[ad_1]

Lee Hyuck

Elevator Pitch

POSCO Holdings Inc. (NYSE:PKX) [005490:KS] inventory is awarded a Purchase ranking. My earlier Might 1, 2024 replace reviewed PKX’s Q1 2024 monetary outcomes.

The present article analyzes POSCO Holdings’ not too long ago introduced capital return and progress plans. The inventory’s potential shareholder yield for 2024 is now at a mid-single digit degree after contemplating the corporate’s newest treasury share cancellation plan. Additionally, PKX goals to broaden the highest line for its battery supplies enterprise by a formidable +32% CAGR for the 2023-2026 time-frame.

I improve my ranking for POSCO Holdings from a Maintain to a Purchase, with the inventory providing a good mixture of yield (mid-single digit proportion shareholder yield) and progress (battery supplies enterprise’ long-term or 2026 income aim).

Share Repurchase and Cancellation of Treasury Inventory Will Enhance Shareholder Yield

Final Friday, POSCO Holdings revealed an announcement disclosing that the corporate will “purchase again and cancel all newly bought treasury shares price KRW100 billion” this yr. Within the July 12, 2024 announcement, PKX additionally highlighted that it’s focusing on to “cancel treasury shares” price KRW1.9 trillion or equal to “6% of excellent shares” within the 2024-2026 time-frame.

In different phrases, PKX goals to cancel roughly KRW2.0 trillion price of its personal shares within the coming three years. As such, POSCO Holdings’ potential ahead annualized buyback yield is 2.3%. That is calculated by dividing the KRW2.0 trillion price of shares focused for buybacks and cancellation by the inventory’s market capitalization, after which averaging it for the three-year interval.

It’s affordable for the buyback yield metric to incorporate the cancellation of treasury inventory, because it is not the norm for Korean corporations to cancel their treasury shares. A June 5, 2024 Korea Instances information commentary indicated that “solely 2.3 p.c of corporations in Korea retired their treasury shares” not like their US counterparts. Which means that it’s extra applicable to think about capital as being returned to shareholders when the repurchased shares are literally cancelled.

POSCO Holdings’ dividend coverage assumes a “base dividend of KRW 10,000 per share” as indicated on the corporate’s investor relations web page. Due to this fact, the sell-side analysts’ consensus FY 2024 dividend per share forecast of KRW10,075 (supply: S&P Capital IQ) or barely above the bottom dividend is practical.

The inventory’s consensus FY 2024 dividend yield is 2.6% based mostly on the KRW10,075 per share dividend estimate, whereas its potential buyback yield for the present yr is 2.3% as talked about above. This interprets into a fairly interesting mid-single digit proportion shareholder yield (sum of dividend yield and buyback yield) of 4.9% for POSCO Holdings.

Lithium-ion Battery Supplies Enterprise’ High-Line Growth Aim

On July 12, 2024, PKX additionally issued a 6-Okay submitting outlining its aim of realizing a KRW11 trillion prime line for the corporate’s lithium-ion battery supplies operations in 2026.

The corporate’s lithium-ion battery supplies unit referred to as POSCO Future M [003670:KS] registered a income of KRW4.76 trillion in the latest fiscal yr or FY 2023. As such, POSCO Holdings’ KRW11 trillion top-line targets for its battery supplies enterprise is equal to a possible income CAGR of +32% for the FY 2023-2026 interval. It will likely be honest to say that the battery supplies unit will likely be a key medium-term progress engine for PKX.

