[ad_1]

jetcityimage/iStock Editorial through Getty Photos

Elevator Pitch

Mazda Motor Company (OTCPK:MZDAY) [7261:JP] shares are assigned a Purchase funding ranking. In my January 2, 2024, initiation article, I wrote about MZDAY’s gross sales outlook for the China market and the corporate’s electrification transition.

My resolution is to revise my ranking for Mazda Motor from a Maintain beforehand to a Purchase now. I’ve turned bullish on Mazda Motor, after contemplating the corporate’s lately introduced organizational adjustments and its newest month-to-month gross sales numbers for the North American market.

The corporate’s shares may be purchased or bought on the Japanese fairness market and the Over-The-Counter market. The liquidity of Mazda Motor’s OTC shares is respectable with a imply each day buying and selling worth of round $800,000 (supply: S&P Capital IQ) for the final three months. As a comparability, the common each day buying and selling worth of Mazda Motor’s shares traded on the Tokyo Inventory Trade for the previous three months was roughly $50 million. US stockbrokers like Interactive Brokers with overseas markets entry will permit their shoppers to commerce in Mazda Motor’s Japanese shares.

Newest Organizational Modifications Will Take Impact In April

At its most up-to-date Q3 FY 2024 (October 1, 2023 to December 31, 2023) earnings name, the corporate pressured that “probably the most essential issues we’re doing at Mazda this yr is to arrange our group for future success.” In particular phrases, Mazda Motor highlighted at its newest quarterly outcomes briefing that it goals to make “enhancements to our group construction” to enhance “buyer focus and worker engagement.”

Within the earlier a part of this month, Mazda Motor revealed a press launch detailing its new “organizational and personnel adjustments” which is able to come into impact at first of April 2024.

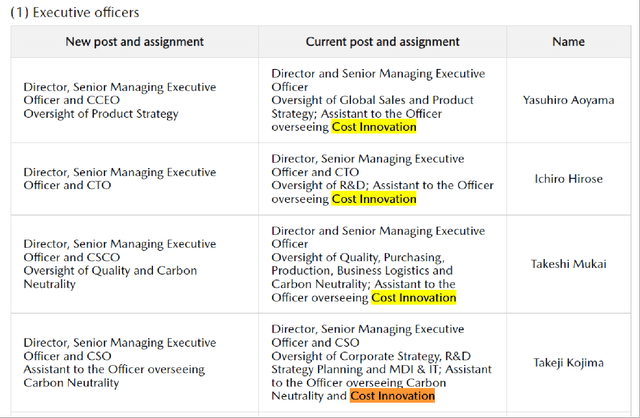

Modifications To The Roles Of Chosen Members Of Mazda Motor’s Administration Workforce

Mazda Motor’s March 11, 2024 Press Launch

As per the chart offered above, a couple of of Mazda Motor’s govt officers had been beforehand sporting a number of hats and had extra duties referring to “price innovation.” These embody administration group members who had been accountable for “gross sales and product”, and the corporate’s Chief Expertise Officer or CTO. At first of April this yr, these chosen govt officers will be capable of focus extra on their respective main roles and assist to drive Mazda Motor’s future income progress, product improvement, and expertise improvement.

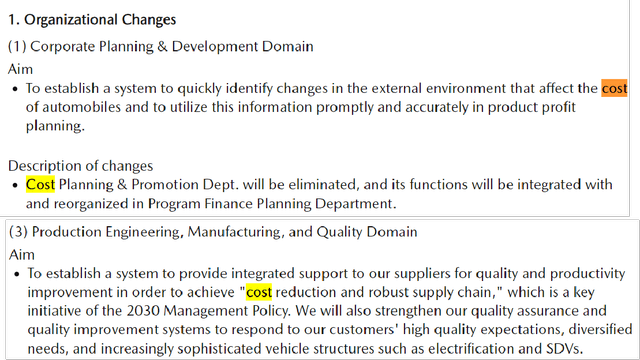

Mazda Motor’s Particular Organizational Modifications Relating To Prices

Mazda Motor’s March 11, 2024 Press Launch

Individually, Mazda Motor has plans to implement organizational adjustments to create new techniques monitoring developments which may influence “the price of vehicles” and aiding suppliers within the areas of “high quality and productiveness enchancment” as per its March 11 press launch. It’s cheap to imagine that the corporate is stepping up efforts to handle its bills in a extra proactive method.

