[ad_1]

Terryfic3D/iStock Unreleased through Getty Pictures

Introduction

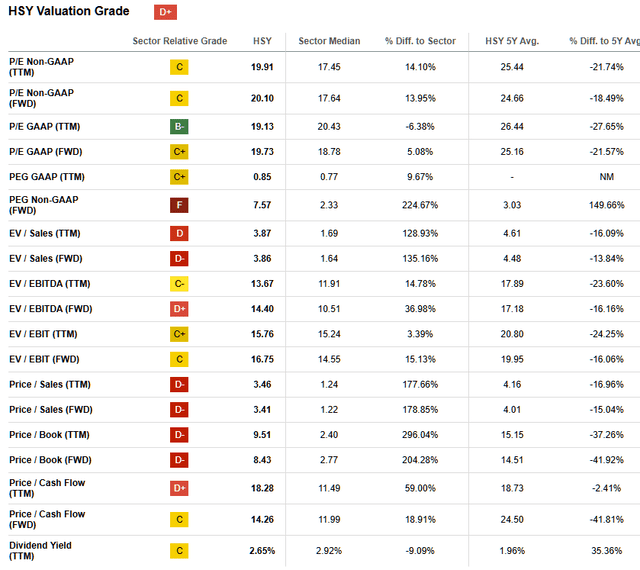

The inventory of The Hershey Firm (NYSE:HSY), one of many largest chocolate makers on the earth, has considerably underperformed the broader market in 2023 and 2024. Whereas it is laborious to miss the truth that buyers have been overly optimistic about the corporate’s pricing energy and development prospects in 2022 and early 2023, HSY shares have been buying and selling for as a lot as $263, or a P/E ratio of 27 – issues are very totally different at the moment.

With historic cocoa worth inflation, the emergence of weight-loss medication doubtlessly hurting demand, and inflation-ridden shoppers, Hershey buyers have taken an more and more conservative stance. Since October 2023, Hershey shares commerce in a spread of $180 to $210, or a ahead P/E of roughly 20. In my opinion, the market is underestimating the truth that Hershey is much less affected by the rise in cocoa costs than a few of its opponents, largely as a result of comparatively low cocoa content material in lots of its merchandise. It’s fairly potential that Hershey’s place and scale will allow it to emerge from this part stronger than its opponents and additional consolidate its main place.

After all, a P/E of 20 (Desk 1) is under no circumstances a discount valuation, however given Hershey’s undoubtedly sturdy model fairness and conservative administration, I believe some premium is warranted. Having studied Hershey’s fundamentals, let me due to this fact share the three (and a half) explanation why I added HSY inventory to my diversified and income-oriented inventory portfolio.

Desk 1: The Hershey Firm (HSY): Valuation metrics (Looking for Alpha)

Cause 1: Sturdy Profitability And Significant Investments In Future Development

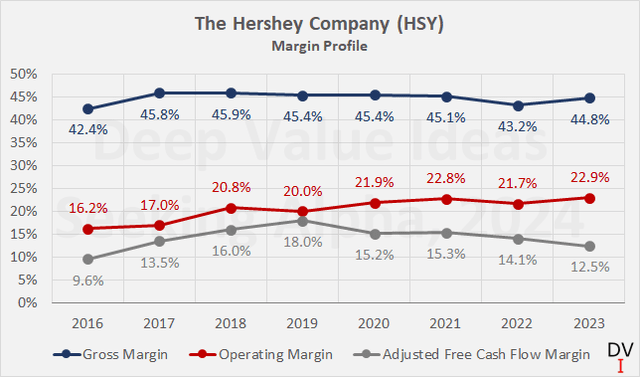

A excessive and low fluctuating gross margin is without doubt one of the most essential traits of a well-positioned firm. With a long-term common gross margin of 44.8% (Determine 1, blue), Hershey has loads of room for promoting, administrative and interest-related bills in addition to – after all – shareholder returns.

