[ad_1]

Key Takeaways

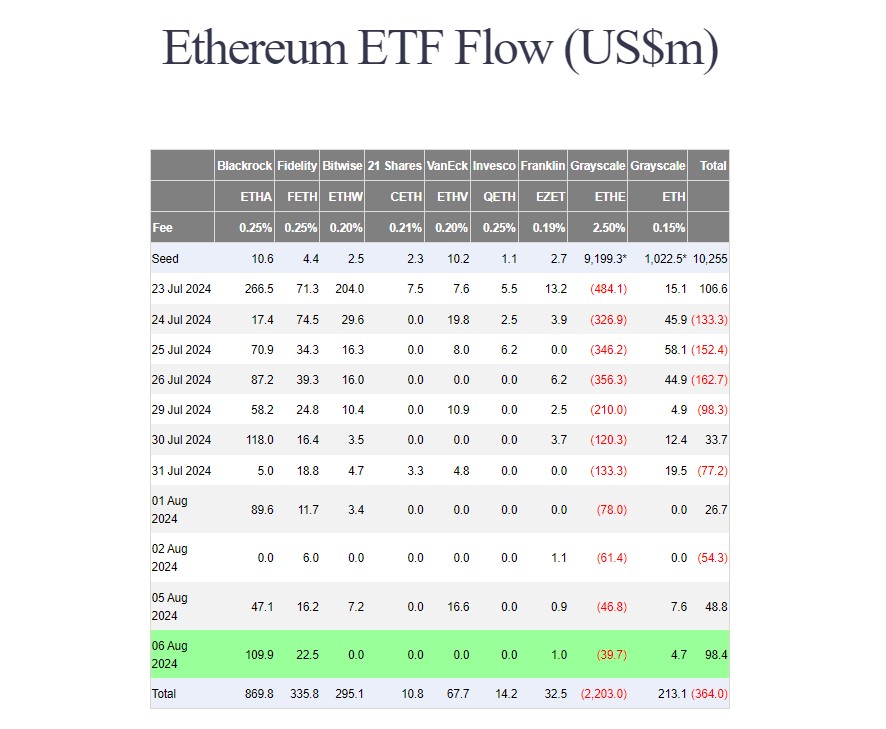

Grayscale’s Ethereum ETF skilled its lowest each day outflow.

Regardless of combined efficiency, the 9 ETFs collectively noticed internet inflows of $98 million on Wednesday.

Share this text

Round $40 million exited the Grayscale Ethereum Belief, now buying and selling as an exchange-traded fund (ETF) on August 6, in accordance with knowledge from Farside Traders. This marks the bottom each day outflow since its conversion from a belief final month.

The each day tempo of outflows from the fund, working underneath the ETHE ticker, hit a peak of $484 million on its debut date. ETHE outflows topped $1.5 billion after the primary week of buying and selling.

Nevertheless, the tempo of exits has cooled because the begin of this week. On Monday, ETHE reported over $61 million in internet outflows, adopted by roughly $47 million drained on Tuesday. With the brand new outflows reported on Wednesday, the whole ETHE outflows have exceeded $147 million to this point this week.

Beforehand, analyst Mads Eberhardts anticipated a slowdown in ETHE outflows this week. He additionally instructed a possible value enhance after outflows stabilized.

US spot Ethereum ETFs are experiencing a combined development because of slower inflows into nearly all of funds. BlackRock’s iShares Ethereum Belief (ETHA) has been probably the most profitable amongst others within the group. The ETF ended Wednesday with virtually $110 million in internet inflows, bringing the whole to almost $870 million since its launch.

Total, the 9 funds took in a internet $98 million in money on Wednesday. Constancy’s Ethereum (FETH) fund adopted BlackRock with $22.5 million in inflows. Different positive aspects had been additionally seen in Grayscale’s Ethereum Mini Belief (ETH) and Franklin Templeton’s Ethereum ETF (EZET).

Share this text

[ad_2]

Source link