[ad_1]

In CBRE’s Funding Intentions Survey, 97 % of respondents, lots of whom are the world’s largest institutional actual property traders, stated they plan to extend capital deployment to knowledge facilities. The survey authors famous that knowledge middle transaction quantity for all of North American totaled $4.8 billion in 2023, a 29 % YOY improve.

Funding in knowledge facilities is anticipated to extend considerably over the subsequent few years. Thirty-eight % of respondents had lower than 5 % of their capital belongings invested in knowledge facilities, however 82 % of them count on to extend funding on this sector over the subsequent 5 years.

READ ALSO: Are Microgrids the Reply to CRE’s Energy Battle?

At the moment, investor urge for food is strongest within the high-yield, opportunistic and value-add actual property segments with stable market fundamentals, however 80 % of CBRE respondents indicated a desire for this asset kind, up from 65 % in a 2023 survey. Excessive inflation and rates of interest have decreased investor curiosity in core belongings, down from 50 % in 2021 to 30 % this yr. Equally, core-plus asset curiosity amongst respondents dropped from 58 % in 2021 to 34 % in 2024, with investor curiosity broadly shifting to turnkey choices from powered shell for the second consecutive yr.

Trying ahead, 31 % of respondents consider one of the best knowledge middle alternatives over the subsequent two years shall be in build-to-suits for the hyperscale knowledge middle market—no change from final yr’s survey however a big improve over 2022 and 2021, when 22 % and 17 %, respectively, expressed this desire.

The previous few actual property cycles demonstrated that demand for knowledge facilities is sort of recession-proof, and lots of purposes, significantly these with high-credit tenants, reminiscent of massive enterprise non-public deployments, are usually sticky,” stated Dallas-based Todd Smith, who leads the Know-how Properties Group at Transwestern. “There may be confidence that regardless of any ebbs and flows on the demand on this space which will happen, demand and subsequent funding shall be buoyed by continued macro wants for ever- rising knowledge,” he added.

“The size of the capital required to fulfill demand is permitting each current and new traders to help engaging alternatives, that are particularly interesting given knowledge facilities’ positioning because the spine of the broader AI-driven digital revolution that’s creating long-term, secular tailwinds,” added New York-based Brent Mayo, Newmark’s government managing director of Knowledge Middle and Digital Infrastructure Capital Markets.

He famous that constructing prices will proceed rise, with new amenities designed to help bigger and denser workloads with tougher cooling necessities and infrastructure wants. “Deeper swimming pools of capital will should be fashioned to help the trade,” he added, noting the dimensions of improvement alternatives and sizing of in-place, stabilized portfolios would require an unprecedented quantity of capital to help current operators, builders, and end-users.

Fabulous fundamentals

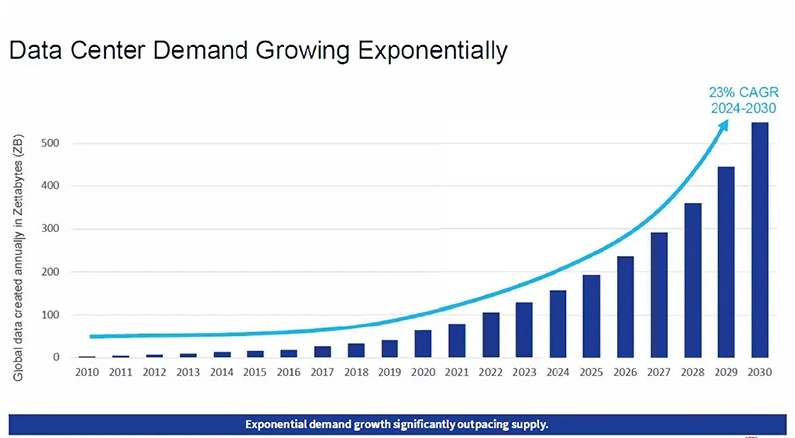

There’s good purpose for the info middle fever. Demand for knowledge middle capability is rising exponentially, outpacing provide on account of will increase in distant and hybrid work, cloud computing, synthetic intelligence workloads, and general use of digital units. Primarily based on present demand, demand for knowledge middle capability globally is forecast at 23 % CAGR in line with JLL (See under).

Albers famous that business actual property funds with knowledge facilities amongst their targets have raised $48 billion during the last three years, and main mergers and acquisition and take-private exercise on this house totaled virtually $75 billion over the identical interval, with a lot of this funding coming from private-equity sources or REITs.

This various actual property sector, a mix of actual property, know-how and infrastructure, has skilled surging demand and file absorption, producing robust improvement yields and general returns. Total annual returns for knowledge middle REITS in 2023, for instance, elevated a whopping 30.08 %, in line with a NAREIT report.

“The excessive efficiency of main tech firms behind cloud service, social media and now AI fashions, and their necessities for bigger computing capability is the important thing driver for investor exercise within the knowledge middle house,” stated San Francisco-based Jacob Albers, head of Different Insights at Cushman & Wakefield. “Annual cloud revenues have grown by 66 % since 2020.”

Rising demand and excessive absorption translated to vital YOY lease progress throughout the board in Q1 2024, reported CBRE. 5 main markets, nonetheless, skilled extraordinary lease progress , with Silicon Valley rents surging 54 % to $170-$200 kW/month); Northern Virginia 47.5 % to $135-$160 kW/month; Chicago, 47 % to $125-$140 kW/month; Dallas-Fort Price, 29 % to $125-$135 kW/month; and Phoenix, 20 % to $130-$170 kW/month.