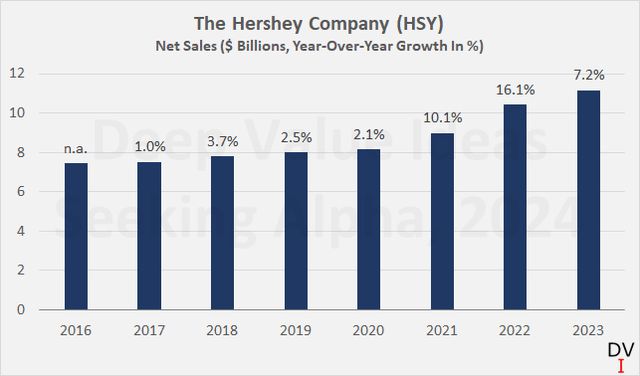

Promoting spend has declined considerably through the years, from 7.0% of internet gross sales in 2016 to five.4% in 2023, however what might be interpreted as underinvestment within the enterprise to prioritize near-term working margin enchancment (Determine 1, purple) ought to as an alternative be seen as acceptable promoting spend towards a backdrop of the above-average inflation- but in addition demand-driven gross sales development (Determine 2). Additionally, the working margin enchancment of greater than 670 foundation factors in simply eight years sounds spectacular, however needless to say the 2016-2017 interval was a big damaging outlier and Hershey’s typical working margin is round 20%. In any case, a rise by 2 to three share factors in comparison with the long-term common is sort of strong, particularly towards the backdrop of excessive inflation in 2022 and 2023, the place many corporations needed to (briefly) take in a big a part of the elevated enter prices.

Determine 1: The Hershey Firm (HSY): Gross, working, and adjusted free money circulate margin on an annual foundation (personal work, based mostly on firm fillings)

Determine 2: The Hershey Firm (HSY): Annual internet gross sales and year-over-year development in p.c (personal work, based mostly on firm fillings)

Nonetheless, in distinction to the continual working margin enlargement, Hershey’s adjusted free money circulate margin (FCF) has contracted lately after peaking at a really strong 18% in 2019 (Determine 1, grey). As all the time, I’ve adjusted FCF for working capital actions (three-year rolling common) and thought of stock-based compensation as a money expense. Within the case of Hershey, I additionally took under consideration the recurring fairness investments in tax credit score qualifying partnerships (common of seven% of working money circulate, OCF). The tax credit scale back Hershey’s tax expense, which is inherently included in OCF, and due to this fact I didn’t deduct the associated write-down (see Be aware 10 on p. 80 of HSY’s 2023 10-Okay for extra data).

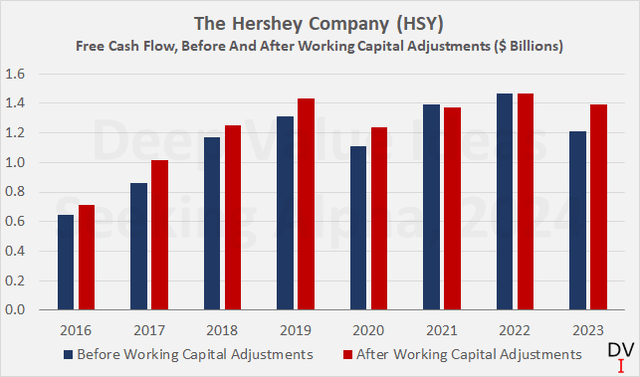

In my opinion, the decline in free money circulate margin isn’t actually a priority. Trying on the blue bars in Determine 3, which characterize Hershey’s free money circulate earlier than working capital changes, one can see that the unadjusted free money circulate margin would have been barely decrease in earlier years, leading to a extra favorable margin-related comparability. The present weak FCF margin is essentially on account of increased working capital accounts (inventories at 12% of internet gross sales and ongoing enhance in receivables), so I believe it’s affordable to count on Hershey to see favorable money flow-related results in 2024 and thus a restoration in FCF margin.

