[ad_1]

adventtr

Whereas the inventory market has been on a roll since October 2023, there are bearish indicators on the horizon that point out now could be a great time to begin hedging these inventory portfolios with valuable metals like gold and silver.

Despite the fact that the value of gold has risen 40% since I first steered it on July 14, 2022, it’s not too late to learn from an extended place as inventory market fundamentals develop more and more fragile.

Gold and silver are typically a protected guess when the greenback is underneath stress. At the moment, the greenback is without doubt one of the strongest currencies on the earth. However it’s nonetheless a fiat foreign money, and the US authorities is turning into more and more over-extended as each the federal price range and the debt to GDP are rising to ever riskier heights. The US debt at the moment stands at $34.6 trillion, whereas the US Debt-to-GDP has risen to 123%, increased than it was on the shut of WWII.

Yield Curve Inversions – The Most Dependable Indicators For Recessions

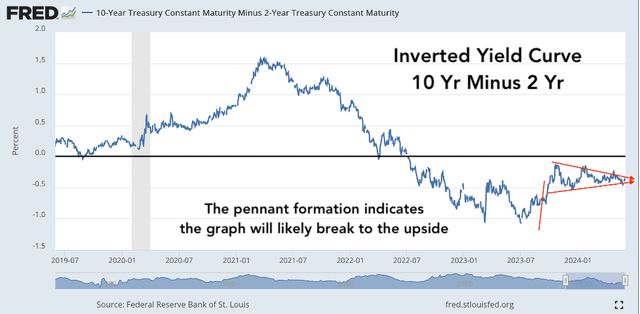

A traditionally lengthy, deeply inverted yield curve suggests there’s a recession in our future. If measurement and breadth are any indications, it could possibly be extreme. Discover within the chart under, the graph line has created an extended pennant formation. This sort of formation often ends in the inventory breaking within the course of the flagpole, on this case upward. Whether or not this breakout units a brand new development or is simply one other wave on the graph line stays to be seen.

Fig. 1

St. Louis Fed

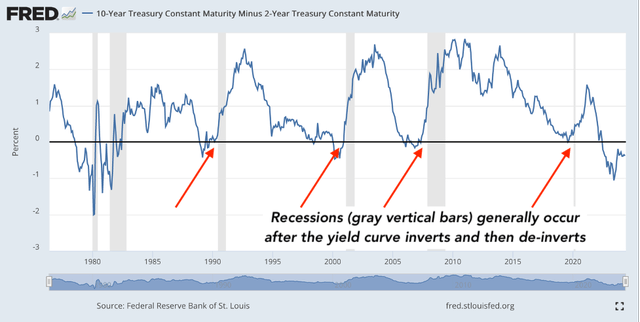

Some analysts argue that the inverted yield curve indicator is damaged as a result of it has been inverted for over two years, a traditionally unprecedented size of time. Nevertheless, a better have a look at the graph under signifies that recessions arrive after the yield curve de-inverts. Discover that the grey vertical bars indicating recessions happen shortly after the graph rises above the zero line – when the yield curve de-inverts – although typically it might take so long as 6 months, as occurred within the lead-up to the 2007-09 recession.

Fig. 2

Inverted Yield Curve 1980-2024 (St. Louis Fed)

Based mostly on the reliability of this indicator, it might be clever to proceed with warning, at the same time as inventory market indexes soar to new highs.

Quantitative Easing Might Be Shut To The Finish Recreation

The Fed has tinkered with rates of interest and QE for therefore lengthy, bailouts for troubled banks and firms have grow to be routine. However resorting to QE to keep at bay each recession that comes our method is dangerous. The Fed may create a spring-loaded recession that will not be contained by QE. Any makes an attempt to take action may trigger severe injury to our foreign money.

