[ad_1]

JHVEPhoto/iStock Editorial through Getty Pictures

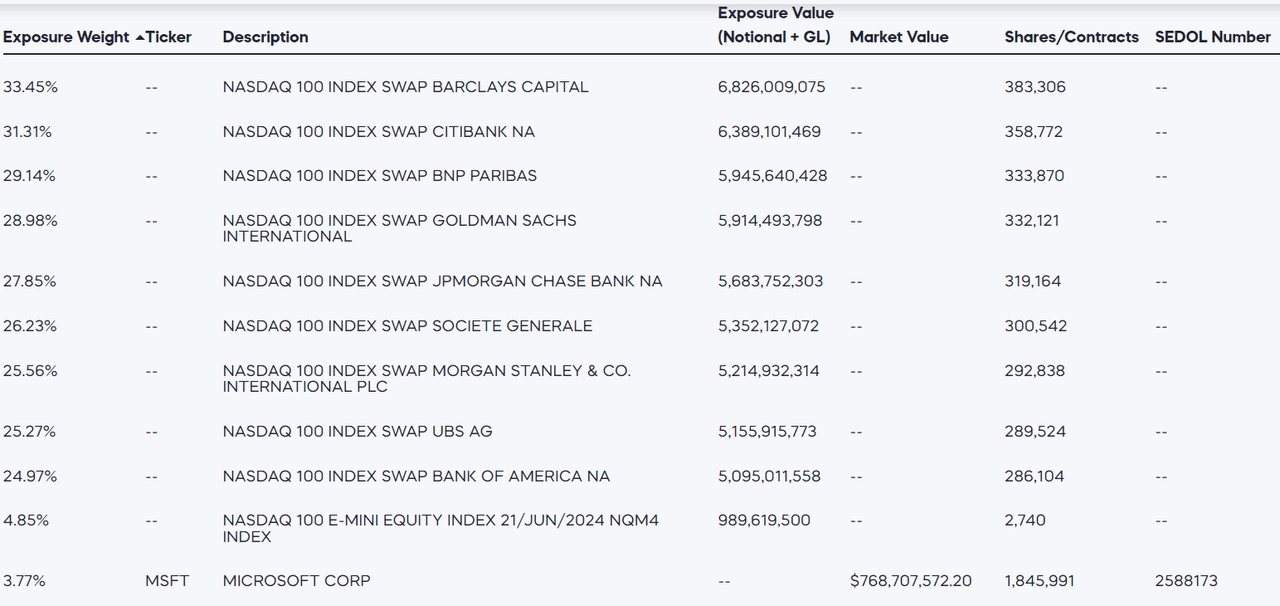

ProShares UltraPro QQQ ETF (NASDAQ:TQQQ) tracks 3x Nasdaq 100 each day returns. TQQQ makes use of OTC swaps with varied counterparties to attain this 3x each day publicity.

TQQQ Holdings (ProShares)

It is positively a high-risk, high-potential reward asset. In a bull market, TQQQ can outperform virtually all the pieces else. In a bear market, holding TQQQ could be fairly painful.

Nevertheless, there’s a approach to maintain TQQQ with out having to endure huge drawdowns. What I am introducing on this article is a reasonably dangerous and complex choices overlay to assist decrease publicity throughout a Nasdaq 100 selloff, defending the investor from a pullback state of affairs.

Combining TQQQ with QQQ Places

The Invesco QQQ Belief ETF (QQQ) is the principle ETF that tracks the Nasdaq 100. Thus, TQQQ is successfully 3x QQQ, or “triple” QQQ (this is likely to be the explanation for the “T” within the ticker).

QQQ has among the most liquid choices on the planet. Additionally, QQQ has 0 DTE choices, which implies there are possibility expiries each single buying and selling day. This offers merchants practically unparalleled management over how they’ll hedge their positions.

The fundamental technique is fairly easy: by holding TQQQ and a few QQQ places, you’ll be able to insulate your self from the draw back and even understand a optimistic return if QQQ actually sells off exhausting. In the meantime, you might have the aggressive upside supplied by holding TQQQ.

