[ad_1]

honglouwawa

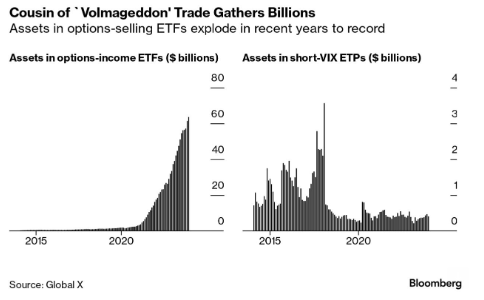

We’re more and more seeing funding managers launch short-volatility structured merchandise that mix investments in fairness indices just like the Nasdaq 100 Index with a derivatives overlay to generate choice earnings. In March, Bloomberg estimated that over $60 billion was invested in these methods (Determine 1).

Determine 1 – Growing investor urge for food for options-income ETFs (Bloomberg)

One new entrant on this area is the Neos Nasdaq-100 Excessive Revenue ETF (NASDAQ:QQQI).

Much like its sibling fund, the Neos S&P 500 Index Excessive Revenue ETF (SPYI), QQQI’s mandate permits the fund supervisor flexibility in various the notional overwritten and selecting to jot down name spreads as an alternative of calls. This flexibility will be very beneficial after sharp market declines when promoting calls can truncate fund returns.

Total, the QQQI has delivered whole returns consistent with the buy-rated JEPQ ETF. The selection between QQQI and JEPQ might come right down to an investor’s choice for earnings or capital beneficial properties. I price the QQQI a purchase.

Fund Overview

The Neos Nasdaq-100 Excessive Revenue ETF is an actively managed ETF that goals to spend money on the holdings of the Nasdaq-100 Index whereas utilizing a ‘data-driven’ name choice technique to generate premium earnings.

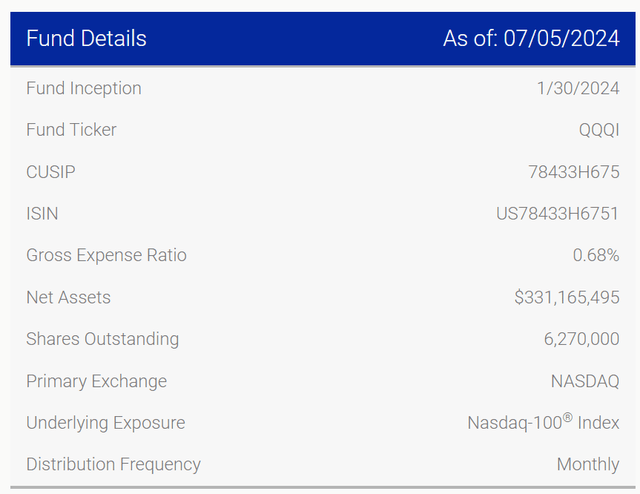

The QQQI ETF was not too long ago launched in January 2024, so it doesn’t have an extended working historical past. Nevertheless, following the success of its sibling fund, the Neos S&P 500 Index Excessive Revenue ETF (“SPYI”), QQQI has gathered over $330 million in belongings in a matter of months (Determine 2). Like SPYI, the QQQI ETF prices a 0.68% expense ratio.

Determine 2 – QQQI overview (neosfunds.com)

Technique

Much like SPYI, the QQQI invests within the shares that make up the Nasdaq-100 Index plus a name choices technique that includes a mixture of written name choices and lengthy name choices (i.e. writing name spreads).

Moreover, by using NDX Index choices which can be categorized as ‘Part 1256 Contracts’, the QQQI ETF might obtain favorable tax therapy as Part 1256 contracts are taxed at 60% long-term / 40% short-term capital beneficial properties taxes.

Portfolio Holdings

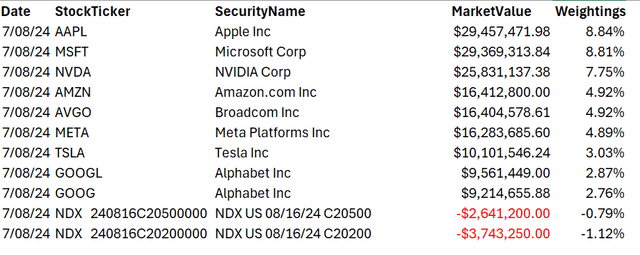

As per the fund’s mandate, the QQQI ETF holds the shares within the Nasdaq-100 Index along with writing name choices. As of July 8, 2024, the QQQI ETF has written name choices on the NDX Index with strike costs of 20500 and 20200 and expiring on August sixteenth (Determine 3). Opposite to the technique description above, the QQQI ETF at present doesn’t maintain any lengthy name choices.

Determine 3 – Abbreviated portfolio holdings of QQQI (Writer created from portfolio holdings file)

With the Nasdaq-100 Index at present at ~20,400, it seems the QQQI has written choices which can be barely within the cash (“ITM”) and out of the cash (“OTM”). The QQQI has written 124 choice contracts in whole, value $254 million in notional worth (every NDX choice multiplier is $100), so the QQQI has overwritten ~76% of the notional of the fund.

Returns

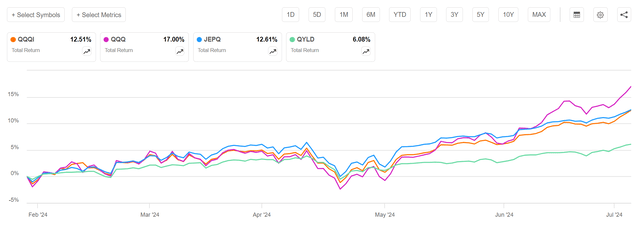

Since its inception, the QQQI ETF has delivered robust whole returns of 12.5% in comparison with 17.0% for the Invesco QQQ ETF (QQQ), which can also be primarily based on the Nasdaq-100 Index (Determine 4).

