[ad_1]

The put-call ratio offers an investor or dealer with a sign of an asset’s sentiment—whether or not bullish or bearish.

The put-call ratio measures the amount of put choices traded relative to the amount of name choices traded.

It’s calculated by dividing the variety of traded put choices by the variety of traded name choices.

Put-call ratio = quantity of put choices / quantity of name choices

As a result of it’s known as the “put-call” ratio (and never the “call-put” ratio), it’s the put choices divided by the decision choices and never the opposite method round.

Contents

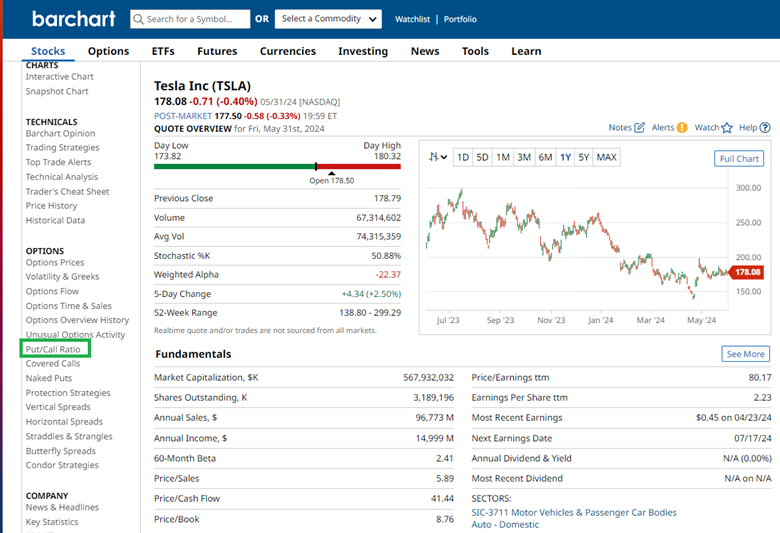

The only method is to kind the ticker image into BarChart.com and convey up the inventory overview web page.

For apparent causes, the put-call ratio solely applies to equities with choices obtainable.

Let’s take a random optionable inventory for instance, say Tesla (TSLA).

Then click on “Put / Name Ratio” within the left menu:

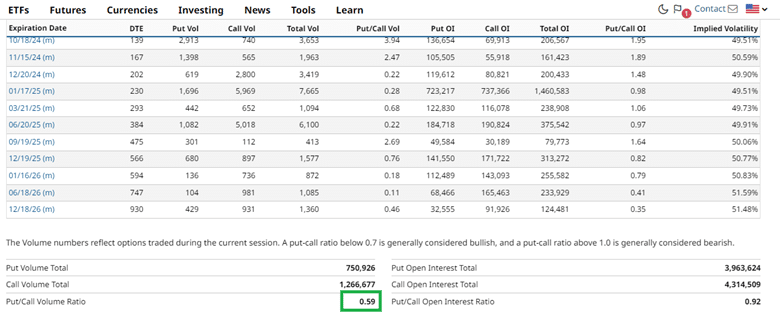

You get a desk with put and name volumes of the choices for various expiration cycles:

If all these numbers make your eyes glaze over, as mine, then all you might want to do is scroll to the underside, and you will note the summarized put/name quantity ratio.

Within the case of Tesla, it’s exhibiting 0.59.

If you wish to verify this calculation, Tesla has a complete put quantity of 750,926 and a complete name quantity of 1,266,677.

Dividing the latter by the previous, you get 0.59.

As is talked about on the Barchart web page:

“The amount numbers replicate choices traded in the course of the present session. A put-call ratio beneath 0.7 is mostly thought-about bullish, and a put-call ratio above 1.0 is mostly thought-about bearish.”

Since Tesla’s put/name ratio is beneath 0.7, it reveals a bullish sentiment.

Buyers purchase put choices for safety in declining belongings.

When places are low in comparison with calls, buyers are usually not shopping for that many places.

Or it may imply that buyers are shopping for many name choices for hypothesis of an up-move.

In each instances, that ends in a low put/name ratio.

Simply do not forget that numerous places are bearish. Numerous calls are bullish.

The put/name ratio tells us what number of places there are in relation to calls.

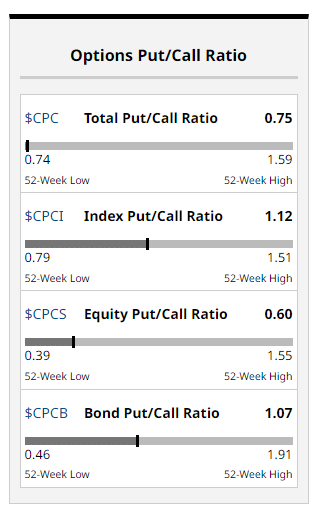

What if you wish to see the sentiment of the market fairly than simply a person inventory?

Merely go to the Choices overview web page on Barchart, and you will note a panel on the suitable that appears like this:

Get Your Free Put Promoting Calculator

The “Fairness Put/Name Ratio” presently reveals 0.60.

That’s the combination put/name ratio of all of the optionable shares mixed.

The put/name ratio for the index is 1.12.

And the overall put/name ratio combining each equities and index is 0.75.

What is good is that the slider reveals this ratio’s present place in relation to the excessive and low for the final 52 weeks (or yr).

The whole put/name ratio is near its 52-week low, which is a really bullish sentiment.

By the way, a bullish sentiment is according to the everyday sentiment of the market throughout an election yr, which is 2024.

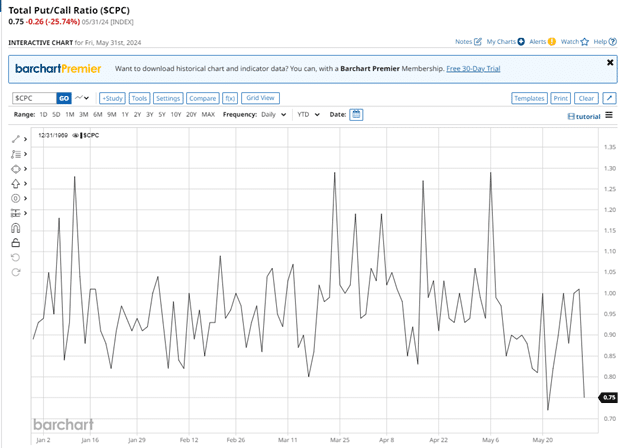

If you wish to see the put/name ratio over time, merely kind within the symbols “$CPC,” “$CPCI,” and “$CPCS” (together with the $ signal) into Barchart:

These symbols are particular to Barchart and will not work in different charting platforms.

A simple option to bear in mind these symbols is to assume:

$CPC = Cumulative Put Name

$CPCI = Cumulative Put Name for Index

$CPCS = Cumulative Put Name for Shares

The put/name ratio is only one method the buyers can gauge the market’s sentiment.

Buyers ought to use it along side different indicators, corresponding to a breadth indicator, to get an excellent higher image.

We hope you loved this text on learn how to decide the put-call ratios.

In case you have any questions, please ship an electronic mail or depart a remark beneath.

Commerce secure!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who are usually not aware of trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link