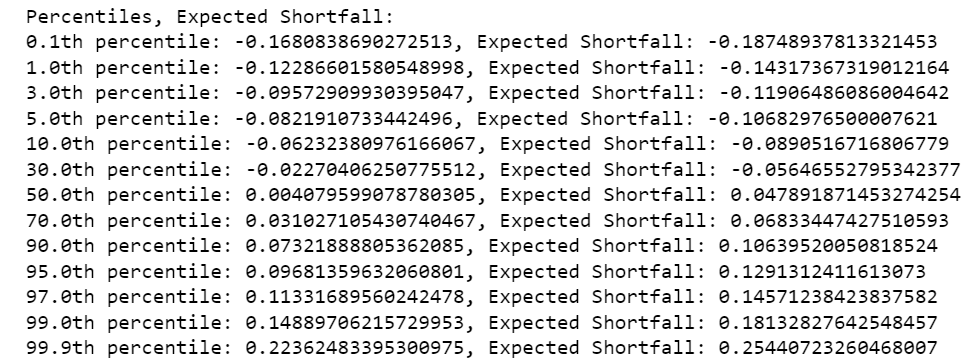

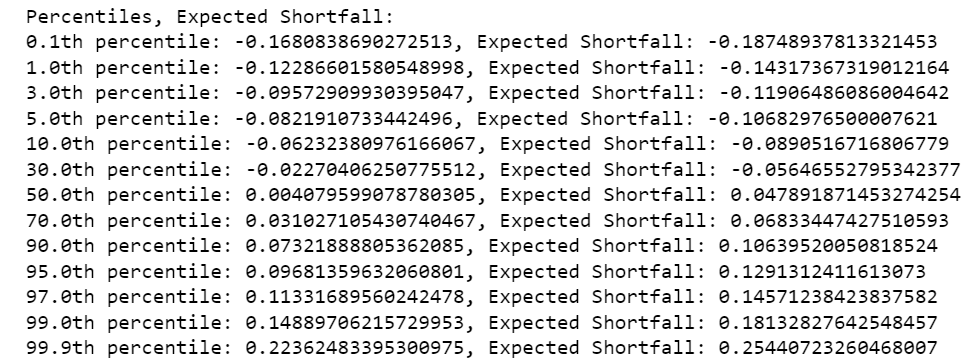

Let’s check out a Monte Carlo simulation based mostly on the each day returns of QQQ. All I’m doing is taking the historic each day returns and randomly sampling a sequence of them to create the returns over the course of 10 buying and selling days – which is about 2 weeks. I’m working this Monte Carlo 100,000 occasions, which provides us a very good pattern of potential outcomes.

Right here I present some percentiles of efficiency over the course of 10 simulated buying and selling days.

Percentiles and Anticipated Shortfall (Writer, Monte Carlo)

Here is easy methods to learn this:

The ten.0th percentile reveals -0.0623 which implies that within the backside 10%, QQQ went down greater than 6.23% over the course of 10 buying and selling days. The anticipated shortfall is -0.0891, which implies that when QQQ was within the backside 10%, the typical it went down over the course of these 10 buying and selling days was 8.91%. The anticipated shortfall can also be generally known as the conditional worth in danger (cVAR). CVAR solutions the query: “conditional on our pattern breaching some z-score or percentile, what’s the anticipated worth of the return in that state of affairs?”

Now let us take a look at the ninetieth percentile. The 0.0732 implies that within the high 10% of the time, QQQ could have a minimum of a 7.32% return over the course of 10 buying and selling days. And the anticipated shortfall of 0.1064 implies that when it’s in that high 10%, QQQ will on common return 10.64% over these 10 buying and selling days.

The great thing about Monte Carlo is which you can set this up your self and get very comparable outcomes. I’ve used the time sequence of each day returns since QQQ’s launch, which you’ll simply get on Yahoo! Finance. The slight variations in Monte Carlo outcomes solely come from some randomization. The Central Restrict Theorem ensures that the averages of random samples of any distribution finally method a traditional distribution and that the variance of the means decreases because the pattern dimension grows. Therefore these outcomes ought to have a fairly small variance between particular person situations, particularly if our pattern dimension is 100,000 rounds.

Let’s have a look at how we will use these numbers to do some hedging. For brevity, let’s simply assume I am solely speaking about sequences of 10 consecutive buying and selling days. As a result of 10 days is comparatively brief, we will assume that TQQQ will transfer round 3x no matter QQQ’s returns will probably be (this assumption breaks down once we begin speaking about months or years). The core lengthy place will probably be TQQQ. We’ll use QQQ places as crash insurance coverage.

Percentiles and Anticipated Shortfall (Writer, Monte Carlo)

The primary trick right here is to purchase QQQ places which are NTM – or whose strike value is slightly below the spot value of QQQ. There are two advantages right here. The primary is that near-the-money places are inclined to have decrease implied volatility than OTM places, due to the IV skew. IV represents the value you’re paying for the insurance coverage safety supplied by an possibility contract. Usually, places which are additional OTM (decrease strike costs) have greater IV. You’ll be able to consider this because the market bidding up black swan, left tail, and crash safety. The second profit is that if the value dips slightly, the choices will probably be ITM and you’re protected against that time ahead – all the pieces decrease than the strike value is “totally insured”.

