[ad_1]

loonger

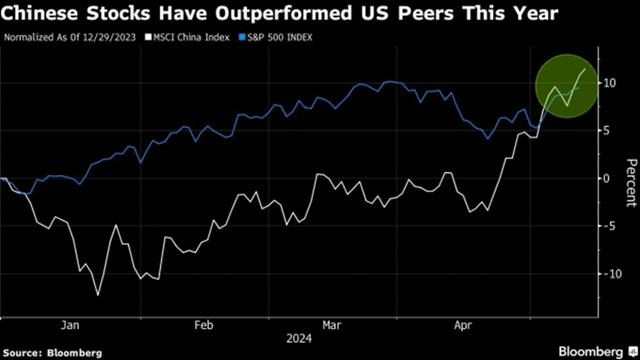

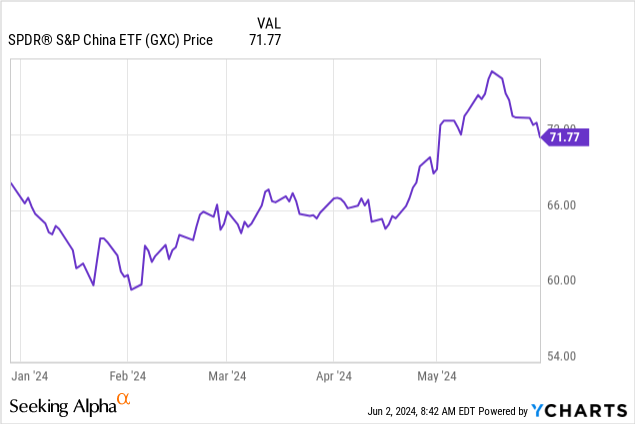

Since I final coated the offshore-focused SPDR S&P China ETF (NYSEARCA:GXC) final 12 months (see GXC: A Chinese language Stability Sheet Recession Looms Giant), the fund has gone by way of some ups and downs. The excellent news, although, is that regardless of a tough Q1, there’s been loads of cause for optimism since then – a key issue behind my reversal on China after the Lunar New Yr (see KBA: Poised To Profit From A Chinese language Dragon Yr Turnaround).

Bloomberg

Sure, there’s nonetheless stability sheet recession danger, however not like final 12 months, when coverage help was largely incremental, the Chinese language authorities has proven much more intent post-New Yr. To recap, the central financial institution has stepped up its tempo of charge cuts, whereas the pro-growth agenda outlined at its newest Nationwide Individuals’s Congress assembly, buttressed by strong 2024 GDP progress and inflation targets, in addition to ~RMB1tn of sovereign bond issuances, signifies a really optimistic course of journey. One other key enhance was the ramped up coverage help for equities, most notably through state-backed purchases of onshore index funds.

World Instances

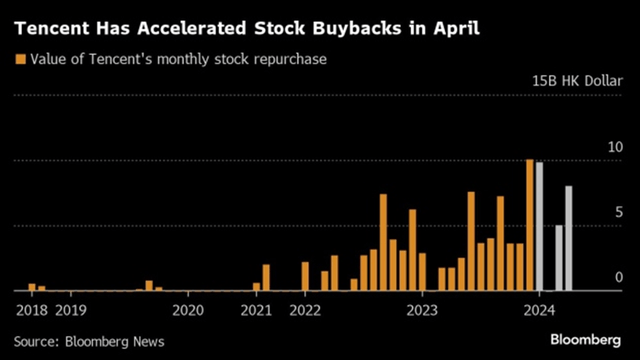

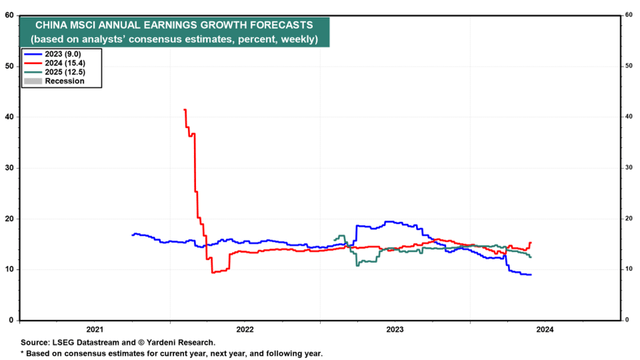

To be clear, China’s fundamentals are nonetheless flawed. Nominal GDP will not develop anyplace close to what it used to, and neither will earnings. Numerous the negatives are already, nevertheless, within the worth, significantly for offshore listings (US depositary receipts and Hong Kong ‘H-shares’) – key parts of the GXC portfolio. So even when we do see downward revisions from the present low to mid-teens % bottom-line progress outlook, traders ought to nonetheless come out forward. Within the meantime, maintain a watch out for China’s lately introduced ‘9-Level Steering’, which might set off extra buybacks and dividends from cash-rich ‘huge tech’ names listed in US/HK. Internet-net, I fairly just like the tactical GXC setup for the approaching months.

