[ad_1]

JHVEPhoto

Marvell Expertise (NASDAQ:MRVL) is a key provider of information heart infrastructure semiconductor options for information heart core and community edge. Marvell’s information heart enterprise represented greater than 70% of whole revenues in the newest quarter. Marvell anticipates its AI revenues from optics and customized ASIC reaching greater than $1.5 billion by FY25. Moreover, the corporate is nicely positioned to develop its information heart switching portfolio (Energetic Electrical Cables) within the close to future. I’m initiating with a ‘Purchase’ score with a one-year value goal of $80 per share.

Development in AI Optics and Customized Silicon

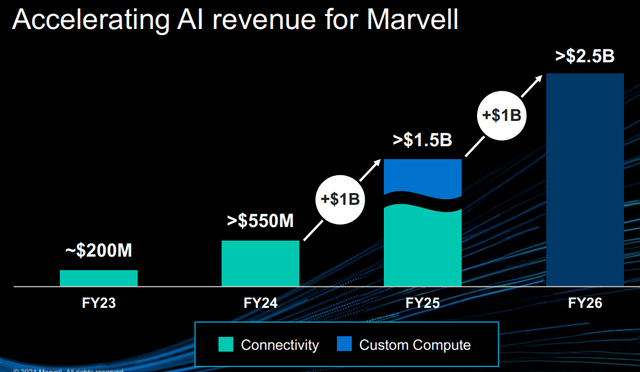

Marvell’s AI publicity lies in its information heart optics and customized silicon (“ASIC”) enterprise. As proven within the chart beneath, the corporate is predicted to ship >1.5 billion in income from AI by FY25.

Marvell Investor Presentation

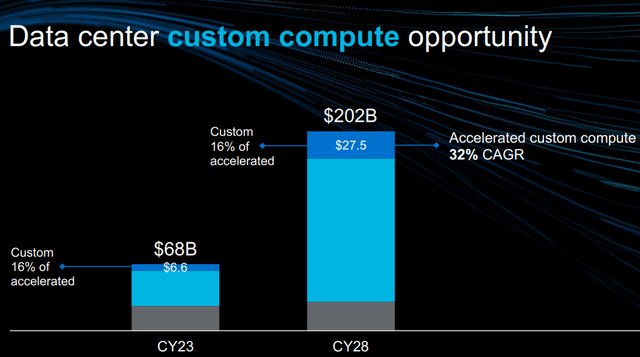

AI Optics: Marvell’s optics portfolio contains pulse amplitude modulation, digital sign processors, laser drivers, trans-impedance amplifiers, and information heart interconnect options. Information facilities require interconnect options to attach large GPU, routers and switches. Marvell is nicely poised to seize the fast development in information heart interconnectivity market. Customized ASIC: The corporate develops system-on-a-chip options tailor-made to particular person prospects. As an illustration, hyperscalers, equivalent to Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOGL), can both buy commonplace GPU merchandise from Nvidia (NVDA), AMD (AMD), or Intel (INTC), or design their very own chips with Marvell’s ASIC expertise. In keeping with the administration, Marvell has been working with all of the hyperscalers to design their very own chips. As reported by Enterprise Insider, Marvell holds round 15% of market share in customized ASIC market. Marvell has collaborated on the manufacturing of Amazon’s 5nm Tranium chip and Google’s 5nm Axion ARM CPU chip. Moreover, Marvell has been advancing its 3nm expertise with these hyperscalers. As proven within the slide beneath, the full addressable marketplace for customized ASIC is anticipated to develop at a CAGR of 32% from FY23 to FY28, primarily pushed by fast AI and information heart development.

Marvell Investor Presentation

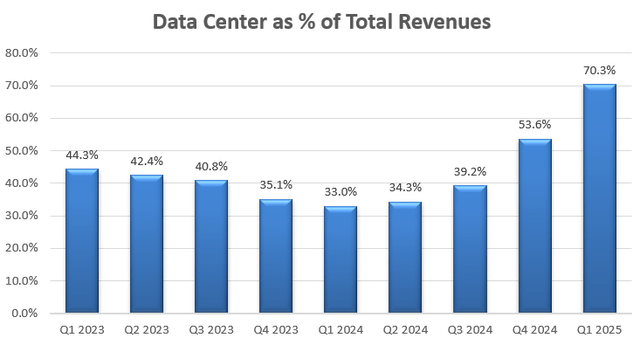

As AI is rising quickly presently, I anticipate Marvell’s optics and customized ASIC companies will develop at a quick tempo within the coming years. As depicted within the chart beneath, Marvell has rising its information heart enterprise considerably over the previous few quarters, contributing greater than 70% of whole revenues in Q1 FY25.

