[ad_1]

Revealed on July fifteenth, 2024 by Nathan Parsh

Excessive-yield shares pay out dividends which might be considerably greater than market common dividends. For instance, the S&P 500’s present yield is simply ~1.3%.

Excessive-yield shares could be very useful to shore up earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Now we have created a spreadsheet of shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra.

You possibly can obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Truist Monetary Company (TFC) is a part of our ‘Excessive Dividend 50’ sequence, the place we analyze the 50 highest yielding shares within the Certain Evaluation Analysis Database.

This text will look at the corporate to see if Truist Monetary is worthy of funding.

Enterprise Overview

Truist is a holding firm within the U.S. that resulted from a merger of equals between BB&T and SunTrust Financial institution in late 2019.

Truist gives a large rage of monetary providers, together with retail and business banking, investments, wealth administration, asset administration, mortgage, company banking, capital markets, and specialised lending. The corporate is valued at $54 billion.

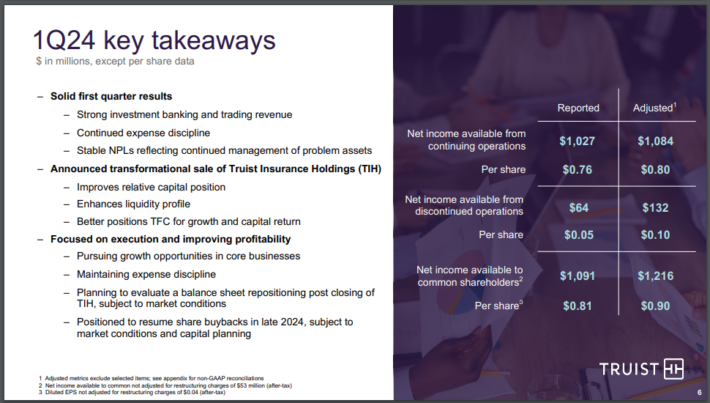

Truist reported first quarter outcomes on April twenty second, 2024.

Supply: Investor Relations

The corporate’s adjusted internet earnings totaled $1.22 billion, or $0.90 per share, which in contrast unfavorably to adjusted internet earnings of $1.4 billion, or $1.05 per share, within the prior yr.

Common property declined $29 billion, or 5.2%, to $531 billion year-over-year whereas common loans and leases had been down $19 billion, or 5.8%, to $3.09 billion. Deposits had been decrease by 5% to $389 billion.

Web curiosity earnings of $3.425 billion, which was down from $3.918 billion within the prior yr. Because of this, the online curiosity margin contracted 28 foundation factors to 2.89%. This was the results of greater deposit prices coinciding with a decline in incomes property.

Truist recorded a $500 million provision for credit score losses, down barely from $502 million within the prior yr. As well as, internet charge-offs totaled $490 million, or 0.64%, of common loans and leases, which was up from $297 million, or 0.37%, within the first quarter of 2023.

Truist is anticipated to earn $3.37 per share in 2024, which might be a 6.1% lower from the prior yr. We anticipate that the corporate will develop earnings-per-share by 9% yearly over the subsequent 5 years.

Development Prospects

Truist has struggled to provide development lately. The financial institution’s earnings-per-share have compounded at a price of three% over the past decade.

Nonetheless, earnings-per-share have declined by nearly 2% yearly over the past 5 years.

Truist does have some methods to enhance its bottom-line. This contains natural development by business and retail mortgage development.

Common loans did lower nearly 6% in the latest quarter on a year-over-year foundation, however had been down simply 1.3% on a sequential foundation, so the tempo of the declines has stabilized.

Additionally hindering outcomes has the been the elevated price of deposits given the excessive rate of interest surroundings that presently exists. This has weighed on internet curiosity earnings as seen by the current declines.

Curiosity bills have surged, together with a 65% enhance within the first quarter because it turns into extra expensive for banks to supply greater rates of interest on deposits.

There are some areas that Truist can leverage to enhance its enterprise efficiency.