Bloomberg

GXC Overview – Aggressive however not the Lowest Value Play on China’s Offshore Listings

The basics of State Road’s (STT) SPDR S&P China ETF stays largely intact. For one, GXC continues to trace the capitalization-weighted S&P China BMI Index, a basket of predominantly Hong Kong-listed shares. Because of this like different comparable China large-cap ETFs (iShares’ MSCI China ETF (MCHI) and Franklin FTSE China ETF (FLCH)), GXC is principally a client/tech fund shielded from depositary receipt-related dangers.

On the fee aspect, GXC’s ~0.6% expense ratio is in step with MCHI, although it does path FLCH’s best-in-class ~0.2% charge construction. Mixed with liquidity concerns, although, GXC’s ~12bps bid/ask unfold locations it on the decrease finish on total price. Within the meantime, the fund has continued to submit consecutive quarters of asset declines, which will not assist bridge the liquidity hole – the present $490m is effectively beneath what the fund managed at the moment final 12 months.

State Road

GXC Portfolio – Broader and Extra Diversified

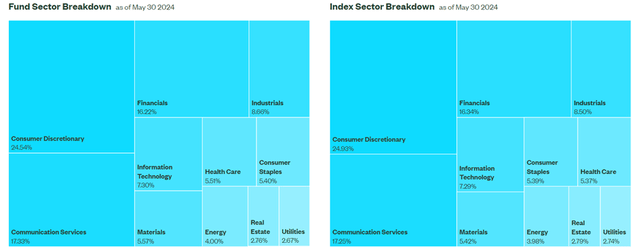

According to prior quarters, the GXC portfolio is skewed towards the 2 key sectors China’s largest web platforms are categorized below – Shopper Discretionary (24.5%) and Communication Companies (17.3%). Financials is the opposite huge publicity at 16.2%, adopted by Industrials (as much as 8.7%) and Info Know-how (all the way down to 7.3%). Whereas the fund might sound top-heavy, its Shopper Discretionary/ Communication Companies sector focus continues to be a number of share factors decrease than MCHI (>50%) and FLCH (~48%).

State Road

On the single-stock degree, GXC additionally stands aside with its very broad ~1.2k inventory portfolio. Because of this, whereas 4 of GXC’s 5 largest holdings are main Chinese language web names, they’ve decrease % allocations than MCHI (659 holdings) and FLCH (955 holdings). China’s largest banks, like China Development Financial institution (OTCPK:CICHY) and Industrial and Industrial Financial institution of China (OTCPK:IDCBY), additionally characteristic closely, although their % weightings are equally decrease than comparable China ETFs.

State Road

GXC Efficiency – Down however on the Approach Again Up

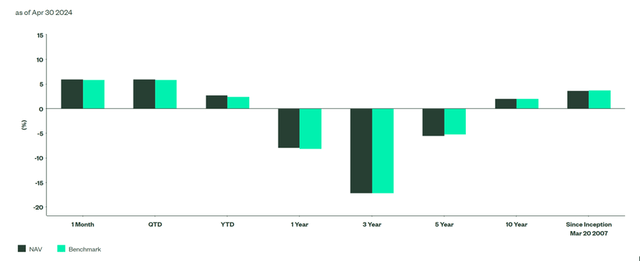

Together with the remainder of the Chinese language large-cap ETF universe, GXC has seen consecutive years of unfavourable whole returns. Issues have begun to reverse post-Chinese language New Yr, although, little doubt helped by a particularly low valuation base and considerably extra accommodative coverage measures.

Whereas GXC has now returned +2.7% year-to-date in NAV phrases (+6.0% Q2 up to now), it has additionally lagged behind MCHI (+9.1%) and FLCH (+6.6%). A key cause for that is GXC’s comparatively decrease publicity to China’s largest shares, lots of which have benefited disproportionately from current coverage help. This additionally means, nevertheless, that GXC’s lagging portfolio is healthier positioned to seize the later levels of the China rally when the upside broadens out.

State Road

One different optimistic to proudly owning GXC is its (semi-annual) distribution payout, which is each larger and extra secure than comparables by way of the cycles. For context, on a trailing twelve-month foundation, GXC pays a 3.5% yield, boosted by its elevated $2.52/share payout final 12 months. Count on extra upside into the June distribution, as even with extra downward revisions for the struggling property sector, Q1 2024 earnings remained in optimistic territory. And with extra coverage help within the pipeline, the present low to mid-teen % consensus earnings progress expectation will not be out of attain this 12 months. In any case, China nonetheless trades at a trough ~10x ahead earnings a number of, so the GXC danger/reward appears fairly favorable right here.

Yardeni

China’s ‘Yr of the Dragon’ Rally Might Nonetheless Have Legs

To be clear, the Chinese language financial system stays a challenged one long-term, and sure, there are nonetheless dangers to the funding case. However with equities already all the way down to trough-level valuations, these negatives (and extra) are already within the worth. Offshore listings, particularly, stand out as the best way to play the following leg of the China rally, given their relative low cost and leverage to numerous upcoming coverage catalysts. All in all, I see a powerful case to be tactically lengthy offshore-focused GXC from right here.

[ad_2]

Source link