[ad_1]

Sundry Pictures

Just some days in the past cyber-security agency CrowdStrike Holdings (CRWD) was accountable for the big international IT outage inflicting the grounding of air planes, the shutdown of thousands and thousands of Home windows units and different disruptions.

With CrowdStrike’s inventory getting hammered in consequence, a key competitor, SentinelOne, Inc. (NYSE:S) is rising as a possible beneficiary within the cyber-security market.

As buyers battle to determine the impression of the IT outage on CrowdStrike’s enterprise, I feel some prospects might lean in the direction of migrating their enterprise to different cyber-security platforms and choose to not renew their CrowdStrike software program licenses.

Since SentinelOne is in the identical enterprise as CrowdStrike, the competitor might revenue from accelerating gross sales progress, notably in giant company accounts.

IT Outage And Model Injury For CrowdStrike

A defective safety replace for CrowdStrike’s cyber-security platform Falcon was the explanation behind a extreme IT outage that affected pc techniques around the globe final week.

CrowdStrike’s inventory has gotten hammered as a consequence and I’ve warned towards buyers shopping for the drop and, probably, catching a falling knife. Although CrowdStrike has protected itself towards any direct legal responsibility with its phrases of service, I feel a substantial quantity of brand name injury has been performed right here which in flip would possibly lead to opponents with the ability to capitalize on a perceived competitor’s weak spot.

I additionally suppose that the severity of the outage might result in authorized repercussions (lawsuits) which may pose a danger to any restoration prospects for CrowdStrike’s inventory.

A competitor that would revenue from CrowdStrike’s stumbles is SentinelOne which operates the SentinelOne’s Singularit Platform that protects prospects towards cyber-security dangers. Basically, SentinelOne is in the identical enterprise as CrowdStrike besides that the latter has prevented a serious, brand-damaging PR catastrophe.

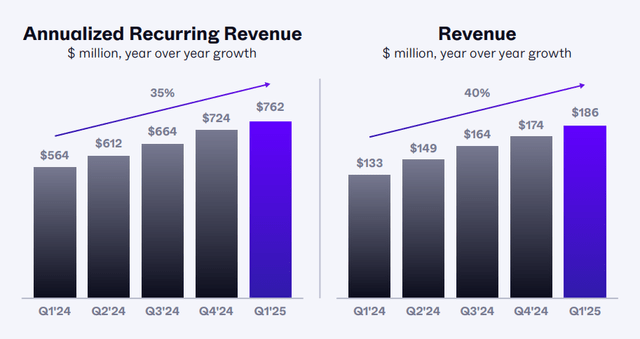

Similar to CrowdStrike, SentinelOne is a fast-growing, enterprise-focused cyber-security platform. In 1Q25, SentinelOne loved 40% YoY gross sales progress and reached a complete gross sales quantity of $186 million, the best ever, whereas annual recurring revenues rose 35% YoY to $762 million.

Income Development (SentinelOne Inc.)

Because of this SentinelOne is rising sooner than CrowdStrike, which reported gross sales progress of 33% within the final quarter and complete gross sales of $921 million. CrowdStrike’s annual recurring income was up 33% to $3.6 billion. Although CrowdStrike is quicker, the expansion trajectory, notably with respect to earnings, clearly advantages SentinelOne.

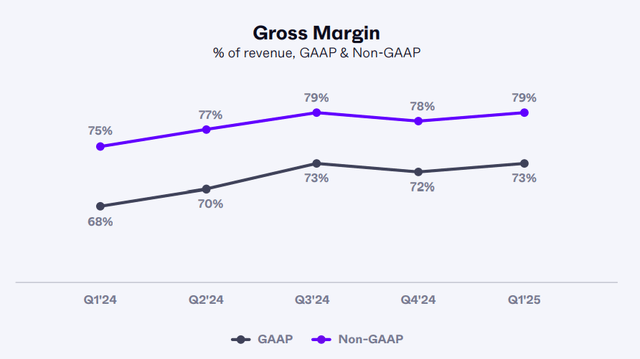

Moreover, SentinelOne is providing buyers comparable gross margins and the corporate has been profitable in rising its margins, one thing that may’t be stated about CrowdStrike. Within the final quarter, SentinelOne had a GAAP gross margin of 73%, including 5 share factors YoY. CrowdStrike’s gross margin was 76% in 1Q25, however the firm did not obtain any progress in its margin in any respect.

Gross Margin (SentinelOne Inc.)

