[ad_1]

Our aim with The Day by day Temporary is to simplify the largest tales within the Indian markets and assist you perceive what they imply. We received’t simply let you know what occurred, however why and the way too. We do that present in each codecs: video and audio. This piece curates the tales that we discuss.

You possibly can take heed to the podcast on Spotify, Apple Podcasts, or wherever you get your podcasts and movies on YouTube. It’s also possible to watch The Day by day Temporary in Hindi.

In at the moment’s version of The Day by day Temporary:

SEBI desires to guard retail buyers

Is debt good or dangerous?

SEBI has proposed a brand new framework to make algo buying and selling extra accessible for retail buyers whereas conserving the market protected and honest. This transfer comes as extra retail buyers are beginning to use algo buying and selling, and a number of other unregulated algo platforms have popped up, usually promising unrealistic returns.

To offer you a fast concept, Algo Buying and selling makes use of pc packages to routinely purchase and promote shares based mostly on set guidelines. For instance, an algorithm could be set to purchase a inventory if its value goes above ₹100 and promote it if it drops beneath ₹95. This removes the necessity to watch the markets always and ensures trades occur rapidly. In actuality, although, these algorithms can get very advanced.

The large benefits of algorithmic buying and selling are pace and self-discipline. Algorithms can course of enormous quantities of knowledge and place trades in milliseconds—a lot quicker than any human may. Plus, they observe the foundations with out letting feelings get in the way in which.

