[ad_1]

Richard Drury

Thesis

The PGIM Brief Length Excessive Yield Alternatives Fund (NYSE:SDHY) is a set revenue closed finish fund from Prudential. The CEF got here to market in 2020, at a really inopportune time, particularly proper earlier than the Federal Reserve began elevating charges. Like most CEFs which IPO-ed at poor occasions, SDHY noticed its market worth transfer under web asset worth, the place it has been caught for the previous few years.

As per its literature, the CEF goals to seize the returns of shorter length excessive yield bonds:

The Fund seeks to offer complete return, by a mixture of present revenue and capital appreciation by investing primarily in under funding‐grade mounted revenue devices. The Fund seeks to take care of a weighted common portfolio length of three years or much less and a weighted common maturity of 5 years or much less.

On this article we’re going to have a more in-depth have a look at the CEF, its composition and efficiency, and articulate our view on the closed finish fund going ahead.

Portfolio composition – shorter maturity U.S. excessive yield

As per its literature, the CEF goals to carry shorter dated excessive yield bonds:

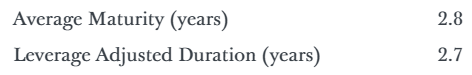

Length (Fund Web site)

Its leverage adjusted length is 2.7 years, and its common collateral maturity is 2.8 years. Center of the highway HY CEFs normally have a 4 yr length.

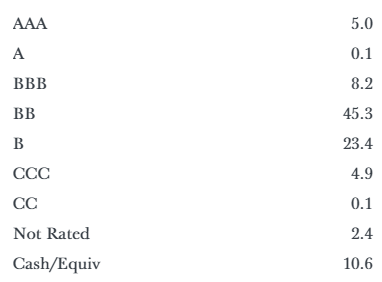

The fund focuses on ‘BB’ rated credit:

Rankings (Fund Web site)

‘BB’ names make up 45% of the portfolio, adopted by ‘B’ credit at 23% and a small bucket for ‘CCC’ paper of 4.9%. From a sectoral standpoint, the CEF has a balanced and granular composition:

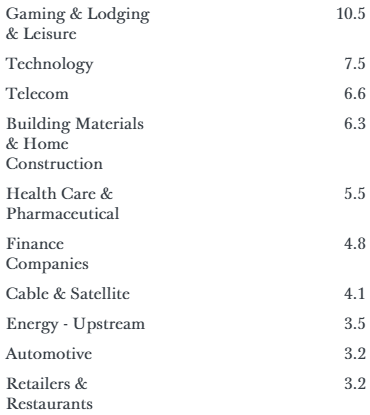

Sectors (Fund Web site)

Gaming & Lodging names make up 10.5% of the fund, adopted by Expertise at 7.5% and Telecom at 6.6%. We normally use a 15% goal for any sector, with funds exhibiting increased percentages falling into the ‘concentrated’ names bucket.

Efficiency is disappointing

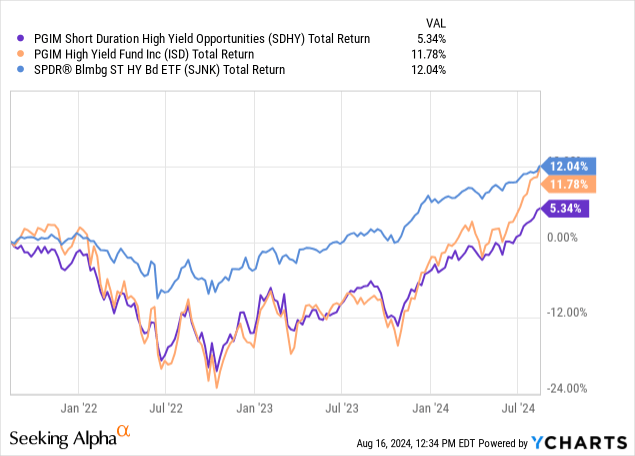

Though the fund targets decrease length names and may have executed significantly better than its friends in the course of the 2022 price hike interval, its efficiency states in any other case:

The CEF has nearly the identical complete return profile because the 4-year length PGIM Excessive Yield Fund (ISD), and severely lags the SPDR Bloomberg ST HY Bond ETF (SJNK). We’re utilizing SJNK as a comparability level as a result of the ETF represents a non-leveraged expression of quick length high-yield bonds. Among the underperformance exhibited by SDHY is as a result of low cost to NAV widening, however total the CEF didn’t get the profit it was on the lookout for through its quick length construct.