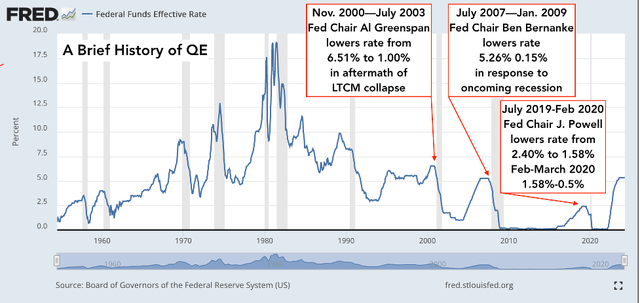

These totally invested within the inventory market might assume they’re protected from a steep downturn. The latest previous has satisfied traders that within the occasion of a recession, the Fed will hit the QE Straightforward Button, reverse the inventory market’s downhill slide, and ship it increased than ever. Over the previous quarter-century, this has certainly been the case. The chart under exhibits the Fed dramatically lowered charges in response to an oncoming recession in 2000, 2007, and 2019-2020.

Fig. 3

Federal Funds Price Chart (St. Louis Fed)

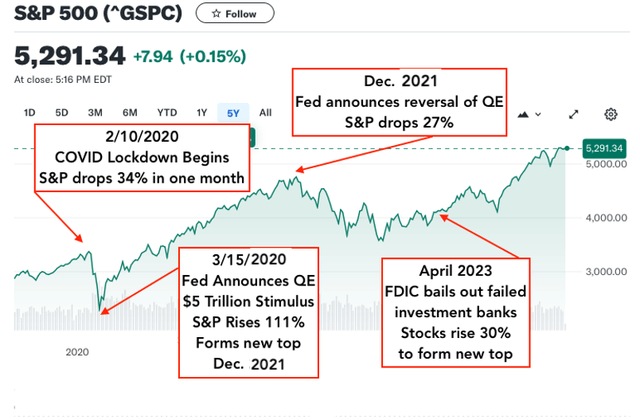

The S&P tends to reply shortly to those shifts within the Federal Funds charges. When companies have been shuttered in response to the COVID-19 pandemic in Feb. 2020, the S&P 500 dropped 34% in simply weeks. However when the Fed introduced one other spherical of QE in March 2020, the markets immediately snapped again, reinforcing the outdated adage “Do not combat the Fed.” When the Fed introduced the reversal of QE in December 2022, the S&P dropped 27%. Quick-forward to the 2nd quarter of 2023 when the Treasury Division introduced bailouts for a number of failing funding banks in April of that yr. The S&P resumed its steep upward climb and soared to a brand new all-time excessive.

Fig. 4

S&P Historic Chart (Finance.Yahoo)

Whereas this was nice information for traders, such treatments might have created a reckless atmosphere within the inventory market, whereby traders weight their portfolios far too closely towards shares with out correct hedging with Treasury payments and valuable metals.

A Historical past of Quantitative Easing

Because the US monetary system sails additional and additional into the uncharted waters of quantitative easing, neither the Fed nor Treasury Division appears to know what lies past.

Nevertheless, although the QE moniker is new, there’s some historic precedent concerning the usage of fiat foreign money to pay for both a authorities price range that exceeds receipts or bail out giant firms which have quick access to the highest levers of presidency. Previously, main governments have performed each. Investigating the outcomes of these monetary insurance policies could be instructive.

The Yuan Dynasty and the world’s first experiment with fiat foreign money

The primary half of the Yuan Dynasty, which lasted from 1271 to 1368, was marked by legendary wealth and luxurious, as depicted within the tales of Marco Polo. We are able to virtually gauge when the tide started to show by the date that Marco Polo’s social gathering left China in 1292. Having realized the emperor had no intention of permitting them to go away his service, Marco Polo and his touring social gathering volunteered to escort a Mongolian princess to the Persian Khan to whom she had been betrothed. The Italian explorers have been an apparent selection, contemplating they have been skilled vacationers. After a grueling journey, they delivered the princess to Persia after which shortly made their method again to Italy.

