[ad_1]

Just_Super

MongoDB’s (NASDAQ:MDB) Q2 outcomes had been strong, contributing to a pointy rebound within the firm’s share worth. Ahead steerage and fairly upbeat administration commentary could have been extra liable for the share worth motion although.

After smooth Q1 outcomes, sentiment in direction of MongoDB had grow to be overly bearish, with traders starting to query the corporate’s aggressive positioning. MongoDB’s potential to proceed touchdown clients and increasing inside present clients at a wholesome tempo ought to assist to allay a few of these fears although. As ought to MongoDB’s commentary round its Search product gaining traction.

I beforehand prompt that after the Q1 share worth drop, MongoDB was positioned to generate pretty sturdy returns for traders over an extended sufficient timeframe. I felt that the corporate might be in for an prolonged interval of weak point although, due largely to the weak demand atmosphere and MongoDB’s massive investments in future development, which proceed to weigh on margins. Whereas MongoDB’s Q2 outcomes had been strong, I anticipate pretty flat development and margins within the near-term, somewhat than a significant enchancment in efficiency.

Market Circumstances

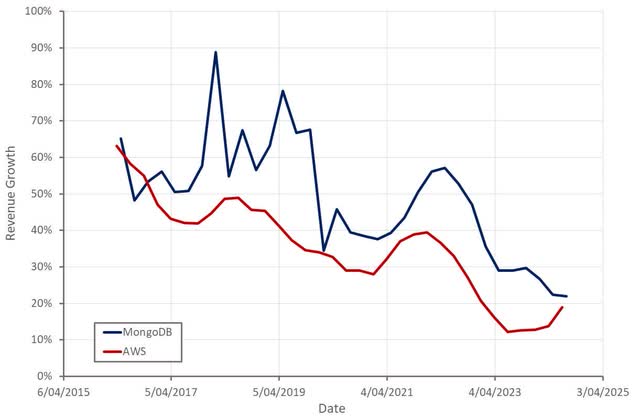

MongoDB witnessed a broad-based consumption slowdown within the first quarter of FY2025, which carried over into the second quarter. Cloud spend seems to be selecting up once more, however this will primarily be the results of AI, limiting its broader implications. MongoDB’s development has intently adopted AWS’ previously however I believe there’s a risk that the expansion price of the 2 companies diverges going ahead because of the affect of AI.

The macro atmosphere will not be impacting MongoDB’s potential to draw new clients although. In consequence, I anticipate the corporate’s development to rebound sharply when macro situations enhance. Whereas decrease rates of interest might be a catalyst for improved demand, this have to be weighed towards the danger of a recession.

Determine 1: MongoDB and AWS Income Progress (supply: Created by writer utilizing knowledge from firm studies)

Whereas there proceed to be massive expectations round AI, it is not a significant tailwind for MongoDB but. Firms are usually directing funding towards {hardware} and creating basis fashions. As well as, many firms that wish to implement AI are nonetheless experimenting with the expertise. Elastic (ESTC) has prompt that initiatives are starting to progress into manufacturing, though MongoDB hasn’t seen numerous inference workloads in manufacturing.

Generative AI ought to pressure firms to modernize infrastructure, which is the true alternative for MongoDB. AI also can speed up this shift by reducing the associated fee and time of modernizing legacy purposes. Whereas MongoDB has promising initiatives on this space, it’s too early to be a development driver.

MongoDB Enterprise Updates

MongoDB believes it’s the best knowledge layer for AI apps as it could course of queries towards complicated knowledge buildings rapidly. It additionally negates the necessity for a number of database methods, lowering complexity. This text is a pleasant overview of generative AIs distinctive calls for and why MongoDB is nicely positioned versus one thing like PostrgreSQL. MongoDB additionally believes that’s positioned to profit because the latency of LLMs declines and real-time knowledge turns into extra vital.

In help of driving adoption of MongoDB in AI use circumstances, the corporate has launched the MongoDB AI Purposes Program. This program presents clients a variety of assets (reference architectures, end-to-end tech stack, skilled companies, unified help system) to assist them implement AI utilizing MongoDB.

