[ad_1]

At present, we’ll take a look at the choice Greek gamma with regard to credit score spreads.

Whereas many merchants are acquainted with Delta, Gamma is usually neglected, but it performs a significant function, significantly within the conduct of credit score spreads.

Contents

The primary few Greeks an possibility dealer may study are delta, vega, and theta.

They point out how an possibility place’s revenue and loss (P&L) may change if the underlying worth, volatility, and passage of time change.

Gamma is totally different as a result of it signifies how delta adjustments because the underlying worth adjustments.

Gamma positively impacts the place’s P&L.

Nevertheless it doesn’t have an effect on it straight.

Gamma impacts delta, which in flip impacts the P&L.

As such, it’s extra difficult to grasp and is comprehensible after you may have an excellent grasp of delta.

An instance at all times helps.

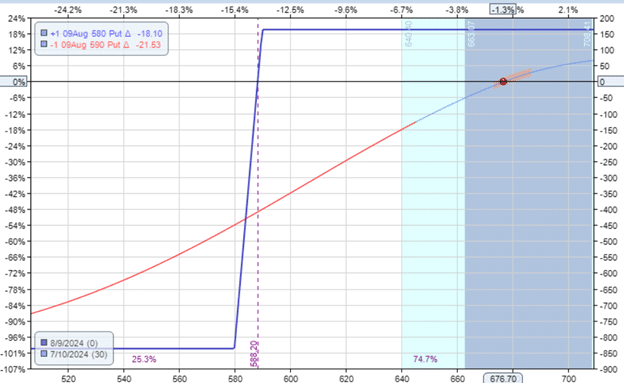

Suppose a dealer has the next credit score unfold on Netflix (NFLX) on July tenth, 2024:

A brief put possibility with a strike at $590 and an extended put possibility with a strike at $580.

Each with the August ninth expiration, which is 30 days away.

The present Greeks are:

Delta: 3.37Theta: 4.30Vega: -5.65Gamma: -0.07

It is a bull put credit score unfold with a optimistic delta of three.37, the place the dealer expects the value of Netflix to go up.

A 3.37 delta in an possibility place has a market publicity much like having 3.37 shares of Netflix inventory at $676.70 per share (the value of NFLX on the time).

In different phrases, the bull put unfold has $2280 Delta {Dollars} of publicity.

That’s 3.37 x $676.70.

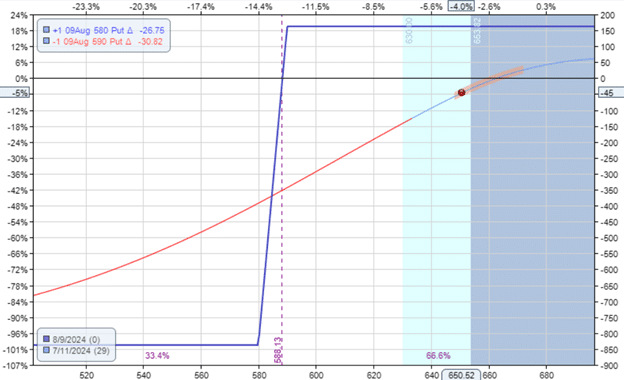

Now, 24 hours later, on July eleventh, the place appears to be like like this attributable to a fall in NFLX inventory worth…

And the Greeks are actually:

Delta: 4.38Theta: 4.29Vega: -5.39Gamma: -0.06

The P&L (revenue and loss) decreased by $45 as a result of the inventory worth went within the unsuitable route.

The delta has elevated from 3.37 to 4.38 due primarily to gamma’s impact.

(We use the time period “primarily” as a result of it is usually affected by different components.

However let’s not over-complicate issues.)

This will increase the Delta {Dollars} publicity to 4.38 x $650.52 = $2849.

Whereas the dealer may be advantageous with an preliminary $2280 place on NFLX, to start with, he might not be advantageous with a $2849 place.

Whereas he could also be advantageous being bullish at 3.37 delta, he might not be advantageous with a 4.38 delta.

A 4.38 place is extra bullish than he had began with.

The worst is that the place turns into bullish when the inventory turns into extra bearish.

The rise in delta made his place worse.

That’s what detrimental gamma does.

It makes it in order that if the commerce goes in opposition to the dealer, the dealer turns into worse for the dealer.

The bigger the magnitude of this gamma worth, the bigger this impact is.

After we speak concerning the magnitude of gamma, we confer with the dimensions of the quantity with out regard to the signal.

So, a -0.14 gamma has a bigger magnitude than -0.07 and would have a bigger impact.

The impact that gamma has is that it adjustments delta.

The bigger the gamma worth, the extra it adjustments delta when the value strikes.

A -0.14 gamma will change the delta greater than a -0.07 gamma for a given one-point transfer within the inventory worth.

In technical phrases, we are saying that gamma is the speed of change of delta with respect to the value.

4 Ideas For Higher Iron Condors

No.

Gamma could be detrimental or optimistic for credit score spreads relying on how close to or far the unfold is from the present worth.