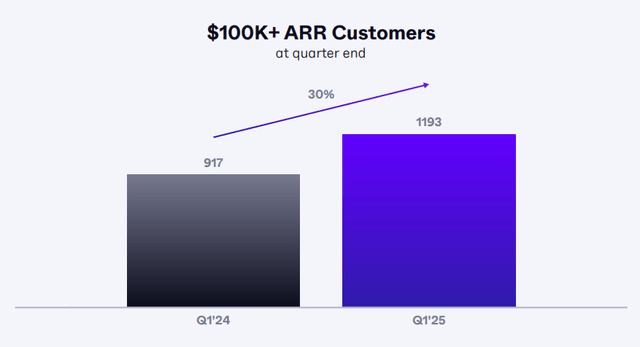

The place I see a particular alternative for SentinelOne to seize advantages from CrowdStrike’s issues is within the giant account class. Giant accounts are outlined as people who produce at the very least $100k in annualized gross sales, and these accounts usually belong to giant firms.

SentinelOne has loved some first rate progress right here previously couple of years and simply within the final quarter loved 30% buyer progress, bringing the full of huge company prospects to almost 1,200.

Clearly, it will be these excessive spenders which can be having an out-sized affect on SentinelOne’s gross sales progress and with some prospects doubtless having misplaced belief given CrowdStrike’s safety lapses, I feel SentinelOne may gain advantage from some account migration right here and seize some new worthwhile prospects.

Buyer Development (SentinelOne Inc)

SentinelOne Is Very Low cost Relative To CrowdStrike

Even with out the IT debacle final week, I might not see CrowdStrike as a legitimate funding due to the corporate’s quite unsustainable valuation.

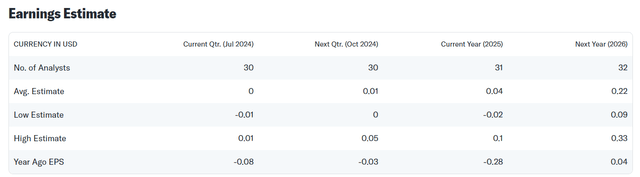

CrowdStrike’s inventory is promoting for 52x subsequent 12 months’s earnings, whereas it additionally modifications fingers for 12x subsequent 12 months’s gross sales. These are some excessive multiples, although CrowdStrike’s valuation has contracted by about 25% within the final week. On the flip aspect, SentinelOne is promoting for 7x subsequent 12 months’s gross sales and 103x earnings.

SentinelOne’s revenue a number of is excessive solely on a superficial foundation, nevertheless. The cyber-security firm simply reached profitability, and its earnings per share are anticipated to skyrocket within the coming years. Simply subsequent 12 months, SentinelOne is predicted to see 450% revenue progress in comparison with CrowdStrike’s 23% YoY revenue progress charge.

SentinelOne thus has a lot stronger revenue progress, greater gross sales progress, a bit weaker GAAP gross margins (which can be rising) and a significantly better valuation from a gross sales estimate perspective.

Earnings Estimate (Yahoo Finance)

Why The Funding Thesis Would possibly Not Work Out

SentinelOne is an apparent selection for me, contemplating that substantial operational overlap between SentinelOne and CrowdStrike exists. Each corporations primarily provide the identical providers, with the distinction that SentinelOne’s enterprise is just not dragged down by the unprecedented IT carnage associated to CrowdStrike and Microsoft final week. With that stated, although, I could be fully incorrect about SentinelOne with the ability to seize prospects from CrowdStrike.

If CrowdStrike have been to show that, it may possibly retain prospects even within the wake of the IT outage, then SentinelOne may not see any incremental gross sales progress profit.

My Conclusion

SentinelOne could possibly be the final word beneficiary of CrowdStrike’s PR catastrophe final week. Some CrowdStrike prospects might resolve to not renew their software program licenses and migrate their enterprise over to corporations like SentinelOne which primarily affords the identical type of cyber-security safety that CrowdStrike does.

Moreover, the IT outage has performed appreciable model injury to CrowdStrike, which is one thing that makes a competing service provide from SentinelOne that rather more enticing.

Lastly, SentinelOne is rather more cheaply valued than CrowdStrike, although CrowdStrike’s valuation already plummeted 25%. SentinelOne affords buyers a fast-growing cybersecurity enterprise, robust margins and the potential to capitalize on a competitor’s mess-up.

All issues thought of, I feel the danger/reward relationship for SentinelOne is favorable, and I’m ready to purchase extra inventory within the brief time period.

[ad_2]

Source link