[ad_1]

Robert Approach

Meta Platforms (NASDAQ:META) submitted a greater than anticipated quarterly earnings sheet for Q2’24 which mirrored continuous upside momentum within the firm’s core promoting enterprise. Meta is benefiting from robust development in its promoting phase, pushed by development in advert pricing, and the social media firm delivered, regardless of heavier investments into AI merchandise, very strong free money stream. Meta generated free money stream margins of near 30% in Q2 and issued a robust income outlook for the third quarter. I contemplate Meta, along with Alphabet (GOOG), to be essentially the most attractively-priced investments within the large-cap tech group. Meta is buying and selling at a 21% low cost to the trade group common P/E which makes the agency’s shares a discount!

Earlier ranking

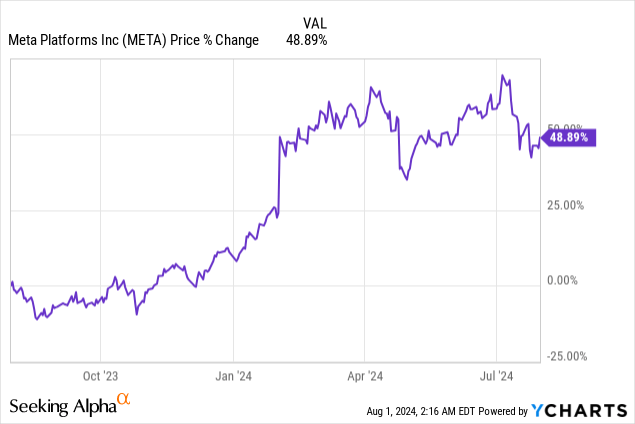

I upgraded shares of Meta from maintain to purchase in my final work on the social media firm — Why I Am Aggressively Shopping for The Drop — as a result of Meta benefited from a rebound within the digital promoting enterprise, but shares cratered after Q2’24 earnings. Meta continued to ship robust promoting leads to the second-quarter, primarily due to robust pricing development for the corporate’s digital advertisements. Regardless of a pointy upside revaluation within the final 12 months, shares of Meta nonetheless characterize very deep earnings worth.

Meta beat earnings, high line development aided by AI spending, robust free money stream

The social media firm beat estimates on each the highest and the underside line for its second fiscal quarter: Meta reported GAAP EPS of $5.16 per-share in Q2’24 which beat the consensus prediction by $0.40 per-share. When it comes to revenues, the platform pulled in $39.1B, which beat the typical Wall Road estimate by $760M.

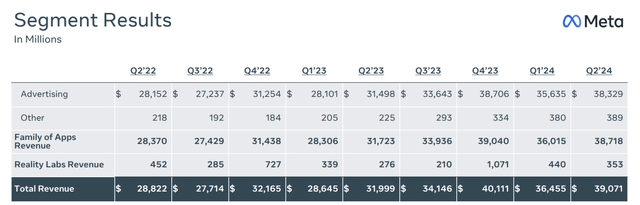

Meta’s earnings beat was mainly pushed by Meta Platforms’ resilient digital promoting enterprise and a robust high line efficiency right here. Promoting generated $38.3B in revenues, displaying a year-over-year development price of twenty-two%. Promoting income represented 98% of Meta’s income combine within the second fiscal quarter.

Meta Platforms

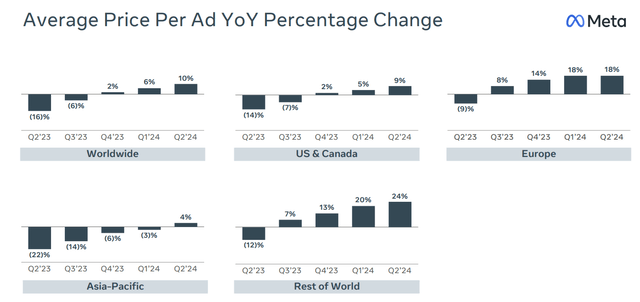

Extra particularly, favorable promoting pricing traits are driving Meta’s important high line enlargement. On a consolidated degree, advert costs went up by 10% in Q2 resulting from robust digital advert demand throughout Meta’s apps and platforms. Within the U.S. & Canada, by far the 2 most essential markets for Meta, common advert costs elevated 9% within the second-quarter whereas Europe’s advertisements might be priced 18% greater than within the year-earlier interval.

What I like right here is that Meta’s advert value development is accelerating within the profitable U.S. & Canada geography. The outlook right here can also be favorable as Meta is investing closely into its AI capabilities and stated that it expects its AI assistant, for example, to be essentially the most used AI assistant on this planet by year-end.