Marvell Quarterly Earnings

Weak point in Different Cyclical Enterprise

Marvell has 30% of income publicity in some cyclical companies together with enterprise networking, service infrastructure, client electronics, and automotive markets. In Q1 FY25, enterprise networking declined by 58% in income year-over-year, service infrastructure declined by 75%, client by 70%, and automotive/industrial markets by 13% in income.

Amid the excessive rates of interest macro surroundings, enterprise and telco firms are tightening their IT budgets. Moreover, CIOs must prioritize AI spendings inside their constrained IT budgets. These macro headwinds are inflicting momentary softness in enterprise/telco/automotive/industrial markets.

Over the long run, I proceed to anticipate these cyclical companies to develop, albeit at a slower tempo than the information heart enterprise. In October 2022, Marvell introduced its 100G/lane energetic electrical cables (“AECs”), enabling 400G, 800G and 1.6T server-to-switch and switch-to-switch options. Marvell’s ethernet controllers and community adapters may proceed to develop alongside enterprise ethernet market. Having stated that, these cyclical companies are more likely to proceed inflicting near-term headwinds.

Latest End result and FY25 Outlook

Marvel launched its Q1 FY25 earnings on Could 30, reporting 12.2% decline in income and 21.8% decline in web earnings, primarily brought on by notable declines in 5G, auto/industrial, enterprise networking and carriers companies, as mentioned earlier.

My greatest takeaway from the quarter is its robust development in information heart enterprise, which grew by 87% year-over-year and seven% sequentially. In the course of the earnings name, the administration expressed optimism in regards to the rising demand for AI purposes. The corporate has begun the preliminary ramp of customized AI compute silicon with hyperscalers. I anticipate the income contribution from customized ASIC will start in FY25.

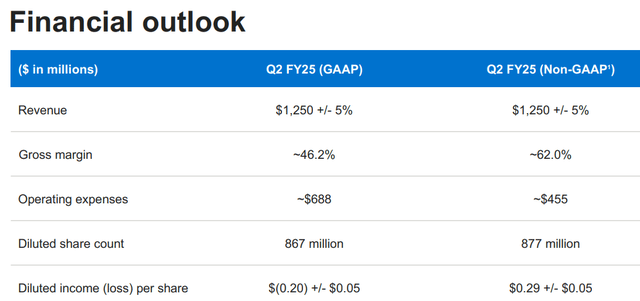

For Q2, the corporate anticipates its income to develop by 8% on a sequential foundation, primarily pushed by the robust development in information heart.

Marvell Investor Presentation

I’m contemplating the next elements for FY25:

Information Middle: Contemplating Marvell’s robust development in Q1, I anticipate the information heart enterprise will develop by 70% in FY25, pushed by each interconnectivity and customized ASIC companies. It’s price noting that Marvell solely generated $2.2 billion income in information heart in FY24; due to this fact, they’ve a small base to develop quickly for his or her interconnectivity and customized ASIC companies. Enterprise Networking and Service Infrastructure: The tip-markets are experiencing stock destocking presently, and it’s doable that the market will begin to normalize and get well within the second half of FY25. To be conservative, I forecast Marvell’s income will decline by 40% in FY25. Automotive semiconductor market is normalizing within the post-pandemic interval. S&P World forecasts that world new mild automobile gross sales in 2024 will see a 2.8% enhance year-over-year. Automotive is a small portion of Marvell’s enterprise, representing lower than 7% of whole income. I anticipate its income will develop by 3% in FY25.

Placing these items collectively, I anticipate Marvell will develop its income by 7.3% in FY25.