I believe it could be improper to interpret this as an indication of poor working capital administration. Fairly the opposite, Hershey’s days payables excellent ratio has been steadily rising, reaching 60 days in 2023, whereas the times gross sales excellent ratio has improved from 29 days to round 25 days lately. Admittedly, and possibly on account of the continued acquisitions, the stock days ratio has had a damaging impression on working capital effectivity (a rise from round 65 to 75 days since 2016), however total working capital administration may be very strong and traits in the appropriate route, as evidenced by the lower within the money conversion cycle from 50 to 40 days over the past eight years.

Determine 3: The Hershey Firm (HSY): Free money circulate, earlier than and after changes for working capital actions however together with changes for stock-based compensation and fairness investments in tax credit score qualifying partnerships (personal work, based mostly on firm fillings)

The stepped-up funding within the enterprise – which is after all welcome – is one cause why I count on free money circulate profitability to enhance solely steadily. Whereas Hershey solely invested round 3.5% of its internet gross sales within the enterprise in 2016 and 2017, relative capital expenditure exceeded 5% in 2020 and reached 6.9% in 2023 (adjusting for inflation, relative investments are even increased). For 2024, administration is planning investments of $600 to $650 million, i.e. round 5.5% of anticipated internet gross sales, which suggests a average optimistic impact on FCF. One other driver for the anticipated improved FCF profitability is Hershey’s “Advancing Agility & Automation Initiative”, which administration expects to have a optimistic impression of $100 million in 2024.

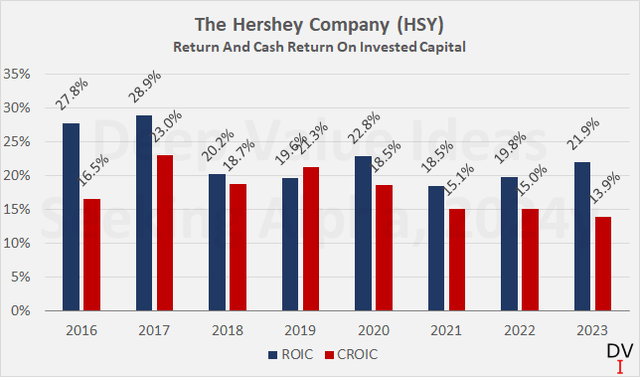

The at present comparatively weak free money circulate can be the explanation for the decline within the money return on invested capital (CROIC, purple bars in Determine 4). Nonetheless, a CROIC of 14% remains to be effectively above any affordable expectation for the price of fairness (the CAPM-derived value of fairness is at present 5.9%), which may be very optimistic certainly. Moreover, the present above-average investments must be seen as development investments reasonably than upkeep investments, which can be mirrored within the distinction between ROIC (based mostly on internet working earnings after tax, blue bars in Determine 4) and CROIC. In my opinion, a return to a CROIC within the excessive teenagers is an affordable expectation and underlines Hershey’s continued sturdy shareholder worth creation.

Determine 4: The Hershey Firm (HSY): Return and money return on invested capital (personal work, based mostly on firm fillings)

All in all, I contemplate the mix of a gross margin of just about 50%, a normalized CROIC within the excessive teenagers and strong working capital administration to be a powerful indication of a succesful and long-term considering administration, prioritizing worth creation and shareholder returns.

Cause 2: A Conservatively Managed Stability Sheet With Optionality

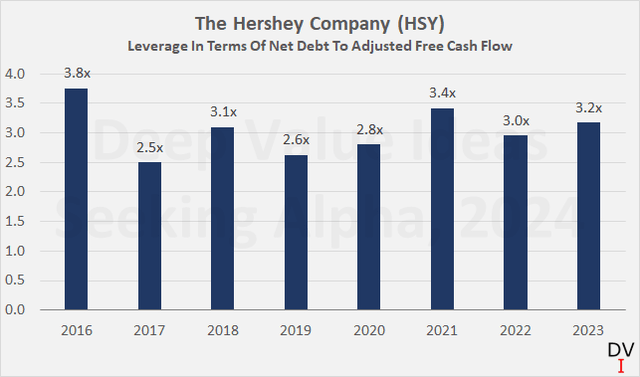

Hershey’s internet debt elevated from $2.7 billion on the finish of 2016 to $4.4 billion on the finish of 2023, primarily on account of acquisitions. Nonetheless, HSY’s leverage ratio, as measured by internet debt to adjusted free money circulate, remained comparatively flat throughout this era and at roughly 3x stays very manageable (Determine 5).

