[ad_1]

Daniel Grizelj/DigitalVision by way of Getty Photos

The conundrum dividend traders usually face is whether or not to put money into excessive yield shares or low-yielding shares with quick dividend progress.

This goes for each accumulators (staff) and withdrawers (retirees).

All else being equal, the core query is that this:

Would you moderately accumulate extra shares over time or have fewer shares that improve in worth quicker?

For these within the accumulation section of their journey, greater yields imply extra dividends coming in to reinvest into extra shares, which interprets into extra compounding of share rely. All else being equal, extra shares owned = extra dividends.

Then again, corporations with quicker dividend progress are usually greater high quality, quicker rising corporations with safer dividends. These shares sometimes take pleasure in quicker share worth appreciation, making capital positive aspects a core piece of the returns profile. The dividend earnings stream might be smaller to start out out, however since dividend progress is predicted to be quicker, your future dividend earnings ought to be a lot greater.

For these within the withdrawal section, greater yields clearly imply extra quick dividend earnings to fund your life-style and on a regular basis spending. However except you’re extremely selective and sensible about stock-picking, greater yields additionally open the opportunity of dividend cuts and can doubtless end in decrease inventory worth appreciation over time.

Then again, some argue that even retirees ought to deal with dividend progress moderately than excessive earnings. If the rise in total portfolio worth, from each dividends and worth appreciation, is larger than your spending wants, then a retiree can fund their life-style by a mixture of dividend earnings and promoting shares.

In the event you have been to ask me whether or not I (as somebody within the accumulation section) want greater dividend yields or quicker dividend progress, my reply can be a powerful:

Sure.

In a super world, I might have each: a inventory with a reasonably excessive yield and quick dividend progress.

I do know, I do know. It appears like a pipe dream. Why do not I simply throw in a non-public jet and Ferrari whereas I am at it?

Actually, it’s not doable to speculate solely in these dividend unicorns — shares with excessive yields and quick dividend progress charges — within the ETF world.

Let me reveal this.

Listed below are three pretty fashionable excessive yield dividend ETFs:

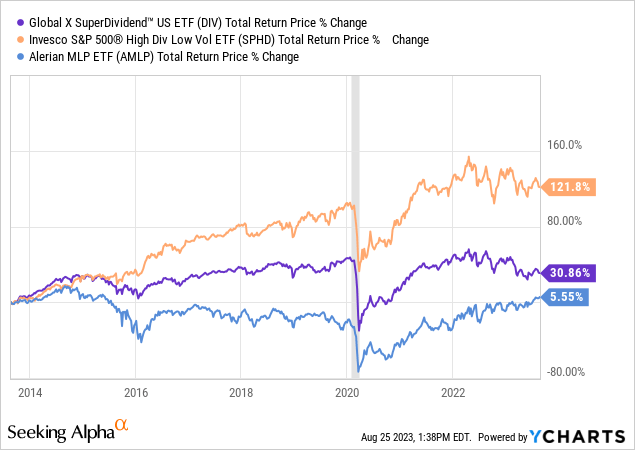

International X SuperDividend U.S. ETF (DIV) — 7.5% Yield Invesco S&P 500 Excessive Dividend Low Volatility ETF (SPHD) — 4.7% Yield Alerian MLP ETF (AMLP) — 8.2% Yield

These ETFs aren’t cherry-picked aside from being a number of the extra fashionable excessive yield dividend ETFs which were round for a minimum of 10 years. Complete returns range, however usually talking, the upper the ETF’s yield, the decrease its worth appreciation and complete returns over time.

