[ad_1]

Entrance-Operating Seasonality in US Inventory Sectors

Seasonality performs a big function in monetary markets and has change into a necessary idea for each practitioners and researchers. This phenomenon is especially distinguished in commodities, the place pure cycles like climate or harvest intervals immediately have an effect on provide and demand, resulting in predictable value actions. Nonetheless, seasonality additionally performs a task in fairness markets, influencing inventory costs based mostly on recurring calendar patterns, reminiscent of month-end results or vacation intervals. Recognizing these patterns can present buyers with an edge by figuring out home windows of alternative or threat of their funding methods.

On this research, we mix our information obtained from articles reminiscent of Dealer’s Information to Entrance-Operating Commodity Seasonality (how front-running impacts commodity seasonality patterns), Market Seasonality Impact in World Fairness Indexes (calendar-based anomalies throughout international fairness markets), January Impact Filter and Imply Reversion in Shares (well-known phenomenon the place small-cap shares typically outperform in January) or 12-Month Cycle in Cross-Part of Inventory Returns (the cyclical nature of returns throughout shares over a yearly horizon). These insights underline the significance of understanding seasonality in each commodities and equities, providing buyers the instruments to refine their methods and capitalize on predictable market behaviors.

Methodology

On this research, we utilized the every day adjusted closing costs of the 9 sectors of the S&P 500 index (ETFs) for all analyses. These sectors embrace XLB (supplies), XLE (vitality), XLF (financials), XLI (industrials), XLK (know-how), XLP (shopper staples), XLU (utilities), XLV (well being care), XLY (shopper discretionary). Nonetheless, the evaluation was carried out utilizing solely the ultimate worth of every month.

The ETFs are adjusted for dividends and splits, guaranteeing that historic costs have been modified to replicate dividend payouts and inventory splits. This adjustment offers a extra correct illustration of the ETF’s efficiency over time by accounting for whole returns, together with reinvested dividends, and by correcting for value modifications attributable to splits. Utilizing these adjusted costs is essential for exact historic efficiency evaluation and technique comparability. The info had been sourced from Yahoo Finance and span the interval from December 22, 1998, to September 5, 2024.

True seasonality

Firstly, we constructed a technique based mostly on a real seasonality. On this technique, ETFs are chosen for buy within the following month based mostly on their earlier efficiency throughout that particular month. For instance, on the finish of December, an investor selects ETFs for January by evaluating their efficiency within the earlier January and selecting the simplest ones for the lengthy facet (alternatively, the least efficient for the quick facet).

Based mostly on these rankings, we chosen the best-performing ETFs from the identical month of the earlier 12 months, comparable to the upcoming month. This course of was repeated month-to-month. For comparability, we additionally constructed a benchmark comprising the typical efficiency of all ETFs for every month.

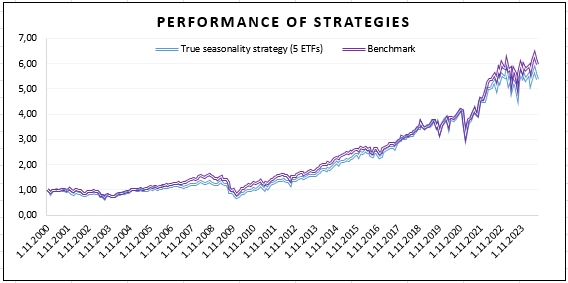

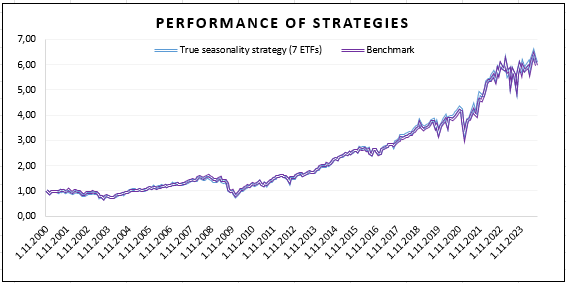

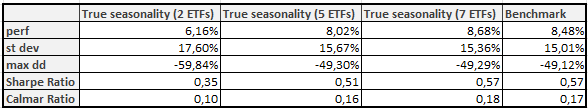

In accordance with Desk 1, the outcomes achieved by the true seasonality technique are, at greatest, corresponding to these of the benchmark, as is obvious from the graphs in Determine 1. Whatever the variety of ETFs chosen for an extended place, the technique stays inefficient (on the efficiency and likewise on the return/threat foundation).

