[ad_1]

Boarding1Now/iStock Editorial by way of Getty Photos

In July, I coated Normal Dynamics (NYSE:GD) and maintained my purchase ranking on the inventory with a $316.50 value goal, intently matching the Wall Road analysts’ value goal of $316.50. Since then, the corporate has reported its second quarter outcomes, which offers a superb second to evaluate the earnings and replace the worth goal for Normal Dynamics inventory and clarify that regardless of provide chain points, the inventory stays compelling.

Why Our Normal Dynamics Evaluation Issues To You As An Investor?

I largely cowl shares within the aerospace & protection, airline, airport infrastructure and associated industries and that’s not essentially as a result of these are the industries I like finest, however with an aerospace engineering background, these are the industries I’m finest positioned to cowl with a qualitative in addition to quantitative method. Normal Dynamics is one among over 100 names that I cowl in these industries and consequently, by following my work you get a reasonably full view of the business. In particular person evaluation of corporations, it isn’t the purpose to match corporations to see which one has the best upside as a result of with over 100 names coated it is just too a lot to take action.

As an alternative, all names I cowl profit from an intensive analytical course of. With that analytical rigor, we analyze each firm in our protection portfolio and as a substitute of evaluating names we developed an analytical mannequin that makes use of a wide selection of enter variables to offer each identify with a valuation and multi-year inventory value goal cadence primarily based on an EV/EBITDA valuation towards the corporate’s median EV/EBITDA a number of and the peer group a number of. Other than a multi-year value goal primarily based on these multiples, we additionally rating every inventory with a ranking system that features a mixture of earnings development, historic efficiency towards the broader markets, anticipated upside of shares towards the long-term historic index development charge of inventory markets. By doing so, the names in our protection profit from a unified solution to decide rankings and calculate inventory value targets, and we don’t have to match all 100 names in our portfolio to determine which identify is extra enticing. It’s a distinctive instrument that we’ve got developed to calculate inventory value targets and rankings in a transparent and concise manner for buyers as they do their due diligence supplemented by recurring protection, permitting us to detect any modifications in efficiency or end-market energy early on.

Normal Dynamics Grows On All Key Metrics

Normal Dynamics

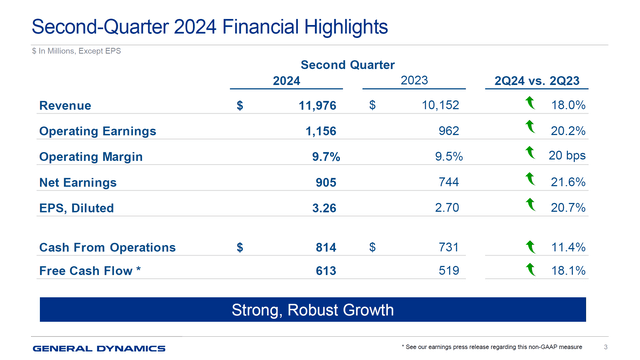

Second quarter outcomes confirmed robust development on all key metrics; Revenues elevated by 18% to just about $12 billion, whereas working margins elevated 20.2% to $1.156 billion aided by a 20 bps growth to working margins and web earnings and EPS had comparable development. What I additionally appreciated is the money flows. Whereas money move era stays closely backloaded, I contemplate the year-on-year modifications to be a constructive growth on working capital unloading.

Second quarter revenues beat analyst estimates by $476.58 million, however EPS of $3.26 missed estimates by $0.05 pushed by a slight delay in enterprise jet deliveries that shifted the shipments exterior of the reporting quarter.

Normal Dynamics

Aerospace revenues, which consists of Plane Manufacturing and Plane Providers, elevated 51% to $2.94 billion whereas margins dropped from 12.1% to 10.9% leading to earnings development of 35% to $319 million. The rise in gross sales was pushed by new plane deliveries and elevated companies enterprise.

Plane manufacturing gross sales rose 70% to $2.067 billion and that was pushed by a greater supply combine together with the preliminary deliveries of the newly licensed G700 enterprise jet and there additionally was the next quantity as Normal Dynamics delivered 37 Gulfstream airplanes in comparison with 24 a yr in the past. The upper deliveries to me are an indication that whereas aerospace provide chain points are there, they’re getting higher, and we’re additionally seeing some stock unwinding as beforehand constructed G700 jets are being delivered to prospects. That’s regardless of a slip of 4 enterprise jets deliveries into the following quarter, and that’s not an enormous slip. The deliveries slipped from the final week of the quarter into the following quarter, with one delivered already delivered within the first month of Q3. It must also be famous that two jets should undergo some further certification work, as a result of Gulfstream configured the cabin on request of the shopper in a format that doesn’t fall beneath the present kind certificates and requires a supplemental kind certificates, which requires some further work.

