[ad_1]

janiecbros

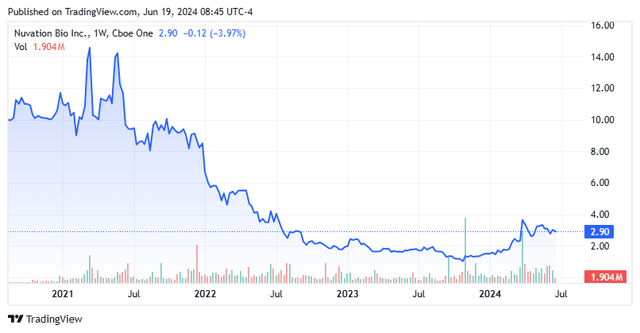

At the moment, we put Nuvation Bio (NYSE:NUVB) within the highlight for the primary time. The inventory value of this oncology targeted medical stage biotech concern has tripled for the reason that market’s current lows of late October. The shares have weakened a bit just lately. What’s forward for Nuvation Bio and its shareholders for the remainder of 2024? An evaluation follows beneath.

Searching for Alpha

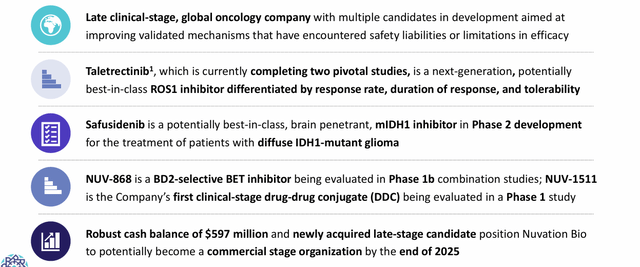

Nuvation Bio is headquartered in New York Metropolis. This firm is concentrated on creating differentiated and novel therapeutic candidates within the oncology area. The corporate is now creating taletrectinib, a compound it acquired earlier this 12 months through the all-stock buy of AnHeart Therapeutics. This acquisition has been a major driver of the inventory’s surge in 2024.

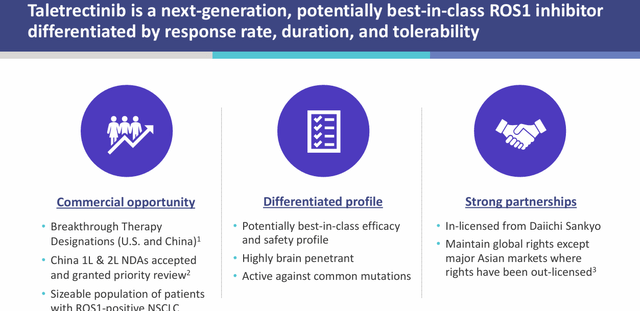

June 2024 Firm Presentation

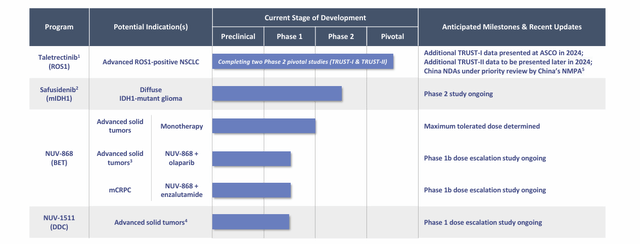

Taletrectinib is a next-generation, probably best-in-class ROS1 inhibitor. With the buyout of AnHeart, Nuvation additionally picked up a pipeline asset known as safusidenib, a probably best-in-class mutant IDH1 inhibitor. This compound has proven excessive blood-brain barrier penetration in early research, however nonetheless is in Part 1 growth.

Of be aware, growth and industrial rights to taletrectinib and safusidenib had been in-licensed from Daiichi Sankyo. A few of these rights (China, Japan and Korea) have been out-licensed.

June 2024 Firm Presentation

Developed in home, Nuvation additionally has a BD2 selective oral small molecule BET inhibitor that epigenetically regulates proteins that management tumor progress and differentiation, dubbed NUV-868. Nuvation additionally just lately acquired an IND authorised for NUV-1511, a drug-drug conjugate (DDC) which is a spinoff of a broadly used chemotherapy agent. Nuvation is focusing on strong tumors with this asset that clearly may be very early-stage at this level. The inventory at the moment trades just under three bucks a share and sports activities an approximate market capitalization of simply north of $700 million.

