worth in what has turn into a really difficult market.

[ad_2]

Source link