MongoDB has additionally been piloting packages with clients to shift legacy purposes onto its database. The migration from a relational database to a doc database is comparatively simple. It’s rewriting purposes that’s tough. Generative AI has the potential to make this a far much less labor-intensive course of although. MongoDB has seen a dramatic discount within the time and value of rewriting software code and producing take a look at suites that be sure that new code performs the identical because the previous code. It should take time for this program to generate significant income although.

MongoDB is seeing strong momentum in search, which validates the corporate’s perception that its platform can handle all use circumstances. Supply Hero is utilizing MongoDB Atlas Vector Search and one of many world’s largest gaming firms shifted its content material moderation platform to Atlas and Atlas Search. This firm is utilizing Atlas Search Nodes for workload isolation and excessive efficiency. Stream Processing was made usually obtainable in Could and there has reportedly been sturdy curiosity.

Monetary Evaluation

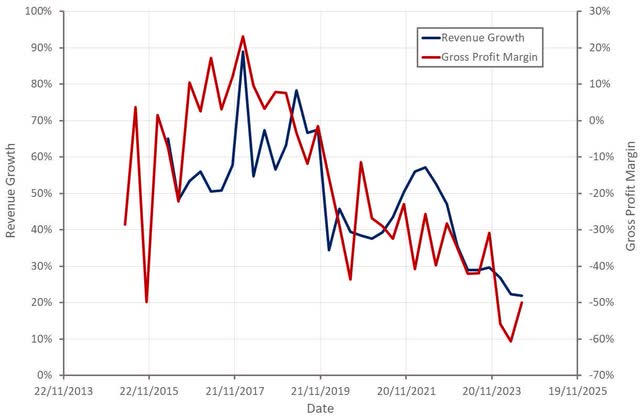

MongoDB generated 478 million USD income within the second quarter, a rise of 13% YoY. Whereas this seems weak, a lot of this is because of a tough comparable interval within the prior yr because of the accounting remedy of multi-year licensing. Adjusting for this development extra like 22%. Atlas income was solely up 27% YoY, though consumption development was higher than anticipated within the second quarter.

MongoDB expects 493-497 million USD income within the third quarter, a 14% enhance YoY. For the total monetary yr, the corporate is guiding to 1.92-1.93 million USD income, additionally representing a 14% development price. MongoDB faces more and more tough comparable intervals because the yr progresses as a consequence of unused Atlas commitments within the prior yr.

Determine 2: MongoDB Income Progress and Service Gross Revenue Margin (supply: Created by writer utilizing knowledge from MongoDB)

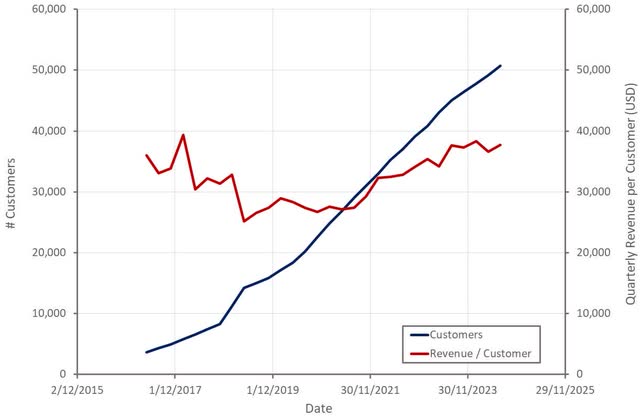

MongoDB had 50,700 complete clients on the finish of the second quarter, a rise of 13% YoY. There have been 2,189 clients with greater than 100,000 USD ARR, a rise of 18% YoY.

MongoDB’s retention price remained sturdy within the second quarter. The corporate’s web ARR growth price was 119%. Whereas MongoDB has been making an attempt to focus gross sales on buying greater high quality workloads, it’s too early to evaluate the affect of this.

Determine 3: MongoDB Clients (supply: Created by writer utilizing knowledge from MongoDB)

