[ad_1]

Richard Drury

Inflection investing goals at figuring out inflection factors, i.e., adjustments in pattern from damaging to constructive (or no less than to impartial). It has connections with capital cycle idea. This idea focuses on the artistic destruction course of that dominates cyclical sectors: durations of excessive costs spur producers to broaden manufacturing in extra of demand, which results in a glut and a collapse in costs, to which producers reply by reducing manufacturing, till costs get better, and the cycle can begin once more. Investing on the backside of a cycle, earlier than the inevitable restoration, is a type of inflection investing.

Inflection factors are usually not essentially tied to the capital cycle. They’ll additionally coincide with political occasions resulting in a extra business-friendly setting and an improved financial outlook, which mirror positively on the basics of total industries. For instance, the election of Milei in Argentina arguably marked an inflection level for the Argentinian inventory market.

I imagine Sasol (NYSE:SSL) (OTCPK:SASOF), one of many world’s largest producers of chemical compounds and fuels from coal and fuel, at the moment finds itself on the intersection of two inflection tales. The primary has to do with the specifics of the sectors the corporate operates in: the chemical sector has confronted important difficulties within the final two years; it seems now to have reached a backside and a restoration might materialize over the following 12 months. The second has to do with current political occasions in South Africa, the place nearly all of the corporate’s operations are concentrated, and the political consensus is transferring in a extra pragmatic path.

Prospects for the chemical sector

Sasol is a well-diversified and built-in firm working in three foremost segments: mining, power, and chemical compounds. In FY 2023, Sasol reported adjusted EBITDA of R68.6 billion, of which 7% attributable to mining, 56% to power and 37% to chemical compounds. Contemplating that power costs have been traditionally excessive in FY 2023, whereas chemical costs have been declining, the chemical and power sectors at the moment contribute roughly the identical to the underside line, whereas mining is of negligible significance. The chemical phase can be the one the place the strategic focus of the corporate goes to be positioned going ahead. The prospects of the chemical sector have due to this fact a major influence on the long run financials of the corporate.

Following the invasion of Ukraine, margins within the chemical sector have been severely compressed. Costs decreased, attributable to a slowdown in financial development and excessive stock ranges. On the identical time, prices, significantly attributable to power and feedstocks, elevated, exacerbated by excessive labor prices and regulatory burdens. The influence was significantly felt by European producers. Corporations like BASF have been compelled to downsize or “rightsize” their European operations to protect profitability. Sasol was additionally affected. The corporate has operations in Europe (primarily in Germany, but in addition in Slovakia and Italy), along with Africa and North America. From the start of FY 2024 (in July 2023), gross sales revenues are down 23% from European operations, whereas they’re down 15% from African operations and 13% from American operations. Operations in Africa have been additionally affected by challenges skilled by Transnet, the state-owned South African logistical firm.

Regardless of this bleak outlook, there are indicators the sector has bottomed and began to get better. S&P International is forecasting a gradual restoration in 2024, with a probable flattish first half and average development within the second half. Fitch gave the sector a “impartial” outlook for 2024, noting that costs and margins reached bottom-of-the-cycle circumstances in 2023. In keeping with VCI, Germany’s main chemical trade affiliation, in Q1 2024, regardless of costs nonetheless 5.6% beneath the year-earlier interval, manufacturing expanded by 4.4%, the primary improve because the COVID-19 pandemic.

The next excerpts are taken from the Q2 2024 Convention Name:

Chemical substances Eurasia adjusted EBITDA decreased by 84% in comparison with the earlier interval. Margins have been largely impacted by continued low market demand and better pre-war power costs. Towards the backdrop of difficult macroeconomic setting and weaker chemical compounds demand globally, we keep our steerage ranges throughout all of the Chemical segments, with a restoration of demand anticipated within the second half of 2024.

Chemical substances pricing and demand appear to have reached the underside finish of the cycle on the finish of CY23 with indicators of sluggish restoration in key markets on volumes and costs, partly pushed by elevated oil costs.

Comparable feedback from different sector’s leaders echo the identical sentiment. Peter Huntsman, President and CEO of Huntsman:

It’s nonetheless too early within the quarter to make daring predictions. Nonetheless, the order patterns that I’m seeing in most areas of the world tells me that in most of our divisions, we have now seen the top of a really lengthy interval of stock drawdowns, and costs and volumes look to be steadily enhancing […] I really feel extra optimistic than I did on the year-end and see extra proverbial inexperienced shoots than I’ve over the previous 12 to 18 months.

Guillermo Novo, Chairman and CEO of Ashland:

Whereas we’re cautiously optimistic concerning the enhancing demand developments that we’re experiencing within the quarter and into January and February, there may be nonetheless heightened uncertainty relating to buyer demand normalization. Usually, we might be constructing stock for the height season right now. And at the moment, we aren’t doing that construct.

South African political state of affairs

Latest elections in South Africa marked a transfer to the political heart. The ANC (African Nationwide Congress, the occasion that has run South Africa since 1994) gained the elections however misplaced its majority for the primary time in 30 years. Nonetheless, the nightmare situation of a post-elections alliance of the ANC with the 2 different leftist events (Julius Malema’s Financial Freedom Fighters and the ex-president Jacob Zuma’s MK occasion) was prevented. As an alternative, the ANC allied itself with the Democratic Alliance, a extra average occasion that’s perceived to be pro-market and business-friendly.