Particulars Of The Firm’s Battery Supplies Facility Growth Plans

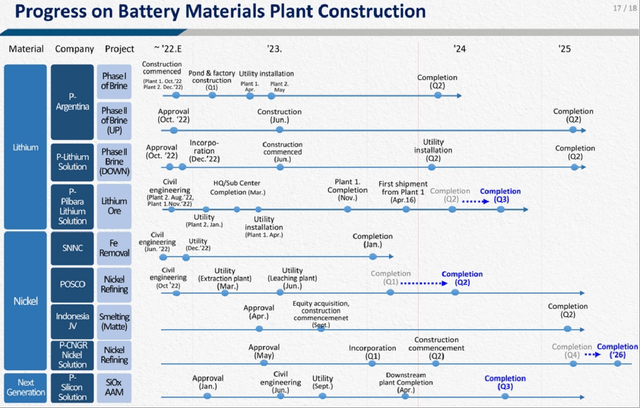

POSCO Holdings’ Q1 2024 Earnings Presentation Slides

As per the chart offered above, the corporate has plans in place to ascertain new battery supplies manufacturing services. The focused +32% prime line CAGR for PKX’s battery supplies enterprise will likely be achieved by rising the manufacturing capability of its operations with these new services within the pipeline. In keeping with a July 14, 2024 information article revealed in The Korea Financial Day by day, the corporate intends to monetize “non-core belongings and low-profit companies” for KRW2.6 trillion to finance the enlargement of its lithium-ion battery supplies enterprise.

The rise in income contribution from the lithium-ion battery supplies enterprise has two key positives for PKX.

One constructive is that POSCO Holdings will turn out to be extra diversified over time with a discount in income focus dangers. PKX derived 82% of its FY 2023 income from its core metal manufacturing enterprise. POSCO Holdings’ important dependence on the corporate’s metal operations implies that PKX’s total monetary efficiency is definitely impacted by financial weak point (affecting metal demand) and oversupply within the metal market.

The opposite constructive is that PKX is prone to command a extra demanding valuation a number of with a rise in income publicity to the battery supplies enterprise. POSCO Future M, POSCO Holdings’ battery supplies unit, is a individually listed entity that trades on the Korea Trade with a consensus subsequent twelve months’ Enterprise Worth-to-Income a number of of 5.0 instances (supply: S&P Capital IQ). As compared, the market at present values POSCO Holdings at a comparatively decrease consensus subsequent twelve months’ Enterprise Worth-to-Income ratio of 0.6 instances. Based mostly on the variations in valuations, it’s clear that the market sees the battery supplies enterprise having higher progress potential than the metal enterprise.

Q2 2024 Outcomes Preview

POSCO Holdings will reveal the corporate’s second quarter monetary efficiency on July 25.

My view is that PKX’s Q2 outcomes will likely be in keeping with expectations and there will not be main damaging surprises. The corporate’s core metal operations will probably stay beneath strain resulting from metal worth weak point, however that is already mirrored in its consensus monetary forecasts.

A July 15, 2024 analysis commentary revealed by S&P International highlighted that “China’s home metal costs would possibly proceed to fluctuate at decrease ranges, amid subdued metal demand and comparatively robust metal manufacturing.” China is the largest provider of metal worldwide, so weak metal costs within the nation will even influence the promoting costs for POSCO Holdings’ metal merchandise.

Nonetheless, the damaging outlook for the metal enterprise is already mirrored in PKX’s Q2 2024 consensus projections. As per S&P Capital IQ’s consensus information, POSCO Holdings’ prime line and normalized EPS in KRW phrases are projected to lower by -7.4% YoY and -42.9%, respectively in Q2. That is fairly just like the corporate’s precise -6.7% YoY income contraction and -48.4% YoY bottom-line drop for Q1 2024.

Threat Elements

There are a selection of dangers to observe concerning POSCO Holdings.

Firstly, the inventory’s precise shareholder yield could be decrease than anticipated, if the corporate does not cancel its treasury shares as per its newest announcement.

Secondly, PKX might fail to satisfy its 2026 income goal, assuming that it’s not in a position to execute nicely on its asset monetization plans to finance the manufacturing capability enlargement initiatives for its battery supplies enterprise.

Thirdly, it’s attainable that POSCO Holdings’ second quarter outcomes are a miss within the occasion that the corporate’s precise metal product promoting costs are a lot decrease than anticipated.

Concluding Ideas

I fee POSCO Holdings as a Purchase now, as the corporate’s shares have significant valuation re-rating potential. As talked about earlier on this article, PKX’s listed battery supplies enterprise trades at a a lot larger Enterprise Worth-to-Income a number of than its guardian. Due to this fact, it’s affordable to suppose that POSCO Holdings’ Enterprise Worth-to-Income metric can broaden going ahead with a better top-line contribution from the battery supplies operations. The latest determination to cancel KRW2.0 trillion of treasury shares, which can improve the inventory’s shareholder yield, is one other valuation re-rating driver.

[ad_2]

Source link