Fig. 5

One among Emperor Yuan’s (aka Kublai Khans’s) failed army adventures, The Invasion of Japan (Wikimedia Commons)

From the time of their departure, the Yuan Dynasty devolved additional into struggle. Inflation spiraled as Emperor Yuan printed ever extra fiat foreign money to pay for his struggle excursions. In consequence, the as soon as thriving Chinese language economic system tanked. Tens of millions of Chinese language discovered themselves in excessive poverty, and the emperor was held responsible. The Yuan Dynasty did handle to final roughly 90 years earlier than it fell to a robust Chinese language warlord. However the dynasty was short-lived nonetheless. Solely two Chinese language dynasties of the Widespread Period have been shorter.

The Mississippi Firm and the world’s first inventory market bubble

Quick-forward to the daybreak of the 18th Century, whereby a charismatic and extremely profitable Scottish gambler by the identify of John Legislation involves France underneath a cloud of scandal. For need of a greater strategy to make a residing, Legislation gravitated towards the best casinos in Paris, the place he shortly established a fame as an awfully fortunate and intensely charming gambler. Contemplating card video games have been the preferred types of playing in that period, and nobody ever caught John Legislation dishonest, he was probably a card counter – an indication of excessive intelligence, significantly in regard to memorizing numbers and calculating chances.

As a result of playing was extraordinarily well-liked with aristocrats, John Legislation discovered himself rubbing elbows with the Duke of Orleans, who was quickly appointed France’s regent as his nephew, the kid King Louis XV, awaited the age of majority. Like so many others, Philippe II, the Duke of Orleans, was taken with the Scottish gambler. John Legislation immediately noticed a profitable alternative in his budding friendship with essentially the most highly effective man in France.

Legislation had been born right into a household of goldsmiths and bankers. He entered the household enterprise on the age of 14 and have become an adept accountant. He was thought-about a prodigy till his father died, whereupon he succumbed to the lure of playing.

Because of his intensive data of finance, John Legislation satisfied the Duke of Orleans to mix a large portion of his wealth with Legislation’s to type a personal financial institution referred to as Banque Generale. A yr later, Legislation satisfied his patron to nationalize the financial institution and rename it the Banque Royale, which grew to become France’s first nationwide financial institution, with John Legislation at its head with the title Controller Basic of Funds.

At first, John Legislation made a decent central banker. All banknotes have been backed by gold, silver, or actual property. He instituted fiscal reforms, together with the elimination of tolls on well-traveled roads and canals to release commerce. He additionally financed street building and made low-interest loans accessible to start-up companies. Inside two years, business had elevated by 60 p.c and the variety of service provider ships setting sail from French ports went from 16 to 300.

However Legislation unwittingly set himself up for a fall when he consolidated all French-owned buying and selling firms in North America into the Mississippi Firm. Whereas a lot of Legislation’s monetary experiments have been profitable, his experiments with the Mississippi Firm inventory shares have been disastrous.

His first mistake was permitting traders to purchase shares on credit score, shortly resulting in an over-heated market. He doubled down on that mistake by paying a beneficiant dividend of 4 p.c per share (versus a hard and fast sum of money per share), such that the dividends grew to become more and more beneficiant because the inventory worth rose. This set off a devastating suggestions loop.

Over the months that adopted, dozens of individuals have been crushed to demise within the packed crowds that milled round John Legislation’s mansion, clamoring to purchase inventory within the Mississippi Firm. The inventory worth soared far past the precise worth of the corporate, creating the primary inventory market bubble in historical past.

Fig. 6

Rue Quincampoix (John Legislation’s avenue) in 1720; a crowd of traders clamor to purchase inventory in John Legislation’s Mississippi Firm (Wikimedia Commons)

Like all bubbles, the value of Mississippi Firm inventory shares ultimately peaked after which crashed as traders found getting their a reimbursement was far harder than shopping for in.

Many highly effective noblemen had poured their fortunes into the Mississippi Firm. Their fury was a pressure to be contended with. The Duke of Orleans had no selection however to permit John Legislation to print up sufficient unsecured foreign money to purchase again the shares of the inventory. This motion devalued the French foreign money and despatched inflation hovering, roiling the French market.

