[ad_1]

What a distinction a 12 months makes.

Whereas the mortgage business has been buy loan-heavy for a number of years now, it might lastly be beginning to shift.

A brand new report from Optimum Blue revealed that fee and time period refinance quantity elevated practically 110% in August from a month earlier, and 310% from the 12 months earlier than.

Driving the rising pattern is cheaper mortgage charges, which have lastly begun to speed up decrease in latest months.

Assuming they proceed on their newfound trajectory, there’s a great likelihood refis will likely be again en vogue in 2025 and past.

Mortgage Refinance Share Highest Since Spring 2022

It has been a tough few years for mortgage officers and mortgage brokers, however it’s doable the worst is over.

As mortgage charges practically tripled from sub-3% ranges in early 2022 to over 8% final 12 months, originators got here up with the saying, “Survive ‘til 25.”

The thought was that in the event you might hold on and journey out the storm (of low lending quantity) in 2024, you’d be rewarded in 2025.

And whereas that generally felt far-fetched, it appears to be like prefer it might really come to fruition, and even perhaps forward of schedule.

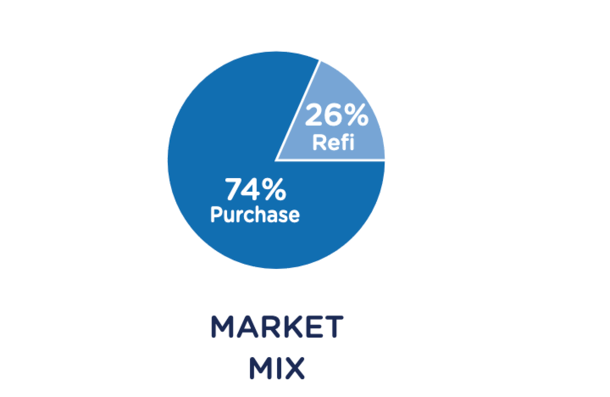

The newest Market Benefit report from Optimum Blue discovered that mortgage refinances accounted for 26% of complete dwelling mortgage manufacturing, the best share since March 2022.

At the moment, you would nonetheless get a 30-year mounted within the 3% vary. However charges ascended quickly from there, principally wiping out all refinance exercise in a matter of months.

So it’s fairly telling that refinance market share is now again to these ranges and sure rising in coming months and years.

The 30-year mounted has fallen pretty dramatically after peaking at round 7.25% this Might. It now stands at round 6% and appears poised to hit the 5s sooner somewhat than later.

Charges have a reasonably sturdy tailwind proper now with weakening financial knowledge, increased unemployment, and a bunch of Fed fee cuts within the pipeline.

That would unleash hundreds of thousands of further refinance candidates, together with many of 4 million who took out a 6.5%+ fee mortgage since 2022.

The Solely Method Is Up

Whereas that is nice information for the mortgage business, and for latest dwelling patrons, mortgage quantity continues to be small potatoes relative to latest years.

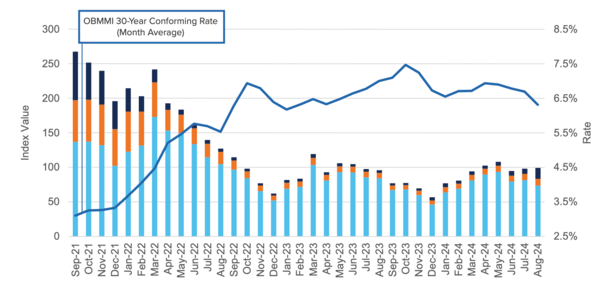

For those who take a look at the chart above, you’ll see the context of that 109% month-to-month enhance and 310% annual surge.

The darkish blue vertical line (fee and time period refinance share) has gotten rather a lot wider, however continues to be only a tiny sliver of general mortgage market quantity.

However once you examine it to ranges seen in 2021 and early 2022, it doesn’t take a lot to register massive share beneficial properties.

Once we embody money out refinances (orange line), which elevated 8% on a month-to-month foundation and over 20% yearly, you get a decent refinance share once more.

And likelihood is this may solely go up as extra mortgages fall into the cash for a refinance.

Recently, it’s largely been VA loans which have benefited from a refinance as a result of mortgage charges on such loans are the bottom.

But when charges proceed on their merry could decrease, you’ll begin seeing extra conforming loans profit, which make up the lion’s share of the market.

It has been more durable to make the maths pencil on loans backed by Fannie Mae and Freddie Mac due to LLPAs (pricing changes). That would quickly change.

Residence Buy Lending Has Fallen Flat Thus Far

Whereas refis are lastly having a second, the identical can’t be mentioned of dwelling buy lending (mild blue vertical line above).

Certain, it nonetheless holds a majority share of the mortgage market and sure will subsequent 12 months too, however it’s starting to cede a few of it again to refis.

And that’s troubling given the massive drop in mortgage charges, which was presupposed to get dwelling patrons off the fence.

To date, the impact has been muted, with buy locks really down 16% year-over-year and a staggering 45% since August 2019.

Optimum Blue blamed it on “continued affordability and stock challenges,” with dwelling costs out of attain for a lot of regardless of the advance.

Many anticipated dwelling costs to surge when charges fell, however I’ve been arguing for some time that there’s no inverse relationship.

And actually, dwelling costs and mortgage charges can fall collectively if financial circumstances warrant it.

Keep in mind, there’s a cause the Fed is trying to minimize its personal fed funds fee greater than 200 foundation factors (bps) over the following 12 months.

A slowing economic system is perhaps excellent news for mortgage charges, however not essentially the housing market.

With dwelling costs nonetheless at all-time highs nationally and affordability close to all-time lows, it’s simply not a good time to purchase for a lot of people.

Sprinkle in uncertainty concerning the economic system, the election, and even how they’ll pay actual property agent fee and it’s not so rosy anymore.

In different phrases, considerably decrease mortgage charges may not quantity to increased dwelling costs, or a larger variety of dwelling gross sales simply but.

However given the timing of those decrease charges (submit peak dwelling shopping for season), we gained’t actually know for positive till subsequent spring.

That’s the place the rubber meets the street.

Earlier than creating this web site, I labored as an account government for a wholesale mortgage lender in Los Angeles. My hands-on expertise within the early 2000s impressed me to start writing about mortgages 18 years in the past to assist potential (and present) dwelling patrons higher navigate the house mortgage course of. Comply with me on Twitter for decent takes.

[ad_2]

Source link