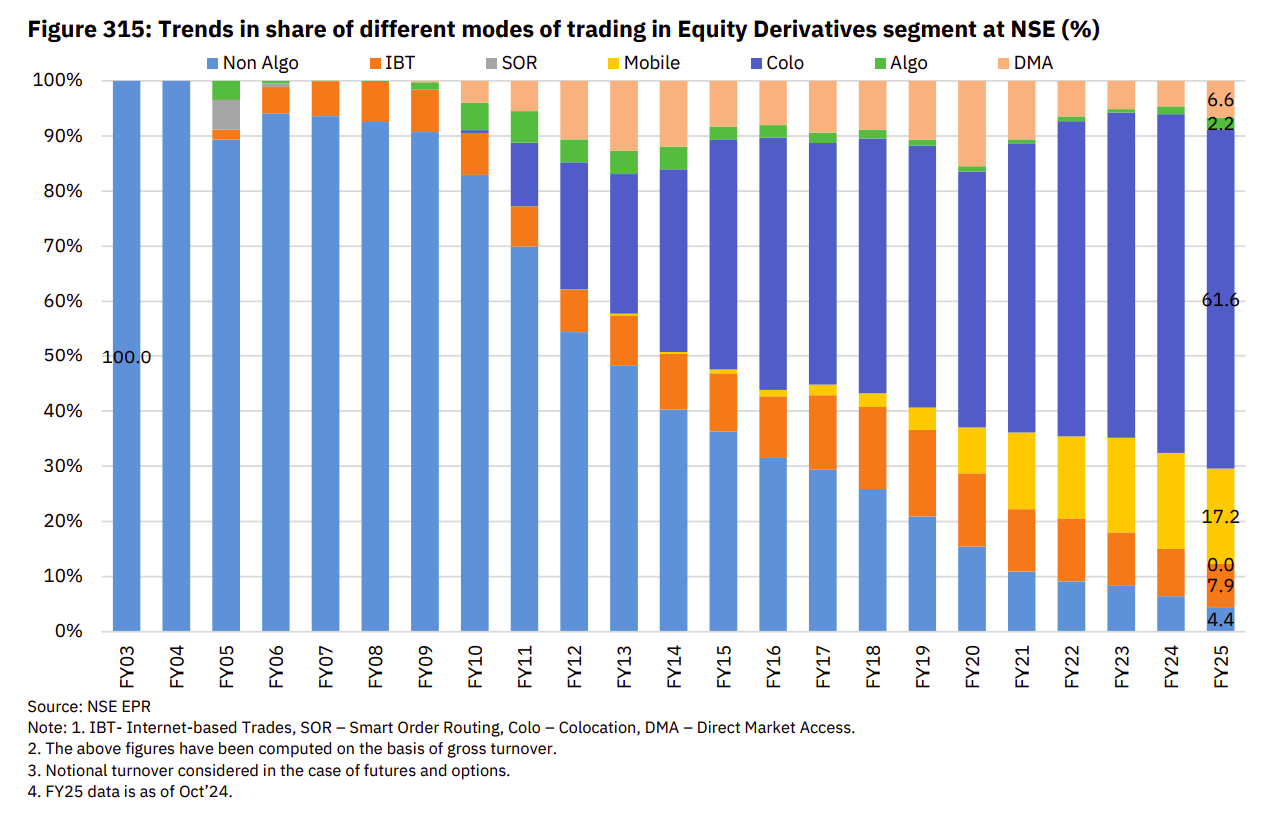

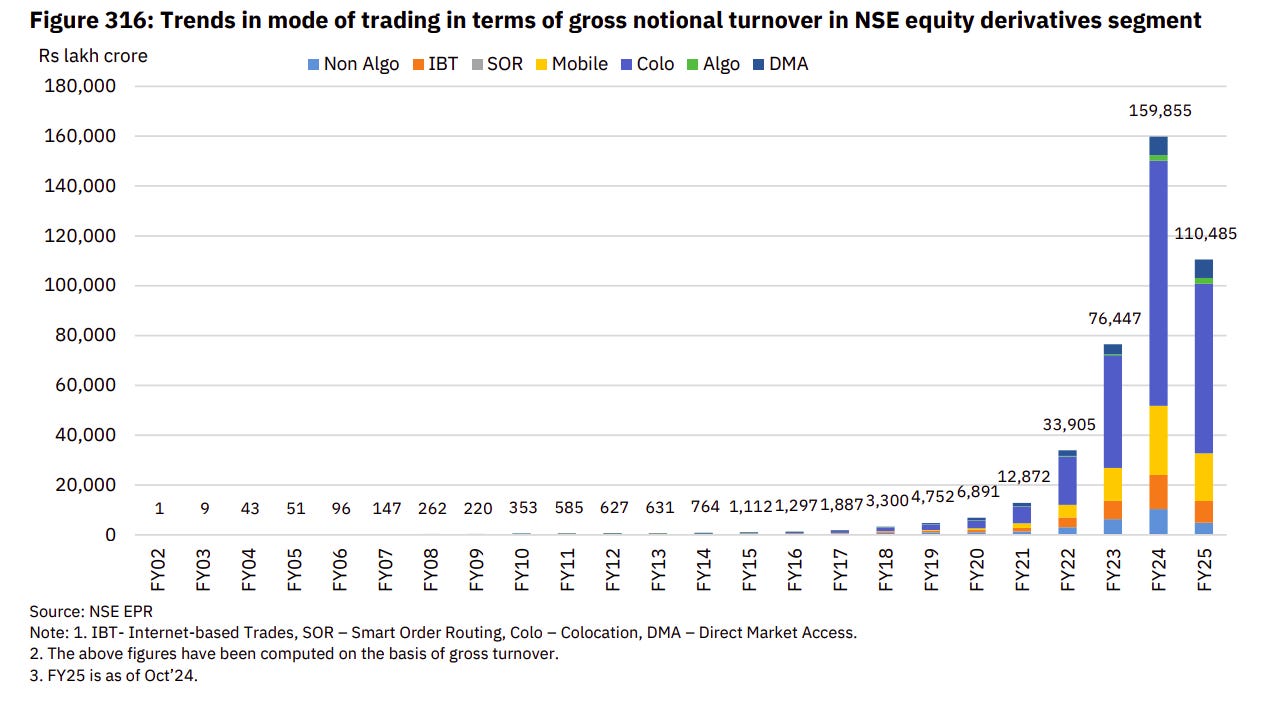

In India, algo buying and selling makes up about 70% of the whole market quantity. That appears like so much, proper? However most of this comes from massive gamers, like high-frequency merchants, not retail buyers.

