[ad_1]

AleksandarNakic

Whereas the S&P 500 Index (SP500) has loved stable returns year-to-date, we have seen bifurcated returns throughout sectors, and even inside sectors. Names like Lululemon Athletica (LULU) proof this, with that inventory sitting at 52-week highs and up 26% year-to-date whereas different retailers are sitting at 52-week lows with year-to-date returns in deeply unfavorable territory.

One identify that is been crushed up considerably greater than common is Pet Valu Holdings Ltd. (TSX:PET:CA), a franchisor of pet shops in Canada that is discovered itself down ~35% year-to-date and ~43% from its all-time highs. The result’s that the inventory has discovered itself hovering solely marginally above its IPO debut costs and buying and selling at a depressed valuation of lower than half of its historic earnings a number of (~14.2x FY2024 annual EPS estimates vs. 30.0x earnings since going public). Let’s dig into the corporate beneath, and why this selloff is providing a shopping for alternative.

All figures are in Canadian {Dollars} until in any other case famous. Pet Valu has important liquidity on the Canadian Market (Toronto Inventory Change), however there’s a important threat to purchasing on the OTC Market due to huge bid/ask spreads, low liquidity, and no assure of future liquidity. Due to this fact, the easiest way to commerce the inventory is on the Canadian Market.

Enterprise Mannequin

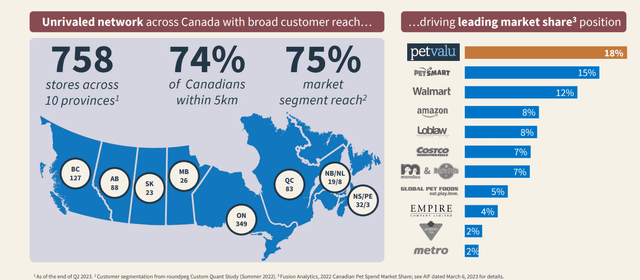

Pet Valu Holdings (“Pet Valu”) opened its first retailer in Toronto in 1976 and has since grown to change into Canada’s largest pet retailer with 758 shops, with simply over 70% of its system being franchised. Not surprisingly (given its scale), it is also the market chief, with 18% market share in Canada, 300 foundation factors above its second closest competitor with an analogous share to Walmart (WMT) and Loblaws (L:CA) mixed. Simply as importantly, the corporate’s footprint is exclusive from a comfort standpoint relative to friends, with Pet Valu having practically 5x as many shops as its closest competitor (PetSmart) and 74% of Canadians inside 5 kilometers of a Pet Valu retailer, with clients in a position to drive and even stroll with ease to their closest retailer. Plus, the corporate has made stable progress rising into areas the place it is much less saturated with its acquisition of Chico’s (Quebec’s largest franchisor of pet specialty shops), including 66 shops within the province of Quebec (bringing its whole to 83), with this deal executed in money, offering a stable enhance to Pet Valu’s annual EPS.

Pet Valu Retailer Footprint & Market Share – Firm Presentation, Fusion Analytics

The majority on Pet Valu’s system-wide gross sales are associated to consumable pet-related merchandise (meals/treats) with this being non-discretionary and recurring in nature, whereas lower than one-fourth of its gross sales are tied to hardlines pet-related merchandise reminiscent of canine chews, collars, leashes, cages, carriers, toys, and so forth. As well as, the corporate additionally has in-store companies which make up ~2% of gross sales, reminiscent of self-serve canine washes and grooming salons. Of word is that not solely does Pet Valu profit from main market share, however its market share has been rising whereas others have seen some stagnation, suggesting its distinctive providing is paying off. Some causes for this market share progress may embrace:

Comfort with a Pet Valu in practically each neighborhood. Sturdy customer support scores and extra private service vs. massive field retailers. The flexibility to go to pets up for adoption within the retailer throughout visits to select up meals and treats, a bonus spotlight to visiting the shop for pet lovers. A small format (~3,500 sq. ft) vs. massive field retailers which makes getting out and in of the shop a breeze for these not desirous about searching. Assist of animals locally by supporting Pet Valu, with $23 million raised since 2010 (Companions for Change program) and over 42,000 pets positioned in endlessly properties for the reason that sponsorship program started in 2018.