What number of QQQ places to purchase? First work out what precisely you’re insuring. Within the case of an extended place in TQQQ, how excessive will it must go to fully cowl the price of your places? Primarily based on the Monte Carlo, I count on that 30% of the time QQQ will transfer up 3.1% or extra, with a mean transfer of 6.8% in these moments (once more, all of those simulated numbers confer with returns over the course of 10 buying and selling days or about 2 weeks; that’s the time interval with which I used to be simulating within the Monte Carlo). This could make TQQQ go up about 9.3%, with a mean transfer of 20.4%. On this case, if the QQQ put premiums expended on the hedge is 4.6% of the worth of all of your TQQQ place, then TQQQ will fully cowl the price of this hedge 30% of the time and even provide you with double the worth of the QQQ places.

Presently, the QQQ 440 places expiring on April 19 prices $770 for a contract. Because of this utilizing the logic above, it must be about 4.6% of the worth of the TQQQ place – so it’s best to have about 770 / 0.046 = $16,739 value of TQQQ shares.

Let us take a look at what occurs on the draw back. I count on that 30% of the time, QQQ goes down 2.3% or extra and that the anticipated shortfall is -5.6%. This interprets to TQQQ having a -6.9% transfer, with a mean anticipated shortfall of -16.8%.

But when QQQ went down 2.3% from the present value of 441, the value could be 431, so the put could be value $900 of intrinsic worth: a $130 revenue from the $770 value foundation. The TQQQ place clearly loses some huge cash ($16,739 down 6.9% is a couple of $1,200 loss), however you can begin to see that the put’s insurance coverage options are kicking in. In an excessive case, think about if QQQ went to 0: the put’s worth approaches $44,000 and TQQQ in fact goes to 0 as properly. However $44,000 is almost 3x greater than the $16,739 you began with. So the put truly creates this convex upside when true left-side tail danger materializes.

Returning to the fitting tail, think about if QQQ goes into the ninetieth percentile of returns. This occurs a tenth of the time. On the 70% percentile, the following value motion of TQQQ has already returned twice the price of our hedge (which was 4.6% of the TQQQ place worth). On the ninetieth percentile, the positive aspects could be so enormous (22% acquire on $16,739 invested) that the price of the hedge can virtually be forgotten.

The underside line is that what you’re seeing is a particular sort of commerce that takes benefit of the tails. If QQQ lingers with out transferring, then you’re paying for the hedge however not getting the appreciation of TQQQ. However large strikes in both path yield very giant payoffs. In brief, that is an antifragile portfolio technique.

Rising Your Anticipated Worth

It isn’t unattainable to extend your anticipated worth on this commerce. I used a generic Monte Carlo, however what if you happen to filtered the return sequence based mostly on sure indicators which appeared previous to these returns? You’ll get a unique distribution of returns, and presumably extra skewed to the optimistic finish in case your indicators have even a slight predictive edge.

One other means to do that is to be opportunistic in regards to the hedge. The core place may be TQQQ, however you needn’t apply the QQQ places till you assess a better probability of left tail strikes. I will not go into depth about what these indicators is likely to be. Personally, my expertise has been that the IV skew (IV throughout strikes or deltas of OTM choices) and the time period construction (IV throughout time or expiries) are considerably useful. I feel it additionally is sensible to make use of macro overlays to tell these selections.

Hedging is simply shopping for insurance coverage. In the event you may be insured when the dangers are a bit greater, then in the long term you’ll be able to let the legislation of huge numbers play out in your favor. If you’re at all times insured, you’re at all times protected however you additionally pay much more than if you’ll be able to efficiently take off the insurance coverage throughout decrease danger regimes.

The ultimate piece about growing the anticipated worth is to show the places right into a put unfold. Due to the IV skew, the places which are additional OTM have greater implied volatilities. By shopping for the NTM and promoting far OTM places you earn a little bit of an IV arbitrage. In our instance, you would possibly purchase the 440 strike put and promote the 400 strike put. After all, it caps the upside within the occasion of a QQQ crash beneath 400, however the put will usually simply be a means of decreasing the price of your hedge. You’ll be able to truly use the Monte Carlo to examine the precise possibilities which it’s best to count on such drawdowns to happen.

Does This Make Sense Right now?

