[ad_1]

Lemon_tm

GLD ETF and recession

I final wrote on the SPDR Gold Shares ETF (NYSEARCA:GLD) a couple of month in the past. As you possibly can see from the screenshot beneath, that article was titled “GLD: 3 Issues Much less Talked About” and was revealed on the Searching for Alpha platform on July 16, 2024. In that article, I took a long-term view and argued why I see gold as a core holding in our portfolio.

Searching for Alpha

Since then, there have been a couple of materials modifications within the macroeconomic panorama. The highest one on my thoughts is that the potential for a tough touchdown is a much more doubtless state of affairs now. Specifically, the unemployment fee rose to 4.3% in response to July’s job report. The rise is extensively thought of a set off level of the Sahm Rule. The market is now far more involved in regards to the potential that the drastic curiosity hikes in recent times might trigger a tough touchdown/recession within the close to future.

Towards this backdrop, I believe it will be useful for this follow-up article to take a near-term perspective and particularly deal with the function of GLD within the case of a tough touchdown. As such, the rest of this text will look at GLD’s historic efficiency throughout current market downturns. The evaluation demonstrates that GLD has traditionally served as efficient hedges throughout such occasions – one thing you in all probability already know.

However I guess the important thing takeaway is one thing new to most traders – regardless of its infamous commodity nature, GLD has really demonstrated LOWER volatility and equal restoration time throughout main downturns in comparison with the general fairness market. I thus assume the brand new developments since my final writing have enhanced GLD’s timeliness as a hedge towards a possible onerous touchdown.

GLD ETF: some primary and not-so-basic data

In case there are readers new to the fund, GLD is the primary ETF to market that invests instantly in bodily gold and in addition the biggest by way of AUM on this area to the very best of my data. As detailed in its fund description beneath (the emphases have been added by me):

GLD tracks the gold spot value, much less bills and liabilities, utilizing gold bars held in London vaults. The product construction decreased the difficulties of shopping for, storing and insuring bodily gold bullion for traders. Actively traded, the shares present deep liquidity. Its construction as a grantor belief protects traders, trustees can’t lend the gold bars. Nonetheless, taxes on long-term good points may be steep, as GLD is deemed a collectible by the IRS.

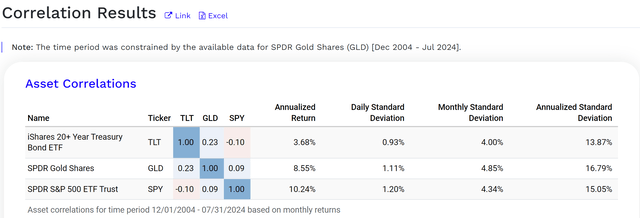

Most traders have to be effectively conscious of GLD’s function in diversification. Certainly, GLD has traditionally demonstrated a really low correlation with each the bond and the fairness market, as represented by the iShares 20+ 12 months Treasury Bond ETF (TLT) and SPDR S&P 500 ETF Belief (SPY), respectively. The chart beneath reveals the correlation of GLD ETF relative to TLT and SPY. As seen, GLD has a low correlation coefficient of 0.23 with TLT and a fair decrease correlation of 0.09 with SPY, supporting the usage of GLD as a diversifier inside a portfolio.

If we look at historic information deeper, a couple of issues may shock you. GLD is characterised as a neighborhood fund and is usually criticized for its value volatility. This notoriety, like many different issues, actually will depend on the way you measure it. For example, GLD’s annual commonplace deviation was round 16.8% as seen within the chart beneath, certainly noticeably increased than SPY’s 15%.

Portfolio Visualizer

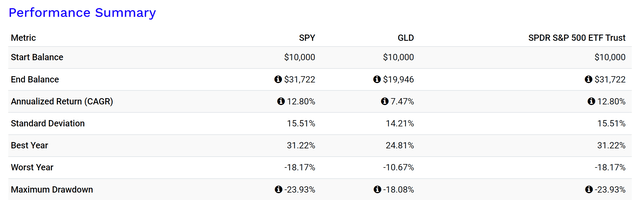

Nonetheless, the image can change if our focus shifts. For example, the chart beneath compares the efficiency of GLD and SPY ETF throughout extra metrics. Because the most important concern of this text is the potential for a recession, I wish to draw your consideration to the worst 12 months efficiency and most drawdowns. As seen, GLD has featured far much less extreme worst-year loss than SPY (-10.67% vs. -18.17%) and most drawdown (-18.08% vs. -23.93%) traditionally.