Moreover, we calculated additionally the long-short variations of this technique to find out whether or not a brief or lengthy place can be extra applicable for every ETF. Nonetheless, it seems that quick positions are ineffective on this technique, and solely lengthy positions are cheap.

Entrance-running technique

Resulting from favorable outcomes achieved by the front-running technique based mostly on commodity sectors introduced within the article Dealer’s Information to Entrance-Operating Commodity Seasonality, we determined to use an identical front-running strategy to US inventory sectors. For instance, on the finish of December, an investor selects ETFs for January by assessing their efficiency from the earlier February and selecting the top-performing ones. Nonetheless, in contrast to the unique strategy, which selects ETFs for lengthy/quick positions based mostly on the comparability of the efficiency in month t-11 to the efficiency during the last 12 month interval (time-series strategy to the seasonality), our strategy for fairness sectors makes use of the cross-sectional strategy to seasonality – within the examined month, we examine the efficiency of sector ETFs to one another.

The front-running strategy to ETF sector seasonality capitalizes on the habits of buyers who observe established seasonality patterns. Understanding that sure investments carry out nicely in a particular month, it may be extra worthwhile to purchase these property one month earlier, earlier than nearly all of buyers act. This early positioning anticipates the stress from elevated demand, which is prone to drive asset costs larger, doubtlessly resulting in larger returns.

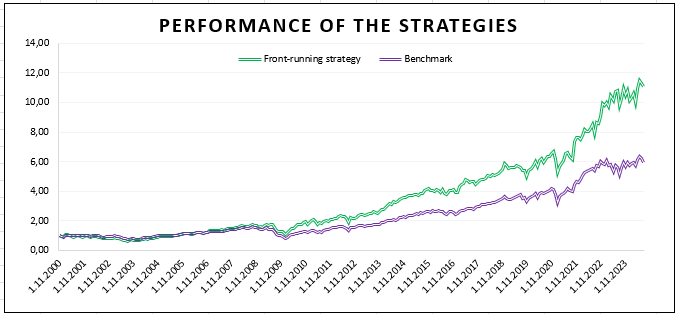

Due to this fact, as with the true seasonality strategy, we rank the ETFs utilizing the identical sample, preserve lengthy positions within the top-ranked ETFs, and rebalance month-to-month. The one modification is that the month used for ETF choice is shifted ahead by one month. By utilizing this strategy, the technique achieved one of the best outcomes by holding two ETFs in lengthy positions. As earlier than, we examine the technique’s efficiency towards a benchmark.

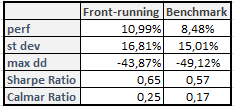

At first look, it’s evident from the graph in Determine 2 that the Entrance-running technique utilizing 2 ETFs for lengthy positions outperforms the benchmark, notably since 2009. This conclusion can also be supported by the information in Desk 2. Though the Entrance-running technique reveals a better normal deviation in comparison with benchmark, its superior returns end in a extra favorable Sharpe Ratio. Moreover, the upper Calmar Ratio highlights the effectivity of this technique. All the different variants, be it 1, 3, 4, 5, 6, or 7 ETFs in lengthy leg beat the benchmark with a large margin, too.