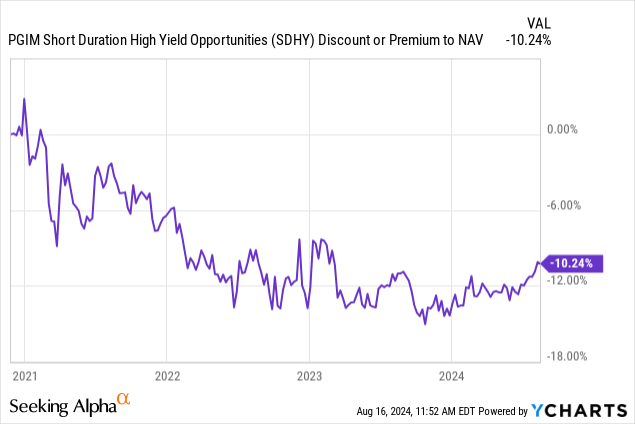

Premium / Low cost to NAV

The fund got here to market at an inopportune time, proper earlier than the beginning of the Fed financial tightening. The fund’s efficiency due to this fact prompted the market to promote the identify:

The CEF moved to a deep low cost to web asset worth as charges moved increased and excessive yield bonds noticed their costs transfer decrease. Till a sustained new bull cycle in credit score, we see the low cost to NAV fluctuating between -6% and -12%.

Length goes to work towards the CEF in a real new bull

Within the sections above we’ve explored the collateral composition for the fund, its poor historic efficiency and its very giant low cost to NAV. We really feel we’re a good distance off from seeing this identify carry out to its true potential. For the fund to return to flat to NAV, we have to have a multi-year ‘true bull’ market, with low bankruptcies and low credit score spreads. We’re of the opinion that we’ll see one other vital risk-off transfer in credit score, even within the base case of a smooth touchdown. The market wants consecutive years of constructive complete returns as a way to reward the CEF through a narrowing of its low cost to NAV.

Moreover, because the Fed begins decreasing charges, the CEF’s length profile (quick one) will work towards the identify because it doesn’t get the good thing about increased length funds which achieve extra when charges transfer decrease.

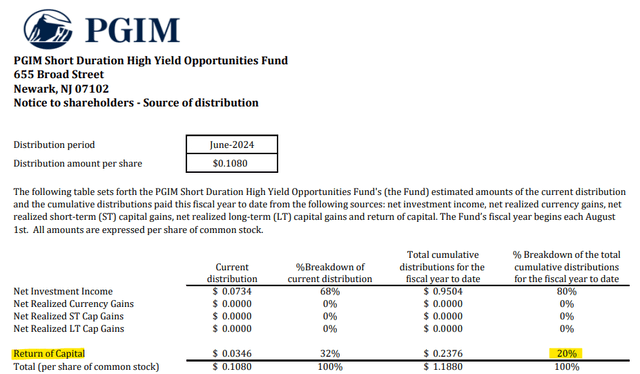

Distribution just isn’t solely lined

The fund has an 8.2% distribution price which isn’t solely lined:

Distribution (Part 19a)

If we have a look at the breakdown from its Part 19a discover, we are going to see that 20% of the distribution is represented by return of capital from a fiscal yr perspective. That determine results in a lined distribution of solely 6.6%, which is extraordinarily low for a reputation with a 7.5% normal deviation and unfavorable Sharpe ratio.

What’s the ahead for this CEF?

The fund undoubtedly got here to market at a nasty time within the macrocycle, however its construct has not achieved the decrease danger profile it was in search of. Traders have punished the identify by driving it right down to a really vital low cost to NAV, low cost which is able to take time to flatten out. We’re of the opinion that solely a multi-year bull market in credit score will assist this identify transcend a -6% low cost to NAV, and that we’re distant from that.

The automobile has additionally been hit exhausting by its floating price leverage which hampered its efficiency as charges rose. Its true distribution price could be very low at 6.6%, and pales compared with different non-leveraged devices comparable to SJNK which has the next true distribution with a lot much less danger.

The one structural function which might be speculated for this identify is the broad low cost to NAV, however we don’t see that closing down any time quickly. We might not maintain this identify at this level within the macrocycle, with a large number of different higher priced choices.

Conclusion

SDHY is a set revenue closed finish fund. The automobile focuses on shorter length excessive yield bonds (2.7 years length) however got here to market at an inopportune time in 2020. The CEF’s efficiency has been poor when in comparison with unleveraged quick length HY friends, and the market has moved the identify to a big low cost to NAV. We really feel the CEF wants a multi-year credit score bull market as a way to transfer near flat to NAV on this structural function. Till then, buyers are getting an unsupported distribution, which isn’t enticing from a danger/reward perspective. Besides the massive low cost to NAV, the CEF doesn’t exhibit any enticing traits. Given the plethora of different alternatives with true yields round 7% and higher danger/reward profiles, we’d promote SDHY right here and look ahead to decrease risk-free charges to permeate the market earlier than this CEF once more.

[ad_2]

Source link