For much out-of-the-money credit score unfold (as in our instance the place the put spreads are far out of the cash at round 20-delta within the possibility chain), gamma is detrimental.

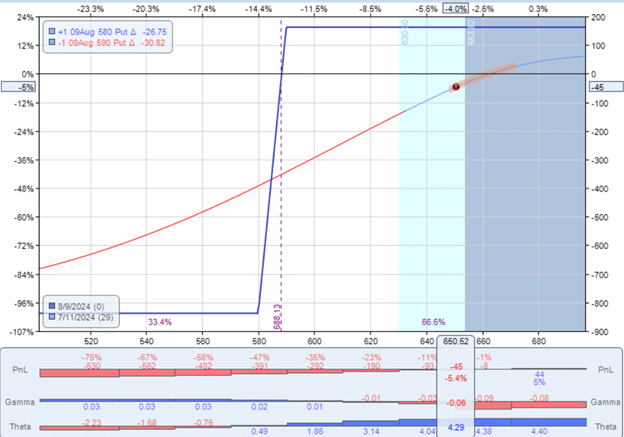

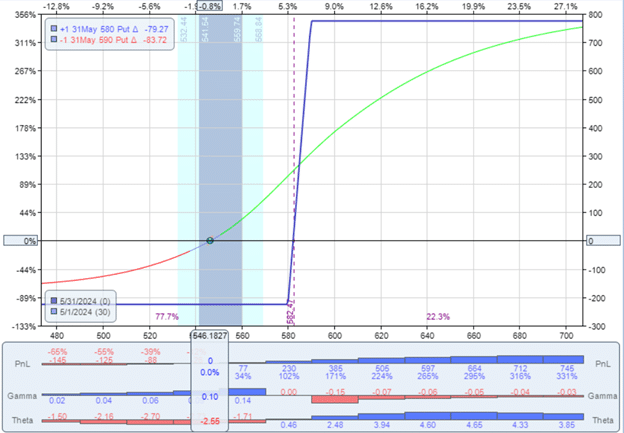

If I activate the gamma histogram in OptionNet Explorer:

You may see that sooner or later, when the value of NFLX drops far sufficient such that the credit score unfold turns into within the cash, gamma turns into optimistic (as indicated by the blue histogram).

Optimistic gamma signifies that the delta will enhance because the inventory worth will increase.

If the inventory worth goes down, then delta will lower.

Let’s say we’ve got an in-the-money $590/$580 bull put credit score unfold as within the following when the NFLX worth is at $546:

We see that we’ve got a optimistic 0.10 gamma.

If NFLX goes up (which is favorable), then the delta will enhance (which can also be favorable for the place).

If NFLX goes down (which is bearish), then gamma will trigger delta to lower to make the place much less bullish.

So, in impact, a optimistic gamma tends to assist a place as the value strikes.

A detrimental gamma tends to harm a place as the value strikes.

Most merchants are promoting out-of-the-money credit score spreads with detrimental gamma.

A big magnitude of gamma causes the delta to vary loads.

When the delta adjustments loads, the P&L of the place can change loads as the value strikes (even when the value strikes by just a bit).

That is what’s known as gamma threat.

Gamma will get bigger nearer to expiration.

Some merchants don’t need their delta to vary, particularly not change in a manner that makes their place go in opposition to them extra (assuming that their place has a detrimental gamma).

Due to this fact, they wish to cut back the quantity of detrimental gamma.

There’s at all times a trade-off.

By decreasing the magnitude of gamma, in addition they cut back theta, which they won’t need if their place depends partly on optimistic theta to generate revenue (as within the case of credit score spreads).

Research the above gamma and theta histograms.

For probably the most half, with some small minor exceptions, each time gamma is detrimental, then theta is optimistic.

Every time theta is optimistic, then gamma is detrimental.

The larger the magnitude of theta, the larger the magnitude of gamma.

While you attempt to lower detrimental gamma, you’ll lower theta as a aspect impact.

While you attempt to enhance theta, you’ll enhance the quantity of detrimental gamma.

Optimistic theta merchants (who make their cash from time decay) and credit score unfold merchants (who partially make their cash from time decay) should stay with detrimental gamma.

Detrimental gamma is a detrimental for his or her place.

It makes issues worse if the commerce goes in opposition to them.

And if the commerce goes of their favor, it makes their credit score spreads much less highly effective.

What about delta-neutral merchants?

They’re the identical as optimistic theta merchants.

Massive gamma can also be a detrimental for them as a result of the gamma adjustments their delta after they want their delta to be as near zero as attainable.

What about lengthy gamma merchants?

Sure, some merchants love giant optimistic gamma.

However that could be a totally different story, and they aren’t buying and selling the out-of-the-money credit score spreads we’re discussing at the moment.

We hope you loved this text on how gamma impacts credit score spreads.

If in case you have any questions, please ship an electronic mail or go away a remark under.

Commerce secure!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who aren’t acquainted with trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link