[ad_1]

I cannot reply this query.

It’s like asking what number of miles this automobile can go on one gallon of fuel.

Initially, it is determined by the kind of automobile.

Whether it is an electrical automobile, it might probably go together with zero gallons of fuel.

Then, it is determined by the scale of the automobile, the load, and the way the driving force drives.

Is it largely freeway driving or stop-and-go?

The theta of a butterfly is determined by the variety of contracts, the underlying belongings, the wing widths, the implied volatility, the days-till-expiration, the place of the fly in relation to the present value, and different elements.

Typical butterflies may have optimistic theta, assuming they’re fairly constructed and never extraordinarily removed from the present value.

I’m not speaking in regards to the bent, out-of-shape, wackily constructed flies far out of the cash, through which case they’ll have adverse theta.

Contents

Butterflies with optimistic theta will revenue from the passage of time as a result of totally different charges of decay of the totally different choices for the legs of the butterfly.

A butterfly is made up of three legs – two lengthy legs and one brief leg, as within the following instance:

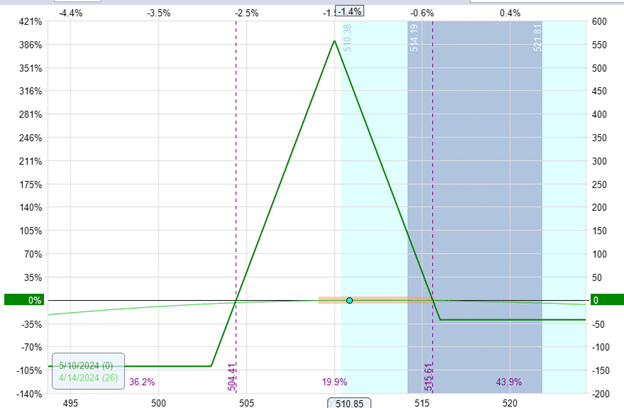

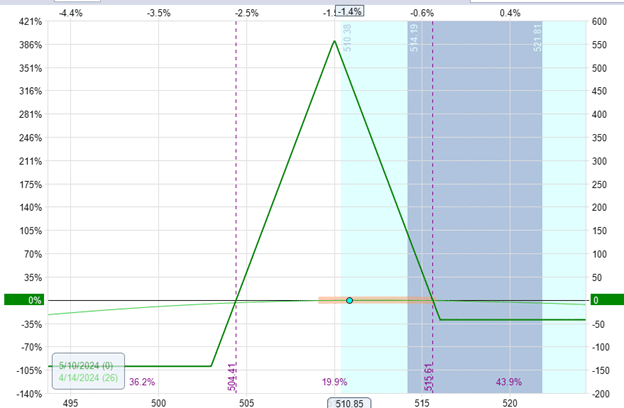

Date: April 12, 2024

Worth: SPY @ $510.85

Purchase one Might 10 SPY 503 putSell two Might 10 SPY 510 putBuy one Might 10 SPY 516 put

That is one contract of a butterfly or a one-lot butterfly.

The lengthy legs are the 503 put possibility and the 516 put possibility as a result of they’re the choices that we’re shopping for.

The 510 strike is the brief leg as a result of we’re promoting (or shorting) that possibility.

It’s an at-the-money butterfly as a result of the brief 510 strike is near the present value of the underlying.

We’re utilizing the SPY (the S&P 500 ETF) on this case.

The general place theta for this butterfly is 1.13.

This quantity tells you the variety of {dollars} the butterfly is anticipated to extend every day if all else stays the identical.

It’s a theoretical quantity as a result of we all know issues is not going to keep the identical.

Let’s have a look at solely the lengthy put possibility on the strike value of $516.

This selection has a theta of -0.13 on a per-share foundation.

On a per-contract foundation, if an investor buys this put possibility, it would lose $13 every day from time decay.

The adverse sign up theta implies that the choice (if bought) will lose cash from the passage of time.

As a result of choices have an expiration date, their extrinsic worth should go to zero.

Due to this fact, the choice loses worth every day because it will get nearer to expiration.

Equally, the lengthy put possibility at strike at 503 will lose $14 per day.

We offered two put choices contracts at a strike value of $510.

The choice on the choice chain exhibits a theta of -0.14 on a per-share foundation for this feature if we purchase it.

As a result of we’re promoting it, we flip the signal.

This selection provides us a optimistic theta of $14 per contract.

Since we’re promoting two contracts, we’re gaining $28 per day.

However we lose $14 per day for the 503 put possibility.

And we lose $13 per day for the 516 put possibility.

In mixture, the butterfly features about $1 per day from optimistic theta:

$28 – $14 – $13 = $1

This is the reason the software program is exhibiting us a theta of 1.13 for the general butterfly.

This quantity calculated by the software program could range barely relying on the platform and software program used.

If we double the contracts of this butterfly, equivalent to:

Purchase two Might 10 SPY 503 putSell 4 Might 10 SPY 510 putBuy two Might 10 SPY 516 put

We’d get double the theta, getting about $2 per day.

