[ad_1]

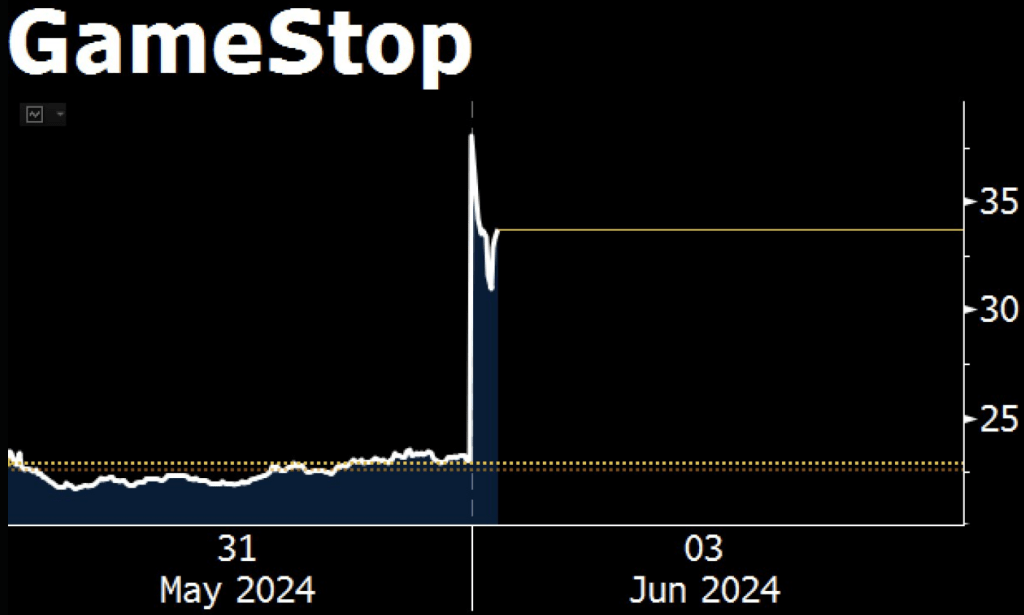

The echoes of 2021’s meme inventory saga reverberated by monetary markets this morning, because the obscure ROAR meme coin and online game retailer GameStop skilled a meteoric rise fueled by social media nostalgia. The catalyst? The return of a well-recognized face – Keith Gill, higher identified by his on-line moniker “Roaring Kitty.”

Associated Studying

Kitty Claws Again In

Retail traders have been despatched scrambling after Gill, a celebrity among the many on-line funding neighborhood on Reddit’s WallStreetBets discussion board, posted a cryptic message hinting at a major stake in GameStop.

The submit, that includes a picture of the “Uno Reverse” card, despatched hypothesis into overdrive. Shortly after, Gill confirmed his bullish stance by revealing an enormous holding of 5 million GameStop shares, valued at roughly $116 million primarily based on Friday’s closing value.

Within the 20 minutes that adopted Gill’s submit, GameStop’s inventory value on Robinhood’s in a single day markets shot up by 20% to $27.50. This improve adopted the inventory’s Friday closing value of $23.14. This 12 months, the shares have elevated by nearly 40%, presumably because of Gill’s sudden comeback.

This disclosure despatched shockwaves by the market. GameStop’s inventory, notorious for its volatility throughout the meme inventory frenzy of 2021, surged over 100% at its peak in pre-market buying and selling on Monday.

NOW: GameStop soars after the Reddit account that drove the meme-stock mania of 2021 posted what seemed to be a $116 million wager https://t.co/0mnyJF4lIf pic.twitter.com/rpRdA2AIWL

— Bloomberg Markets (@markets) June 3, 2024

Whereas the worth finally settled to a powerful 88% improve, the roar from retail traders was plain. The ROAR meme coin, seemingly named in homage to Gill’s on-line persona, mirrored the GameStop value surge of over 300%, reaching a excessive of $0.001643.

A Meme Inventory Revival?

The sudden rise of each ROAR and GameStop has reignited the talk surrounding meme shares. These property, typically characterised by excessive volatility and pushed extra by on-line hype than conventional monetary metrics, captured the creativeness of retail traders in 2021. Gill, who performed a pivotal position within the preliminary GameStop saga, seems to be a key participant on this potential revival.

Nevertheless, analysts stay cautious. GameStop itself is in a precarious place, having not too long ago offered an enormous chunk of shares to bolster its funds whereas dealing with continued internet losses and projected gross sales declines. The corporate’s long-term prospects stay unsure, elevating questions on whether or not it is a real resurgence or just a nostalgic echo of 2021.

Associated Studying

Weighing Hype In opposition to Actuality

The current surge in ROAR and GameStop presents a traditional risk-reward situation for traders. Early members who purchased in at decrease costs stand to reap important earnings. Nevertheless, the inherent volatility of meme shares poses a major hazard of considerable losses.

Featured picture from HubPages, chart from TradingView

[ad_2]

Source link