[ad_1]

amgun

Introduction

We final lined iShares Expanded Tech Sector ETF (NYSEARCA:IGM) in September 2023. At the moment, even if we appreciated its long-term outlook, we felt its valuation was costly and most popular to purchase throughout a dip for the next margin of security. It has been about 10 months since we final lined IGM, we predict it’s time for us to supply one other replace.

ETF Overview

IGM invests in a portfolio of about 280 U.S. expertise shares. The fund has outperformed the broader market for the reason that cyclical low reached in October 2022. IGM is predicted to learn from sturdy earnings development charges of the expertise sector within the subsequent few years. Nonetheless, its valuation may be very costly. Just a few different subsectors akin to software software program, and interactive media & providers inside the expertise house nonetheless have nearer to truthful valuations. Due to this fact, we predict buyers could need to take into account different funds which have larger publicity to those subsectors as an alternative.

Fund Evaluation

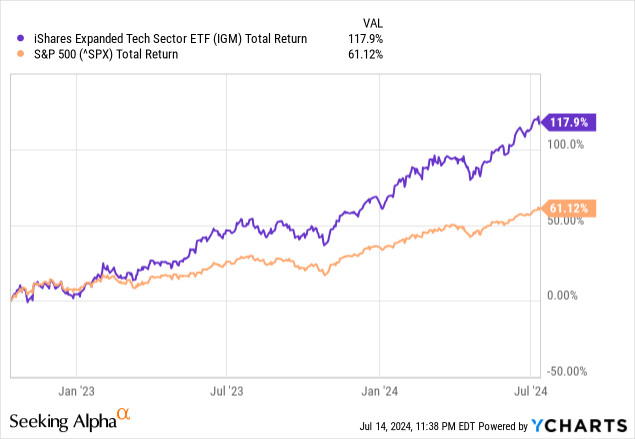

Sturdy rally since our final protection

Even supposing we predict it was costly once we final analyzed IGM in September 2023, the fund delivered very sturdy efficiency, delivering a complete return of 48.1% because of the market’s hype on synthetic intelligence. This return was significantly better than the S&P 500 index’s 26.1% in the identical interval. Because the broader market reached its cyclical low in October 2022, IGM has delivered a complete return of 117.9%, virtually doubled the entire return of 61.1% of the S&P 500 index. As might be seen from the chart under, there have been no significant pullbacks or corrections since October 2022.

YCharts

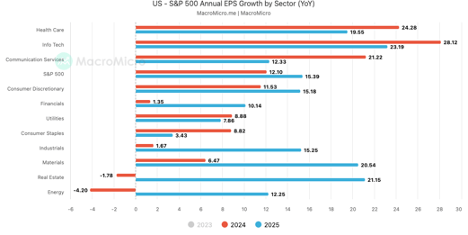

IGM’s elementary: closely tilted in the direction of development

Expertise sector is a fast-growing sector relative to different sectors. Under is a chart that reveals the consensus EPS development charges amongst completely different sectors within the S&P 500 index. Because the chart under reveals, info expertise sector is predicted to develop at annual EPS development charges of 28.1% and 23.2% in 2024 and 2025, respectively. These development charges are considerably higher than most different sectors and significantly better than the broader index. For reader’s info, shares within the S&P 500 index are solely anticipated to develop at annual EPS development charges of 12.1% and 15.4%, respectively. Since IGM solely focuses on expertise shares, it’s doubtless that IGM will proceed to outperform the S&P 500 index within the subsequent few years.

MacroMicro

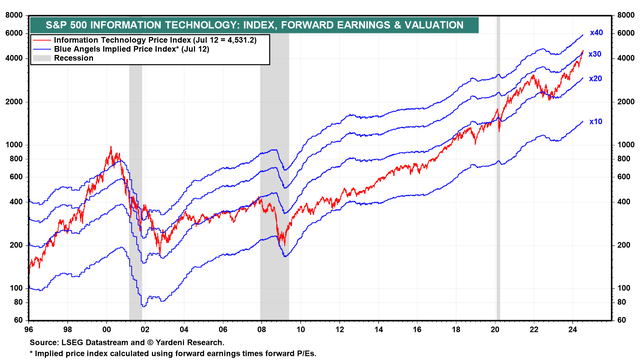

Valuation turns into much more costly

In our earlier article on IGM, we famous that the common ahead P/E ratio of data expertise shares within the S&P 500 was about 27x. It was fairly excessive, as the common ahead P/E ratio previously 20 years was about 20x. The valuation in September 2023 was already close to the height reached in late 2021. The sturdy efficiency of the broader expertise sector previously 12 months has pushed this valuation even larger. As might be seen from the chart under, the ahead P/E ratio of expertise shares within the S&P 500 index is now over 30x, surpassing the height reached in late 2021. Though we’ve not but reached the file over 40x that was set through the dot com bubble in 2000, we’re transferring in the direction of that route except there’s a important pullback. We perceive the way forward for our society might be eternally remodeled by the unreal intelligence and GPTs, but when the valuation continues to broaden, the bubble will doubtless grow to be even larger.