The corporate has made investments to enhance its digital capabilities. This has paid off considerably in a really brief time frame.

Supply: Investor Relations

Clients throughout the banking trade are transferring in the direction of using digital entry to finish a lot of their banking duties. First quarter digital transactions of 76 million represented a 13% enhance from identical interval in 2023. Greater than three-quarters of deposit came about in self-service channels, a rise of 5 share factors over the previous 5 quarters.

The adoption of Zelle, a number one peer-to-peer cost service, has been particularly robust, with transactions up greater than 40% in the latest quarter.

Truist can also be taking steps to give attention to its core enterprise by eliminating these not key to the corporate’s future. This contains the sale of its remaining stake in Truist Insurance coverage Holdings for $10.1 billion.

Moreover, Truist made the strategic choice to promote almost $28 billion of its lower-yielding investments at an after-tax lack of $5.1 billion. The corporate then invested near $19 billion in shorter period investments that yield nearly 5.3%.

Aggressive Benefits & Recession Efficiency

Previous to merging, BB&T and SunTrust had been regional banks that lacked the dimensions and scale of the bigger names within the trade.

That modified following the tie up as Truist is now a top-10 financial institution business financial institution within the U.S. that instructions a bigger market share of high-growth areas across the nation.

This could assist the financial institution through the subsequent recessionary interval, one thing each banks struggled with through the Nice Recession:

BB&T’s efficiency through the 2007 to 2009 interval:

2007 earnings-per-share: $3.14

2008 earnings-per-share: $2.71 (14% decline)

2009 earnings-per-share: $1.15 (58% decline)

SunTrust’s efficiency through the 2007 to 2009 interval:

2007 earnings-per-share: $4.56

2008 earnings-per-share: $2.12 (54% decline)

2009 earnings-per-share: -$3.98 (288% decline)

Each firms noticed their earnings-per-share decline drastically throughout this era, with SunTrust performing a lot worse.

That stated, the mixed entities held up a lot better through the Covid-19 pandemic. Earnings-per-share did fall 13% in 2020, however rebounded to make a brand new excessive the very subsequent yr.

Given the corporate’s efficiency throughout financial downturns, it’s seemingly {that a} lower in profitability would happen within the subsequent recession.

Dividend Evaluation

Whereas the corporate’s long-term outcomes and recession efficiency have been underwhelming, Truist’s dividend development has been fairly robust. Over the past decade, the dividend has a CAGR of simply over 9% over the past decade.

It ought to be famous that Truist has maintained the identical quarterly cost for 8 consecutive quarters. If the corporate doesn’t enhance its dividend this calendar yr then Truist’s 12 yr dividend development streak will finish.

Shares yield 5.1%, which is among the many highest yields that the inventory has supplied within the final 10 years.

Usually, an unusually excessive yield coupled with a stagnant distribution might foretell that the dividend may very well be in danger for being lower and even eradicated.

Whereas we don’t consider {that a} dividend lower is imminent, there’s the chance that dividend development will stay muted within the near-term.

The corporate ought to distribute not less than $2.08 per share in 2024, leading to a payout ratio of 62%. Except for final yr, the conventional payout vary has been 35% to 45% since 2014.

With firm’s payout ratio nicely outdoors of its traditional vary, shareholders shouldn’t anticipate to see a lot in the way in which of dividend development.

That stated, if our projected earnings development materializes then the payout ratio might develop into way more cheap, resulting in the potential for future will increase.

Ultimate Ideas

Truist has remodeled from two regional banks to one of many bigger business banks within the nation. Development has been sporadic over the long-term and the recession efficiency leaves a lot to be desired.

Accompanying the slowdown in earnings has been a dividend pause. The heightened payout ratio and dividend yield implies the potential for a discount in shareholder funds, although we consider {that a} pause is the almost certainly final result.

Buyers searching for dividends from the banking trade may discover the yield engaging, however we warning that these searching for dividend development may very well be upset by the identify.

These searching for earnings development and earnings might do nicely proudly owning shares of the corporate.

In case you are fascinated about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link