Learn-Throughs From Third Quarter Outcomes

It’s related to investigate Mazda Motor’s proposed organizational adjustments in mild of the corporate’s most up-to-date quarterly monetary efficiency.

As per knowledge sourced from S&P Capital IQ, Mazda Motor’s income expanded barely by +1.9% QoQ in Q3 FY 2024 (YE March 31, 2024), which was marginally or +1.3% larger than the consensus prime line estimate. The corporate’s EBIT margin contracted from 8.1% in Q2 FY 2024 to five.7% for Q3 FY 2024, and that was about -0.8 proportion factors under the consensus working margin forecast.

Mazda Motor’s newest quarterly prime line efficiency was respectable, however the firm’s income progress did not shock the market in a giant means. As such, there’s room for MZDAY to commit extra time and vitality to new product improvement and gross sales administration to spice up its future income. This explains why Mazda Motor is narrowing the job scope and lowering the duties for its key administration group members just like the Chief Expertise Officer as talked about earlier.

Additionally, it makes loads of sense for Mazda Motor to put a higher emphasis on expense administration with its organizational adjustments. Mazda Motor’s precise Q3 FY 2024 EBIT margin fell in need of expectations, which is essentially attributable to a JPY17.6 billion improve in “fastened prices” pushed by larger “high quality prices for our immediate high quality actions” as indicated at its analyst briefing Q&A session. Which means it’s pertinent for the corporate to chop prices and enhance its profitability going ahead with the required organizational adjustments as detailed within the previous part.

Latest Gross sales Numbers For North American Market Had been Good

Mazda Motor’s gross sales quantity for the US market grew by a big +14% YoY within the third quarter of fiscal 2024, and the US market represented round 29% of the corporate’s most up-to-date quarterly gross sales quantity. The North American area, which incorporates Colombia, Mexico, Canada, and the US, accounted for an excellent bigger 41% of MZDAY’s Q3 FY 2024 gross sales quantity.

There are good causes to imagine that the US (and North America as a complete) will stay a vital progress marketplace for Mazda Motor within the close to time period. On the firm’s Q3 FY 2024 briefing Q&A session, Mazda Motor outlined its expectations that “whole demand within the U.S. is anticipated to rise” within the new yr, whereas its “progress in whole demand can be fairly restricted” for “different main markets.”

The corporate’s North American and US companies continues to exhibit constructive gross sales progress momentum based mostly on the newest out there knowledge. The corporate’s enterprise unit for North America (US, Colombia, Mexico, and Canada), in any other case generally known as “Mazda North American Operations”, noticed its gross sales quantity for January and February 2024 mixed develop by a powerful +17.5% YoY. The variety of models bought by Mazda North American Operations for February this yr was additionally a brand new historic excessive.

Key Threat Elements

Mazda Motor has sure danger components that traders ought to contemplate.

One danger issue is the precise influence of MZDAY’s proposed organizational adjustments is not so good as what traders would have hoped for. There are potential advantages related to the organizational adjustments talked about earlier on this article like a higher give attention to product improvement and a discount in prices. However execution is vital, and there’s the likelihood that the corporate’s organizational adjustments do not ship the specified outcomes.

One other danger issue is that US automotive demand seems to be weaker than what the market and the corporate anticipate. As indicated above, Mazda Motor views the US market as an essential progress engine. As such, it’s cheap to imagine that MZDAY’s future monetary efficiency for the corporate as a complete would possibly fall in need of expectations, if its US gross sales weaken going ahead.

Concluding Ideas

Mazda Motor is now buying and selling at undemanding consensus subsequent twelve months’ price-to-sales, EV/EBITDA, and EV/EBIT multiples of 0.22 instances, 2.5 instances, and three.4 instances (supply: S&P Capital IQ), respectively. I believe that MZDAY’s future monetary efficiency can shock on the upside and drive a constructive re-rating of the inventory’s valuations, contemplating its newest organizational adjustments and the robust year-to-date gross sales for its North American enterprise.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link