[ad_1]

Torsten Asmus

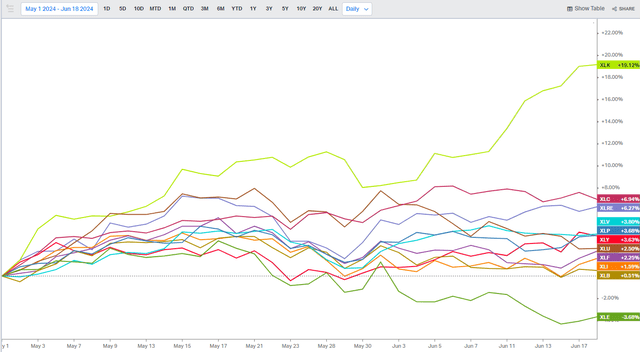

What a distinction 1 / 4 makes. Heading into Q2, the worldwide inventory market rally had been broadening properly. Small caps had been taking part within the upside whereas non-US equities had been truly beating their large-cap US counterparts. What’s extra, relative power was seen in areas away from simply the Info Expertise and Communication Companies sectors. Niches like Financials, Industrials, and Power had been charging forward whilst odds for important fee cuts from the Federal Reserve had been erased from 2024’s financial coverage chalkboard one after the other.

That every one modified beginning round mid-April. Tax Day marked an inflection at which mega-cap tech reasserted its dominance. By Might 1, one other large leg to the AI-driven rally had begun to happen. Leap forward to at this time, and the Magnificent Seven has condensed into the Terrific Triumvirate. NVIDIA (NVDA) has leapfrogged Microsoft (MSFT) and Apple (AAPL) to grow to be the world’s most precious firm, and the I.T. sector writ massive is now greater than 30% of the S&P 500.

I’m downgrading the JPMorgan Fairness Premium Revenue ETF (NYSEARCA:JEPI) from a purchase to a maintain. The covered-call fund carried out properly within the weeks after my earlier evaluation however has underperformed these days amid the growth-on rally. With low implied volatility within the broad market, proudly owning it at this time affords much less option-selling revenue.

Tech Sector Dominance Since Might 1

Koyfin

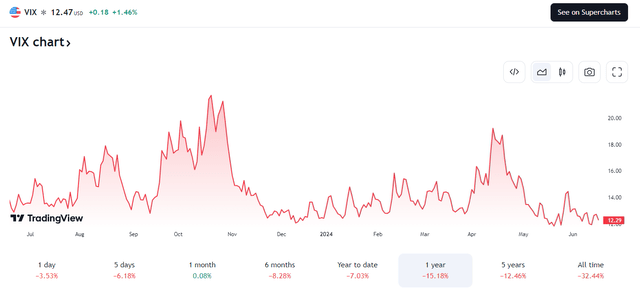

A Low VIX Outcomes In Decreased Choice-Promoting Revenue

TradingView

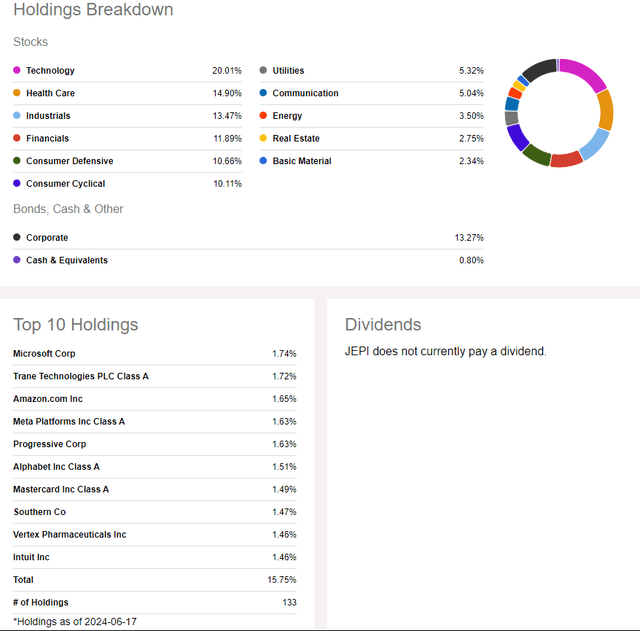

In keeping with the issuer, JEPI generates revenue by means of a mixture of promoting choices and investing in U.S. large-cap shares, searching for to ship a month-to-month revenue stream from related possibility premiums and inventory dividends. The ETF’s managers assemble a diversified, low-volatility fairness portfolio by means of a proprietary analysis course of designed to establish over- and undervalued shares with engaging danger/return traits. Total, JEPI seeks to ship a good portion of the returns related to the S&P 500 Index with much less volatility, along with month-to-month revenue.

JEPI is a big ETF with greater than $33 billion in property below administration as of June 18, 2024. Its 0.35% annual expense ratio is low given the complexity of the technique whereas the fund’s trailing 12-month dividend yield is excessive at 7.4%. Potential buyers ought to perceive that many of the revenue is generated from promoting name choices, not simply from the money flows of the portfolio’s fairness holdings.

Share-price momentum has been lukewarm these days as JEPI’s allocation is akin to an equal-weight technique, so it has underperformed its cap-weighted fund friends which have very excessive publicity to mega-cap progress shares. However JEPI scores properly throughout danger metrics given its diversified portfolio and considerably modest annual commonplace deviation historical past. Liquidity is one other sturdy level given JEPI’s excessive common every day quantity of greater than three million shares and a median 30-day bid/ask unfold of simply two foundation factors, per JPMorgan.

