[ad_1]

Impression of Enterprise Cycles on Machine Studying Predictions

As an outdated investing adage goes, “All people’s a genius in a bull market.” It is straightforward to fall sufferer to the Dunning-Kruger impact, the place attribution bias makes us mistake our luck for skills. When the enterprise cycles change, there are nice issues with exact inventory worth predictability. And this isn’t the one downside for people, who’re baffled by many psychological heuristics. Machine studying algorithms expertise related issues, too. What is occurring, and why is it so? A brand new paper by Wang, Fu, and Fan provides an evidence and proposes some treatments …

From observations of market volatility and mannequin efficiency throughout recession and non-recession intervals, present ML mannequin performances are extremely correlated with market volatility, whatever the particulars of mannequin buildings. Paper Inventory Value Predictability and the Enterprise Cycle By way of Machine Studying demonstrated that even underneath optimum hyperparameter fine-tuning, ML fashions nonetheless ship inferior efficiency in 5 out of the seven NBER recession intervals in comparison with their counterparts’ efficiency in growth intervals.

Together with recession information within the coaching set or incorporating the risk-free price, technical indicators, and macroeconomic variables as predictors yielded blended success in bettering mannequin efficiency. Extra effort is required to reinforce the efficiency of ML fashions with risky information.

The authors suggest an early recession identification methodology that may be simply prolonged from pre-trained neural community forecasting fashions to establish recessions whereas predicting inventory costs. Their proposal includes coaching a decoder that reconstructs the inputs to the forecasting mannequin from its intermediate outputs. The reconstruction error between the enter and the reconstructed enter is a recession index. The next reconstruction error suggests the next chance of a recession. The decoder’s reconstructed inputs additionally function worth and issue expectations.

Finance ML practitioners are recommended to judge their ML fashions in each recession and non-recession intervals to achieve insights into the efficiency dynamics all through the enterprise cycle. Early indications of recessions may help decision-makers in managing the upcoming unfavourable penalties of elevated volatility on purposes reliant on machine studying forecasting fashions, that are encouraging, such because the one introduced.

Authors: Li Rong Wang, Hsuan Fu, and Xiuyi Fan

Title: Inventory Value Predictability and the Enterprise Cycle By way of Machine Studying

Hyperlink: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4703458

Summary:

We examine the impression of enterprise cycles on machine studying (ML) predictions utilizing the S&P 500 index. Our findings reveal that ML fashions typically under-perform throughout most recessions, and incorporating recession historical past, risk-free price, velocity, momentum, and macroeconomic variables doesn’t essentially improve their efficiency. Upon analyzing recessions the place fashions exhibit sturdy efficiency, we observe that these intervals exhibit decrease market volatility in comparison with different recessions. This means that the improved efficiency is primarily influenced by components equivalent to efficient financial insurance policies that stabilize the market, reasonably than the inherent benefit of ML strategies. Nonetheless, offering advance discover of the start of a recession may assist mitigate the unfavourable impacts on mannequin efficiency. Subsequently, we suggest a neural community structure aimed toward detecting the onset of recessions. Moreover, we suggest that ML practitioners consider their fashions throughout each recessions and expansions to achieve complete insights into their efficiency. Preprint submitted to Determination Help Methods October 29, 2023

As all the time, we current a number of fascinating figures and tables:

Notable quotations from the educational analysis paper:

“Regardless of current successes in creating ML fashions for the prediction of economic costs of various belongings, there’s little dialogue within the literature concerning the impression of enterprise cycles and market volatility on inventory worth forecasting with ML fashions. Quite the opposite, a number of research have tried to foretell enterprise cycle phases utilizing ML methods. These research approached the duty as a traditional classification downside [19, 20, 21]; on this context, generic ML classifiers have been skilled on historic information labeled with categorical tags representing the presence or absence of market crashes within the close to future. Nevertheless, making use of such approaches on to recession forecasting is probably not optimum because of the imbalanced nature of recession forecasting information. A extra promising various includes treating this situation as an anomaly detection downside.This paper fills each gaps by exploring the data-shifting results of recession market volatility on ML fashions and anomaly detection strategies for enterprise cycle section forecasting[.]

Our fundamental discovering largely confirms the conjecture that predictions are typically much less correct throughout recession intervals in comparison with growth intervals. For almost all of fashions, we report bigger forecasting errors in recessions than in expansions. Nevertheless, we be aware that just a few fashions don’t coincide with our conjecture. We observe that these fashions have been all evaluated on the 2 recessions within the late Seventies. The oil disaster mixed with excessive inflation on this interval resulted in a serious change in financial policy-making. We argue that this explains the low volatility within the inventory market throughout these intervals. Thus, these two recessions needs to be thought of exceptions in our evaluation.Second, on including the recession observations into the in-sample (coaching) set and we discover that half of the fashions (22 out of 42) present indicators of improved forecasting efficiency. Nevertheless, there isn’t any clear sample on whether or not a particular kind of mannequin (e.g., LSTM, GRU, or BLSTM) or some particular intervals profit from such inclusion. Therefore, the good thing about together with recession information stays considerably opaque for forecasting in recessions.Third, we additionally explored the impression of extra inputs on mannequin efficiency. Particularly, we launched the risk-free price, inventory worth velocity and momentum, and macroeconomic variables. Among the many 42 fashions examined, 17 fashions confirmed improved forecasting accuracy when the risk-free price was included. Equally, 24 out of 42 fashions exhibited enhanced accuracy with the inclusion of velocity and momentum options. These observations counsel that the inclusion of risk-free-rate, velocity and momentum options might have a constructive impression on inventory worth forecasting, though the impact was not constantly noticed throughout all fashions. Apparently, the incorporation of macroeconomic variables improved recession prediction efficiency for fashions skilled solely with growth information (7 out of 9 fashions), however not for fashions skilled utilizing each recession and non-recession information (4 out of 9 fashions).