Determine 4 – QQQI vs. QQQ, since inception (Searching for Alpha)

For a technique that routinely trades away upside for premium earnings, QQQI has a reasonably robust 74% upside seize ratio. Nevertheless, given the plethora of buy-write funds out there, how does QQQI stack up towards its friends?

QQQI vs. Friends

Evaluating the QQQI ETF towards two standard Nasdaq-100-based ETFs, the JPMorgan Nasdaq Fairness Premium Revenue ETF (JEPQ) and the World X Nasdaq 100 Lined Name ETF (QYLD), we are able to see that QQQI has delivered in-line efficiency in contrast with JEPQ however has outperformed the QYLD (Determine 5).

Determine 5 – QQQI vs. JEPQ and QYLD, since inception (Searching for Alpha)

The distinction within the whole return efficiency between QQQI, JEPQ, and QYLD will be attributed to the refined variations of their methods. First, evaluating QQQI to JEPQ, we all know that JEPQ overwrites 100% of its portfolio, however primarily makes use of barely OTM calls. Then again, the quantity of notional overwritten by QQQI is at administration’s discretion, and judging from Determine 3 above, QQQI tends to jot down ATM or barely OTM calls.

Evaluating QQQI and QYLD, we all know that QYLD overwrites 100% of its notional utilizing ATM choices whereas QQQI varies the proportion overwritten and should use OTM choices. Utilizing ATM choices is a sub-optimal answer in rising markets, as the decision choices usually finish within the cash (“ITM”) and QYLD has to pay a money outlay to settle the choices. This results in underperformance.

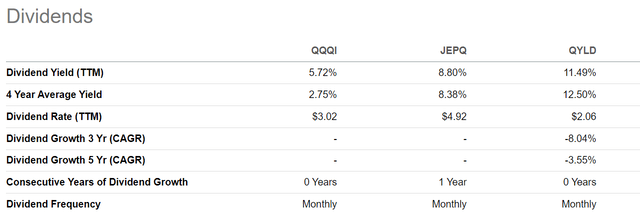

After evaluating whole returns, Determine 6 compares the distribution yields of the three funds. Traders ought to observe that QQQI’s distribution price is unassuming, because the fund solely started operations in January. Primarily based on the newest month’s distribution annualized, QQQI is yielding 14.5%.

Determine 6 – QQQI vs. JEPQ and QYLD, distribution (Searching for Alpha)

Total, QQQI and JEPQ are clearly superior to QYLD by way of whole returns. Nevertheless, choosing between QQQI and JEPQ could also be as much as the investor’s private choice between receiving returns as month-to-month earnings or unrealized as future capital beneficial properties.

Capped-Upside/Uncapped-Draw back Is Major Danger Of QQQI

Whereas QQQI has delivered strong historic returns, one fly within the ointment could also be QQQI’s draw back publicity. The primary weak point of the buy-write technique is that upside returns are capped by name choices offered, however draw back returns are uncapped. Throughout violent selloffs, the QQQI ETF might decline practically as a lot because the underlying index. Though so far we have now not had such a drawdown, it’s virtually inevitable that the QQQI ETF will expertise a big drawdown sooner or later sooner or later.

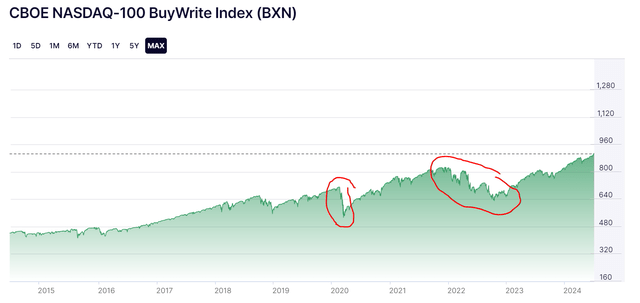

For instance, the CBOE Nasdaq-100 BuyWrite Index, an index modeling the buy-write technique on the Nasdaq-100 Index utilizing ATM choices, has suffered two important 10% drawdowns since 2014 (Determine 7).

Determine 7 – CBOE Nasdaq-100 BuyWrite Index historic returns (cboe.com)

Traders within the QQQI ETF and related buy-write methods must be mentally ready for giant potential drawdowns when the tide turns towards know-how shares.

Conclusion

Following on the success of the SPYI ETF, the Neos Nasdaq 100 Excessive Revenue ETF is a brand new entrant within the BuyWrite ETF area specializing in the Nasdaq 100 Index. The QQQI ETF invests in a portfolio that replicates the Nasdaq 100 Index plus a ‘data-driven’ name choice technique that will purchase and promote name choices to generate earnings.

I consider QQQI’s flexibility in writing coated name spreads on various notional publicity will be very beneficial, particularly after sharp market declines when writing coated calls can truncate returns and result in underperformance.

Up to now, the QQQI ETF seems to be a strong earnings fund, paying a 14.5% annualized distribution yield with whole returns of 12.5% since inception, or 74% of the index’s returns over the identical time interval. QQQI’s whole returns are consistent with the favored JPMorgan Nasdaq Fairness Premium Revenue ETF (“JEPQ”).

Total, I consider the QQQI ETF deserves a purchase for buyers looking for earnings from a progress portfolio. The selection between QQQI and JEPQ is as much as the investor’s choice between receiving whole returns through earnings or future capital beneficial properties.

[ad_2]

Source link