[ad_1]

CleanSpark (CLSK) is America’s Bitcoin Miner™. They personal and function information facilities that primarily run on low-carbon energy. Their infrastructure responsibly helps Bitcoin, the world’s most essential digital commodity and a necessary instrument for monetary independence and inclusion. www.cleanspark.com.

Cleanspark has expanded its operations into the cryptocurrency mining sector, particularly Bitcoin mining. The corporate makes use of its experience in power administration to run energy-efficient Bitcoin mining operations. They leverage their superior microgrid and power options to cut back the electrical energy prices related to the energy-intensive means of mining Bitcoin.

By optimizing power utilization and using renewable power sources the place potential, Cleanspark goals to make its Bitcoin mining operations extra sustainable and cost-effective in comparison with conventional mining setups. This diversification into Bitcoin mining permits Cleanspark to capitalize on the rising cryptocurrency market whereas aligning with its core give attention to power effectivity and sustainability.

This abstract offers an evaluation of Cleanspark Inc (CLSK), an organization within the finance sector, particularly in miscellaneous monetary companies. Listed below are the important thing factors:

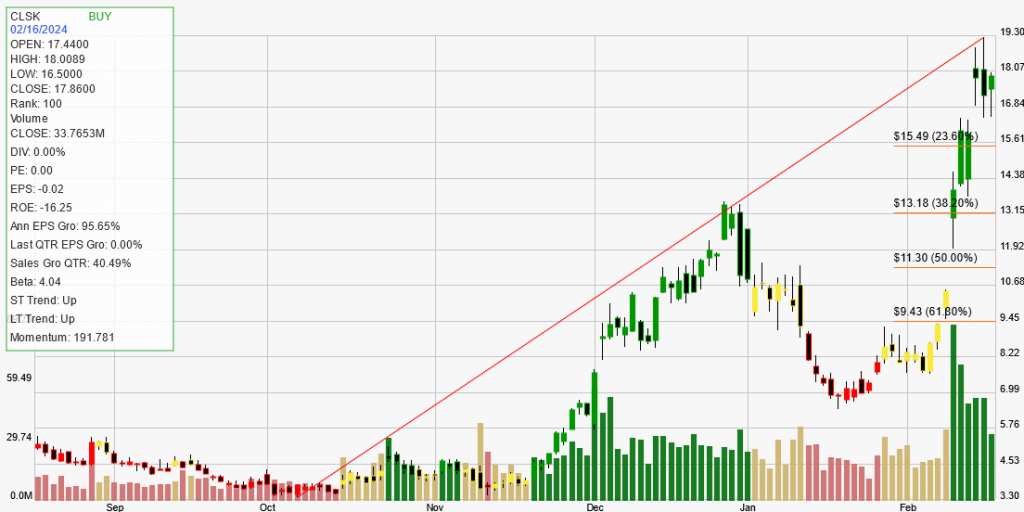

Inventory Efficiency: The inventory has proven robust efficiency with a each day improve of three.66%, a weekly improve of 28.03%, a month-to-month improve of 159.97%, a yearly improve of 401.69%, and a year-to-date improve of 61.92%.

Developments: The long-term and short-term traits are each upward, indicating a constant constructive trajectory for the inventory.

Sign: The present sign is a BUY, suggesting that the inventory could also be advancing in its development. Nevertheless, it’s famous that shares in excessive ranges of value development ought to be allowed to maneuver out of the acute vary earlier than a purchase or promote resolution is made.

Energy Rank: Cleanspark Inc has a energy rank of 100, which means it’s outperforming 100% of its friends.

Monetary Effectivity: The corporate has a adverse return on fairness (ROE) of -16.25%, indicating low monetary effectivity.

Earnings Progress: The annual EPS (Earnings Per Share) progress is 95.65%, which is considerably larger than the 30% common present in robust trending, essentially sound corporations.

Quarterly Efficiency: The corporate has a quarterly EPS progress of 0.00% and a quarterly gross sales progress of 40.49%.

Dividend Yield: Cleanspark Inc doesn’t at the moment provide a dividend, with a yield of 0.00%.

Buying and selling Traits: The inventory has had a complete of 5 trades with a median revenue on winners of $4026.93 and a median loss on losers of $3220.08. The web revenue/loss is $12887.64 with a successful share of 80.00%.

Backtesting: The commerce expectancy over the previous 12 months is 22.52%, with an annual commerce expectancy of 90.09%. The common days in a commerce is 48, and the typical days between trades is 30.

Total, Cleanspark Inc seems to be a powerful performer within the inventory market with a strong upward development and important earnings progress. Nevertheless, its adverse ROE signifies some monetary inefficiency, and the dearth of dividends could also be a disadvantage for income-focused buyers.

[ad_2]

Source link