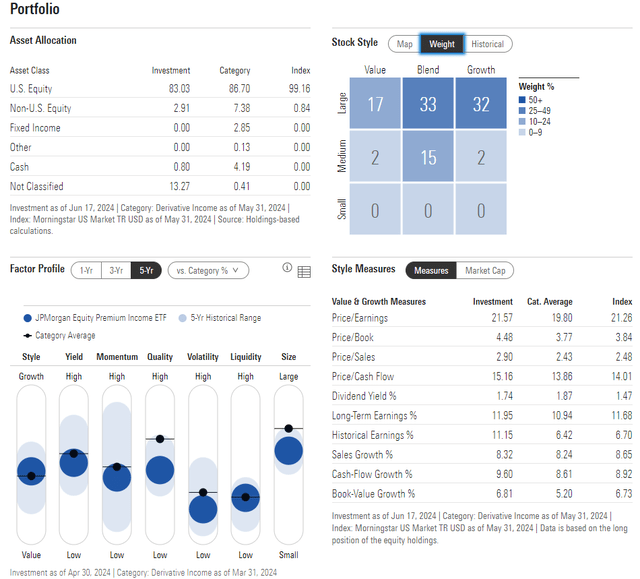

Wanting nearer on the portfolio, the 4-star, Bronze-rated ETF by Morningstar stays primarily a large-cap allocation. It is extra balanced between worth and progress in contrast with the S&P 500, and there’s a materials place in home mid-cap shares. This tells me that JEPI ought to do properly when the so-called S&P 493 does properly, not simply the Magazine 7.

What has me involved although is the valuation. Now near 22x earnings, the fund is certainly not a discount. However with a long-term EPS progress fee below 12%, the PEG ratio is a smidgen from 2.0, which isn’t tremendously costly.

JEPI: Portfolio & Issue Profiles

Morningstar

The place you will discover a important distinction in JEPI versus the broader home inventory market is in its sector breakdown. Tech is simply 20% of the ETF, a major underweight in comparison with the SPX whereas areas like Industrials, Client Staples, and Utilities are overweights. The 133-position portfolio acts like an equal-weight product, provided that the largest single inventory is 1.74% and turnover is excessive at 190%.

JEPI: Sector Diversification, Not a Prime-Heavy Allocation

In search of Alpha

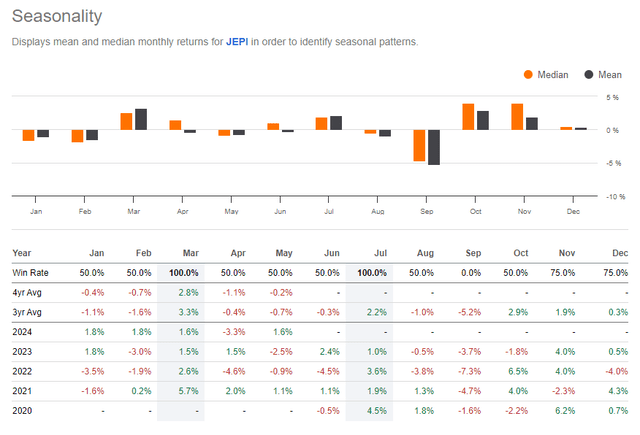

Seasonality isn’t a serious consideration given the fund’s brief historical past, however eyeing the month-to-month developments, we discover that July tends to be a good month. After all, the primary month of the second half is among the many finest durations for the S&P 500 as properly. A positive time to get lengthy JEPI is after implied volatility has elevated, maybe later in Q3 if historical past is a information.

JEPI: Bullish July Developments

In search of Alpha

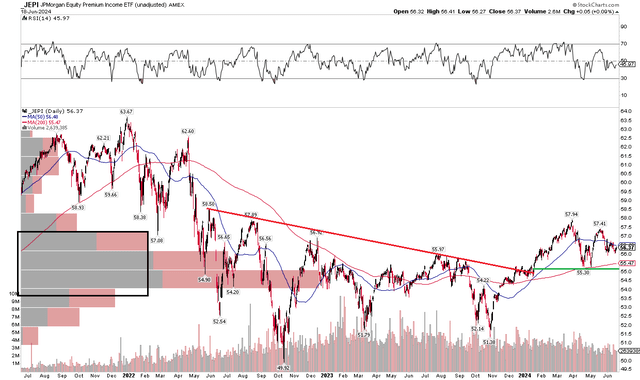

The Technical Take

Charting the fund, we should always first take into account that the excessive dividend payouts trigger value gaps, however we will nonetheless glean an concept of the present pattern and vital value factors to watch. Discover within the graph beneath that the bulls look to be in control of the first pattern. I come to that assertion provided that the long-term 200-day transferring common is positively sloped and shares proceed to carry vital assist across the $55 degree. Again in Q1, I famous that an upside breakout befell and that greater costs had been seemingly. That performed out, however the rally petered out two months later.

Right now, I might prefer to see JEPI climb above its 2024 peak simply shy of the $58 mark on greater quantity. I do not like that quantity has been on the decline for a lot of this yr, although it’s nonetheless very a lot an actively traded ETF. Additionally, the RSI momentum indicator on the high of the chart has rolled over after being sturdy in the course of the first quarter. Nonetheless, a wholesome quantity of quantity by value within the mid-$50s ought to present assist at this time.

Total, momentum has eased with JEPI, however its uptrend stays intact.

JEPI: Holding Key Help, Rising 200dma

StockCharts.com

The Backside Line

With a VIX close to 12 and few indicators of a serious let-up within the mega-cap progress momentum commerce, ready for higher macro and intermarket developments is prudent with JEPI. I just like the technique for buyers searching for excessive revenue, however persistence is required for greater choices pricing to reap the benefits of the call-selling technique.

[ad_2]

Source link