One concern that some buyers may need is that Chewy, Inc. (CHWY) would be the new child on the block in Canada beginning later this quarter, with a deliberate entry into Canada in Q3 in keeping with the corporate. The corporate is definitely a disruptor within the pet area, with ~5% of Individuals (20+ million) being lively Chewy clients and with FY2022 web gross sales of ~$10.0 billion.

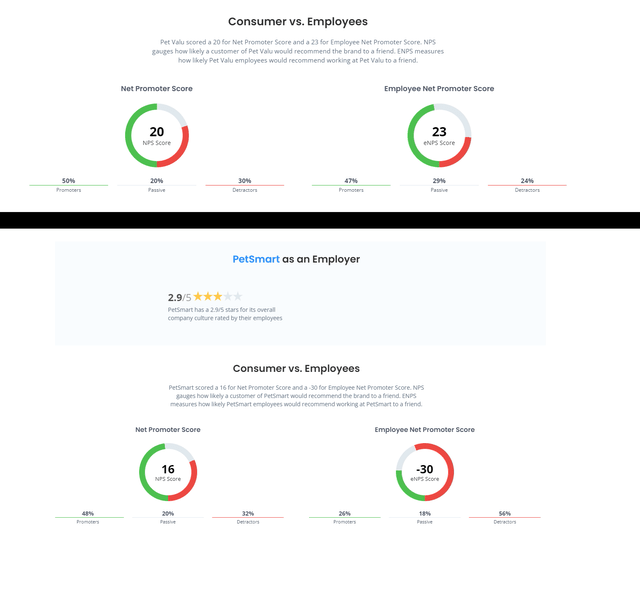

That stated, I do not see as a lot threat to Pet Valu vs. its friends provided that Pet Valu wins on comfort (nearness of places) relative to its Canadian rivals, making it a much less probably substitution for Chewy which additionally provides comfort. Pet Valu additionally wins on NPS scores vs. its present friends and its largest competitor PetSmart, with a 20 NPS rating, 23 Worker NPS rating, and an 80 Buyer Satisfaction Rating [CSAT] in keeping with Comparably, a lot larger than PetSmart at 16 for its NPS rating, -30 on its ENPS rating, 69 (CSAT rating), and decrease Glassdoor assessment rating. Therefore, I might assume the loser might be PetSmart (much less comfort, decrease buyer satisfaction).

Comparably NSP, ENPS, CSAT Scores Pet Valu vs. PetSmart – Comparably.com

With regards to grocery retailer friends, they lack the breadth of choice that Pet Valu provides, suggesting that Chewy’s major space for taking share might be Pet Valu’s rivals vs. Pet Valu.

It is usually price noting that Pet Valu’s loyalty program has continued to develop at a powerful clip, up 30% to over 2.6 million members from “nearly 2.0 million members as of year-end 2021.” That is essential, as a result of these 2.6 million loyalty members made up 80% of the corporate’s system-wide gross sales in its Q2 2023 outcomes, and loyalty members have a lot larger basket sizes than their friends (up from 53% in FY2020). Loyalty program advantages embrace a free bag of pet meals or complimentary canine wash for loyalty members who purchase 12 luggage of pet meals or 4 canine washes, with different advantages embrace Low cost Days.