Supply: NSE Pulse

Supply: NSE Pulse

Right here’s what the newest SEBI draft round says:

Brokers should get approval from inventory exchanges for each algorithm earlier than deployment. As soon as accredited, every algorithm can be given a novel ID for simpler monitoring and auditing.

SEBI has categorized algorithms into two sorts:

White Field Algos : These are totally clear. Customers can see the logic behind them and replicate it.

Black Field Algos : These are proprietary and opaque, largely utilized by establishments. These will face stricter guidelines. Algo suppliers might want to register as analysis analysts and maintain detailed data of their operations.

Retail buyers can now automate trades utilizing dealer APIs with out registering their methods, so long as their static IP deal with is whitelisted by the dealer. These APIs observe the identical threat administration guidelines and fee limits as dealer’s buying and selling platforms, guaranteeing that a lot of orders received’t compromise market integrity. One of many greatest hurdles up to now was the necessity to register each technique and alter in technique to have the ability to automate trades. With this gone, automated buying and selling turns into extra accessible to the general public.

Brokers providing APIs (which join merchants to the inventory market) should guarantee robust safety measures, like two-factor authentication. Additionally they have to restrict API entry to licensed customers with distinctive keys.

Inventory exchanges will monitor algo trades after they’re executed. In the event that they spot any malfunctioning algos, they may have the authority to cease them instantly utilizing a “kill swap.” Exchanges may even be certain that brokers clearly differentiate between algo orders and non-algo orders.

To grasp why SEBI is focusing a lot on algo buying and selling, let’s check out its historical past in India.

Algo buying and selling began in 2008 when SEBI launched Direct Market Entry (DMA). This allowed institutional buyers to position orders straight into trade programs, skipping brokers. It gave them quicker commerce execution and higher management. Later, exchanges like NSE began providing co-location providers, the place merchants may place their servers near the trade’s programs, decreasing delays even additional.

To start with, algo buying and selling was restricted to massive establishments like mutual funds, hedge funds, and proprietary buying and selling desks. By 2012, SEBI launched its first set of tips for algo buying and selling, specializing in managing dangers and stopping market manipulation.

Lately, algo buying and selling has moved past establishments. Brokers began providing APIs, which allowed tech-savvy retail merchants to attach their very own algorithms to buying and selling programs. Platforms additionally emerged, making it simpler for retail buyers to create and take a look at algo methods, even with out coding abilities.

In 2021, SEBI launched a session paper to handle the rising retail curiosity in algo buying and selling and the dangers from unregulated platforms. The paper proposed that each one algos be pre-approved by exchanges and positioned the accountability of compliance on brokers. It was considered one of SEBI’s first main steps to manage algo buying and selling for retail buyers.

By 2022 , SEBI issued a round banning brokers from partnering with unregulated algo platforms. These platforms had turn out to be widespread for providing pre-built methods whereas making deceptive claims about assured earnings. The round additionally prohibited efficiency claims for algorithms and pushed for larger transparency to cease mis-selling. These actions set the stage for the newest draft round.

This broader entry to algo buying and selling has drawn important curiosity from retail buyers. Nonetheless, it has additionally raised considerations about misuse. Many unregulated platforms supplied pre-built methods with unrealistic guarantees of excessive returns. Retail merchants, usually unaware of the dangers, may deploy poorly designed or manipulative algos, resulting in losses or disruptions available in the market.

Whereas algo buying and selling brings pace and effectivity, it additionally carries dangers. Some algos have been misused for manipulative practices like spoofing, the place pretend orders are positioned to control costs. Poorly designed algos also can malfunction, triggering flash crashes or different market disruptions. These dangers spotlight why robust oversight is so essential—one thing SEBI has been working to handle over time.