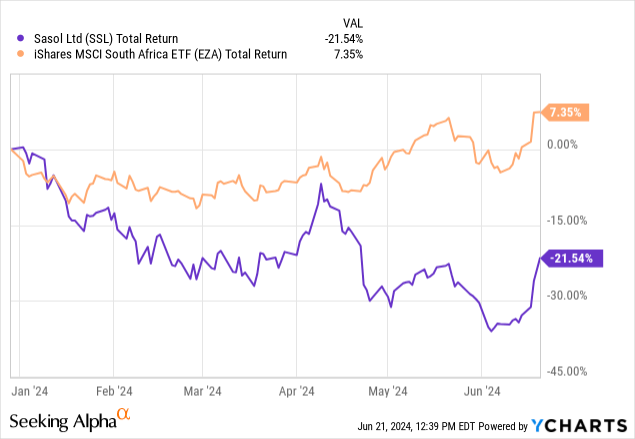

Due to the political uncertainty, South African equities have been buying and selling at a steep low cost earlier than the elections. That is comprehensible contemplating that the EFF had promised to nationalize the central financial institution, whereas the MK meant to scrap the structure. Then again, the market reacted positively to the information of an ANC-led authorities tempered by the pragmatic affect of the Democratic Alliance. The Johannesburg Inventory Alternate rose 3.5% on Tuesday, after which 1.2% on Wednesday. Sasol shares are up greater than 15% during the last week. Nonetheless, they nonetheless stay down greater than 20% year-to-date, as a consequence of weak spot in its finish markets and downward steerage revision originally of the yr, as a consequence of persistent points at its South African operations.

Can South African equities proceed to rerate? Or is that this only a short-term bounce? I imagine the result of the current elections is the very best one, among the many given alternate options. Nonetheless, it stays to be seen whether or not the Democratic Alliance has sufficient political weight to counteract the social welfare insurance policies of the ANC. For now, the 2 events have agreed on a standard agenda of making new jobs and fixing the nation’s infrastructure. Load curtailments by Eskom, in addition to logistical challenges skilled by Transnet, have severely impacted the operations of South African companies like Sasol. This election might certainly mark the inflection level the place normalization begins.

Nonetheless, I’m not assured that South Africa is more likely to resolve its structural issues within the brief time period. To start with, the coalition stays based mostly on a fragile equilibrium, with nearly all of the seats nonetheless within the arms of the ANC. As well as, whereas the ANC’s consensus dropped by 17 proportion factors, the votes didn’t transfer to the Democratic Alliance, however largely to Zuma’s new MK occasion, which helps insurance policies much more excessive than the ANC. As additionally acknowledged by President Ramaphosa in his inauguration speech, South Africa stays a extremely dangerous nation, with “incipient social fragmentation that may simply flip into instability”.

Firm’s technique and valuation

I imagine it’s a idiot’s errand to attempt to predict the following earnings of a enterprise as advanced as Sasol. The excellent news is that quarter-by-quarter efficiency is essentially irrelevant to the success of a long-term funding within the firm. As an alternative, focus ought to be placed on the corporate’s medium- and long-term technique. From this perspective, plainly Sasol is lastly transferring in the precise path.

The historical past of Sasol is marked by dangerous capital allocation selections. An instance is the Lake Charles Chemical substances Mission (LCCP), a 1.5 million tonnes per yr ethane cracker that tripled Sasol’s chemical manufacturing capability in america. The challenge was introduced in 2014, however was accomplished solely in 2020, after a collection of delays and important price overruns. The monetary challenges related to its improvement compelled the resignation in 2019 of the joint CEOs, Cornell and Nqwababa. The brand new CEO, Grobler centered as an alternative on promoting down belongings to deleverage. The technique labored: the corporate has strengthened its steadiness sheets through asset disposals, resumed dividend funds, and lowered its debt obligations.

Going ahead, the unwinding of fabric capex necessities, coupled with operational price optimizations and the absence of additional shareholder value-eroding expansive plans just like LCPP, are more likely to result in a major improve in free money movement. In flip, this elevated free money movement might be partly returned to shareholders within the type of dividends, and partly be used to fund the corporate’s formidable decarbonization plans. Sasol has set the target to scale back carbon emissions by 30% by 2030 and to be net-zero by 2050. The corporate is likely one of the largest emitters of CO2 on the African continent. Its Secunda plant, which makes use of a carbon-intensive coal-to-liquids course of to supply artificial gas, is the one largest emitter web site on the planet. I imagine the corporate has no selection however to adapt to the necessities imposed by the inexperienced power transition, to be able to keep viability as a enterprise in the long run. Although this can constrain shareholder returns, the excellent news is that the transition might be largely self-funded from the elevated internally-generated free money movement. As well as, the transition can be tempered by political realities (Sasol is likely one of the largest employers in South Africa). It might even provide alternatives to entry inexperienced capital grants.

Regardless of the political and operational dangers, the principle argument in favor of an funding determination, along with the change in firm’s technique and the elevated concentrate on profitability, lies within the closely discounted valuation. Sasol has a market capitalization of R87 billion, with an extra R73 billion in internet debt. It ought to be capable of generate between R20 and R35 billion in free money movement, which suggests it trades within the excessive teenagers when it comes to free money movement to EV yield and ahead dividend yield round 9%. It has tangible belongings valued at R193 billion, which is probably going a major underestimation relative to the actual substitute worth, or a 0.45 price-to-book ratio.

Conclusions

I imagine Sasol might flip into an inflection story from two totally different factors of view. To begin with, a transfer to the middle of the political local weather in South Africa ought to permit for the normalization of operational circumstances. Second, the cycle within the chemical sector seems prepared to show, after a few years of weak demand and depressed profitability. Dangers stay excessive, particularly in reference to the South African political setting. Nonetheless, given the fabric low cost to the substitute worth of its belongings, the margin of security appears enough to warrant a purchase ranking.

[ad_2]

Source link