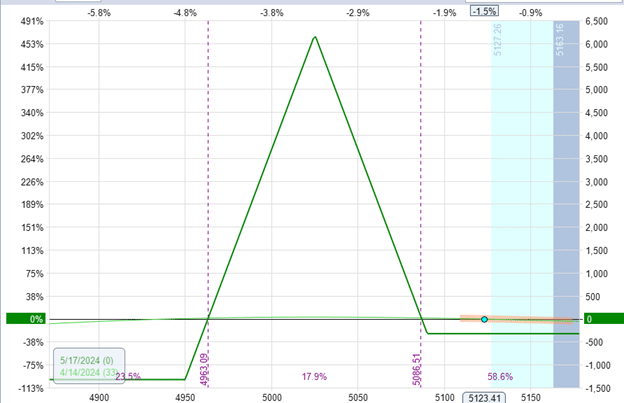

Here’s a butterfly on SPX.

That is the bigger S&P 500 index (not ETF).

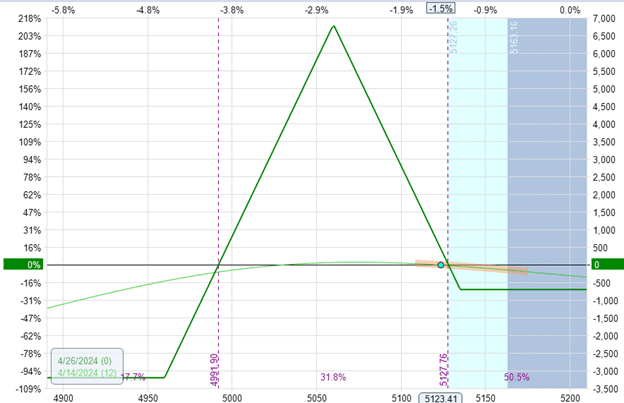

Date: April 12, 2024

Worth: SPX @ $5123.40

Purchase one Might 17 PM SPX 5050 putSell two Might 17 PM SPX 5125 putBuy one Might 17 PM SPX 5190 put

It has a 65-point higher wing width and a 75-point decrease wing width – additionally centered across the present value.

Due to its bigger underlying asset value, it has a theta of 9.

The SPX fly provides almost ten occasions as a lot theta per fly because the SPY fly.

This is smart for the reason that SPX index is about ten occasions as giant because the SPY ETF.

The theta on this SPX fly is rather less than anticipated as a result of this fly has an expiration date that’s one week farther away than the SPY fly.

As a result of this fly has extra time until expiry, its extrinsic worth doesn’t have to lower as quick.

Therefore, much less theta.

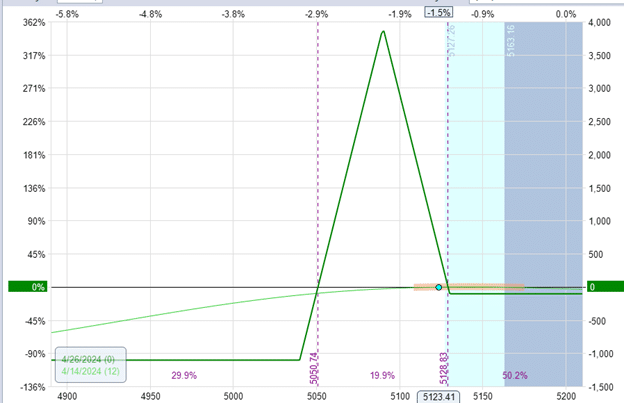

If we had been to shift this fly additional away from value (however conserving the wing width and the expiration date the identical):

Purchase one Might 17 PM SPX 5050 putSell two Might 17 PM SPX 5125 putBuy one Might 17 PM SPX 5190 put

We’d get much less theta at $7.8 per day.

The at-the-money strikes have the very best extrinsic worth.

Since we not promote the at-the-money strikes like earlier than, we don’t get as a lot theta.

Obtain the Choices Buying and selling 101 eBook

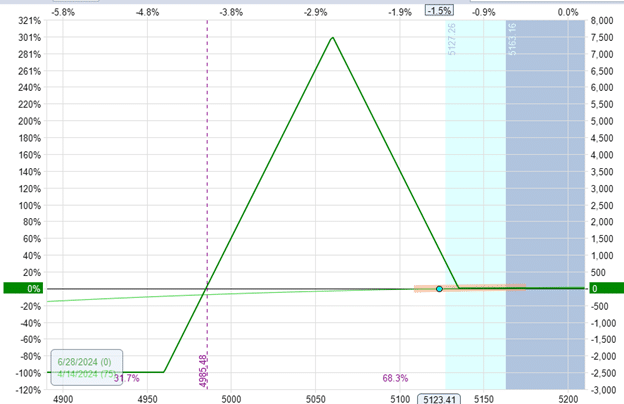

Shorter period flies with much less time to expiration usually have greater theta.

This fly with a 40-point higher wing and 50-point decrease wing on the SPX has $18 of theta per day as a result of it has solely 14 days until expiration.

If we widen its higher wing to 75 factors broad and its decrease wing to 100 factors broad:

We get much more theta at $53 per day.

Shifting the fly additional out in time with 75 days until expiration decreases the theta to $3.5 per day:

What seems to be a easy query seems to have a posh reply.

This starkly contrasts Douglas Adams’ science fiction novel “The Hitchhiker’s Information to the Galaxy,” the place a posh query is requested, and a easy reply is given in return.

A bunch of hyper-intelligent beings requested the supercomputer deep thought in regards to the reply to the final word query of life, the universe, and every thing.

Finally, the pc gave the easy reply of “42”.

We hope you loved this text on how a lot theta is in a butterfly.

In case you have any questions, please ship an electronic mail or depart a remark under.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who are usually not conversant in alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link