Determine 5: The Hershey Firm (HSY): Leverage by way of internet debt to adjusted free money circulate (personal work, based mostly on firm fillings)

Figuring out that adjusted FCF has probably not grown lately, I see the continued affordable leverage as an indication of monetary prudence. That is under no circumstances a given, contemplating how tempting it has been to extend leverage to purchase again shares through the previous low rate of interest atmosphere. Shopping for again shares naturally contributes to earnings per share (EPS) development, but when funded with debt the optimistic impact is ultimately negated by increased curiosity bills, which, within the worst case, jeopardizes monetary stability.

Share buybacks are usually carried out at Hershey, however I might argue that they’re carried out in a really disciplined method. The variety of totally diluted shares excellent has declined by 10 million, or about 4.8%, since 2016. Put one other method, share buybacks solely contributed about 67 foundation factors to EPS development on an annualized foundation (11.7% p.a. since 2016, together with buybacks).

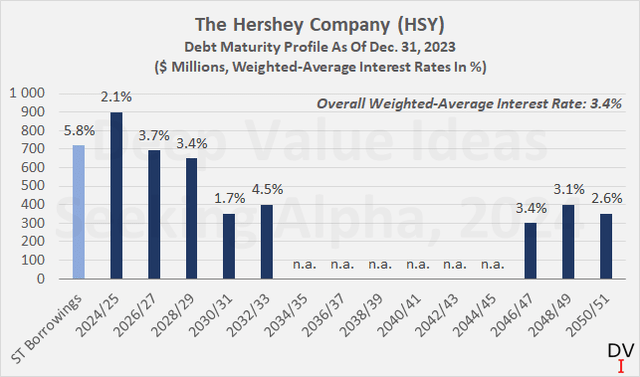

Hershey’s curiosity bills have naturally risen as a result of enhance in debt through the years and the rise in rates of interest because the starting of 2022. For 2024, administration expects internet curiosity expense to be within the vary of $165-175 million, roughly 12% increased than in 2023, when the corporate paid 10% greater than it did in 2022. That is definitely a big enhance, however curiosity bills must be seen within the acceptable context. An curiosity protection ratio of roughly ten occasions free money circulate earlier than curiosity may be very strong, particularly for an organization with dependable and largely recession-resistant money flows.

To some extent, the rise in curiosity expense is because of adjusting short-term borrowings (mild blue bar in Determine 6), which by their nature (financial institution loans and industrial paper) and as a result of inverted yield curve are costlier than fixed-rate long-term debt. I count on Hershey to repay the $300 million 2.050% notes maturing in November. It’s fairly potential that the corporate may even redeem the very low-cost 0.900% notes ($300 million, maturing on June 1, 2025) and as an alternative refinance the – comparatively costly however nonetheless low-cost – $300 million 3.200% notes maturing subsequent August.

In my opinion, Hershey’s treasury division is doing a wonderful job of managing debt maturities (Determine 6), and I don’t count on the weighted-average rate of interest to extend materially even when rates of interest stay at present ranges for the foreseeable future. With post-dividend free money circulate of $500 million to $700 million per 12 months – implying a payout ratio of fifty% to 60% by way of FCF – Hershey theoretically has loads of room to pay down debt if it chooses to take action. Nonetheless, with a leverage ratio of effectively beneath 4 occasions free money circulate and a long-term credit standing of A1 with secure outlook, I might argue that there is no such thing as a must deleverage.