And subsequent, you will note that its hedging function doesn’t cease right here.

Portfolio Visualizer

GLD ETF: drawdowns and restoration time

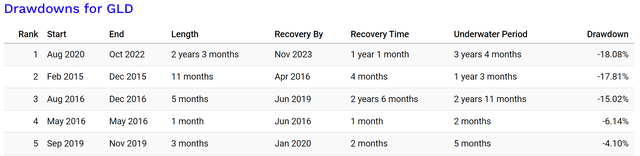

Let’s first increase our evaluation from the worst drawdowns to the highest 5 drawdowns to verify our view will not be biased by one single information level. The following two charts beneath present the main points of the highest 5 drawdowns for GLD and SPY prior to now 10 years. As seen, GLD has suffered much less extreme drawdowns in 4 out of the 5 instances.

Portfolio Visualizer

Portfolio Visualizer

Throughout market downturns, the restoration time is equally essential – particularly while you actively withdraw. Prolonged underwater period can create excessive monetary hardship and in addition emotional stress. The charts above additionally present the restoration time for GLD and SPY throughout their prime 5 drawdowns. As seen, the restoration time varies considerably for each funds. For GLD, the longest restoration took 2 years and 6 months for a drawdown that began in August 2016. In distinction, the shortest restoration was simply 1 month for a drawdown in Could 2016. On common, the median restoration time for GLD is 4 months amongst its prime 5 worst drawdowns, the identical as SPY’s median restoration time throughout its prime 5 drawdowns.

Different dangers and last ideas

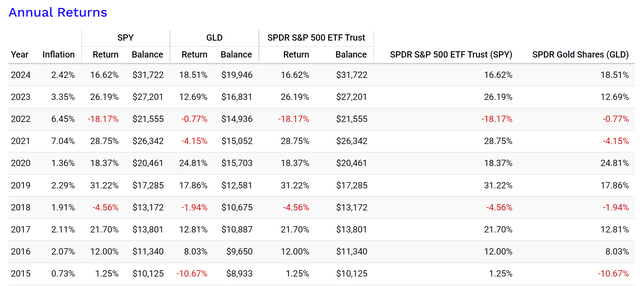

Lastly, let’s additionally look at the timing of the drawdowns. The chart beneath compares the annual returns of GLD and SPY prior to now 10 years. As seen, SPY skilled 2 annual losses throughout the previous 10 years. In each instances, the inclusion of GLD might have considerably decreased the losses. Notably, in 2022, when SPY skilled a major lack of -18.17%, GLD solely declined by -0.77%. To a lesser diploma, in 2018, throughout one other market downturn, GLD’s lack of -1.94% was considerably smaller than SPY’s -4.56%.

Portfolio Visualizer

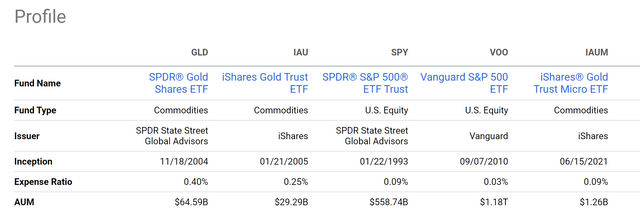

When it comes to draw back dangers, GLD fees a comparatively excessive charge of 0.40%. That is a lot increased than massive listed fairness funds comparable to SPY. As seen within the subsequent chart beneath, additionally it is increased than many different gold funds. Notably, the not too long ago launched iShares Gold Micro ETF (IAUM) incorporates a charge of solely 0.09%, similar to SPY already. Should you recall from an earlier chart, over the previous 10 years, GLD generated a return of seven.47% per 12 months. A 0.4% expense ratio thus interprets into about 5% of the annual return, not a negligible drag. As aforementioned, good points from GLD may be taxed at a better fee because the ETF is handled as a collectible by the IRS. The tax headwinds subsequently also needs to be a part of the funding consideration.

To shut, let me make clear that I’m not making an attempt to indicate that SPY (or fairness basically) is a nasty funding. The purpose I wish to make is that current developments have made GLD a well timed hedge towards a possible onerous touchdown. Most traders are conversant in GLD’s low correlation to different asset courses comparable to bonds and fairness. Nonetheless, a better have a look at the magnitude, restoration time, and timing of its worst drawdowns reveals its hedging function to be much more potent than the correlation coefficient reveals.

Searching for Alpha

[ad_2]

Source link