[ad_1]

When volatility is excessive, merchants typically use methods like promoting premium or adjusting place sizing to handle danger.

At occasions, when the VIX spikes up, some merchants could wish to do a mean-reversion commerce to make a revenue for when the VIX drops again all the way down to regular.

In different phrases, the dealer expects VIX to drop again to its regular common worth (revert again to its imply).

Contents

VIX is the volatility of the SPX index.

It’s generally mentioned that worth doesn’t must mean-revert.

However volatility nearly all the time does.

The one query is timing.

When VIX goes up, that doubtless means SPX has dropped.

We have now all seen shares the place costs dropped however by no means returned again up.

One can argue that for an index, the worth would finally come again up.

However even nonetheless, it might be a really, very very long time.

When SPX dropped from the 4800 stage on the finish of 2021, it took almost two years for it to return again as much as that stage.

That’s the reason ready for a excessive VIX to return to regular could also be simpler than ready for the worth to return to its prior stage.

To not anthropomorphize the market an excessive amount of (an excellent Scrabble phrase), however it’s like an indignant particular person when VIX is excessive.

With time, they are going to settle down.

Nobody stays indignant eternally (hopefully not).

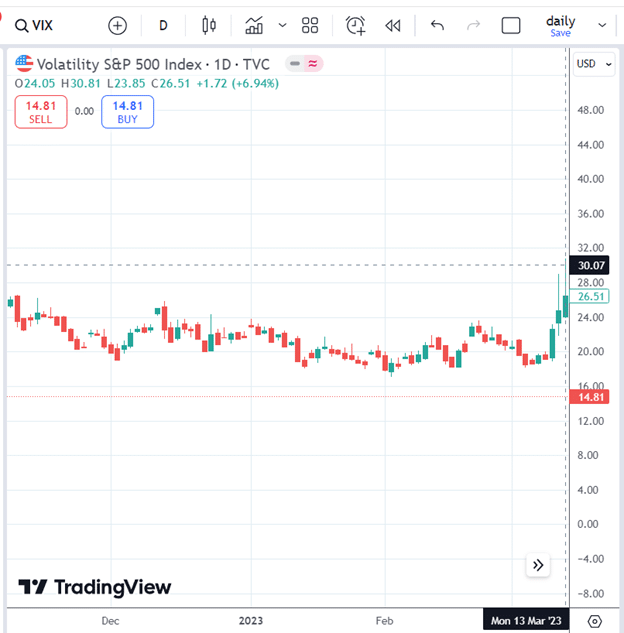

On Monday, March 13, 2023, the VIX went above 30:

A dealer may placed on a bear put unfold on the VIX that has 37 days until expiration.

Date: March 13, 2023

Value: VIX @ 30

Promote one April 19 VIX 20 put @ $0.34Buy one April 19 VIX 25 put @ $2.58

Web debit: -$224

The great factor about these debit spreads is that the utmost danger within the commerce is the debit paid, which, on this case, is $224.

The following day, VIX dropped to 23, and the dealer was comfortable to take the revenue by closing the commerce:

Purchase to shut one April 19 VIX 20 put @ 0.69Sell to shut one April 19 VIX 25 put @ 3.85

Credit score: $316

Web revenue in commerce: $316 – $224 = $92, or 41% return on capital in danger.

One other dealer may purchase shares of SVXY.

The SVXY ETF is a brief VIX ETF. In different phrases, SVXY goes up when VIX goes down.

And it goes down when VIX goes up.

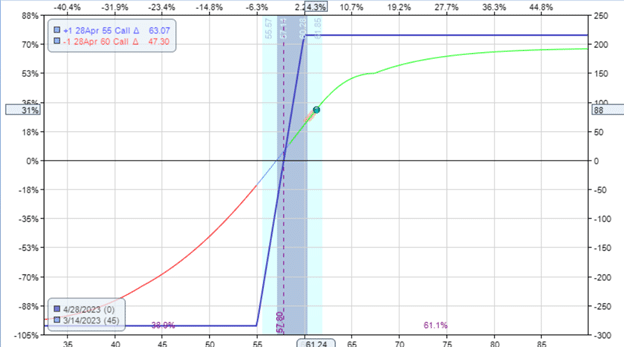

For the reason that dealer is anticipating VIX to go down, they wish to purchase 20 shares of SVXY at $57.05 per share, anticipating it to go up.

The entire price is 20 x $57.05 = $1141.

The following day, the worth of SVXY certainly went as much as $61.24 per share.

Promoting the 20 shares to gather $1224.80 leads to a revenue of $83.80.

In share of capital utilization, it’s 14.7% return.

Better of Choices Buying and selling IQ

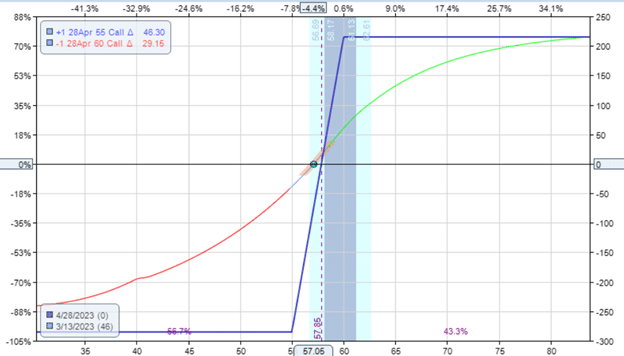

A dealer who may not wish to outlay $1141 may reap the benefits of the leverage of choices and purchase a bull name unfold on SVXY as a substitute.

Date: March 13, 2023

Value: SVXY @ $57.05

Purchase one April 28 SVXY 55 name @ $5.15Sell one April 28 SVXY 60 name @ $2.30

Web debit: -$285

Just like the bear put unfold on the VIX, this bull name unfold on the SVXY has a max lack of the debit paid, on this case, $285.

The following day, the dealer closes the commerce for a revenue of $87, a 30% return on capital utilization:

Promote to shut April 28 SVXY 55 name @ $7.65Buy to shut April 28 SVXY 60 name @ $3.93

Credit score: $372

When the VIX spikes up, merchants have quite a lot of trades to seize the mean-reversion transfer again down.

They will purchase shares of the SVXY instantly, which strikes inversely to the VIX.

Or they’ll purchase a bull name unfold with a decrease capital utilization.

As a result of VIX is an index, they can’t purchase shares of the VIX.

Nonetheless, utilizing a bear put unfold can be utilized to seize a directional transfer down.

We hope you loved this text on methods to commerce when volatility is excessive.

When you have any questions, please ship an electronic mail or depart a remark under.

Commerce protected!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who should not aware of trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link