Determine 6: The Hershey Firm (HSY): Debt maturity profile, together with short-term borrowings comparable to financial institution loans and industrial paper (personal work, based mostly on firm fillings)

Cause 3: Dividend Security Bolstered By Hershey Belief Firm Possession

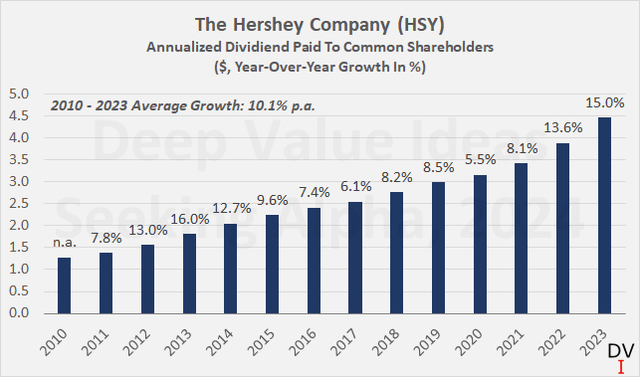

As talked about above, Hershey’s dividend payout ratio is a wholesome 50-60% of adjusted free money circulate. Mixed with the corporate’s strong long-term development, there’s loads of room to boost the dividend. Granted, Hershey didn’t enhance its dividend through the Nice Recession, however the dividend will increase since then (Determine 7) have greater than made up for 3 years of dividend stagnation, which I personally view as an indication of monetary prudence in a really troublesome financial atmosphere. Hershey can pay its 377th consecutive dividend on its widespread inventory on June 14. So, so assuming a quarterly frequency since inception, it now has an unbroken streak of 94 years.

Determine 7: The Hershey Firm (HSY): Dividends paid per widespread share and 12 months (personal work, based mostly on firm fillings)

I consider the mix of a beginning dividend yield of two.8% and a five-year common development fee of 10% (which is consistent with the long-term common) is a compelling alternative for long-term and income-oriented buyers seeking to shield (or develop) the buying energy of their earnings. The “secret” to why I consider Hershey’s dividend isn’t solely very secure, however will proceed to develop at a good tempo, lies within the firm’s capital construction.

Hershey has two lessons of inventory, widespread and Class B shares. The latter have 10 votes per share, whereas the previous have one vote per share and are entitled to elect one-sixth of Hershey’s board (p. 38, HSY 2023 10-Okay). Conversely, widespread shareholders obtain a ten% increased dividend than Class B shareholders – for instance, $4.456 versus $4.050 in 2023 on an annualized foundation.

In contrast to the widespread inventory, the Class B shares are usually not publicly traded and thru them, the Hershey Belief Firm (HTC) retains voting management over Hershey. HTC, which was based by Milton Hershey in 1905, is the trustee of the Milton Hershey College Belief, amongst others, and its function is to “home and educate an indefinite class of poor kids” with a perpetual time horizon. In my opinion, HTC is thus very effectively aligned with long-term shareholders generally and income-oriented buyers specifically.

I contemplate an funding in Hershey to be adequately hedged to protect (and develop) the buying energy of the earnings generated – not solely due to its capital construction, but in addition due to its market-leading place, deal with “on a regular basis treats” (the place worth/inflation play much less of a task) and strong development prospects.

Cause 3.5: Worldwide Growth – A Lot Of Potential However With A Query Mark

Hershey’s market share within the U.S. is more likely to be effectively over 30% (figures from statista for 2021 may be discovered right here). Contemplating that Mars Inc. (personal) controls round 1 / 4 of the market and Chocoladefabriken Lindt & Sprüngli AG (OTCPK:LDSVF, OTCPK:COCXF, OTCPK:CHLSY) and Ferrero Worldwide S.A. (personal) every management round 8%, it may be argued that the U.S. market is already extremely consolidated. On the similar time, Hershey’s main share is a transparent indication of the corporate’s scale and due to this fact its potential for development by means of elevated profitability.