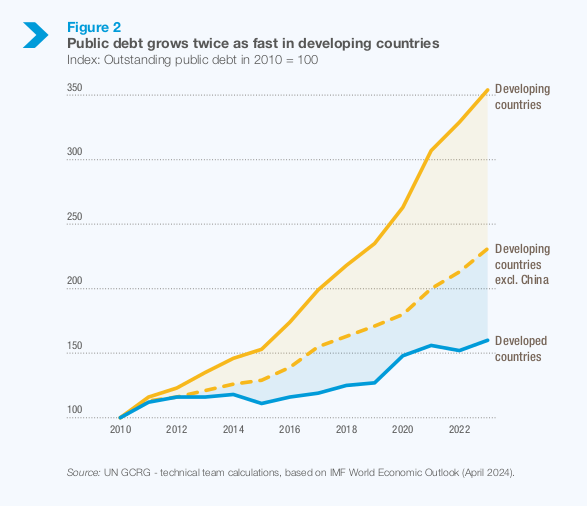

Rising markets are buried below $29 trillion of debt, with a staggering $850 billion going towards curiosity funds yearly. What’s much more worrying is that public debt in growing nations is rising twice as quick as in developed ones. That’s not only a massive quantity—it’s the form of determine that makes your calculator flash “error.”

Supply: UNCTAD

However earlier than we level fingers and label debt because the villain right here, let’s take a step again and add some perspective. As a result of, like most issues in life, debt isn’t merely good or dangerous—it’s all about the way it’s used.

Consider debt like espresso. Sparsely, it’s nice—it retains you going and helps you get issues carried out. However an excessive amount of of it? That’s when you find yourself stressed, anxious, and unable to sleep.

The reality is, that debt could be each useful and dangerous. Developed nations just like the US and Japan use debt to fund productive investments—issues like constructing infrastructure, boosting innovation, and increasing financial capability. These investments create development and make their economies stronger over time.

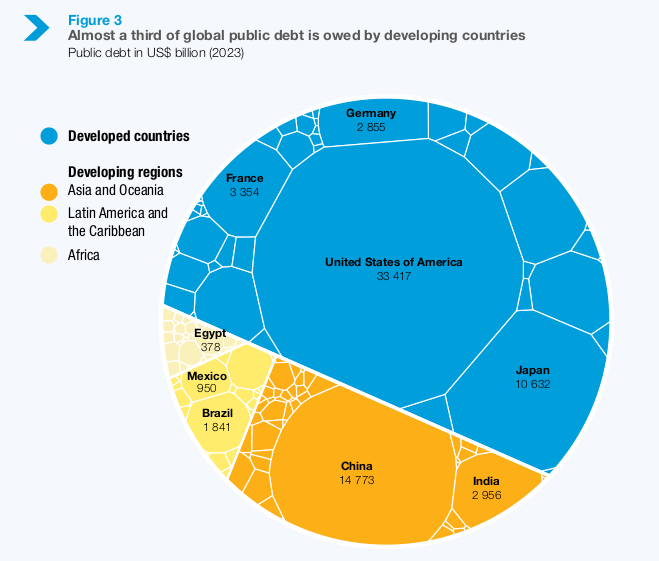

So long as their economies develop quicker than their curiosity funds, they’re within the clear. Take the US, for instance—it has over $33 trillion in debt. Japan’s debt-to-GDP ratio? A jaw-dropping 250%. But, buyers aren’t panicking. Why? As a result of these economies are massive, secure, and have a protracted historical past of managing their debt responsibly.

However that’s not the case in all places.

For rising economies, debt isn’t only a quantity on a steadiness sheet—it’s a heavy burden. Regardless of being house to just about 80% of the world’s inhabitants, growing nations maintain solely 30% of worldwide public debt. That imbalance reveals simply how robust the state of affairs is for these nations.