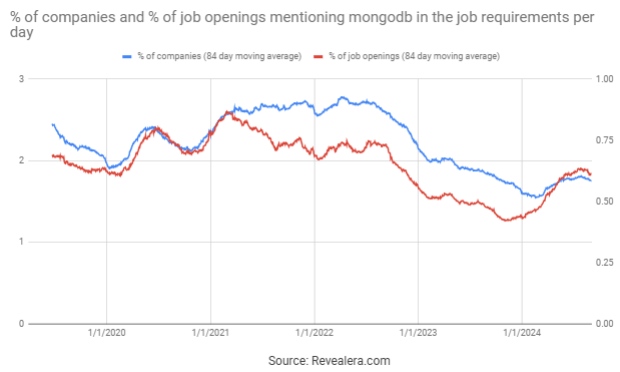

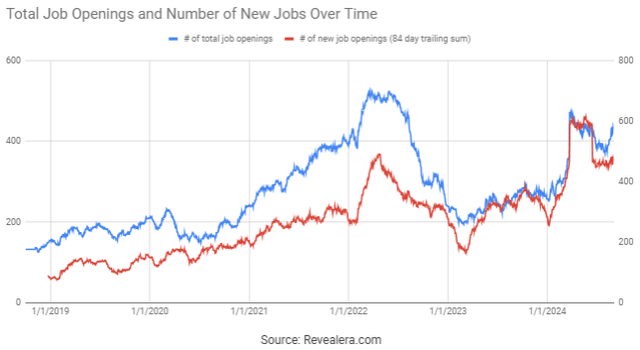

The variety of job openings mentioning MongoDB within the job necessities rebounded modestly in early 2024 however has been pretty flat in latest months. MongoDB continues to draw new clients at a reasonably wholesome tempo, supporting the notion that demand for its software program stays strong.

Determine 4: Job Openings Mentioning MongoDB within the Job Necessities (supply: Revealera.com)

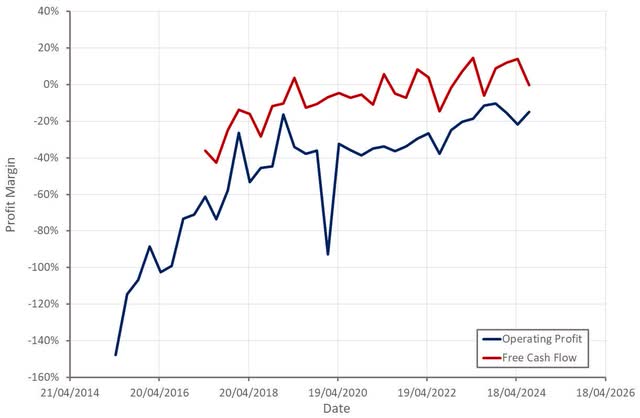

MongoDB’s gross margin declined YoY as a consequence of a decrease mixture of excessive margin licensing income. Whereas Atlas gross margins are nonetheless decrease, the delta is shrinking. Providers margins are additionally a drag in the intervening time, though companies at the moment are a comparatively small contributor to income.

MongoDB’s non-GAAP working margin was 11% in Q2. The quarter benefitted from the timing of selling and sure different spend although. That is anticipated to hit within the second half, which shall be a drag on margins.

Money flows may also possible come underneath stress for numerous causes. MongoDB began paying some cloud prices upfront in Q2 in return for a reduction on pricing. That is anticipated to have a 20 million USD per quarter damaging affect on money flows within the second half. MongoDB can be investing 20-25 million USD within the third quarter to accumulate IPv4 addresses which is able to scale back cloud infrastructure prices sooner or later.

Determine 5: MongoDB Margins (supply: Created by writer utilizing knowledge from MongoDB)

The variety of MongoDB job openings continues to extend, which means that the corporate is not going through any issues exterior of non permanent demand weak point. I do not anticipate a significant enhance in development within the brief run although, that means hiring is prone to weigh on margins going ahead.

Determine 6: MongoDB Job Openings (supply: Revealera.com)

Conclusion

Whereas MongoDB’s Q2 outcomes had been strong, I’m not anticipating a significant reacceleration of the enterprise within the brief run. The demand atmosphere stays smooth, and it’ll take time for MongoDB to see any actual profit from generative AI. MongoDB additionally continues to speculate aggressively in future development, which is able to possible cap near-term profitability enhancements.

Whereas MongoDB’s share worth is up considerably from the lows of 2024, its valuation stays enticing given the corporate’s long-term potential. MongoDB nonetheless has the potential to develop in extra of 30% yearly in a stronger demand atmosphere and may generate excessive margins because it matures. I’m pretty impartial on the inventory in the intervening time although because of the chance of weakening financial situations additional undermining consumption development.

Determine 7: MongoDB EV/S A number of (supply: Looking for Alpha)

[ad_2]

Source link