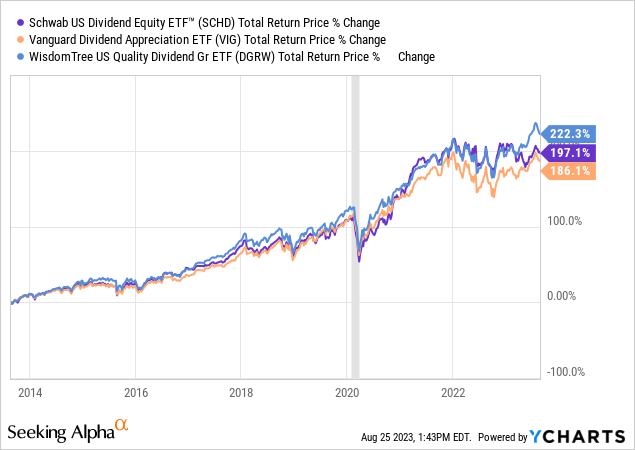

On the subject of dividend progress ETFs, listed here are three fashionable decisions which were round for a minimum of a decade:

Schwab U.S. Dividend Fairness ETF (SCHD) — 3.5% Yield Vanguard Dividend Appreciation Index Fund ETF (VIG) — 2.0% Yield WisdomTree U.S. High quality Dividend Development Fund ETF (DGRW) — 1.9% Yield

As you’ll be able to see, complete returns are dramatically higher for the dividend progress ETFs than for the excessive dividend yield ETFs.

Generally the market might be misguided or off-base, however usually talking, a excessive yield is the market’s approach of claiming that first rate progress seems unlikely. Quicker rising corporations are extra fascinating to traders, and thus, their inventory costs get bid up and their dividend yields pushed down.

However I might argue that it’s doable to discover a treasured few true dividend unicorns providing each excessive yields and speedy dividend progress.

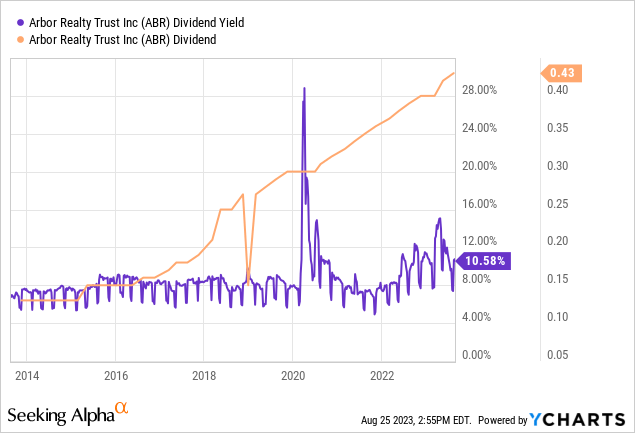

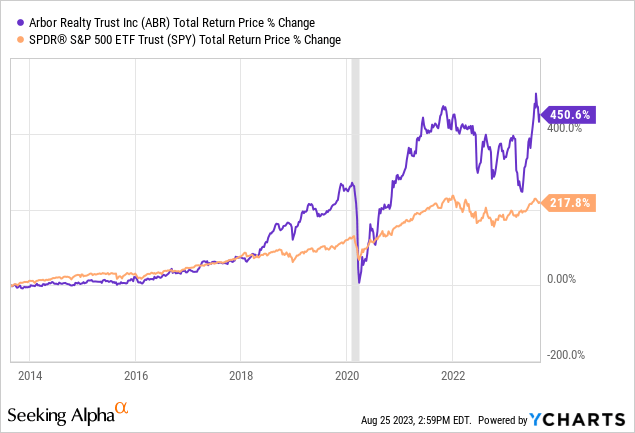

Take the instance of Arbor Realty Belief (ABR), a mortgage REIT with a singular enterprise mannequin and funding philosophy. The mREIT focuses virtually solely on residential and particularly multifamily loans. The loans are much less more likely to default due to the defensiveness of the asset class in addition to administration’s underwriting ability. And in the event that they do default, they’re asset-backed, thus limiting draw back threat.