Supply: UNCTAD

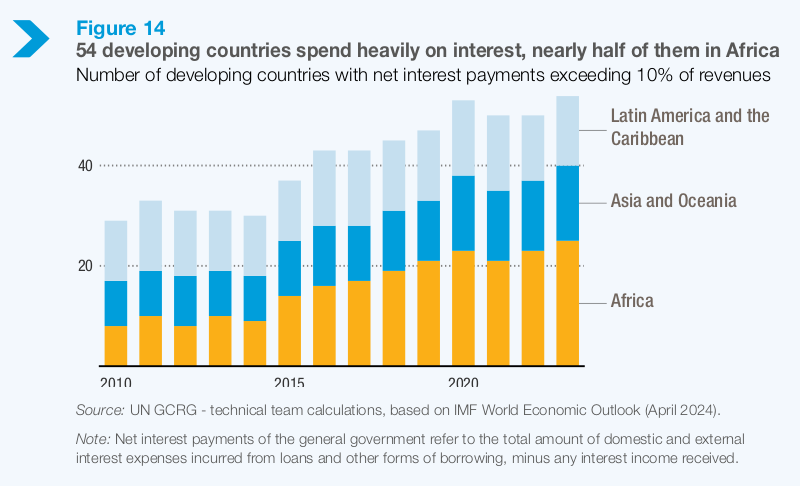

Whereas debt ranges in growing nations could appear small in comparison with international giants, the burden they carry is disproportionately heavy. Take this: 54 growing nations spend greater than 10% of their revenues simply on curiosity funds. Greater than half of those nations are in Africa.

Supply: UNCTAD

Right here’s a wierd however telling comparability: Sri Lanka vs. the US. The US has 330 instances extra debt than Sri Lanka, but Sri Lanka is seen because the riskier wager. Why? As a result of most of Sri Lanka’s debt is used to repay outdated loans as a substitute of funding new infrastructure or boosting its economic system.

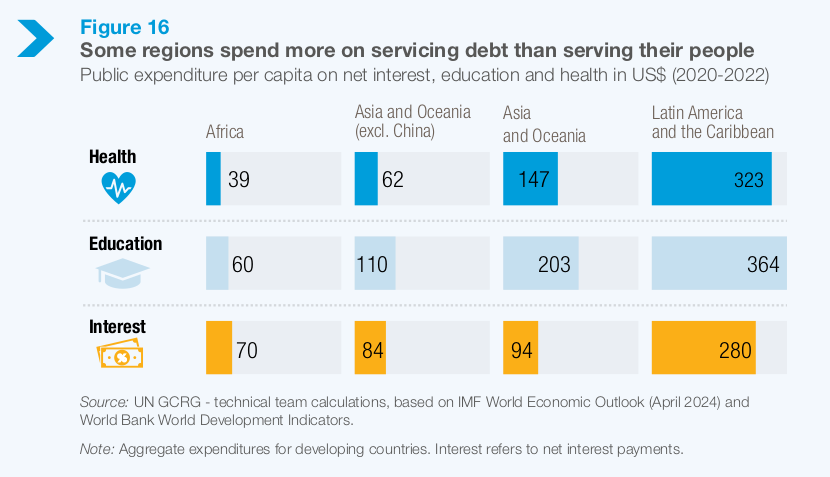

The influence of that is devastating. Many growing nations spend extra on debt funds than they do on healthcare and schooling mixed. In Africa, for instance, the typical per-person spend on debt curiosity is $70, whereas spending on well being is simply $39.

That’s not simply unsustainable—it’s a human tragedy.

Supply: UNCTAD

So, why does debt hit growing nations a lot more durable? An enormous a part of the issue lies within the flawed worldwide monetary system.

