[ad_1]

The Dow Jones Industrial Common accommodates 30 blue chip firms, virtually all of which pay dividends. And whereas the index yields greater than the S&P 500 and Nasdaq Composite, there are solely two of its shares that yield over 5%.

Verizon Communications (NYSE: VZ) is one in all them, with a 6.5% yield. The opposite is commodity chemical firm Dow (NYSE: DOW).

It has nothing to do with the “Dow” within the Dow Jones Industrial Common. Confusion apart, here is why Dow is a superb undervalued high-yield dividend inventory.

Dow is in a downturn

Dow has 4 fundamental segments: packaging, infrastructure, shopper, and mobility. Irrespective of the section or buyer, the corporate’s goal is to make chemical substances utilized in plastics, seals, foams, gels, adhesives, resins, coatings, and the like for the bottom value potential.

Not like a specialty chemical firm, like DuPont, or Corteva, which caters to the agriculture trade, Dow’s differentiating elements are its procurement, manufacturing, and distribution — not a lot making a novel product that its opponents cannot match.

An obstacle of Dow’s mannequin is that it’s closely depending on demand and vulnerable to downturns. Additionally it is susceptible to world provide chains and geopolitical dangers.

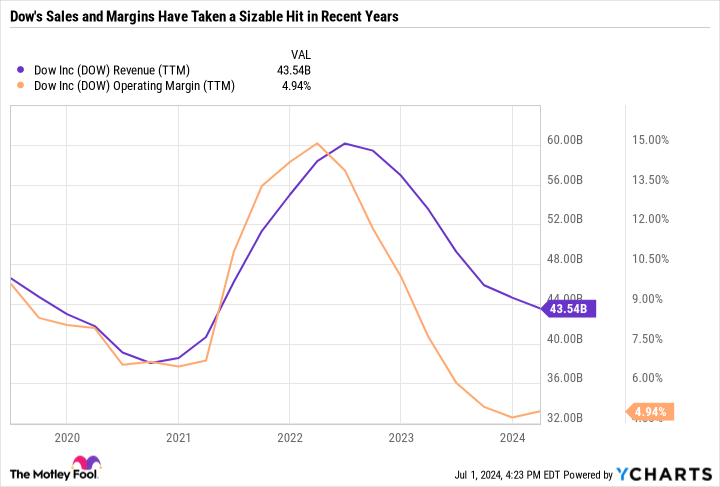

Gross sales and margins surged in late 2021 and early 2022 as demand recovered from the COVID-induced slowdown. However since then, Dow’s gross sales and working margins have been crushed, with working margins falling from round 15% to five% in simply two years.

Dow mentioned the demand dynamics for ethylene and polyethylene intimately on its first-quarter 2024 earnings name, saying that money margins in China stay unfavourable, pressuring suppliers. Nevertheless, the corporate has a value benefit, and administration is assured it’s starting to show the nook.

Regardless of a difficult quarter, the corporate reiterated its steerage for reaching $6.4 billion in earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) for 2024, which might be a considerable enchancment from $4.01 billion in 2023 EBITDA.

Returning to progress

Dow has been investing closely in low-carbon efforts and new markets. The power transition is a possible catalyst, together with chemical substances and supplies to make electrical autos, and lower-emission electric-powered cracking furnaces utilized in chemical manufacturing. By 2030, the corporate expects to develop capability by 20%, EBITDA by over $3 billion per 12 months, and cut back its immediately and not directly produced emissions by 15% in comparison with 2020 ranges.

In its Might investor presentation, administration mentioned that its near-term progress investments since 2021 have already added $800 million per 12 months in incremental mid-cycle EBITDA.

Story continues

Dow’s Path2Zero hydrogen-fueled cracking plant in Alberta, Canada, is dear however might assist the corporate obtain its financial and environmental targets. On the first-quarter earnings name, it mentioned that the venture might ship even increased returns than its Texas-9 cracker, which was instrumental in serving to obtain report earnings in 2021.

Along with the whims of the enterprise cycle, it is vital to know that Dow’s earnings can swing wildly based mostly on the timing of its investments. Proper now, the corporate is in enlargement mode, and capital expenditures are their highest since Dow, DuPont, and Corteva spun off into impartial firms in April 2019.

The excellent news is that Dow took benefit of outsize earnings by paying down debt. It has decreased its internet debt and pension legal responsibility by $9 billion during the last 5 years, with 99% of long-term debt at mounted charges.

A enterprise constructed for returning capital

Dow has been a quite unimpressive inventory. Since spinning off from DowDuPont in April 2019, the inventory value has gone virtually nowhere. The quarterly dividend has additionally stayed the identical at $0.70 or $2.80 per share yearly — good for a ahead yield of 5.3%.

An absence of dividend raises typically signifies that the payout is unaffordable. However as talked about above, Dow is present process a interval of capital investments that it believes will result in extra earnings progress over time.

It additionally has clearly said capital-return targets, with a dividend coverage that targets a forty five% payout of working internet earnings and a 65% payout of working internet earnings by dividends plus share buybacks. As earnings develop over time, we are able to anticipate the dividend to additionally develop. For now, the 5.3% yield is a worthwhile incentive to carry the inventory.

Load up on Dow inventory for a dependable excessive yield

The funding thesis for Dow for the reason that spinoff has centered virtually completely across the dividend. And over the quick time period, it would not be stunning to see the inventory value proceed to languish. However administration is making the best long-term investments to capitalize on the power transition, whereas additionally enhancing its stability sheet. It’s progressing properly on its 2030 targets, for which buyers ought to proceed to carry it accountable.

The valuation additionally appears extremely engaging. Analyst consensus estimates are for $2.95 in 2024 earnings per share and $4.18 in 2025 as the corporate returns to progress. Primarily based on its 2024 earnings, Dow would have a price-to-earnings ratio underneath 18, which is cheap contemplating it’s coming off a weak 12 months.

All informed, Dow checks quite a lot of bins for earnings and worth buyers, making it a worthwhile passive-income play to think about now.

Do you have to make investments $1,000 in Dow proper now?

Before you purchase inventory in Dow, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Dow wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 2, 2024

Daniel Foelber has no place in any of the shares talked about. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure coverage.

Ought to You Purchase the Second-Highest Yielding Inventory within the Dow Jones Industrial Common? was initially printed by The Motley Idiot

[ad_2]

Source link