[ad_1]

aluxum

Funding briefing

After extensively reviewing the funding case for Privia Well being Group, Inc. (NASDAQ:PRVA) findings corroborate a revised purchase score for my part. Following the September FY’22 publication on PRVA, a number of pointers counsel the corporate can unlock danger capital for fairness traders this 12 months. PRVA displays progress in key enterprise metrics underlying its unit economics, rising attributable lives by 335,000 these previous 3 years, together with $750mm in apply collections and ~1,500 in suppliers. Additional, it’s recycling respectable amount of money flows off an asset-light enterprise mannequin and redeploying this again into operations. Internet-net, I revise PRVA to a purchase, eyeing $32/share because the preliminary worth goal.

Determine 1. PRVA worth evolution

Knowledge: Updata

Essential funding details forming purchase thesis

The funding debate is solidified by three main components in PRVA’s case for my part—basic/financial components (asset-light earnings progress), sentiment, and valuation. The case is printed beneath.

1. Q2 financials—clear upsides in core enterprise

Evaluation of the agency’s newest numbers displays a trajectory of progress and operational effectivity. I’ve summarized the 5 main information factors in numerical order beneath:

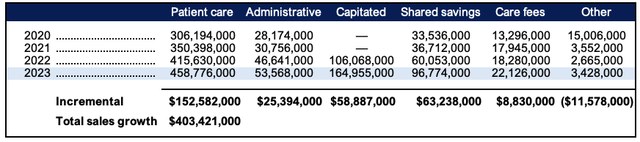

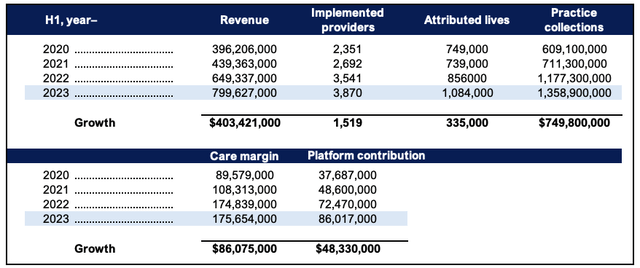

1. High-line progress and gross margins: Complete income got here to $413.4mm, up 23.2% YoY from $335.5mm. This outstanding income progress signifies the corporate’s strong market presence and efficient operational methods. It pulled this to gross of $90.2mm, a acquire of ~$15mm YoY. Progress was underscored by efficiency throughout all segments. For the YTD, turnover got here to $799mm, with affected person care driving the majority of this with $458mm booked on the high line.

Determine 2. H1 income clip, annually from 2020

Knowledge: BIG, firm filings

2. Money circulate backing income: It pulled this to quarterly working revenue of $7mm on OCF of $7.6mm, a c.2% money circulate margin. The majority of money ‘outflows’ are booked as modifications in accounts receivable, because the agency ramps up turnover and books extra revenues ahead from key clients. What’s necessary for my part is the money conversion from working revenue is excessive, but additionally the unit economics backing these money flows and receivables is stretching greater.

4. Supplier Growth: Critically, the unit economics driving gross sales and money flows are a driving progress for PRVA. For one, applied Supplier depend was 9.3% totalling 3,870 for the quarter. Stepping again on this and also you see the expansion in these key metrics since 2020 [Figure 3, using H1 numbers each year]. Suppliers have elevated by 1,519, attributed lives are up 335,000 to 1.08mm, and apply collections have elevated ~$750mm during the last 3 years. This qualifies PRVA as a progress title for my part and suggests additional momentum from its unit economics going ahead. Administration forecast 1.15 attributed lives by yearend, on $2.8Bn in apply collections, and 4,150 applied suppliers. You’ll be able to see the care and platform contributions beneath as properly, noting the doubling of progress in every from H1 FY’20–H1 FY’23. These are constructive factors for my part.

Determine 3.

Knowledge: BIG, firm filings

5. Strategic pivot to value-based care: As an extension of level (4), Q2 noticed value-based care contribute 37% of the highest line, a notable enhance from the 29.6% booked final 12 months. It is a strategic transition for my part. Specifically, it underlines PRVA’s progress in at-risk contracts and matches with the expansion numbers outlined earlier. You see this within the agency’s broad providing. The 1.08mm attributed lives are claimed throughout >100 at-risk payer contracts. The 27% YoY progress in attributed lives outlined earlier can be key proof PRVA’s technique is working right here as properly.

