[ad_1]

Tony Anderson

Abstract

Following my protection on The Middleby Company (NASDAQ:MIDD) in Jun’24, wherein I really useful a promote ranking resulting from my expectation that MIDD is more likely to miss consensus FY24 EBITDA estimates, this put up is to offer an replace on my ideas on the enterprise and inventory. I’m now giving MIDD a maintain ranking (improve from promote) as a result of the 2Q24 outcomes and up to date macro developments have reshaped my outlook for the enterprise. I now see potential for MIDD’s Industrial Foodservice [CF] phase to see robust natural development acceleration, which can drive a robust a number of re-rating upwards. Nonetheless, it’s nonetheless too early to find out if so. As such, I’m staying on the sidelines for now.

Funding thesis

On 01-08-2024, MIDD launched its 2Q24 earnings, which noticed complete gross sales of $992 million, supported by ~$619 million in CF, ~$193 million in Residential Kitchen [RK], and ~$180 million in Meals Processing [FP]. The segments noticed -4%, -6.2%, and -5% declines on a reported foundation and -3.9%, -6.7%, and -5.7% organically, respectively. Declining income efficiency drove the adj EBITDA margin down 22% to 21.8%, however the CF EBITDA margin held up properly, increasing by 30bps y/y. In consequence, complete firm adj EBITDA noticed $216 million, and this led to adj EPS declining from $2.48 to $2.39, a ~4% decline.

The incremental information shared within the 2Q24 report and the macro modifications have brought on me to alter my views on MIDD’s FY24 outlook. Recall in my earlier put up, my largest concern was that the CF phase (the most important phase for MIDD) is unlikely to see order development enchancment resulting from two causes: (1) inflation remained sticky and (2) rates of interest remained excessive. Each of those considerations appear to be going away as the newest CPI information exhibits inflation coming down properly (now under 3%), which I now count on to go additional down contemplating shoppers are pulling again on spending and retailers are chopping costs. This bodes properly for the fed to essentially lower charges this time round, which does appear to be they may, given the message despatched.

As well as, the underlying demand atmosphere seems to have recovered a lot quicker than I anticipated, as MIDD noticed 9% sequential order development in 2Q24 and that order traits have normalized (per administration). Importantly, the stock oversupply state of affairs is within the rear mirrors, whereby orders are actually extra carefully aligned with demand. If I’m proper concerning the path that the macro economic system is heading in (an upcycle), demand will begin to get better, particularly with decrease rates of interest that decrease the price of financing new restaurant openings.

The opposite situation that I had considerations about was the worth improve (took impact in June). Surprisingly, this didn’t impression demand (orders nonetheless grew 9% sequentially), and I believe this displays positively on the demand state of affairs. Additionally, administration famous that the aggressive promotional panorama is finished and dusted, now again to a normalized state of affairs vs. pre-COVID ranges. This means to me that the oversupply state of affairs has gotten higher (no must aggressively implement promotions to clear stock) and demand has improved (no want for aggressive promotions to seize demand).

That stated, these developments don’t imply that MIDD is in a development cycle already. I might say MIDD remains to be within the transition section, the place extra convincing information must be seen earlier than traders will be assured concerning the development outlook. Particularly, order development has but to be translated into income development (orders grew 9% sequentially, however CF income solely grew 5% sequentially). Clients are nonetheless pushing out their new retailer opening timeline, which I believe goes to remain this fashion till they acquire confidence within the Fed’s determination on charges. A number one indicator I’m monitoring to know whether or not the restaurant trade is again in development mode is the Restaurant Efficiency Index by the Nationwide Restaurant Affiliation. Till this information turns above 100 (indicating the trade is in growth mode), I’ll stay in statement mode for MIDD’s CF phase.

NRA

The RK phase is one other phase that I believe deserves monitoring (I beforehand solely targeted on the CF phase as a result of it was the most important) given the macro modifications. Whereas RK noticed an natural gross sales decline of 670 bps in 2Q24, which drove the adj. EBITDA margin down by 470 bps y/y, I believe 2H24 goes to do a lot better than 1H24. The primary driver for this phase is housing demand, which is impacted by a number of components like housing begins, present dwelling inventories, and mortgage charges. Positively, in contrast to in 1H24, the event and outlook of all these have improved.

Housing begins have continued to enhance because the trough noticed in Could. Current dwelling inventories have improved because the begin of the 12 months. Mortgage charges have come down, which ought to proceed to go down because the fed cuts price, and this could trigger the above two factors to additional enhance (decrease charges drive housing demand, which drives housing begins; decrease charges trigger extra present owners to listing their properties, which improves the housing provide state of affairs).

There appear to be early indicators of those reflecting in MIDD books, because the phase noticed its strongest order quarter over the previous 24 months (orders have been up 14% sequentially). Suppose this phase improves as I count on, it could actually assist MIDD in assembly FY24 EBITDA estimates.

Valuation

Personal calculation

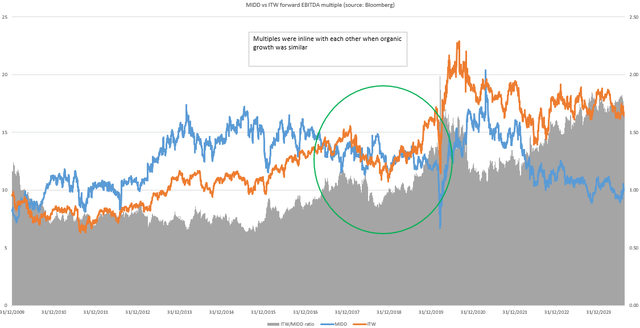

My view of MIDD has gotten higher since June due to the order efficiency and macro developments, and this has impacted the best way I view MIDD’s valuation in the present day. A key purpose why I believe MIDD has continued to commerce under Illinois Instrument Works (ITW) is due to the decrease natural development thus far. Nonetheless, if MIDD’s CF phase begins to print constructive natural development enchancment, supported by orders translating into precise income and a greater demand atmosphere, this valuation hole may shut.

Traditionally, pre-covid, MIDD trades at a premium to ITW at round 1.1x. The state of affairs flipped when MIDD began to report decrease natural development (consult with my earlier put up for comparability). Suppose each firms begin to report comparable natural development energy (this occurred in 2018). Each firms ought to commerce consistent with one another. Therefore, if MIDD’s CF phase natural development reaccelerates to ITW’s degree (ITW reported 2.5% natural development for its meals tools phase in 2Q24), MIDD might even see a robust rerating to ITW’s a number of of 17x ahead EBITDA, which can symbolize a large upside.

Total, my present view is that MIDD’s upside state of affairs hinges on its CF development accelerating to ITW’s degree. I acknowledge the potential, and the present macro setup is leaning towards favorable for MIDD. Nonetheless, I believe it’s too early to conclude that it will occur within the close to time period; therefore, I’m giving it a maintain ranking.

Conclusion

In conclusion, my ranking for MIDD is now a maintain ranking as current efficiency and the evolving macroeconomic panorama have reshaped my funding thesis. I’m not upgrading to a purchase as a result of the present information remains to be inadequate to persuade me that MIDD goes to see robust development acceleration for its CF phase, which I consider is a key factor to multiples re-rating upwards. For now, I believe the perfect plan of action is to proceed monitoring key metrics, reminiscent of order development and the broader restaurant trade efficiency.

[ad_2]

Source link