The U.S. chocolate market is predicted to develop at a compound annual development fee of 5.2% within the coming years, and I might argue that it’ll not be troublesome for Hershey to completely take part on this development. Nonetheless, it must be borne in thoughts that a big a part of this development might be on account of anticipated inflation, so it won’t essentially totally translate to bottom-line development. On this context, I consider Hershey’s stepped-up investments and price financial savings program are the appropriate measures to make sure continued strong earnings development, partially by taking market share.

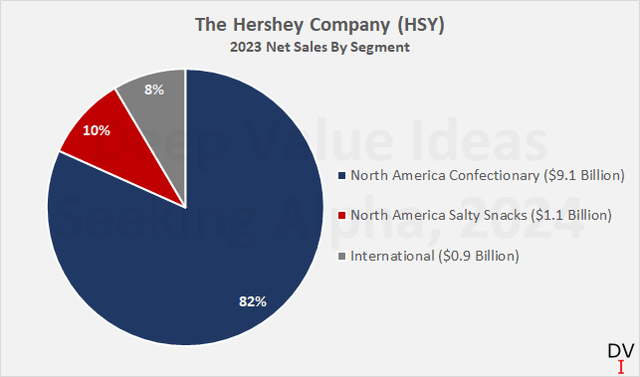

Hershey stays centered on North America (Determine 8), the place it generates greater than 90% of its gross sales and earnings, thereby indicating vital potential for worldwide enlargement. Nonetheless, contemplating that each the North America Salty Snacks enterprise and the Worldwide enterprise are nonetheless lower than half as worthwhile because the North America Confectionery enterprise (roughly 15% vs. 30% working margin), I might argue that there’s additionally ample room for development by means of margin enlargement in these segments.

Determine 8: The Hershey Firm (HSY): 2023 internet gross sales by reporting phase (personal work, based mostly on firm fillings)

Hershey’s worldwide enlargement holds appreciable potential, however naturally comes with an enormous query mark. Mars Inc. possible has generated gross sales of $22 billion from confectionery in 2023. Taking into consideration the market shares talked about above, the corporate in all probability generates round a 3rd of its gross sales from confectionery within the U.S. There isn’t any doubt that Mars – which has been within the sweet enterprise since 1920 – has executed an exceptional job of increasing internationally. However after all, that does not imply it is not possible for Hershey to succeed internationally as effectively. It will not be straightforward, nonetheless, particularly contemplating that lots of Hershey’s manufacturers are recognized for his or her distinctive flavors, that are troublesome to determine within the European market and possibly in Asia as effectively. Reformulating the flavour of the long-lasting Hershey’s chocolate to attraction abroad shoppers can be an enormous mistake in my eyes. Nonetheless, with the corporate’s more and more diversified model portfolio and in addition sure distribution agreements, I believe there may be nonetheless lots of potential with out jeopardizing the popularity of the core model. That being mentioned, with a gradual and regular rollout and skillful advertising, I would not rule out worldwide success for Hershey’s chocolate in Europe and Asia.

Abstract And Conclusion – Why HSY Inventory Is A Purchase Now

In stark distinction to a couple of 12 months in the past – when HSY shares have been hitting new all-time highs and buying and selling at a P/E within the excessive twenties – buyers appear far much less optimistic concerning the chocolate market chief within the U.S. at the moment. Because of fears of weight-loss medication impacting consumption, cocoa worth inflation and shoppers turning to low cost manufacturers within the face of structurally elevated inflation, HSY shares are buying and selling at a valuation that warrants a starter place, for my part.