Yardeni Analysis

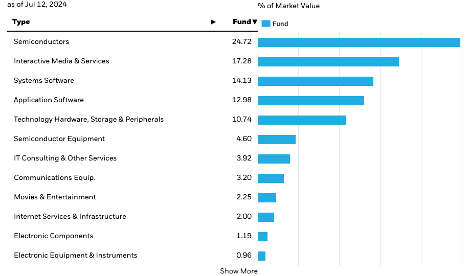

Allow us to take a look at the valuation of IGM’s primary subsectors. As might be seen from the chart under, IGM’s prime 4 subsectors embody: semiconductors (24.7%), interactive media & providers (17.3%), programs software program (14.1%), and software software program (13.0%).

iShares

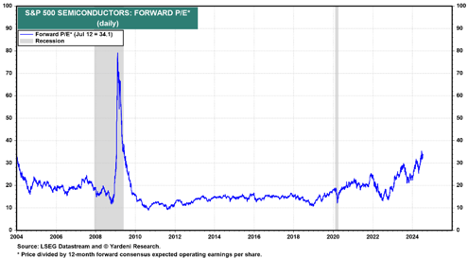

IGM’s prime subsector, semiconductors, may be very costly. As might be seen from the chart under, the ahead P/E ratio of semiconductor shares within the S&P 500 index is presently at 34.1x. That is a lot larger than the common vary of about 18-20x previously 2 a long time, and far larger than the height reached in late 2021.

Yardeni Analysis

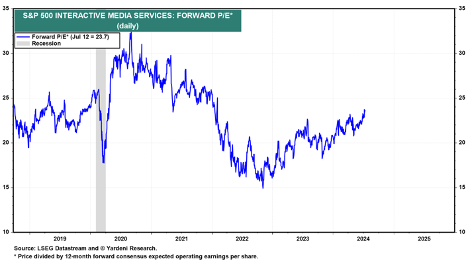

IGM’s second largest subsector, interactive media & providers, nonetheless has an affordable valuation. As might be seen from the chart under, the ahead P/E ratio of those shares within the S&P 500 index is barely 23.7x. That is nonetheless under their peak of above 30x reached since 2020 and has solely began to succeed in the valuation stage earlier than the pandemic in 2019.

Yardeni Analysis

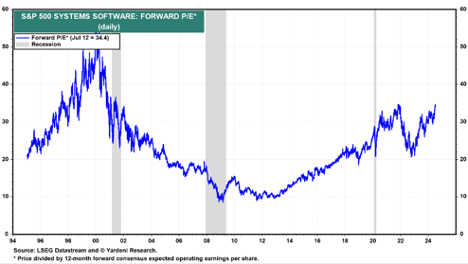

IGM’s third largest subsector, system software program, is wealthy in valuation. As might be seen from the chart under, the common ahead P/E ratio of those system software program shares within the S&P 500 index has reached 34.4x. This valuation is definitely a lot larger than the cyclical low of about 21x reached in October 2022, and can be considerably larger than the common previously 20 years.

Yardeni Analysis

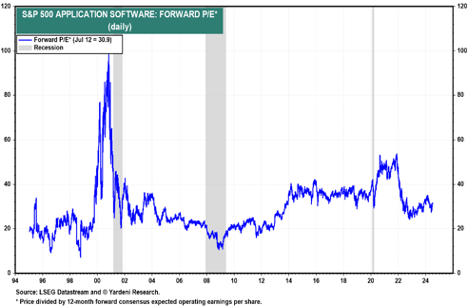

Lastly, IGM’s fourth largest subsector, software software program, isn’t costly relative to different sectors. The typical ahead P/E ratio of those shares within the S&P 500 index is barely about 30.9x. That is nonetheless a lot decrease than the above 50x valuation reached through the pandemic.

Yardeni Analysis

Investor Takeaway

Based mostly on our evaluation, the broader expertise house is pricey and therefore there’s important draw back threat if the broader market decides it’s time to pull again. Our evaluation signifies that there are nonetheless areas within the expertise house that aren’t costly, akin to software software program and interactive media & providers subsectors. Due to this fact, we predict it might be higher to hunt different funds which have larger publicity to those cheaper subsectors as an alternative. For instance, iShares Expanded Tech-Software program Sector ETF (IGV) has a 63% publicity to software software program subsector. We hope to research IGV and supply our suggestions on this fund very quickly.

[ad_2]

Source link