As for Chico’s and its ~100,000 loyalty members as of year-end 2022, the Chico’s Privilege Card holders are awarded two factors for each greenback spent pre-tax on qualifying purchases which may be redeemed for subsequent purchases at Chico shops. As well as, Pet Valu acknowledges its VIP clients with added advantages, with its VIP clients making up its most loyal purchasers, as famous within the firm’s Q1 2023 Convention Name by Pet Valu’s CEO, Richard Maltsbarger:

“So for every one in every of these VIP clients, a lot of whom have spent nearly a decade being a loyal buyer to Pet Valu, oftentimes with $10,000 to $20,000 to $30,000 to spend over their lifetime with us, we really customise a really particular present field that is tied to the pets that they are buying for inside our Pet Valu shops. We then, in partnership with our native franchisee or retailer supervisor, invite the VIP buyer into the shop and truly by means of one thing solely we are able to do with our true store-based human connection, actually say thanks, a deep, private, heartfelt thanks as we hand over this VIP field utterly personalized to them. Inside each field is a handwritten word from me thanking them for his or her enterprise and a chance to talk with somebody on our govt workers in the event that they identical to to offer extra enter into how we might be a fair higher accomplice for them within the pet area. That is one thing that’s on the premier stage of our present loyalty program wherein we simply wish to say thanks to our perfect clients.”

– Q1 2023 Convention Name, Pet Valu CEO, Richard Maltsbarger.

I consider it is a sensible initiative that makes Pet Valu stand out and whereas this VIP expertise might solely be realized by a small cohort of its clients, it ensures that these clients see that they’re acknowledged for his or her help and sure helps to make them life-long clients of Pet Valu. Therefore, between this VIP expertise and the sturdy progress in its loyalty members, I consider that Pet Valu has constructed one thing particular at its company & franchised shops, and I’ve discovered this to be true at most shops I’ve visited, with very educated (and immediate) pet-focused customer support vs. big-box retailers and plenty of PetSmart places the place that is much less the case and or non-existent.

One other level price noting is that Pet Valu has a really sturdy administration workforce for a mid-cap firm, with its President & CEO Richard Maltsberger spending 14 years at Lowe’s (LOW) in positions together with President of Worldwide (oversaw enlargement of RONA), Chief Growth Officer, and most not too long ago Chief Working Officer for the US. In the meantime, the corporate’s new CFO Linda Drysdale additionally has a stable resume, with time spent at Interac Corp. (Canada’s main cost companies supplier) as CFO and a number of other years at Canadian Tire in positions starting from VP, Head of Inside Audit, CFO of Canadian Tire Monetary Providers, and VP, Monetary Planning & Evaluation for teams together with Client Manufacturers, IT, Digital/E-Comm, Advertising and marketing, Provide Chain, and Actual Property.

Pet Valu Administration – Firm Web site

As well as, Pet Valu’s Senior Vice President, Company Retailer Operations is Gaylyn Craig who has been with Pet Valu for 9 years after spending 16 years with Starbucks (SBUX) as Regional Licensed Supervisor, Subject Implementation Supervisor, District Supervisor, and Retailer Supervisor. Plus, the corporate’s Chief Digital & Advertising and marketing Officer Tanbir Grover additionally spent practically a decade at Lowe’s (most not too long ago VP of E-Commerce & Omnichannel) and its Chief Merchandising Officer (Kendalee MacKay) held a number of positions with grocery juggernaut Loblaws and was most not too long ago VP Merchandising & Enterprise Growth at Buyers Drug Mart (acquired by Loblaws in 2013 for $12.4 billion). To summarize, I might argue that it is a sturdy workforce throughout the board that’s extremely able to taking up any competitors, making me consider that the Chewy fears are overblown.

Lastly, it is price noting that whereas we may see competitors intensify, the {industry} itself advantages from a rising numbers of pet homeowners and multi-pet households, larger total spend on pets as a result of humanization of pets (treating pets as a member of the household), a rising Canadian inhabitants, and a better proportion of millennials preferring pets to having youngsters. Therefore, with spending on pets being much less delicate to the present slowdown, a bigger total pie as a result of a better inhabitants, a rising variety of households with pets and better spending per family (humanization of pets), there’s extra share to go round, suggesting a few of the competitors worries may be offset by these dynamics.