Regardless of constantly sporting a dividend yield of 8-10%, the dividend has additionally greater than tripled during the last ten years:

Sure, it’s true that ABR obtained crushed within the Nice Recession and needed to reduce their dividend. However if you happen to had purchased someday within the years after the Nice Recession, you’d at this time be sitting on a large yield-on-cost.

To not point out greater than doubling the S&P 500’s (SPY) complete returns within the final decade.

Dividend unicorns like this are naturally fairly uncommon. Very sensible individuals are continually on the hunt for unimaginable offers like this. Plenty of individuals assume they discover them, however the excessive yield shares they’ve discovered develop into idiot’s gold.

Generally a inventory goes from having a low yield to a excessive yield as a result of the market acknowledges that the corporate’s section of speedy progress is over.

Generally firm administration groups merely promise greater than they’re able to delivering.

Worse but, generally the excessive yield portends on oncoming dividend reduce.

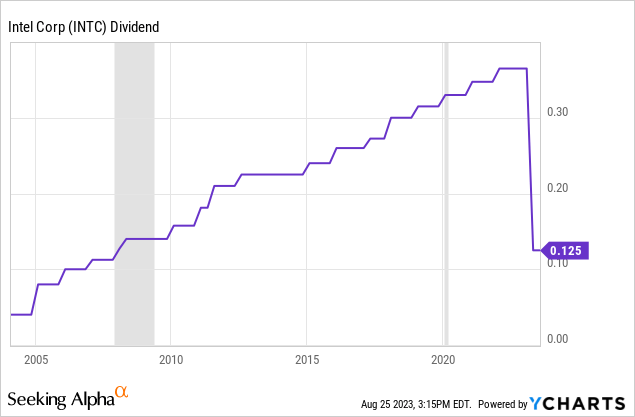

Earlier this 12 months, I made a small funding in Intel (INTC), considering it could possibly be one in all these uncommon dividend unicorns. It is yield soared over 5%, in comparison with its historic common of round 2.5%. I used to be (and nonetheless am) bullish on its long-term prospects as a non-China, non-Taiwan semiconductor producer.

Furthermore, I assumed the corporate’s huge, $26 billion+ battle chest of money & short-term investments can be sufficient to maintain the dividend whereas investing closely for the longer term. Sadly, capex necessities mixed with a extreme droop in PC gross sales modified the scenario.

Then a pallid-faced Pat Gelsinger, CEO of INTC, appeared on CNBC to ship the grim information of a 66% dividend discount.

So, INTC turned out to not be a dividend unicorn.

I feel an identical, gradual practice wreck could possibly be enjoying out with the venerable 3M (MMM). Because the inventory has bought off, the dividend yield has crested 6%. However I do not see this one as a dividend unicorn. Not by a longshot.

“What?” I can sense your objection. “3M is a extremely revered Dividend King with a 64-year dividend progress streak! How dare you insult his majesty, you insolent idiot!”

However have a look at the details. The corporate faces a number of enormous authorized liabilities for PFAS chemical substances, faulty earplugs, anti-bribery legal guidelines, and so forth. The payouts for these liabilities are going to blow an enormous gap in free money move, and we do not even understand how far more harm future settlements will trigger. Plus, 3M is about to spin off an enormous chunk of its property within the healthcare enterprise, which could possibly be the proper time to, ahem, right-size the $3.3 billion annual dividend.

Administration mentioned nothing about the way forward for the dividend on the Q2 earnings convention name, which might point out a scarcity of dedication to its present stage.

I am not saying the dividend will certainly be reduce. However I’m saying 3M is very unlikely to be a type of dividend unicorns that provides each a excessive yield and quick dividend progress.

Three Potential Dividend Unicorns

I do know what you are considering.

“Alright, magic boy, do you even have any tips to point out me, or are you all high hat and no rabbit?”

Protecting in thoughts that dividend unicorns are extraordinarily uncommon and infrequently, just like the legendary creature, too good to be true, listed here are three high-yield shares I am shopping for that I imagine may even have the ability to maintain above-average dividend progress.