France ultimately regained its monetary footing however principally stumbled by way of the 18th Century proper as much as the French Revolution.

The Weimar Republic’s Nice Forex Collapse

Fig. 7

Germans present stacks of cash to purchase widespread gadgets throughout Twenties hyperinflation (Wikimedia Commons)

Confronted with the large price of WWI along with compelled reparations, the German central financial institution started shopping for exhausting foreign money (backed by metallic) in alternate for fiat foreign money. The central financial institution printed all the cash they wanted to purchase up as a lot exhausting foreign money as residents and expats would promote. The sellers had no concept their German marks would quickly be nugatory. In early 1922, one US greenback was price 320 marks. By November 1923, one US greenback was price over 4.2 trillion German marks. The Weimar authorities was dissolved by an act of Parliament and a brand new German authorities reset the foreign money in 1924, changing the mark with the Reichsmark, which was backed by mortgage bonds. In addition they stopped the German nationwide financial institution from printing extra foreign money. The German foreign money stabilized, and German society returned to some semblance of normality. Nevertheless, the Germans had so fully misplaced religion within the former regime, they made ripe pickings for a demagogue named Adolf Hitler. In 1939, the Nazi Germans invaded Poland and kicked off WWII. Six years later, they surrendered – a nation twice defeated within the new century.

The place Our Financial system Stands As we speak

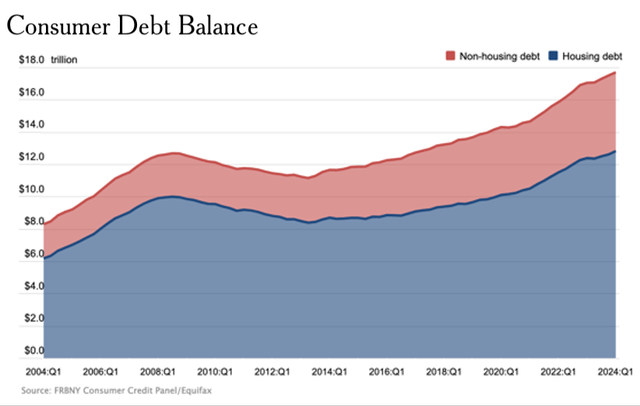

As of June 2024, our nation’s Debt to GDP ratio is at 121% after rising to a historic excessive of 133% in 2020. In the meantime, US Client debt has risen from $14.3 trillion to $17.69 trillion since 2020 Q1, a 24% rise.

Fig. 8

New York Fed

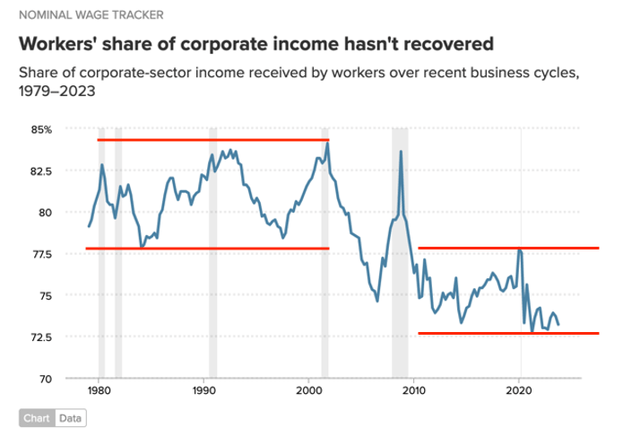

Whereas the federal government insists employee paychecks are maintaining with inflation, these paychecks are steadily falling behind of their share of company earnings. The chart under exhibits that whereas employee compensation as a share of company earnings tends to vacillate between 77%-84%, since 2010 it has remained under 77% and is at the moment hovering round 73%.