Valuation

To estimate the normalized income development past FY25, I’m contemplating the followings:

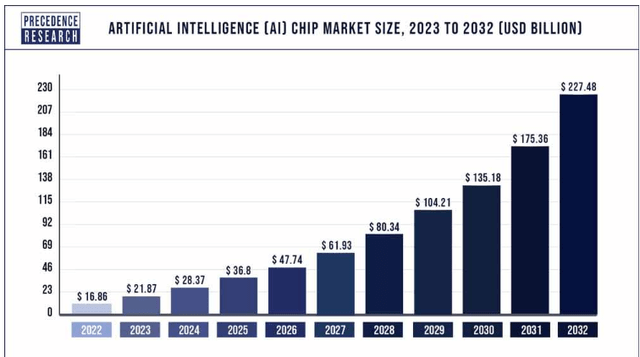

Information Middle: I’m optimistic about Marvell’s customized silicon and AI optical enterprise. Priority Analysis predicts that AI chip market will develop at a CAGR of 29.72% from 2023 to 2032. Contemplating the fast AI adoption by enterprise prospects and Hyperscalers, I anticipate Marvell’s information heart will develop at a price of 30%+ past FY25.

Priority Analysis

Enterprise Networking and 5G: the market has been rising at round mid-single digit up to now. Enterprise prospects have to put money into edge-networking sooner or later to deploy AI coaching and inference workloads. I anticipate Marvell will develop the enterprise by 5% yearly. Auto chips: in response to a number of auto chip firms, equivalent to ON Semiconductor (ON) and NXP Semiconductors (NXPI), the automotive semiconductor market is extra more likely to develop at a price of 12%+ sooner or later. As such, I assume Marvell can develop in keeping with the market development within the close to future.

As such, I assume Marvell will develop its income by 16% yearly past FY25.

In April 2021, Marvell accomplished the acquisition of Inphi for $10 billion, a number one high-speed information interconnect platform for information heart market. With hindsight, it was an amazing acquisition that has considerably contributed to Marvell’s present expertise developments within the information heart market.

As well as, Marvell acquired Innovium in August 2021 to speed up its networking options for cloud and edge information facilities. These acquisitions have resulted in big amortization prices for Marvell over the previous few years, incurring greater than $1 billion in annual amortization. In FY23, Marvell nonetheless had $4 billion in intangible property on its steadiness sheet, and I calculate that its acquisition amortization prices will begin to decline progressively within the close to future, contributing to margin enlargement alternatives for the corporate.

I estimate that Marvell will enhance its working bills by 13.5% yearly, resulting in a 360bps annual margin enlargement.

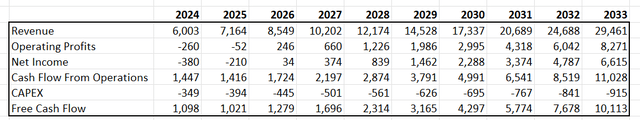

As well as, I assume the corporate will allocate 10% of whole income in direction of M&A, contributing 3.3% development to the topline. The abstract of the DCF mannequin is:

Marvell DCF – Creator’s Calculations

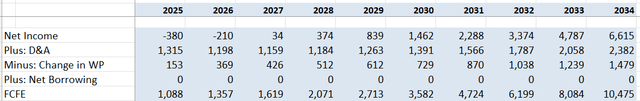

I calculate the free money move from fairness as follows:

Marvell FCFE- Creator’s Calculations

The price of fairness is calculated to be 17% assuming: threat free price 4.2%; beta 1.88; fairness threat premium 7%. Discounting all the longer term FCFE, the one-year value goal is calculated to be $80 per share.

Key Dangers

Cyclical Companies: Marvell is a semiconductor firm, operates in a extremely cyclical business. Within the close to time period, its 5G, enterprise networking, automotive and industrial companies are within the down cycle. Over the long run, I anticipate Marvell’s income development continues to be unstable, and traders have to be ready for the volatility every quarter.

China Publicity: China represents 43% of whole income, and Marvell is uncovered to the chance of any potential regulatory actions equivalent to tariffs, export controls and sanctions. The end result of the US presidential election may additionally affect Marvell’s publicity to export restrictions.

Rising Inventory-Primarily based Compensations: Marvell spent 11.1% of whole income in stock-based compensation (“SBC”) in FY24, an acceleration from 9.3% in FY23. As a semiconductor firm, Marvell’s SBC spendings are fairly excessive. The administration must correctly handle its spending in SBC going ahead.

Conclusion

I like Marvell’s main place in AI optics and customized ASIC markets, and their enterprise is kind of related , particularly with the rising calls for for information heart and AI computing. I’m initiating with a ‘Purchase’ score with a one-year value goal of $80 per share.

[ad_2]

Source link