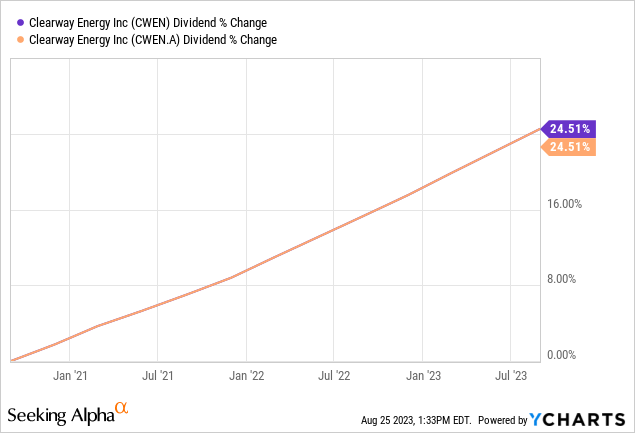

Clearway Power Inc. (CWEN, CWEN.A)

CWEN (and CWEN.A — its sister share class with the next yield, much less buying and selling quantity, and extra voting energy) owns stabilized, working renewable energy manufacturing services (wind and photo voltaic) plus battery storage services and pure gas-fired energy vegetation.

Its guardian corporations/sponsors are International Infrastructure Companions and TotalEnergies (TTE), a strong duo of equal homeowners that ought to guarantee a continuing pipeline of recent property to fill CWEN’s portfolio.

Over the past three years, CWEN’s dividend has grown at a excessive single-digit tempo, and administration asserts that the corporate stays on monitor to ship 7-8% annual dividend progress by a minimum of 2026.

The inventory has bought off laborious this 12 months because of weak wind energy manufacturing and better rates of interest. However I might argue these are each dangerous causes for the inventory to dump.

A gradual interval of wind speeds doesn’t essentially point out a everlasting discount in wind energy manufacturing. It seems to have been an anomaly and that wind speeds will revert to the imply over time. No corporate-level, fixed-rate debt matures till 2028, which implies CWEN has no refinancing threat till then. Most of CWEN’s debt is within the type of non-recourse, project-level debt that absolutely amortizes over the mortgage time period. In different phrases, the asset’s money flows absolutely repay the debt principal over time. Although these project-level loans function floating charges, CWEN makes use of rate of interest hedges to mitigate rising rates of interest. CWEN nonetheless has $100s of hundreds of thousands in dry powder from the well-timed sale of its thermal vitality property just a few years in the past, eliminating any want for fairness or company debt for progress investments over the following few years.

The first threat I see to CWEN’s means to maintain paying and rising its dividend is the potential for a extreme climate occasion like a wildfire to trigger one in all its utility firm prospects to default on their energy buy settlement (“PPA”). That is precisely what occurred with California’s PG&E Company (PCG) about 5 years in the past, forcing CWEN to scale back its dividend and pause its dividend progress.

Even this state of affairs, nonetheless, will not be as dire because it sounds, as a result of within the PG&E case, the courtroom finally upheld the PPAs with CWEN, and CWEN was promptly capable of restore its dividend and proceed dividend progress.

In search of Alpha, modified by writer

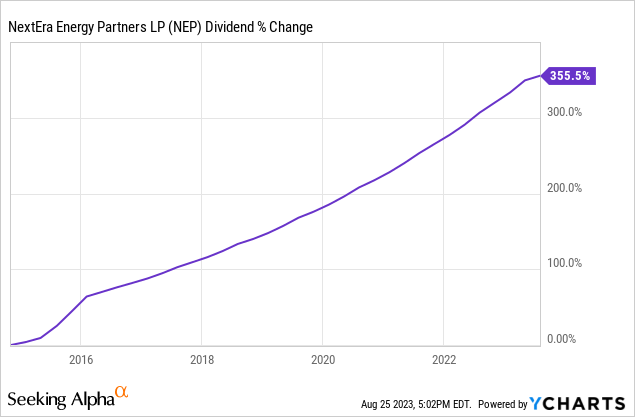

NextEra Power Companions (NEP)

NEP’s story is just like that of CWEN. Like CWEN, NEP owns stabilized renewable vitality property working below long-term contracts, sometimes with funding grade prospects like utilities, companies, universities, and governments.