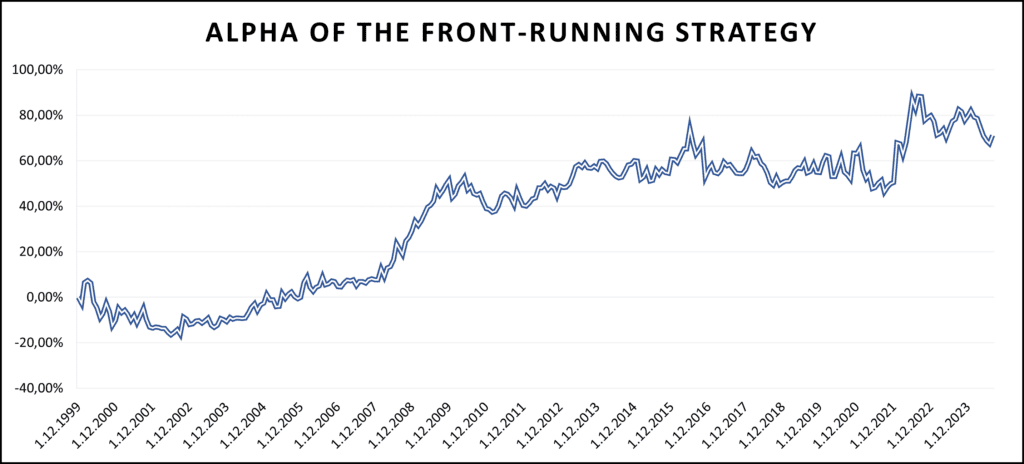

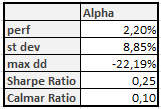

Additionaly, we calculated the Alpha of the Entrance-running technique relative to the benchmark, which is similar as in earlier analyses (equally weighted universe of sector ETFs).

The efficiency of the Alpha of the Entrance-running technique relative to the benchmark, illustrated within the graph in Determine 3, exhibits a bent to develop with no important drawdowns. This displays the effectivity and outperformance of the technique in comparison with the benchmark.

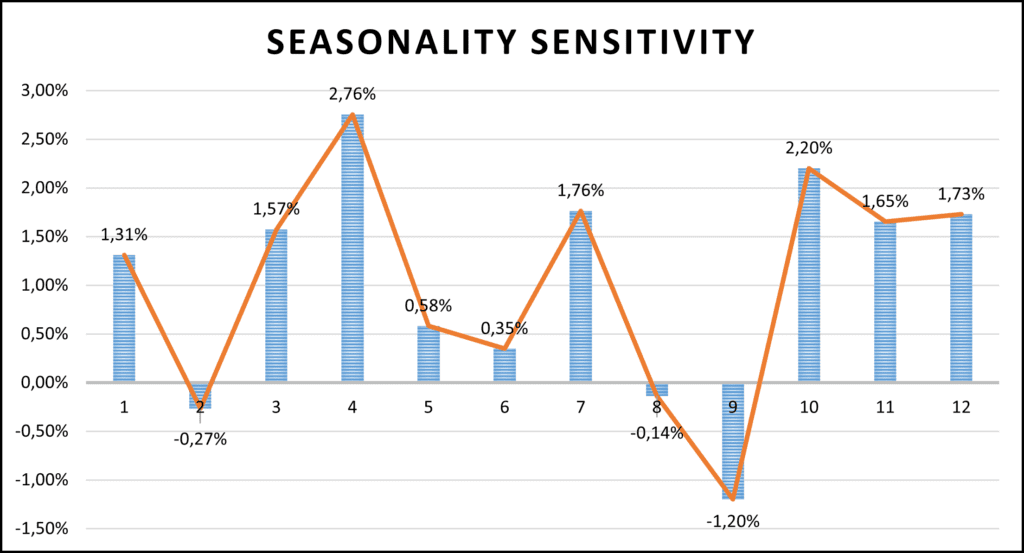

Seasonality sensitivity

Within the remaining a part of this research, we investigated whether or not there’s any seasonality sensitivity in US inventory sectors, in different phrases, whether or not particular months months exhibit a stronger seasonality impact than regular. This evaluation was impressed by the Seasonality Evaluation by Quantpedia, which will also be utilized to every day information.