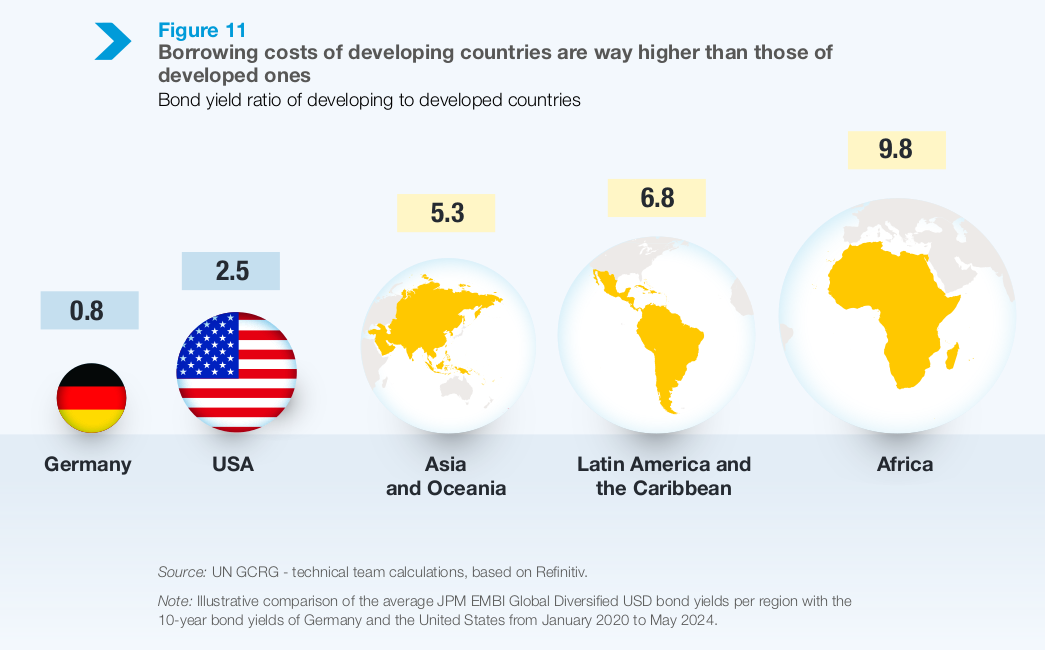

1. Sky-Excessive Borrowing Prices:Creating nations pay 2 to 12 instances increased rates of interest than developed nations. Why? As a result of they’re seen as dangerous. Buyers demand increased returns for taking over that threat—sarcastically, from economies which might be already struggling.

Supply: UNCTAD

2. Heavy Reliance on Overseas Collectors:With restricted home financial savings, these nations rely closely on overseas lenders. However right here’s the catch: this debt should be repaid in laborious currencies just like the US greenback.The end result? Half of growing nations spend a minimum of 6.3% of their export revenues simply to service their debt.

3. Non-public Collectors Don’t Play Truthful:Round 61% of exterior debt in growing nations is owed to personal collectors—banks, hedge funds, and monetary establishments. These lenders cost increased rates of interest and are notoriously robust in relation to renegotiating debt. They’re not desirous about financial restoration—they’re in it for the cash.

So, what’s the way in which ahead?

The UN’s 2024 World of Debt report doesn’t simply spotlight the issue—it affords options. The report lays out a roadmap to finance sustainable growth, specializing in three key actions:

Cut back the price of debt by offering inexpensive financing choices.

Scale up long-term investments, particularly in crucial areas like infrastructure and local weather motion.

Repair the worldwide monetary system to make sure growing nations have a seat on the decision-making desk.

Right here’s the factor: debt, when used the suitable means, generally is a highly effective instrument for development. However with out significant reforms, the present system will proceed draining sources from the place they’re wanted most—hospitals, faculties, and local weather initiatives.

So, the following time somebody says, “Debt is dangerous,” ask them: “Whose debt?” For the US, it’s a flex of financial energy. However for nations like Sri Lanka or Nigeria, it’s a full-blown disaster.

And if international leaders don’t step as much as repair this imbalance quickly, we could be left asking a fair scarier query: What occurs when the debt lastly turns into an excessive amount of to deal with?

IndusInd Worldwide Holdings Ltd is about to finish its ₹9,861 crore acquisition of Reliance Capital by January 2025, marking the decision of considered one of India’s main IBC instances. The deal contains plans to repay the debt by 2026-27 and strategically checklist subsidiaries, additional strengthening IndusInd’s place within the monetary sector.

Apollo Tyres is tackling the challenges of pure rubber shortages and value volatility by shifting to recycled rubber and bio-based supplies. The corporate goals to attain 40% sustainable sourcing by 2030, decreasing its dependence on pure rubber, chopping prices, and aligning with international sustainability targets.

India’s non-public sector PMI jumped to 60.7 in December 2024, pushed by robust development in providers and manufacturing. Employment hit file highs, and easing inflation improved financial outlooks, pointing to robust momentum heading into 2025.

This version of the e-newsletter was written by Krishna and Kashish

Thanks for studying. Do share this with your folks and make them as sensible as you might be ![]() Be a part of the dialogue on at the moment’s version right here.

Be a part of the dialogue on at the moment’s version right here.

[ad_2]

Source link