Plane companies revenues had been up 18.5% and that was pushed by timing of upkeep occasions and the next variety of Gulfstream jets in companies.

The working margin was pressured partly due to the G700 airplanes within the combine, which include some further prices to retrofit, out-of-station work, and a few studying curve step ups wanted to mature the margins whereas the certification took longer than anticipated. So, the margin stress is just not essentially a nasty factor and displays a brand new licensed enterprise jet within the combine. As soon as provide chain delays ease additional and the margins on the G700 airplanes steps up, we should always see the reported margins get well.

Normal Dynamics

Fight Methods gross sales grew 19% to $2.29 billion with margins increasing from 13% to 13.7% leading to 25% earnings development to $313 million. The section consists of three enterprise traces, that are Weapon Methods and Munitions, Navy Automobiles and Engineering and Providers.

Pushed by elevated demand for artillery and munitions, as a result of battle in Ukraine, gross sales grew 53.3%. Navy autos, which incorporates tanks and wheeled autos, rose 3.2%. That isn’t a line of enterprise the place we count on imminent, enormous development in the best way we’re seeing with artillery associated gross sales. The reason being fairly easy, the availability chain points are enormous and complicated, and gross sales campaigns don’t materialize in a single day. The navy autos enterprise is realistically one that’s going to be a secure enterprise with a little bit of development. The Engineering and companies enterprise noticed gross sales develop by 41.5%, and I consider that may very well be pushed by engineering on the XM30 Mechanized Infantry Fight Car which is within the detailed design part after a contract was acquired in Q2 2023.

Normal Dynamics

Marine System revenues elevated 13% to $3.45 billion, pushed by Columbus-class submarine development for building and engineering, whereas the Virginia-class submarine and DDG-51 destroyer applications additionally contributed to gross sales development. The enterprise consists of three subsegments, particularly nuclear-powered submarines, floor ships and restore and different companies. The expansion was recorded within the first two segments, the place gross sales grew 15.9% and 11.8%. Restore and different companies revenues had been down 6.4%.

Margins softened barely from 7.7% to 7.1% for a $10 million development in working earnings to $245 million. The margin contraction was pushed by the continued provide chain pressures for submarines. Digital Boat efficiency, which mainly displays the submarine enterprise, noticed continued margin stress and that’s pushed by the submarine industrial base which was considerably affected by the pandemic. Constructing that advanced provide chain again to the place it was to assist submarine constructing plans is one thing that’s difficult, much more so provided that the submarine industrial base has been shrinking for years. The pandemic additionally got here at a time when a good portion of the workforce was eligible for retirement, deepening the workforce disaster in that section. That workforce won’t be again to energy in a single day and truly requires funding from the economic bases in addition to the procuring companions for the coaching of the workforce, much more so after we needless to say with a smaller industrial base extra submersible applications are being supported. To maintain the applications considerably on monitor, we aren’t speaking about hiring 1,000 employees as soon as, however we’re speaking about a number of 1000’s of individuals needing to be employed per yr for the foreseeable future.

The excellent news is that sequentially the margins have improved as provide chain points are considerably easing and in 2023, the annual hiring objective was reached and exceeded, however the tempo of hiring have to be maintained.

The Applied sciences section revenues had been up 2.5% to $3.3 billion with income increasing from $283 million to $320 million marking 13% greater earnings as margins expanded from 8.8% to 9.7%. The Applied sciences section is just not a high-growth section, it consists of IT options which noticed gross sales improve by 2.1% and C5ISR which noticed gross sales improve 3.1%. Whereas IT doesn’t seem to be a enterprise section that will undergo from provide chain points, it nonetheless did, and the year-on-year development and margin growth reveals that these pressures are additionally easing for that section.

Money move used throughout the quarter was $814 million and free money move of $613 million, which was up 11.4% and 18.1%. 12 months-on-year, the rise in free money move was in keeping with the income development, so that may be a nice consequence. Much more so, after we contemplate that early within the yr, there’s a working capital construct for materials purchases for supply and money receipts in the direction of the top of the yr. In different phrases, money move era stays considerably backloaded.