Now that we have got some background on the corporate, let’s dig into the current monetary outcomes:

Current Outcomes

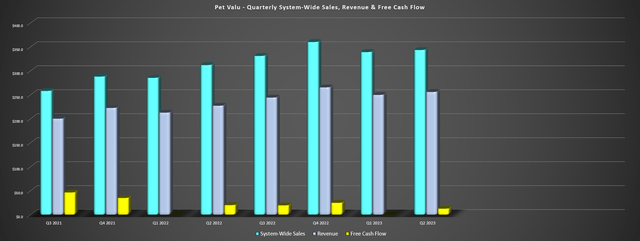

Pet Valu launched its Q2 outcomes final month, reporting system-wide gross sales of $343.9 million (+10% year-over-year), same-store gross sales progress of 6.0% (4.8% enhance in common spend, 1.2% transaction progress), and income of $256.4 million, up 13% year-over-year. In the meantime, regardless of larger web capital expenditures for its provide chain transformation (new distribution facilities), the corporate nonetheless generated $13.0 million in free money circulation, a stable efficiency throughout a interval that was impacted by some softness in hardlines (extra discretionary purchases), which the corporate attributes to some softness in shopper demand and the tougher macro backdrop. The opposite headwind outdoors of a weaker Canadian Greenback was that some customers have switched to bigger meals bag sizes for financial savings which suggests much less frequent visits, lowering the power for Pet Valu to learn as a lot from impulse buys throughout common visits.

That stated, and as famous earlier, ~80% of gross sales come from extra recurring gadgets like consumables and companies. So, the corporate has nonetheless managed to develop income and system-wide gross sales at a double-digit charge regardless of these short-term headwinds.

Pet Valu – System-Vast Gross sales, Income & Free Money Circulate – Firm Filings, Creator’s Chart

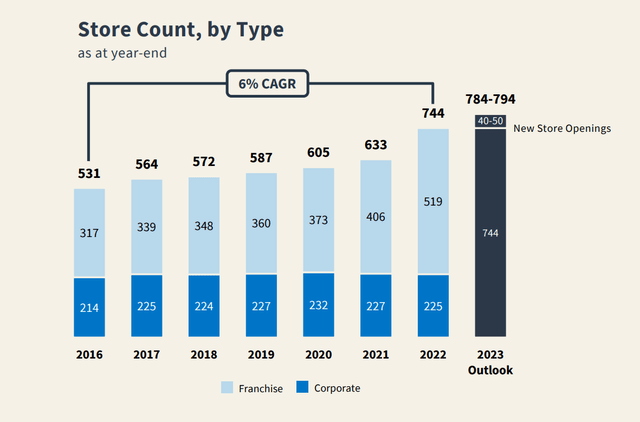

As for unit progress, Pet Valu famous that it opened 788 new shops within the shops (ending with 758 shops), and it has maintained its outlook offered at the start of 2023 which is for $1.05 to $1.08 billion in annual income, 7-10% same-store gross sales progress, and 40-50 new retailer openings (implying 6% progress year-over-year on the mid-point). These are very spectacular figures that talk to the resilience of the pet {industry} as an entire and simply as importantly, the franchisee improvement pipeline stays sturdy regardless of larger charges, which is not stunning provided that Pet Valu boasts related unit economics to Domino’s Pizza (DPZ), one other extremely profitable retail model, with an estimated ~4-year payback, annual common unit volumes of ~$2.0 million, and a comparatively low funding value of ~$410,000. And it is also price noting that 65% of Pet Valu’s present franchisees personal only one retailer with 22% proudly owning two shops, suggesting room for natural progress in addition to new candidates.