Come one, come all

Mayo predicted, nonetheless, that capital availability within the near-term will tighten given how rapidly demand has elevated and improvement has surged. However capital flows to knowledge facilities are anticipated to normalize over time as demand patterns develop into extra predictable.

The highest business actual property traders on this house, in line with Smith, are Blackstone, GI Companions, Digital Bridge, The Carlysle Group, KKR, EQT, Berkshire Companions, and Stonepeak. However Denver-based Gordon Dolven, analysis director for CBRE Americas Knowledge Facilities, famous that Massive Tech customers, reminiscent of Microsoft, Google, Oracle, Amazon, and Meta, are more and more growing their very own knowledge facilities.

A big portion of capital coming into the sector entails main traders which might be buying or partnering with operators to broaden improvement pipelines, whereas a quantity smaller-scale traders coming into this house are buying land websites and taking pre-development steps of securing energy, entitlements, utilities, and different website preparation earlier than promoting to knowledge middle builders, Albers stated.

CBRE reported that in midyear 2023, U.S knowledge middle improvement jumped 26 % YOY improve, to five,174.1 megawatts (one MW is the same as a million watts), and a file 3,077.8 MWs was underneath building. In 2024, nonetheless, building exercise in main markets alone is anticipated to succeed in a brand new all-time excessive of greater than 2,500 MWs.

Preleasing exercise in main markets is accelerating new building, as 2,553.1 MWs or 83 % of the brand new capability underneath building is already leased. High capability customers proceed to be cloud service suppliers, however AI is driving up demand considerably, particularly in main markets the place the general emptiness charge stays close to a file low of three.7 %. And with few relocation choices, the report famous that almost all tenants are renewing current leases quite than searching for new amenities.

Northern Virginia, the biggest data-center market nationally, stays preeminent for capability and improvement, however different main markets proceed to see substantial pipeline progress, with a number of markets experiencing double or triple the pipeline capability of only a couple years in the past, Albers famous.

Smaller markets are experiencing unprecedented progress, pushed by much less latency-sensitive workloads, the provision of energy at scale, and financial incentives that may materially affect the price of knowledge middle improvement and operations, famous Mayo.

“Secondary markets, reminiscent of Columbus, Kansas Metropolis, Salt Lake Metropolis, Reno and Charlotte, have witnessed main campus bulletins, with extra rural large-scale improvement rising throughout U.S. states, reminiscent of Indiana, Mississippi, Alabama and New Mexico, added Albers.

In response to CoreSite, proximity to a company headquarters or concentrations of shoppers or companions, together with connectivity choices, latency necessities, monetary incentives, energy price and availability, environmental hazards and the enterprise ecosystem throughout the area that gives the info middle trade infrastructure and interconnection options, are driving new knowledge middle improvement. This report listed the ten largest knowledge middle markets, so as of MW capability: Northern Virginia, Dallas-Fort Price, Silicon Valley, Los Angeles, the New York Tri-State Space, Chicago, Washington DC, Atlanta, Miami and Phoenix.

The ability of knowledge

Knowledge facilities require intensive power capability, which is spurring great progress in improvement and funding in infrastructure, too. Mayo contended that energy availability is the largest problem the trade will face within the coming years. Conservatively talking, he steered that knowledge middle power demand would require at the very least 35-45 GWs of further electrical energy by 2030.

New chips utilized in servers at this time require exponentially extra energy than 10 years in the past, Dolven stated, and AI middle demand, which requires about 10 occasions as a lot energy as different computing workloads, is including undo stress to each energy era and grid programs.

“Load progress, for lack of a greater time period, must improve,” Dolven continued, noting that the transmission-distribution community is the largest drawback knowledge middle builders and operators are going through. “The grid is mission important, as it’s the new railroad or twenty first Century plumbing that allows all of this data that we’re producing and receiving.”

Albers famous that knowledge middle improvement is following the place large-scale energy era—tons of of megawatts and ideally over a gigawatt—shall be accessible throughout the subsequent few years. “In some instances,” he added, “improvement of energy era within the type of photo voltaic or different renewable micro-grids adjoining to an information middle have been thought of.”

Because the trade continues to embrace sustainability, these belongings current vital challenges to make sure resiliency and tie into current and new power infrastructure improvement to maintain progress, said a midyear 2024 U.S. Actual Property Offers report from PwC. It famous that rising power demand by digital-economy properties, coupled with a broad push to transition to scrub power sources, presents vital progress alternatives for actual property and infrastructure funding

Dolven emphasised that knowledge middle progress relies on increasing utility infrastructure, as the present grid isn’t designed to ship large quantities of electrical energy to small parcels of 10-50 acres. “This want is producing a willingness amongst builders to fund or help in building of substations on the parcels the place they’re constructing knowledge facilities, quite than wait in line for the utility to construct a substation for them,” he continued, noting that this additionally accelerates connectivity.

As well as, Dolven stated that traders are rising capital funding to colocation of renewable power amenities and knowledge facilities. “The dream objective is for knowledge facilities to be absolutely electrified by an adjoining renewable power supply,” he added, noting that the complication is power manufacturing with wind and photo voltaic are unreliable or not possible 24 hours a day.

“The worldwide colocation market is estimated at roughly $85 billion in 2024 and is anticipated to develop to over $120 billion in three years,” stated Albers, noting that even with out progress in AI, capability demand is anticipated to extend 35 % by 2020.

[ad_2]

Source link