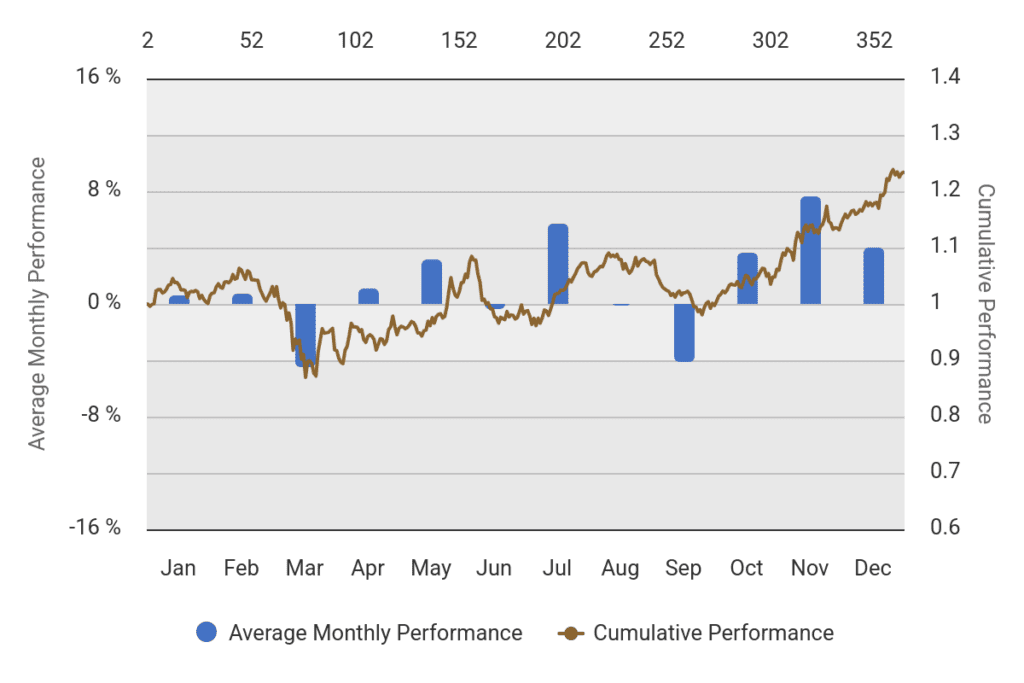

Since this analysis is predicated on month-to-month information, the calculations should be carried out manually. The way it labored? We took the month-to-month efficiency of the front-running seasonal technique from the earlier chapter (Determine 2) and analyzed what’s the efficiency contribution of the every month into the efficiency. The resultant sensitivity chart seems to be like this:

From the graph in Determine 5, we will trace at two well-known results and tendencies. The upper efficiency within the interval between October and April could also be attributed to the market seasonality impact, which is detailed within the Market Seasonality Impact in World Fairness Indexes. One other doable sample is quarterly seasonality, as described in Momentum Seasonality and Investor Preferences, which will be seen as the upper efficiency in the beginning of every new quarter, particularly in January, April, July, and October. Nonetheless, we wish to keep away from drawing sturdy conclusions from this evaluation because the resultant sensitivity chart might nonetheless be a coincidence.

Conclusion

The habits of buyers specializing in seasonal patterns really impacts the market within the month previous the anticipated seasonality. By contemplating this phenomenom and incorporating it into our technique, we will create an efficient strategy that outperforms not solely the true seasonality technique, but in addition the benchmark. The alpha of the front-running technique can also be constructive, reflecting its capacity to beat the benchmark. The seasonal sensitivity evaluation hints two extra patterns, nevertheless, we wish to keep away from drawing sturdy conclusions at this second and will revisit this subject sooner or later.

Creator: Sona Beluska, Junior Quant Analyst, Quantpedia

Are you on the lookout for extra methods to examine? Join our publication or go to our Weblog or Screener.

Do you wish to study extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you wish to study extra about Quantpedia Professional service? Test its description, watch movies, overview reporting capabilities and go to our pricing provide.

Are you on the lookout for historic information or backtesting platforms? Test our checklist of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookSeek advice from a buddy

[ad_2]

Source link