Pet Valu – Retailer Rely by Kind – Firm Web site

From a improvement standpoint, the corporate famous that it accomplished 18 renovations, enlargement or relocation initiatives year-to-date (of a deliberate 20-30 in FY2023), and that it signed a lease for a brand new distribution middle within the Metro Vancouver Area that’s practically accomplished (10 years commencing on January 1st, 2024), with a focused launch in mid-2024. Pet Valu expects its upgraded distribution facilities will serve a number of functions. The primary is that it’ll double its capability to help progress and considerably cut back its reliance on third-party logistics. The second is that it is going to be in a position to introduce automation (not at present getting used) and assist enhance fill accuracy plus decrease prices. Third, it should considerably enhance the corporate’s wholesale distribution to its rising Chico franchise base which makes up lower than 10% of its whole system at present.

Performatrin Extremely Uncooked Bites Beef – Firm Web site Chico

Lastly, from a product standpoint and comfort, Pet Valu received a Product Innovation Award on the Retail Council of Canada Grand Prix for its Extremely-Freeze Dried Uncooked Bites as a part of its Performatrin, with the corporate noting in its year-end outcomes that it is seen sturdy progress on this progress charges on this product. In the meantime, the corporate expanded its E-Commerce providing earlier this 12 months with an Autoship subscription service, and the corporate continues to work on initiatives associated to buyer usability and pace enhancements for E-Commerce to assist it stand out amongst out from an ease of use standpoint. These investments appear to be paying off with continued site visitors progress to its web site in Q2 and continued progress in its lively loyalty buyer depend. Lastly, the corporate has begun rolling out its proprietary model portfolio to Chico places and has participation from 100% of Chico franchisees, translating to almost 400 SKUs. This progress in its loyalty program is essential because it has distinctive insights into its members to assist with focused advertising and marketing to assist offset any current slowdown.

So, how does the valuation look?

Valuation

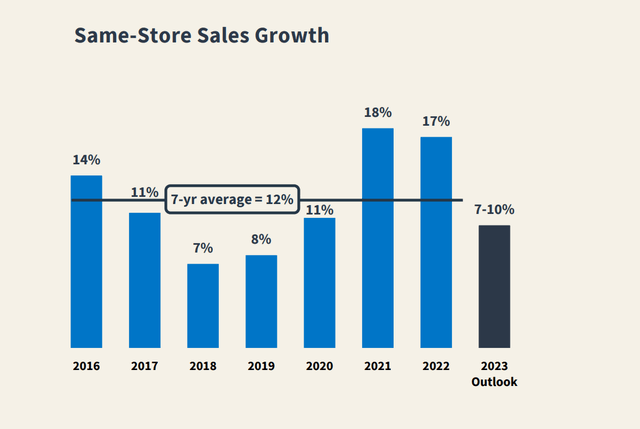

Based mostly on 71.5 million shares and a share value of C$25.60, Pet Valu trades at a market cap of ~$1.83 billion and an enterprise worth of ~$2.12 billion, with ample liquidity to hold out its deliberate investments with ~$140 million in liquidity ($130 million accessible on RCF with an efficient rate of interest of seven.0% and $9 million in money). This can be a dirt-cheap valuation for an organization able to producing $140 million in free money circulation in FY2025, leaving the inventory buying and selling at simply ~15.0x FY2025 free money circulation estimates. That is far too low of a a number of for a recession-resistant retailer with a predominantly franchise mannequin (~70% of shops franchised), and particularly for a market chief with Pet Valu’s stable monitor report, on monitor for eight consecutive years of constructive same-store gross sales progress (12% progress on trailing 7-year common foundation), with constant mid-single-digit unit progress.

