[ad_1]

Shares of Michael Saylor‘s MicroStrategy Inc. MSTR rose as a lot as 25.73% to hit a report closing excessive at $340 apiece, as in comparison with a 0.05% decline within the Nasdaq 100 Index Monday. The shares rose by 5.31% to $358.06 per share through the after-hours commerce the identical day.

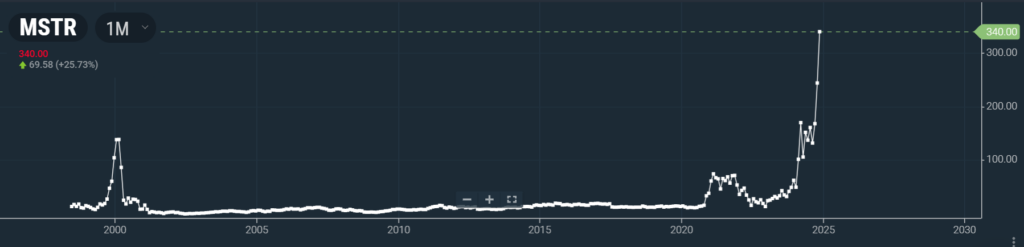

The surge marked the best stage for the shares on Monday because the dot-com bubble in March 2000.

What Occurred: The rally in MicroStrategy shares was fueled by the rise in Bitcoin BTC/USD, an important asset held by the latter in its portfolio. MicroStrategy is a enterprise intelligence, cellular software program, and cloud-based providers firm, however greater than the rest, it serves as a proxy for Bitcoin.

On the time of writing, BTC was buying and selling at $89,768.

The corporate calls itself the world’s first “Bitcoin Treasury firm.” Volatility in MicroStrategy’s inventory because of its Bitcoin place permits the corporate to borrow and lift capital at a low price in an effort to flip round and purchase extra Bitcoin.

MicroStrategy introduced that it acquired roughly 27,200 BTC between Oct. 31 and Nov. 10 for roughly $2.03 billion in money. The corporate bought the bitcoin at a mean price of $74,463 per coin and the cryptocurrency hit an all-time excessive at $89,560.95 on Monday. As of Nov. 11, MicroStrategy held a complete of 252,220 bitcoins, bought at a mean worth of $39,266, in line with Coingecko. Consequently, MicroStrategy holds about 1.201% of the full Bitcoin provide, with its present holding priced at round $22.64 billion.

The highest 5 largest company holders of Bitcoin, following MicroStrategy, embody Marathon Digital Holdings MARA, Galaxy Digital Holdings GLXY, Tesla Inc. TSLA and Coinbase World Inc. COIN.

Additionally Learn: What’s Going On With MicroStrategy Inventory Monday?

Why It Issues: The dot-com bubble was a inventory market bubble that ballooned through the late Nineties and peaked on Friday, March 10, 2000. It was fueled by the rise in investments in Web-based firms.

Fairness markets skilled exponential progress throughout this era, exemplified by the technology-dominated Nasdaq index, which surged from underneath 1,000 to over 5,000 between 1995 and 2000. This era of exuberance was adopted by a market correction, because the bubble burst between 2001 and 2002, ushering in a bear market.

MicroStrategy shares had hit $313 apiece on March 10, 2000, as per Benzinga Professional information, which was transcended by Monday’s rally.

See Additionally: Kiyosaki Goals To Personal 100 Bitcoins By 2025: ‘I Want Bitcoin Was Again To $10 A Coin, However Wishing Has By no means Made Poor Folks Richer’

Worth Motion: MicroStrategy shares have risen by 396.21% on a year-to-date foundation. The whole traded quantity stood at 37.315 million shares, in line with Nasdaq. Benzinga Professional information instructed the relative energy index was at 81.31, implying that the inventory could also be overbought.

4 analysts monitoring the corporate keep a ‘purchase’ ranking of the inventory, in line with Nasdaq information. The three-month common of the 12-month analyst worth targets implies a share worth of $302.75, which has already been surpassed by the corporate.

As per Benzinga Professional, the corporate’s strategic monetary maneuvers, notably its use of extra money to accumulate extra bitcoins, have boosted its bitcoin-per-share metric, thereby enhancing shareholder worth. Moreover, the potential growth of market valuation past the normal 3-4x ahead income, coupled with an accelerating cloud enterprise, innovation by way of AI initiatives, and forthcoming favorable accounting adjustments for digital belongings, helps a optimistic outlook for MicroStrategy’s monetary future.

Picture by way of Flickr

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

[ad_2]

Source link