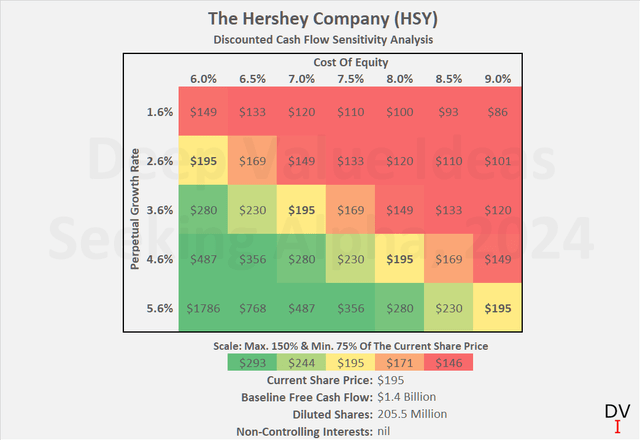

After all, at $195, my discounted money circulate mannequin for HSY inventory nonetheless implies a perpetual development fee of three.6% at an anticipated value of fairness of seven.0% (Determine 9), which itself represents an fairness danger premium of solely 2.35% (over the 30-year Treasury). Nonetheless, there are a number of explanation why I consider it’s value paying up for high quality right here.

Determine 9: The Hershey Firm (HSY): Discounted money circulate sensitivity evaluation (personal work, based mostly on firm fillings)

Hershey’s is undoubtedly a well-run firm working in a reasonably recession-resistant sector, promoting merchandise which have the benefit of being low-cost on a regular basis treats. That is to not say that Hershey’s is affordable chocolate, after all – it is the type of on a regular basis treats that even inflation-ridden shoppers are unlikely to withstand, very similar to a bag of Lay’s chips (PepsiCo, Inc., PEP) or a Coke (The Coca-Cola Firm, KO), for instance.

Consequently, the corporate has sturdy pricing energy, which is underlined by the superb gross sales development of current years and the continued margin enlargement. The deal with chocolate with a comparatively low cocoa content material additionally reduces the impression from the unstable and just lately exploded cocoa worth. Hershey’s free money circulate margin, and due to this fact money return on invested capital, is at present negatively impacted by comparatively excessive working capital and elevated funding within the enterprise. Nonetheless, the long-term development in associated metrics suggests sound working capital administration and that free money circulate will ultimately get well. I’m additionally assured that Hershey’s present above-average investments will repay. The corporate has a historical past of disciplined and sustainable development with out partaking in excessively massive and due to this fact dangerous acquisitions.

Regardless of the at present stagnating free money circulate, Hershey’s leverage stays very manageable, and its curiosity protection ratio continues to be strong (10x free money circulate earlier than curiosity). The corporate’s treasury division is doing a wonderful job of managing debt maturities and rate of interest publicity (weighted-average rate of interest of solely 3.4%). If Hershey suspends share repurchases within the coming years, it might simply repay its debt because it comes due. After all, this thought experiment ought to solely function an illustration of administration’s monetary prudence and never level to the necessity to scale back debt.

Lengthy-term oriented buy-and-hold buyers with an emphasis on income-generating shares will definitely respect the corporate’s capital construction. The Hershey Belief Firm’s voting management protects the corporate from hostile takeovers and aligns administration very effectively with the pursuits of the Milton Hershey College Belief and due to this fact long-term widespread shareholders.

Lastly, I consider that Hershey’s worldwide enlargement might characterize a strong development alternative effectively past what the already fairly consolidated U.S. market has to supply, which is predicted to develop within the mid-single digits within the coming years. On the similar time, Hershey’s scale as a market chief within the home market affords the potential for continued margin enlargement and thus strong earnings development regardless of structurally increased inflation.

I just lately purchased a starter place in Hershey shares, which at present represents 0.25% of my portfolio worth. I intend so as to add to this place slowly or extra shortly relying on how HSY inventory performs within the coming months and count on it to ultimately make up 2% of my portfolio, making it certainly one of my bigger positions.

Thanks very a lot for studying my newest article. Whether or not you agree or disagree with my conclusions, I all the time welcome your opinion and suggestions within the feedback beneath. And if there’s something I ought to enhance or develop on in future articles, drop me a line as effectively. As all the time, please contemplate this text solely as a primary step in your individual due diligence.

[ad_2]

Source link