Largely as a result of its guardian firm/sponsor in NextEra Power Inc. (NEE) is without doubt one of the world’s largest builders of wind, photo voltaic, and battery storage services, NEP has been capable of handily ship on its goal of 12-15% annual dividend progress since its IPO in 2014.

NEP has additionally gotten dinged for weak wind energy manufacturing, which I imagine to be a short lived phenomenon, however the greater difficulty is its use of convertible fairness portfolio financing (“CEPF”). Quite than instantly issuing fairness for progress investments, these offers principally allowed NEP to postpone fairness issuance till years later whereas paying ultra-low or zero p.c curiosity within the meantime.

In a zero rate of interest world, CEPF labored swimmingly. Not a lot in at this time’s surroundings. However as an indication of administration’s alignment with shareholders and dedication to dividend progress, they’re suspending incentive distribution rights (“IDRs”) and in search of to promote NEP’s few pure gasoline pipelines with the intention to remove all near-term CEPF liabilities. This moderately than pause dividend progress.

Administration asserts that NEP has no additional fairness wants for a minimum of one other 12 months and that NEP will nonetheless have the ability to improve its dividend at 12% yearly going ahead.

Similar dangers as CWEN, plus execution threat pertaining to NEP’s sale of gasoline pipelines and elimination of CEPFs. However I imagine in administration. They’re actually incentivized to maintain up the dividend progress!

VICI Properties (VICI)

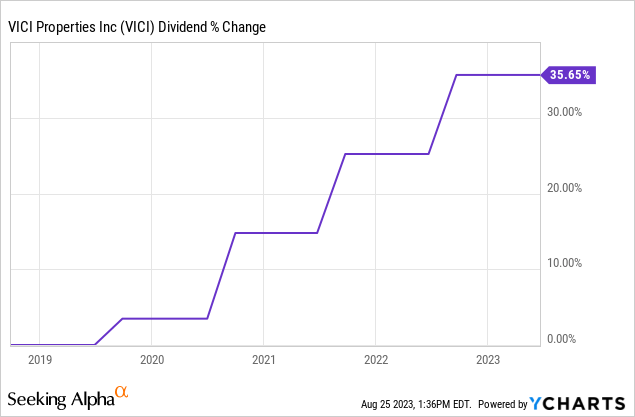

Lastly, the outlier within the group is VICI, the Landlord of Las Vegas. It is a REIT that owns trophy on line casino properties on the Las Vegas strip in addition to regional gaming hotspots round North America. Since its creation as a REIT in 2017 popping out of the Caesars Leisure (CZR) chapter, VICI has delivered spectacular dividend progress of about 8% per 12 months.

After just lately finishing the $17 billion acquisition of MGM Development Properties and its iconic on line casino resorts, VICI’s progress charge will virtually definitely gradual from the excessive single-digits to the mid-single-digits.

However between extra property acquisitions and ~2% annual lease escalations, VICI will proceed to develop. I’m assuming roughly 5% dividend progress going ahead.

Mixed with a 5%+ dividend yield, does this make for a “dividend unicorn”? That is up for particular person interpretation, however I’ll say sure.

Backside Line

Can you may have your cake (excessive dividend yield) and eat it too (quick dividend progress)?

You would be clever to be skeptical. However dividend unicorns exist. The market is fairly environment friendly, but it surely is not all-knowing.

So far as high-yielding dividend shares go, I feel the three above have a very good likelihood of not solely sustaining their dividends but in addition rising them at a speedy clip going ahead.

[ad_2]

Source link