[ad_1]

NiseriN

Funding overview

I wrote about Planet Labs (NYSE:PL) beforehand (Dec 2023) with a purchase ranking because the enterprise was the chief within the trade and I believed the expansion runway was extraordinarily lengthy, supported by very robust secular tailwinds. Whereas the share value has not reacted in the way in which I needed, I proceed to consider PL is a purchase as PL continues to execute properly each financially and operationally. Particularly for development, PL has proven that development acceleration is feasible in its 1Q25 outcomes.

1Q25 earnings (introduced on sixth June 2024)

PL reported 1Q25 income of $60.4 million (1% above consensus). Adj EBITDA additionally got here in higher than consensus estimates, at -$8.4 million vs. consensus expectations of -$11 million. Different key working metrics had been additionally optimistic, the place PL grew whole clients by 14.2% y/y to 1,031, sustaining the mid-teens buyer development tempo over the previous 2 years. Importantly, PL noticed a 100% internet greenback retention ratio.

Enterprise on monitor each financially and operationally

Might Investing Concepts

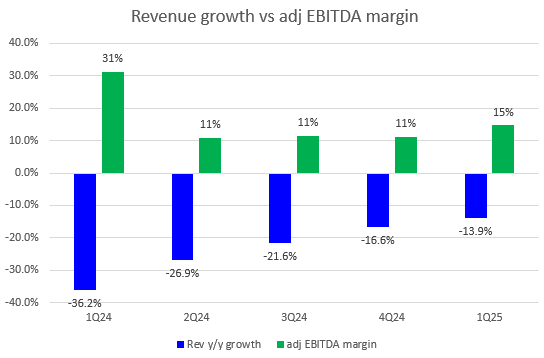

I proceed to consider the market just isn’t appreciating the progress that PL is exhibiting, each financially and operationally. Financially, the slowdown in development, from >30% to 11% up to now 3 quarters, and poor profitability profile have weighed on the inventory over current historical past. Nevertheless, that has modified; PL confirmed development acceleration in 1Q24, with adj EBITDA margin exhibiting continued enchancment.

Operationally, PL continues to indicate nice execution, which I’m anticipating to assist development acceleration forward. Beginning with Tanager-1, this hyperspectral satellite tv for pc is prepared for launch. The anticipated timeline is for it to launch in July (it has already arrived on the launch web site). The satellite tv for pc is scheduled for liftoff in July and will likely be joined by 36 SuperDove satellites. With this, it additional cements PL’s aggressive benefit within the trade, as this may improve PL’s current Earth Commentary choices, PlanetScope and SkySat, by including greater than 400 spectral bands of knowledge. I’m anticipating a profitable launch as Tanager shares the identical bus platform with Pelican, which had a profitable tech demo launched final 12 months.

Additionally, with this launch, it opens up extra industrial alternatives for PL (i.e., extra development alternatives). Firstly, the imagery captured by Tanager-1 will likely be analyzed by professional scientists (together with the PL’s associate, Carbon Mapper) to determine methane and carbon dioxide super-emitters globally. I anticipate robust adoption of those knowledge units, as it’s a rising focus of governments world wide to control methane emissions. Secondly, PL additionally additional improves its worth proposition to clients as Tanager’s hyperspectral knowledge will improve knowledge units for verticals, as cited within the 1Q25 earnings name: protection and intelligence monitoring, biodiversity assessments, mineral mapping, and water high quality assessments.

PL

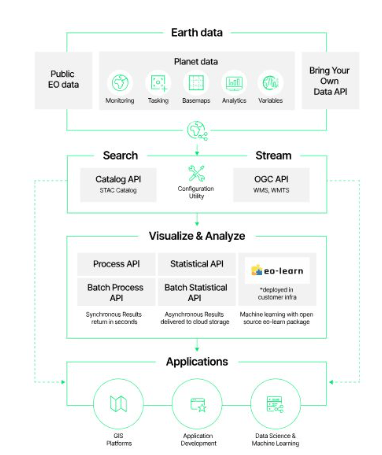

PL has additionally launched its Insights Platform in April, which I consider is a recreation changer. This platform integrates Sentinel Hub with PL’s Earth knowledge merchandise and analytics. For reference, PL acquired Sentinel Hub through the acquisition of Sinergise in August 2023. I say it is a recreation changer as a result of the mix of choices beneath the Perception Platform permits each authorities and industrial clients to extra seamlessly entry, analyze, and disseminate Earth-observation insights through a extra centralized hub. Basically, I see this platform because the underlying infrastructure (one thing like an working system) for purchasers, because it centralizes all giant datasets into one single platform, and clients can hyperlink their APIs or construct purposes on prime of this platform. Over time, as PL feeds extra knowledge into this platform and clients construct extra purposes utilizing knowledge from this platform, PL turns into integral to the shopper’s workflow, and this provides PL a number of pricing energy. PL may additionally simply up-sell clients all different merchandise (perhaps extra particular knowledge units) for the reason that buyer is already utilizing the platform. As such, I’m actually optimistic about this product.

