[ad_1]

The most effective methods to make strong funding choices is to concentrate to Warren Buffett’s portfolio. A lot of his largest holdings have outperformed the marketplace for years and even a long time at a time.

One among his long-term positions, Visa (NYSE: V), caught my eye after a latest correction. Buffett has held onto this inventory since 2011. There are two thrilling explanation why you must think about Visa to your portfolio proper now.

That is the kind of inventory that each investor needs to personal

In certainly one of his extra well-known quotes, Buffett tried to elucidate a lesson he is discovered time and again: Belief nice companies, not administration groups. “When a administration with a fame for brilliance tackles a enterprise with a fame for unhealthy economics,” Buffett as soon as suggested, “it’s the fame of the enterprise that is still intact.”

The lesson right here is easy: Purchase high-quality companies that even a half-competent administration staff might run. On this regard, Visa is the right instance. A couple of months in the past, I speculated that Visa might turn out to be the subsequent trillion-dollar inventory. It wasn’t the savvy administration staff that I beloved, however the enterprise fundamentals that even a poor administration staff would discover troublesome to screw up. Visa’s essential benefit, I argued, was the long-term tailwind of community results.

What are community results? This enterprise faculty time period basically describes a services or products that will get extra precious the extra that individuals use it. Social media is a major instance. Even the very best social media platform will not get wherever with out hitting a vital mass of customers. On this means, a social media community’s best benefit is its person base, not its know-how. Folks need to be a part of networks that others are part of, which signifies that the bigger platforms tend to develop even larger over time.

Fee networks like Visa function in a lot the identical means. Nobody needs to make use of a credit score or debit card that retailers will not settle for. And retailers do not need to settle for types of fee that buyers do not use. The pure result’s {industry} consolidation. In keeping with knowledge compiled by Statista, Visa has an enormous 61% market share for general-purpose fee playing cards within the U.S. Mastercard is available in second with a market share of 25%, whereas simply two corporations spherical off the remainder of the {industry}. This is not a brand new dynamic, both. Mastercard and Visa have loved industry-duopoly positions for greater than a decade, with Visa commanding a heavy lead the complete time.

Nice shares not often get this low-cost

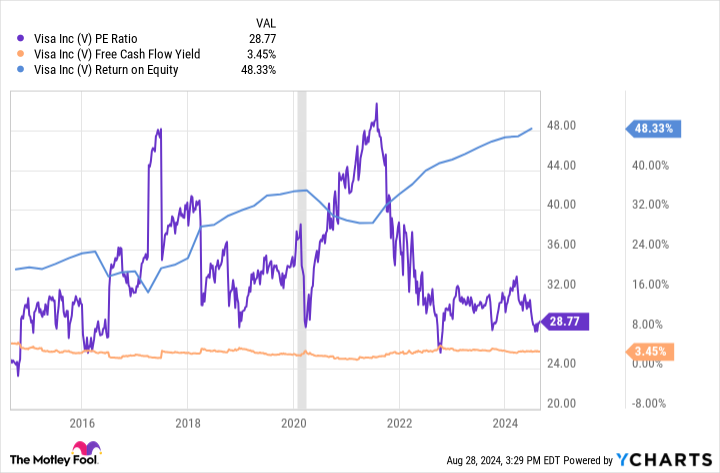

Huge-industry consolidation mixed with an asset-light enterprise mannequin has resulted in big and regular earnings for Visa. Its returns on fairness are extremely spectacular contemplating the corporate employs a conservative quantity of leverage. Free-cash-flow era has almost at all times been optimistic. And after a small correction, shares now commerce at almost their least expensive ranges in years on a price-to-earnings foundation.

Story continues

Proper now, the S&P 500 as an entire trades at a price-to-earnings ratio of 29.2. Which means Visa inventory trades at a reduction to the market common regardless of working an extremely dependable and worthwhile enterprise mannequin that advantages from community results that ought to endure for many years to return. In keeping with latest filings, it would not seem as if Warren Buffett has been promoting any of his Visa place. It is onerous to think about him doing so at these costs.

Is Visa inventory a purchase proper now? The reply seems to be a robust “sure.” At these ranges, the corporate is a superb match for worth and development traders alike.

Must you make investments $1,000 in Visa proper now?

Before you purchase inventory in Visa, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Visa wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Mastercard and Visa. The Motley Idiot recommends the next choices: lengthy January 2025 $370 calls on Mastercard and quick January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.

Is Visa Inventory a Purchase? was initially revealed by The Motley Idiot

[ad_2]

Source link