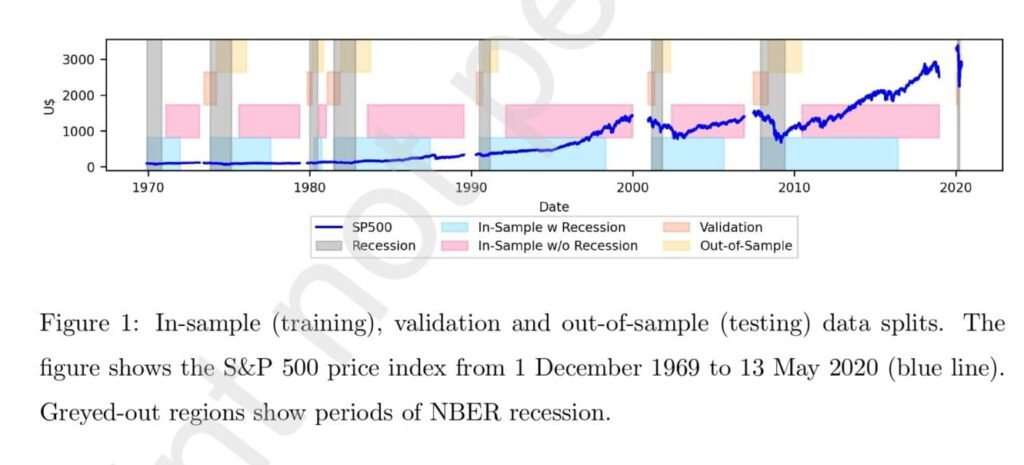

The information have been divided into seven overlapping subperiods (aligned with the variety of recessions by the Nationwide Bureau of Financial Analysis (NBER)) as illustrated in Determine 1. Every subperiod consists of 4 consecutive information splits and spans two adjoining recessions to maximise the usage of the collected information (leading to subperiods with various lengths). Every mannequin was skilled on both “In-Pattern With Recession (ISWR)” or “In-Pattern With out Recession (ISWOR)”, hyper-parameter-tuned with “Validation”, and evaluated on OOS from a single subperiod.

In Determine 1, we observe that in recession intervals, inventory costs exhibit various charges of decline. This commentary motivates our investigation into whether or not the inclusion of velocity (worth adjustments) and momentum (velocity adjustments) indicators calculated from inventory costs may improve predictions throughout recessions.

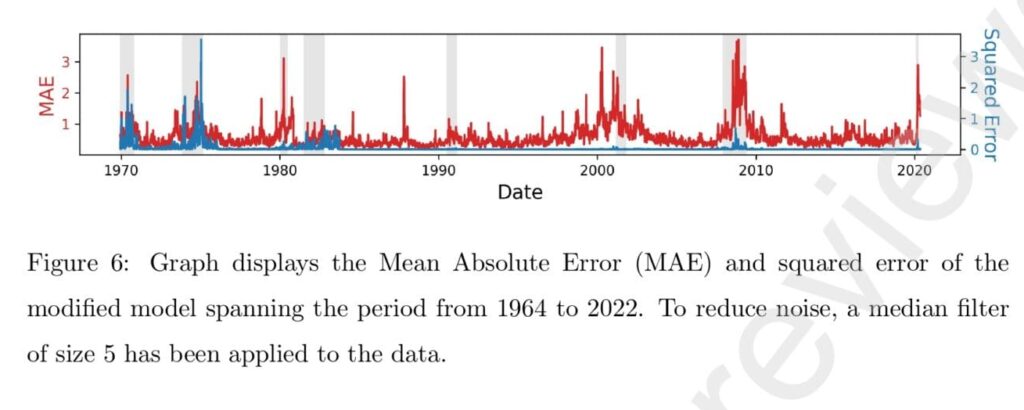

Our methodology includes attaching a decoder to a skilled neural community forecasting mannequin, which reconstructs the enter from the outputs of any intermediate layer of the prediction mannequin. The reconstruction MAE (imply absolute error; the magnitude of distinction between the reconstructed and authentic enter; chosen for its robustness to outliers [37] when in comparison with different error metrics like root imply squared error) is hypothesized to function a dependable measure of knowledge unfamiliarity. By coaching the mannequin solely on information from non-recession intervals, we anticipate with the ability to distinguish between recession and growth intervals, thereby offering an correct estimation of the onset and finish of every recession. From a monetary perspective, the reconstructed enter represents expectations of costs and components, which function benchmark data for funding selections. The reconstruction MAE quantifies the deviation between the anticipated and realized values of costs and components. Determine 6 exhibits the MAE of such a mannequin throughout all seven subperiods. It’s evident that in recessions, the MAE displays a notable enhance, whereas throughout non-recession intervals, the MAE stays comparatively low. This commentary highlights the potential of our proposed mannequin for early recession identification.”

Are you in search of extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you wish to study extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing supply.

Do you wish to study extra about Quantpedia Professional service? Test its description, watch movies, evaluation reporting capabilities and go to our pricing supply.

Are you in search of historic information or backtesting platforms? Test our listing of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookConsult with a good friend

[ad_2]

Source link