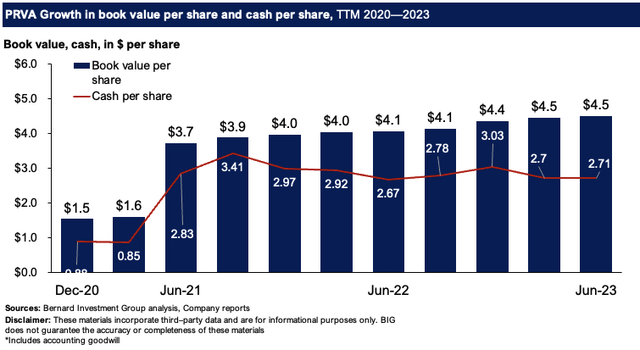

2. Financial worth created for shareholders

There are a number of benefits to PRVA’s working mannequin that make it engaging inside my fairness finances. For one, it’s an asset-light mannequin that produces affordable money flows off capital deployed. This has resulted in a tidy sequential enhance in web asset worth per share and money per share. You’ve got received guide worth/share up from $3.70 since itemizing to $4.50/share, whereas it now boasts >$2.70 in money per share.

Determine 4.

BIG Insights

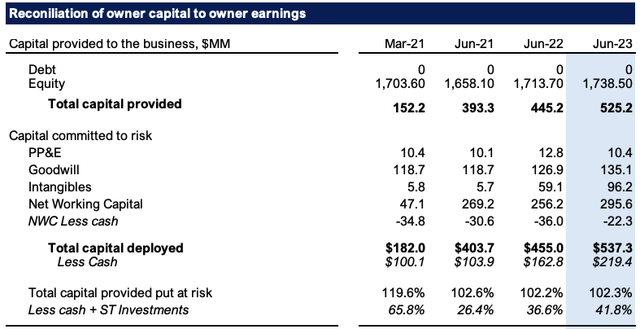

Traders have offered the agency with $525mm in capital (all fairness financed) and PRVA has put 102% of this in danger into rising the enterprise. Stripping out the money available, it has solely put 42% to work, the rest tied up in marketable securities. Not the worst thought, with money yielding 4–5% these previous 2 years. The money additionally offers PRVA the optionality to deploy when wanted and nearly covers all non-interest-bearing liabilities within the present account.

Determine 5.

Knowledge: BIG, firm filings

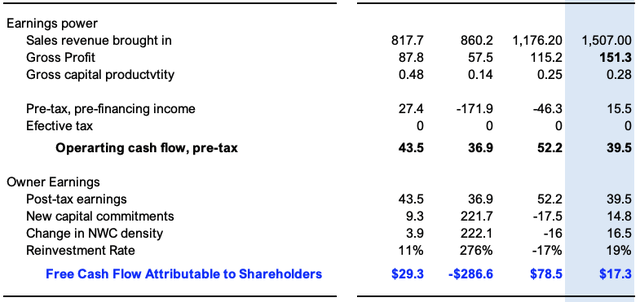

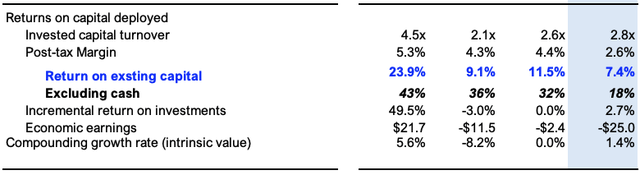

PRVA earned $39.5mm in trailing OCF on this $537mm and recycled ~19% of money circulate again into the enterprise to fund its progress initiatives for the rest of FY’23. It additionally made ~$15mm in new capital commitments to supply the $39.5mm in money circulate, in any other case a 2.6% margin as outlined earlier. Critically, the agency additionally spun of ~$17.3mm in money to its homeowners (TTM values) by the tip of the quarter.

Determine 6.

Knowledge: BIG, firm filings

Critically, the money circulate return on investments (“CFRoI”) has yielded 7.4% within the TTM, however pushes to 18% extracting money available from the invested capital calculus. The agency’s strengths lie in its capital effectivity, the place it seems to be to make use of a value differentiation technique, turning over its investments 2.8x over the TTM. That is in synch with historic vary. The differentiation technique implies it’s looking for aggressive benefit by pricing its providers/choices beneath the business common—is sensible for my part, given the numerous conversions of attributed lives on a rolling foundation. This implies it may possibly give attention to driving upside on the post-tax margin and probably enhance profitability past what’s seen right here.

Furthermore, at 18% trailing CFRoI, you are incremental funding returns of two.7%, which is accretive to the corporate’s valuation. What this evaluation tells me is that:

PRVA’s asset-light enterprise mannequin drives financial worth by way of the environment friendly use of capital to supply money flows; These money flows are recycling again to PRVA at ~18%— up to28% on common during the last 3 years (TTM values); This allows the corporate to redeploy money at these charges of return to compound the intrinsic worth of the enterprise.

These are engaging economics for my part and help an upside view on the corporate’s market worth, which is more likely to observe its enterprise returns over the long term.

Determine 7.