Meta Platforms

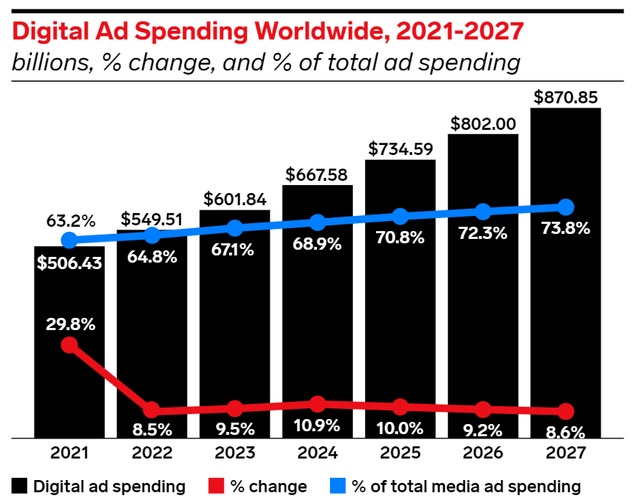

This advert pricing development must be seen within the context of an increasing digital promoting market the place just a few massive gamers are basically dominating the whole market. The largest corporations listed here are clearly Meta and Google, and each corporations are primed to learn from a secular shift of promoting {dollars} to digital advertising channels. In line with eMarketer, digital advert spending is ready for continuous development within the subsequent a number of years, with the digital advert spending share set to extend from 67% in FY 2023 to 74% by FY 2027. Meta and Google are in prime positions to seize this development, though I consider that Meta may gain advantage greater than Google given its dependence on promoting revenues.

eMarketer

Meta Platforms continued to crush it with its free money stream efficiency, and that is regardless of an uptick in CapEx resulting from investments in new AI merchandise. The social media agency achieved $10.9B in free money stream within the second fiscal quarter on revenues of $39.1B. The free money stream margin, the only most essential determine to find out platform profitability, for my part, got here out at 28%.

Within the final 12 months, Meta Platforms generated a large $37.7B in free money stream at a margin of 32.4%. Nonetheless, the social media firm’s free money stream margin dropped 19% 12 months over 12 months, mainly as a result of Meta Platforms is ramping up its AI spending, which is mirrored within the following chart as greater CapEx spending (purchases of property & tools).

As you too can see under, Meta’s CapEx has gone up 33% 12 months over 12 months in Q2, and has grown about 50% sooner than revenues. This acceleration is the results of Meta’s aggressive stance on AI spending. So far as free money flows are involved, buyers should anticipate this AI spend to weigh on free money stream margins going ahead. What will likely be attention-grabbing to see within the coming quarters is to what extent AI spending is driving new free money flows for the social media firm.

in mil $

Q2’23

Q3’23

This fall’23

Q1’24

Q2’24

Y/Y Development

Revenues

$31,999

$34,146

$40,111

$36,455

$39,071

22.1%

Working Money Circulation

$17,309

$20,402

$19,404

$19,246

$19,370

11.9%

Purchases of Property/Tools

($6,134)

($6,496)

($7,592)

($6,400)

($8,173)

33.2%

Funds on Finance Leases

($220)

($267)

($307)

($315)

($299)

35.9%

Free Money Circulation

$10,955

$13,639

$11,505

$12,531

$10,898

-0.5%

Free Money Circulation Margin

34.2%

39.9%

28.7%

34.4%

27.9%

-18.5%

Click on to enlarge

(Supply: Writer)

I do see Meta doubtlessly doubling down on its inventory buybacks, nonetheless, which is one thing that would present an offset to elevated AI spending. Earlier this 12 months, Meta licensed a $50B inventory buyback, which interprets to roughly 5 quarters value of free money stream. Though Meta’s free money stream has been about flat 12 months over 12 months in Q2’24, I anticipate Meta to considerably enhance its buyback exercise within the coming years as a method to return extra free money stream to shareholders. From a capital return viewpoint, Meta’s Q2 demonstrated that the corporate will stay a extremely engaging large-cap funding going ahead.

Meta is a steal and considered one of my two highest conviction concepts within the large-cap tech market

Meta’s shares climbed 7% after the social media firm submitted its Q2’24 earnings sheet, primarily due to the social media firm’s robust income outlook for the third fiscal quarter. Meta guided for $38.5-$41.0B in income for Q3, which might translate to a 16% Y/Y development price, indicating that the corporate continues to anticipate advert demand energy for its core promoting enterprise.