Partnership with Nvidia strengthens PL aggressive benefit

4 days in the past, PL introduced their collaboration with NVIDIA round onboard processing for its Pelican-2 satellite tv for pc (mainly, PL will fly NVIDIA’s Jetson Edge AI Platform aboard Pelican-2). Particularly, Pelican represents PL’s next-gen imaging constellation and is predicted to ship improved capability, velocity, and accuracy. I consider this additional strengthens PL’s benefit in processing knowledge (we’re speaking about ~30 terabytes of day by day knowledge), which interprets into a greater worth proposition to clients. The power to course of extra knowledge on the edge goes to be a large aggressive benefit for PL, because it hurries up the method of extracting helpful insights from giant portions of knowledge. In different phrases, this implies PL is ready to supply extra helpful merchandise to clients in much less time.

Valuation

PL Might Investing Concepts

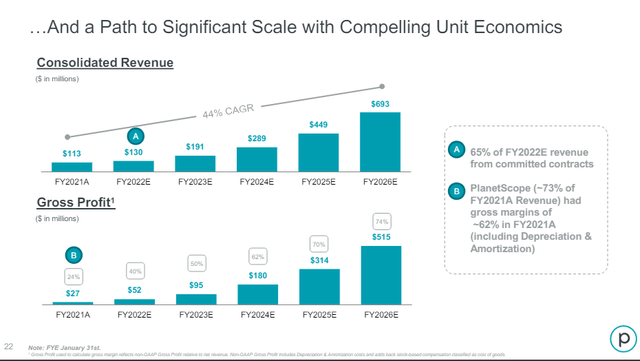

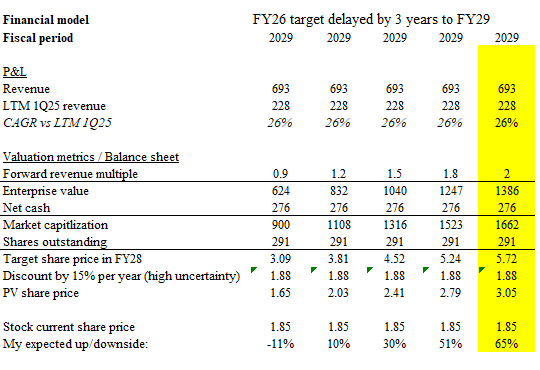

Primarily based on my analysis and evaluation, my anticipated goal value for PL is a variety between $1.90 and $3.50. Due to the problem in modeling the timing of development, I’ve reconstructed my mannequin to concentrate on administration’s long-term goal (initially $693 million by FY26). Primarily based on PL’s LTM 1Q25 income of $228 million, PL is about 3 years behind its unique timeline. Assuming the timeline to attain $693 million is pushed again by 3 years, I assumed PL would obtain the goal by FY29. I’ve additionally laid out 5 totally different eventualities, every with a distinct ahead income a number of assumption, to showcase the danger/reward state of affairs (at a reduced foundation). My view is that if PL can obtain $693 million by FY29, which interprets to a CAGR of 26% and may be very prone to be adj EBITDA worthwhile by then, multiples ought to commerce up naturally.

Danger

Any accidents associated to the upcoming satellite tv for pc launch of current satellites will closely impair PL’s potential to develop, as they are going to impede its potential to collect knowledge. This may push out the timeline to achieve adj EBITDA worthwhile as extra investments are wanted to restore these satellites.

Conclusion

I give a purchase ranking for PL because it confirmed nice progress each financially and operationally. Current developments just like the upcoming Tanager-1 launch and the Insights Platform are very encouraging, which instilled extra confidence in me that PL can see development acceleration. PL’s partnership with Nvidia strengthens their knowledge processing capabilities, giving them a aggressive edge. Contemplating the risk-reward state of affairs, I consider the present share value presents a lovely entry level for buyers.

[ad_2]

Source link