Knowledge: BIG, firm filings

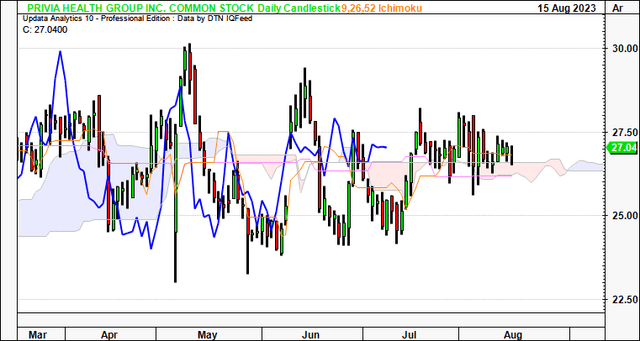

Valuation

To worth PRVA a number of factors are considered. One is the long-term view of worth visibility and goal technical targets. You’ll be able to see in Determine 8, the day by day cloud chart, each the value line and lagging line (in blue) are positioned above the cloud. Critically, it has been testing the cloud as help since July, having bounced from the bottom a variety of occasions. It tells me the inventory finds help even when it sells at these key psychological ranges. That each traces are above the cloud is bullish to me, and the day by day chart seems to be to the weeks forward.

Determine 8.

Knowledge: Updata

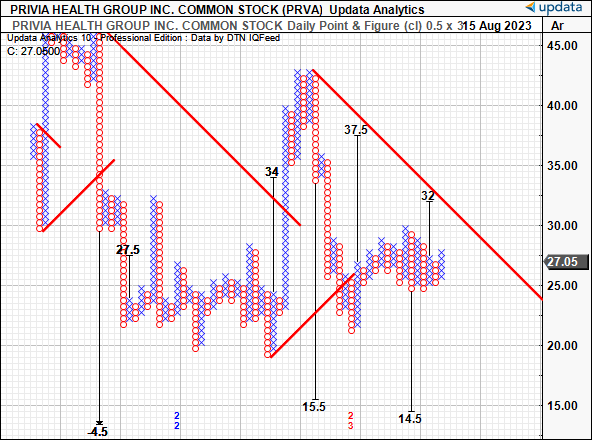

Furthermore, we’ve upside targets to $32 and $37.5 on the purpose and determine research beneath. These cancel the noise of time and supply a extra goal view of worth visibility by eradicating intra-trend volatility. Mathematical formulae are then used to derive the value targets primarily based on a multi-faceted slew of market information. That we’ve upsides to the $30’s is bullish to me, and a break greater might see us head to $32. That is my preliminary goal.

Determine 9.

Knowledge: Updata

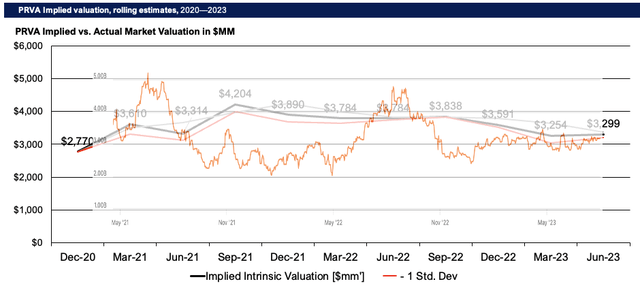

PRVA’s financial components additionally play into the valuation calculus right here. The inventory sells at 1.8x ahead gross sales as I write, attractively priced at a 50% low cost to the sector. The market has already rewarded the corporate with $6 in market worth for each $1 in guide worth—clear indication of the worth of its web property, as outlined beforehand. A agency can even compound its intrinsic worth on the earnings or money flows it produces off the capital deployed into the enterprise, and the way a lot it invests at these charges. Making use of the calculus to PRVA since its itemizing spits out a price of $3.3Bn in market worth, roughly in line the place it sells right this moment.

Determine 9.

Knowledge: BIG Insights, Looking for Alpha

Critically, my ahead assumptions into 2024 put the corporate at $3.7Bn in market worth or $32/share—consistent with the technically derived targets above. This provides a layer of confidence to $32 because the preliminary worth goal in my view, and likewise helps the bullish view.

Determine 10.

Knowledge: BIG Insights, Looking for Alpha

Briefly

PRVA’s comparatively non-complex enterprise mannequin gives upside potential into the approaching durations for my part. You’ve got received an asset-light enterprise mannequin that has potential to earn excessive charges of return on capital deployed, coupled with progress in unit economics and money flows. A purchase score is supported by the financial worth this could create or shareholders going ahead for my part. My assumptions have the agency valued at $3.7Bn out to FY’24, and discounting this to right this moment will get me to $32/share—a determine additional supported each technically and essentially. Internet-net, I revise PRVA to a purchase, on the lookout for asymmetrical upside with the inventory priced at ~1.8x gross sales, 50% low cost to the sector. Revise to purchase.

[ad_2]

Source link