Normal Dynamics Will increase Earnings and Income Steerage

Normal Dynamics

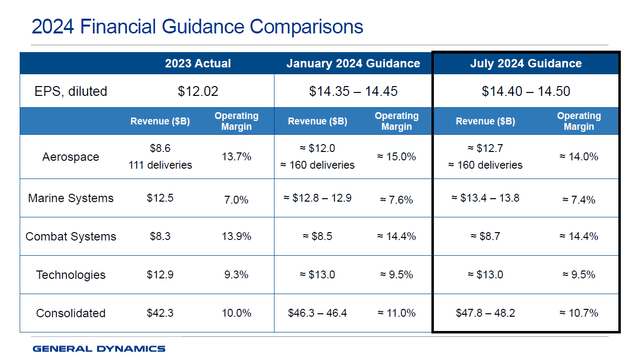

Following a powerful gross sales quarter, Normal Dynamics has elevated its gross sales steering by $1.5 billion on the low finish and $1.8 billion on the excessive finish. A good portion is pushed by a $700 million raise within the aerospace section, with a 100 bps decrease margin as a result of G700 value pressures. Marine Methods revenues are guided $600 million greater on the low finish and $900 million greater on the excessive finish, with a small contraction in margins as submarine provide chain challenges nonetheless drive delays and prices. Fight System gross sales have been guided up $200 million with the identical margin assumption, and the Applied sciences section steering has remained unchanged. This offered a 30-bps stress on working margins, however nonetheless resulted in a $0.05 raise to the earnings per share anticipated for the yr.

Trying a bit deeper into the modifications to the section steering, we see that the supply goal of 160 airplanes has been maintained. So, at the moment, plainly the quarterly slip of some G700 deliveries doesn’t have an effect on the full-year outlook. The margins nonetheless got here down on account of a mixture of G700 delays within the certification and supply. Whereas aerospace provide chain points are easing, they’re nonetheless there and that drives margins down. Whereas this occurs, the following two batches of G700 deliveries ought to profit from much less out-of-station work, fewer retrofits and studying curve results. Sometimes, a studying curve for aerospace merchandise sits round 85%, which signifies that every time cumulated manufacturing doubles there’s a discount of 15% in prices and labor on account of productiveness enhancements. So, we may also see that flowing via the margin steps up this yr and as soon as the aerospace provide chain points ease additional, we should always see a significantly better impression of the G700 studying curve and manufacturing contributions. From the demand aspect, we’re seeing that demand pressures pushed by geopolitical occasions have eased considerably with higher pipeline conversion within the US and enhancements within the Center East and China.

For the Marine Methods section, the margin stress can be pushed by the availability chain challenges. These challenges are considerably stickier in nature as to correctly assist the shipbuilding plans of the US Navy, there may be want for 1000’s of employees to be employed per yr.

The backlog on the finish of the quarter stood at $91.3 billion, in comparison with $93.6 billion firstly of the yr. So, the backlog is crammed properly, protecting roughly 2 years’ price of manufacturing. The principle limiting issue to output is just not essentially demand, it’s the capability within the availability chains that may be carried and that’s largely the limiting issue to development and margins at this level for Normal Dynamics as is the case for a lot of friends.

What Are The Key Dangers For Normal Dynamics?

The important thing dangers for Normal Dynamics are the availability chain points, we see them within the aerospace enterprise, marine and IT. Sequentially, we see that there are indicators of enchancment to these provide chain points, however it’s going to possible take years and, in some instances, require continued investments for these provide chain points to dissolve.

One other threat may very well be any modifications to the protection budgets and spending plans. The US Navy intends to acquire one submarine much less, so not directly that may be a watch merchandise because the finances has been capped by legislation. On the identical time, we additionally observe that slicing one submarine from the funding plan is just not a catastrophe, as a result of at this level the output is the limiting issue. The Navy desires 2 submarines delivered per yr, however as a result of pressure on the submarine advanced it’s nearer to a charge of 1 per yr. So, eradicating one submarine from the plan is just not an illogical step, much more so when contemplating that the Navy is investing over $11 billion to strengthen the economic base. Whereas scrapping one submarine from the 5-year plan doesn’t ship a powerful sign to the economic base, I do consider that an $11 billion funding from the Navy on strengthening the economic base does. At present, the Navy is decommissioning extra submarines than coming into service, and I might assume that over the long term the Navy desires to maintain its submarine fleet regular and even develop that fleet as a substitute of shrinking it, so the funding into the availability chain is an funding for the long term.