June 2024 Firm Presentation

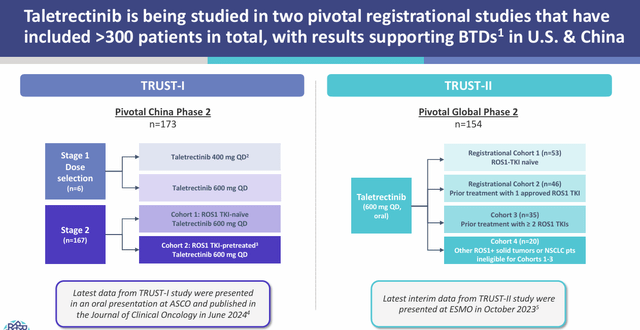

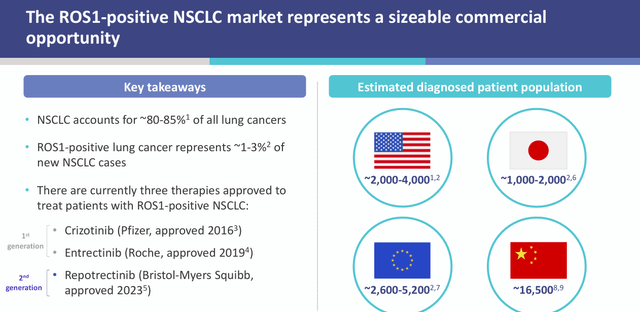

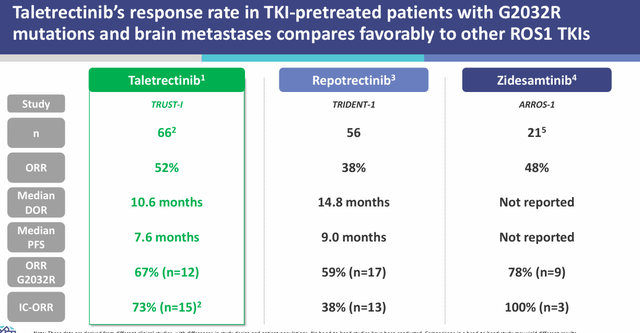

Taletrectinib is at the moment being evaluated for the remedy of sufferers with superior ROS1-positive NSCLC in two Part 2 single-arm pivotal research. One in every of these research, ‘TRUST-1’, is being performed in China and the opposite, ‘TRUST-2’, is a worldwide research. Taletrectinib has garnered Breakthrough Remedy standing each within the U.S. and China. Within the latter, Nuvation has an NDA for taletrectinib to deal with domestically superior or metastatic ROS1-positive NSCLC who both have or haven’t beforehand been handled with ROS1 tyrosine kinase inhibitors (TKIs) at the moment beneath precedence evaluation.

June 2024 Firm Presentation

June 2024 Firm Presentation

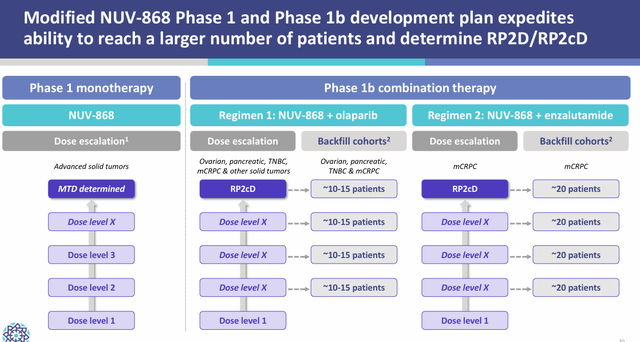

NUV-868 is in earlier stage growth. It’s at the moment being evaluated through a Part 1b dose escalation research together with olaparib. This mixture is focusing on many types of most cancers. These embrace ovarian pancreatic, mCRPC, triple adverse breast most cancers, and different strong tumors. Olaparib is a PARP inhibitor and is marketed beneath the model identify LYNPARZA and is authorised as a upkeep remedy of BRCA-mutated superior ovarian most cancers in adults.

June 2024 Firm Presentation

Analyst Agency Commentary & Stability Sheet

The analyst group is unanimous proper now in its optimistic view on the corporate. Since Nuvation Bio posted its Q1 numbers on Could thirteenth, a half dozen analyst companies, together with Jefferies, Wedbush and RBC Capital have reissued Purchase/Outperform rankings on the inventory. Worth targets proffered vary from $5 to $10 a share.

Among the best elements of Nuvation’s story is its stability sheet. It ended the primary quarter with just below $600 million in money and marketable securities readily available. This represents nearly all of the inventory’s present market capitalization and comes after the corporate posted a web lack of $14.8 million for the quarter. Nuvation is blessed with an extended ‘money runway’ to develop its candidate, which means little likelihood of shareholder dilution through a capital elevate on the horizon. There was no insider exercise within the inventory to date in 2024. Nevertheless, a useful proprietor did add greater than $9.5 million of inventory to their stake final September when the shares traded beneath $1.40 a share.

Conclusion

Searching for Alpha

Nuvation is nicely funded, has a number of ‘photographs on aim’, potential upcoming catalysts and enjoys common help of the analyst agency group. The current acquisition of AnHeart seems to have modified the narrative round Nuvation, an organization that has destroyed substantial shareholder worth since coming public in the summertime of 2020.

June 2024 Firm Presentation

That mentioned, even with the current rally, the market is valuing all of the property of Nuvation at round $120 million after adjusting for the online money on the corporate’s stability sheet. Subsequently, the shares appear to benefit a small ‘watch merchandise’ holding for risk-tolerant traders.

[ad_2]

Source link