Fig. 9

Financial Coverage Institute

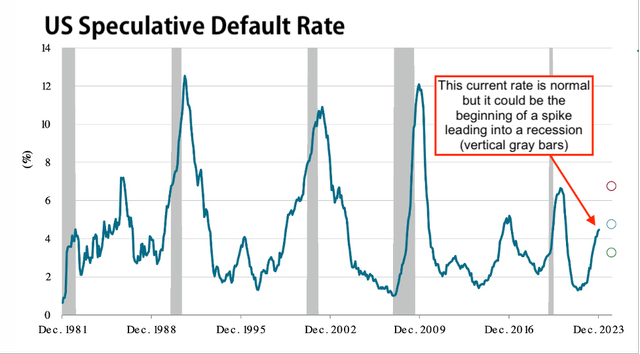

Within the meantime, financial institution and enterprise defaults have been on the rise for the reason that Fed started tapering in 2022. To this point, they do not look like in a hazard zone, until the present upward development is the start of a brand new spike. These are likely to coincide with oncoming recessions.

Fig. 10

SP World

Why Gold and Silver ETFs make a wonderful hedge

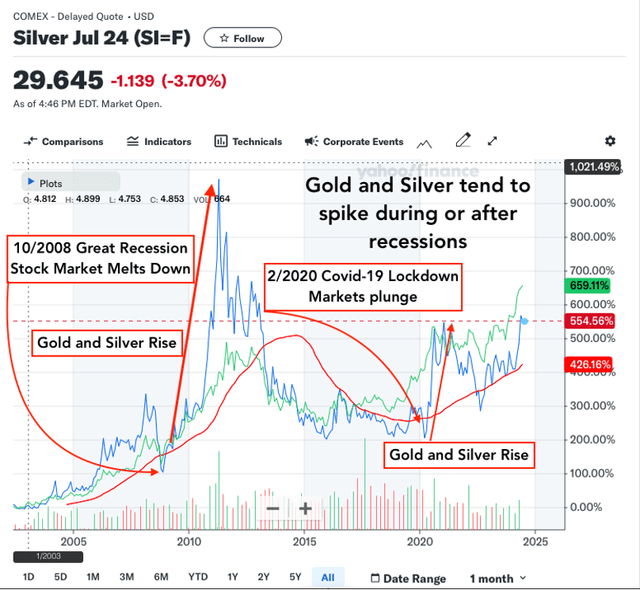

Whereas there’s nonetheless cash to be made buying and selling shares, a gentle drumbeat of market indicators foreshadows a recession. Within the rapid aftermath of the final two recessions, gold and silver bullion soared.

Fig. 11

Gold and Silver Bullion Comparability Chart (Finance.Yahoo)

Since October 2022, gold bullion and silver have risen sharply, more than likely the results of skilled traders hedging their portfolios. Should you really feel you’ve missed the boat on gold, this is some excellent news. You may be capable of meet up with silver. Discover within the chart under that when gold and silver are in an upward development, silver tends to overhaul gold when it comes to general percentages.

Fig. 12

finance.yahoo

Caveats

Gold and silver have risen dramatically over the previous yr, and as you may see from the chart above, each have important pullbacks alongside the way in which. Furthermore, gold and silver are likely to dip on the onset of a recession, earlier than their dramatic rise. An funding in gold and silver at present may probably lose cash earlier than it makes cash. An extended-term maintain could be advisable.

Abstract

There are quite a few indications {that a} recession could also be looming. Since gold and silver carry out extraordinarily properly each throughout and instantly after a recession, each metals make an excellent hedge in opposition to the inventory market.

If you would like to see why I like to recommend gold and silver ETFs over gold and silver mining firms, please see my article “GLD: Gold is Spring-Loaded For An Finish-Of-Summer season Bounce”.

[ad_2]

Source link

![[WEBINAR] Algorithmic Trading with Python: Integrating with Various Brokers and Platforms](https://equitytracknews.com/wp-content/uploads/https://d3rqk6yq02oh9d.cloudfront.net/production/images/meta-images/algorithmic-trading-python-18-june-2024.png)