I actually assume so. QQQ appears to be like like it’s sure for some large strikes quickly. VIX has been very muted and the skew between name IV and put IV has been very low. This implies complacency. The rally from October 2023 has been very spectacular, however may very well be petering out. Primarily based on the chart, it appears sentiment is poised to shift from right here. We may very well be nearing the tip of a 5 wave sample. What usually follows from it is a 3 wave sequence in the other way.

QQQ, 5 waves (Searching for Alpha)

Many traders are beginning to say that the yield curve inversion mannequin is damaged when the downturn must be beginning someday this yr. This all appears like “this time is totally different” speak, and that ought to set off some alarms.

Then again, this rally might need legs too. For my part, danger belongings mainly need to rise because the greenback continues to be debased. And I feel the greenback have to be debased as a result of there isn’t any different means for the US authorities to repay the trillions of {dollars} of debt that matures this yr. With the Fed saying that price cuts are on the horizon, I see loads of upside for markets too.

QQQ can also be composed of many very modern firms that are money stream machines. I feel its heavy focus on large tech is a big plus, even when the AI narrative feels very frothy to some people. My backside line relating to QQQ is that it’s a basket of high quality equities, what I might view as “the very best equities combine,” which I cowl on this article a couple of 3-asset antifragile portfolio. QQQ is among the three belongings I might put in such a portfolio. These equities are winners, and so they have loads of upside so long as the US economic system continues to have some stage of dominance.

So this technique, which is a approach to play the tails to your benefit, actually is sensible at the moment. If TQQQ rallies actually exhausting from right here, you beat the market and also you beat QQQ. If the QQQ falls very exhausting from right here, there’s a level at which the PNL truly flips in your favor.

Threat Dialogue

I’ve talked about this already, however will go over it once more. One danger is that lengthy QQQ choices will naturally expertise time decay or theta. Daily that choices are OTM means extra worth is misplaced from the choice premium. The truth that we’re lengthy choices on this technique implies that this technique is especially susceptible to theta. It’s potential that TQQQ would not enhance sufficient to offset the loss from theta. For instance, if QQQ is flat over an extended time frame, then TQQQ will even be comparatively flat. On this case, the places might have expired nugatory, and the misplaced premiums would imply a internet loss for the general place.

The theta danger is fairly large on this commerce, and this is the reason I don’t advocate rolling the places each time the present tranche of places expire. If you’re spending 4.6% of your place worth on places and also you do that each 2 weeks, then you’ll lose some huge cash fairly shortly. The higher method is to experience the optimistic drift of the market and use indicators of risk-on environments to scale back your danger. I might solely placed on this commerce after I view there’s a greater danger of a drawdown. Assuming I imagine this twice 1 / 4, I restrict these roll dangers to about 8 situations of dropping 4.6% of the place in a yr. It is vital to notice that the quantity of safety you get from a 4.6% allocation to QQQ places truly relies on the IV of places. Larger IV environments imply you’d be capable to purchase much less contracts with the identical 4.6% allocation.

One other danger of holding TQQQ is volatility decay. This can be a danger that’s attribute of leveraged ETPs and it’s ceaselessly thought-about inadvisable to carry one thing like TQQQ for an extended time frame. Volatility causes returns to compound negatively on leveraged funds, and it creates a long-term monitoring error whereby the fund can severely underperform 3x the unique index over an extended time frame that features bouts of volatility. One instance is the 3-year returns, the place QQQ truly outperforms TQQQ regardless of each being optimistic. The excessive volatility within the final three years led to excessive volatility decay.

TQQQ underperforms 3x QQQ within the unstable 3yr (Searching for Alpha)

Then again, additionally it is potential for very lengthy intervals of comparatively low volatility to have a “compound upward” impact the place the leveraged fund dramatically outperforms 3x the unique index.

TQQQ outperforms 3x QQQ within the 10yr (Searching for Alpha)

Volatility shouldn’t be your buddy within the brief time period whenever you maintain TQQQ. That is why understanding easy methods to use QQQ places is a crucial a part of this.

One potential danger is focus danger. TQQQ is extraordinarily unstable. This technique is fairly sophisticated. I like to recommend placing a share allocation the place you’ll be able to afford to lose over 50% of to first take a look at the waters. For instance, if you happen to can afford to lose 5% of your portfolio and no extra, then do not put greater than 8-10% of the portfolio on this till you might have an excellent understanding of what’s going on.

The opposite dangers are mainly overcomplicating the setup and messing it up due to inexperience with derivatives or a misunderstanding of the mathematics behind this. What I suggest is an unconventional technique, so positively ensure you have a grasp on these ideas earlier than making an attempt it by yourself.

[ad_2]

Source link