A 3rd threat for Normal Dynamics, as is the case for a lot of aerospace and protection corporations, is shedding sure key competitions for future platforms. One such program for which Normal Dynamics is within the race is the substitute to the Bradley Preventing Car. Normal Dynamics Land Methods is competing with Rheinmetall, which I beforehand coated, for the contract that may very well be valued north of $40 billion.

At present, demand for protection gear is excessive and whereas I don’t count on that to taper within the close to future and easing of worldwide stress might lead to a longer-term flattening of protection spendings once more. That would complicate funding, however we do observe that whether or not a 1-year, 3-year, 5-year or 10-year return cost Normal Dynamics has outperformed the market, and it isn’t the case that in all of these years the protection finish market was as robust as we at the moment see.

Is Normal Dynamics Inventory A Good Purchase?

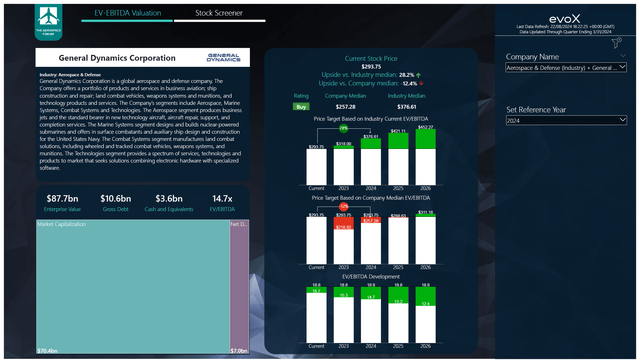

The Aerospace Discussion board

To find out multi-year value targets The Aerospace Discussion board has developed a inventory screener which makes use of a mixture of analyst consensus on EBITDA, CapEx and free money move together with the latest steadiness sheet information, money move statements and my assumptions on debt reimbursement, share repurchases and dividends. Every quarter, we revisit these assumptions and replace accordingly and, if want be, we complement our personal estimates if key gadgets reminiscent of, for instance, acquisitions will not be mirrored in estimates but. The estimates will not be bases on any steering offered by the businesses we cowl, however by a powerful mixture of consensus and my very own estimates.

For Normal Dynamics, the analyst estimates on EBITDA have gone up modestly by lower than 1% whereas free money move estimates have gone down barely but in addition by lower than a % and that’s primarily pushed by the upper prices on the G700 program and the continued difficult setting for the submarine provide chain, which requires continued hiring to measurement the economic base. Valuing the corporate in between the peer group EV/EBITDA a number of and the corporate median leads to a $316.95 value goal, so there may be barely any change within the value goal and I consider there may be round 8% upside to the inventory value.

Whereas 8% may not appear enormous, we additionally should needless to say that is pushed by the expectations for 2024 and there must be considerably extra upside within the years forward. Valuing the inventory with the 2025 earnings in thoughts offers 20% upside and I consider if you happen to have a look at the protection finish market in addition to the enterprise jet market, there may be important demand to proceed rising outcomes. So, I’m not squarely targeted on the 8% upside, however there may be important development within the inventory within the years forward.

Moreover, whereas the 1.94% dividend yield for Normal Dynamics is just not enormous, the corporate has a dividend development monitor report of 29 years with a 10-year CAGR of 8.8% which is greater than the 7.3% we see amongst friends. The dividend development charge, for my part, makes Normal Dynamics compelling for long-term oriented buyers who’re in a position to construct a powerful cost-on-yield base, however there may be additionally enchantment for buyers who don’t plan on proudly owning the inventory for a really very long time.

Conclusion: Normal Dynamics Has an 8% Upside

The second quarter outcomes confirmed a stronger quarter with some margin stress pushed by the G700 and the challenges within the submarine industrial base. Nevertheless, whereas outcomes missed expectations on EPS, I consider earnings had been robust and merely mirrored a slip of some G700 deliveries into the third quarter. Demand stays wholesome, and provide chain challenges within the aerospace section in addition to the submarine enterprise are bettering. With end-market energy, particularly within the protection markets and continued investments from the business and the US Navy within the submarine industrial base to assist the long-term shipbuilding plans, I proceed to charge the inventory a purchase as there are important upsides for the years forward and a number of expansions might additional drive the upside.

[ad_2]

Source link