Pet Valu – Annual Similar-Retailer Gross sales Progress – Firm Presentation

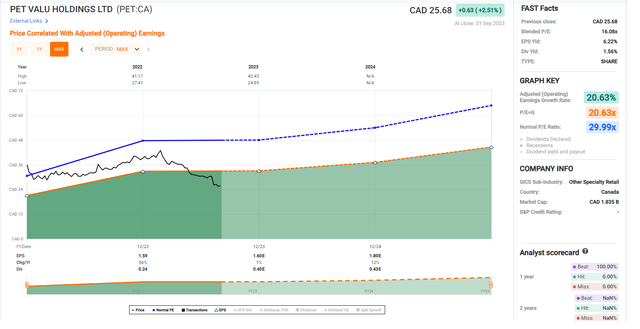

From an earnings standpoint, the inventory can be buying and selling at its most tasty valuation because it went public, sitting at simply ~11.9x FY2025 annual EPS estimates ($2.15) vs. its historic earnings a number of of 30.0x. And whereas I believe the inventory’s earnings a number of since going public is steep, I consider a really conservative for this enterprise is eighteen.0x earnings, pointing to a good worth of $32.40 utilizing FY2024 annual EPS estimates of $1.80 (1-year goal value) and $38.70 (2-year goal value) based mostly on FY2025 annual EPS estimates of $2.15. So, if we measure from the present share value of $25.60, this factors to ~29% upside on a complete return foundation (together with 1.6% dividend yield) to its 1-year goal value and ~53% upside to its 2-year goal value even when making use of a a number of that is 40% beneath the place it is traded since going public. Therefore, this sell-off in Pet Valu seems to be greater than overdone, and I see this as a shopping for alternative.

Pet Valu Holdings Historic Earnings A number of – FASTGraphs.com

Abstract

Pet Valu Holdings Ltd. has loved spectacular progress over the previous a number of years (~6% CAGR for unit progress), advantages from sturdy unit economics (~$2.0 million AUV with 50% cash-on-cash returns) that has helped it preserve a wholesome pipeline of potential franchisees, and outclasses its friends on NPS scores, total critiques, and comfort. Simply as importantly, it is in an {industry} that has given up floor grudgingly on a spend foundation throughout recessionary environments, and has seen an acceleration in progress from 2016 to 20022 as pet humanization has emerged, with pet homeowners’ priorities being high quality, affordability, buying comfort and model identify. These priorities all help Pet Valu’s place as retaining its market management and rising share with a big selection of merchandise (together with modern gadgets in personal label manufacturers), very reasonably priced costs and industry-leading comfort (70% of Canadians inside 5 kilometers of a Pet Valu location).

Nonetheless, Pet Valu Holdings inventory has come underneath stress year-to-date, down 35% for the 12 months with worries a couple of pullback in shopper spending, Chewy’s entrance into Canada resulting in elevated competitors, and margin softness/decrease free money circulation era due to a weaker Canadian Greenback, duplicate working prices for its GTA Distribution Heart and elevated investments. Nonetheless, concerning executing on its enterprise mannequin, Pet Valu continues to excel, and the payback on these investments will probably be significant (provide chain transformation with new DCs and good thing about automation) following this funding section. Plus, the corporate will steadily see its franchise combine enhance because it will increase in scale, which ought to help a better a number of long-term. Therefore, whereas free money circulation might stay pressured short-term, the corporate is making the proper investments to make sure it maintains its market share chief standing, even with elevated competitors.

To summarize, I see Pet Valu inventory as a steal at present ranges, with the inventory buying and selling at lower than 12x FY2025 annual EPS estimates vs. what I consider to be a good a number of of 18-20x earnings. And with the potential to develop its retailer depend by ~60% long-term to its aim of 1,200 shops, this might simply be a C$75.00 inventory long-term and supply good diversification for a portfolio with a rising dividend with a staples-like tilt, with it being a retailer that is a lot much less discretionary and recession resistant.

Therefore, I see this pullback in Pet Valu Holdings Ltd. shares as a present, and I’ve not too long ago began a brand new place within the inventory. Plus, it is doable we may see the corporate start shopping for shares as properly on this selloff to help the inventory, with opportunistic share repurchases mentioned as a possible strategy to return capital to shareholders in its This autumn 2022 outcomes and the value definitely being proper after this violent correction.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link