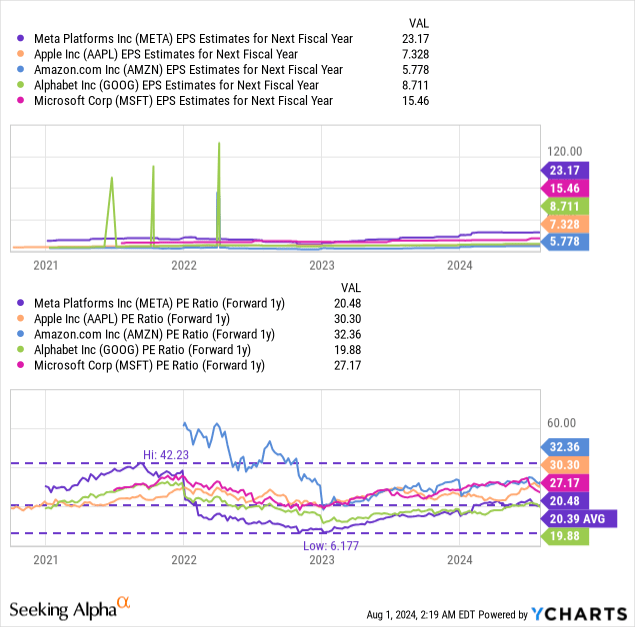

Though shares of Meta have elevated a large 49% within the final 12 months, the corporate’s earnings worth may be very deep, for my part, and Meta at the moment represents probably the greatest values within the large-cap tech group, subsequent to Google. Meta is at the moment valued at a price-to-earnings ratio of 20.5X, which means an earnings yield of 5%. Google, which is the most affordable tech firm within the trade group, is buying and selling at P/E ratio of 19.9X. The trade group right here contains Apple (AAPL), Amazon (AMZN), Alphabet and Microsoft (MSFT).

The trade group common P/E ratio is about 26.0X, and I do not see a particular purpose why Meta Platforms ought to commerce at a reduction to the trade group common valuation ratio contemplating that its high line is rising quickly, and that Meta is excelling by way of free money stream technology. Favorable pricing traits in digital advertisements additionally help an funding in Meta, for my part.

If Meta traded as much as the trade group common P/E ratio of 26.0X — it at the moment trades at a 21% low cost to the trade common P/E — shares of the social media firm might be valued at ~$600. Even then, nonetheless, Meta should be undervalued if the corporate’s investments in AI are resulting in a pay-off by way of accelerating high line development or greater free money stream margins. A $600 inventory value goal for Meta implies 18% upside revaluation potential and with solely Google being cheaper than Meta proper now, I contemplate Meta my second-highest conviction wager within the large-cap tech market.

My highest conviction thought within the sector is Google, which is crushing it in Cloud and whose valuation may be very arduous to know given its strong development momentum.

Dangers with Meta

Whereas Meta is a particularly free money flow-profitable firm and has made a dedication to return extra cash to shareholders, I don’t like that META generates 98% of its revenues from the digital promoting market. Meta just isn’t diversified in any respect, which exposes the corporate to the danger of a big valuation draw-down in case advertisers had been to drag again from paying for advertisements on Meta’s apps. Since advert pricing energy is particularly chargeable for the corporate’s robust income/FCF efficiency proper now, shares would probably undergo important draw back in such an occasion.

As a result of Meta can also be set to proceed to spend extra money on AI investments, as are different corporations like Google, there are two particular dangers right here going ahead: 1) AI-related CapEx are set to proceed to weigh on FCF margins, and a couple of) AI spend might not produce the required pay-off so as to justify elevated CapEx for an extended time period. In different phrases, there’s a danger that AI investments, as earlier Metaverse investments, cannot be justified based mostly off of the earnings/FCF they produce.

Last ideas

Meta delivered a sound earnings card for the second fiscal quarter on Wednesday that confirmed continued energy in digital promoting, favorable pricing traits in digital advertisements, particularly within the U.S. & Canada market the place pricing development is accelerating, and large free money stream… regardless of being negatively affected by a ramp in AI-related spending. The outlook for Q3’24 was very favorable and lowered uncertainty about future advert spend on Meta’s social media apps and platforms. Most significantly, Meta represents one of many two greatest values within the large-cap tech phase, for my part, based mostly on development prospects and valuation, and it’s only outshone by Google. Given Meta’s very affordable valuation based mostly off of earnings, the social media firm is considered one of my high two excessive conviction bets available in the market proper now!

[ad_2]

Source link