[ad_1]

David Papazian

Funding overview

I give a purchase score for Smith Douglas Properties Corp. (NYSE:SDHC) because the enterprise advantages significantly from the present macro scenario—excessive rates of interest and residential undersupply—within the US. As a house builder, SDHC has a transparent demand tailwind for the foreseeable future, and given its differentiated working mannequin, I imagine will probably be capable of proceed capturing demand.

Enterprise description

SDHC operates within the homebuilding trade, with a concentrate on the development and sale of single-family indifferent and hooked up properties. SDHC at present operates in eight key states: Atlanta, Birmingham, Charlotte, Chattanooga, Huntsville, Nashville, Raleigh, and lastly, Houston (entered by way of the acquisition of Devon Road Properties). The corporate went public earlier this yr, in January.

Present macro surroundings is the right storm for SDHC

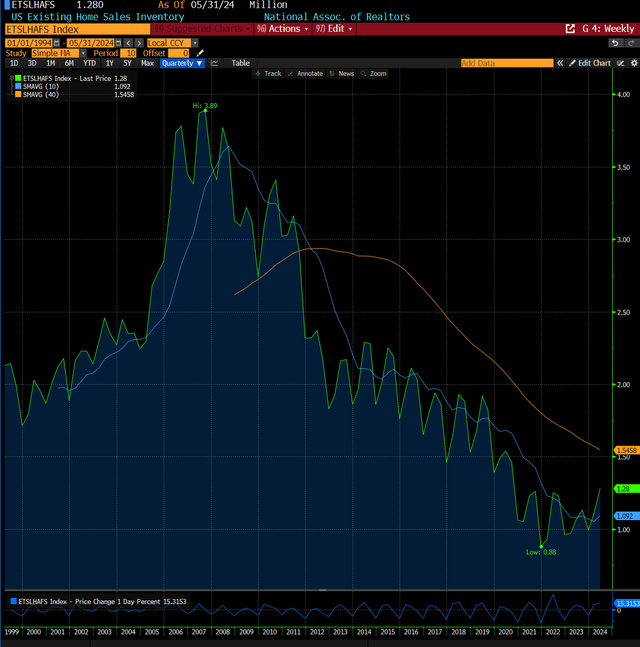

Bloomberg

The present excessive rate of interest surroundings is a constructive factor for SDHC. The surge in mortgage charges has triggered many current house homeowners to delay promoting their properties as they don’t wish to refinance their mortgages at a a lot larger price. In line with a research report, practically 60% of house homeowners have rates of interest beneath 4%, which is an enormous distinction from the present price of >7%. This influence may be seen very apparently from the numerous drop in current house gross sales stock, now at a near-all-time low. Sadly, I do assume that charges are going to remain larger for longer, with potential additional hikes as inflation has confirmed to be quite a bit stickier than anticipated. Simply yesterday, a prime Federal Reserve official talked about that she would help extra price hikes if inflation stayed on the present degree. As such, I see little or no risk of the mortgage price falling within the close to time period. Even when it does, it’ll be at a gradual tempo, which suggests it’ll take a while earlier than the mortgage price goes beneath 4% (justifiable for almost all of current householders to be prepared to refinance their mortgage). Due to this fact, a big a part of house provide goes to stay out of inventory.

Michelle Bowman, one of many Fed’s governors and a voter on its rate-setting Federal Open Market Committee, stated she remained “prepared to lift” borrowing prices once more “ought to progress on inflation stall and even reverse. FT

FRED

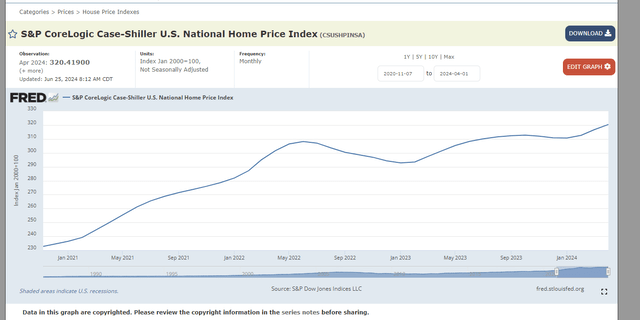

It is a huge tailwind for SDHC, as house consumers are solely left with the selection to purchase new properties. There are two layers of constructive influence right here. The primary is that SDHC will see extra demand. The second is that as a result of demand for single properties outpaces the availability of properties, this has pushed house costs up, which is constructive for each income and earnings progress.

Differentiated enterprise working mannequin

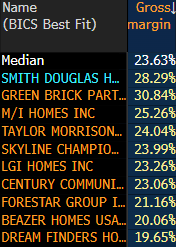

Whereas this macro tailwind is constructive for different house builders, I’m extra constructive on SDHC as a result of its differentiated working mannequin higher positions itself to seize demand from customers. SDHC gives the distinctive mixture of a custom-made build- to-order [BTO] method to the first-time house consumers with quick construct cycle occasions. There are a variety of the reason why homebuyers ought to select SDHC over different builders. For one, the construct time is way shorter (about 60 days in line with 1Q24 earnings), which is significantly better than the trade normal of over 200 days. Secondly, most first-time builders solely supply pre-built properties with restricted customization choices.

Bloomberg

For SDHC, this allows them to attain minimal cancellation charges (~10) and above-average gross margins, as customization permits SDHC to cost larger.

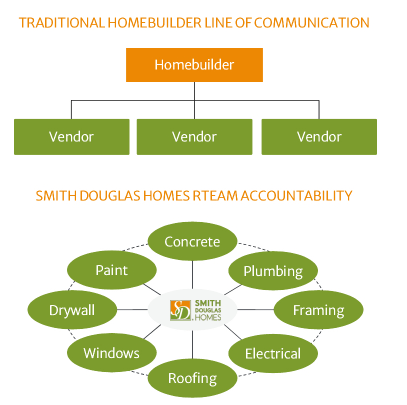

The important thing underlying trigger that allows SDHC to attain such feats is its two proprietary techniques: (1) Rteam, a manufacturing course of that enables for collaboration and coordination between and throughout the corporate and its commerce companions; and (2) SMART Builder, a proprietary single database ERP system that’s building management-focused and manages SDHC’s complete homebuilding ecosystem. With lower than 30 flooring plans accounting for greater than 90% of the corporate’s closings (as per S-1), the corporate has simplified its flooring plan choices, which helps handle the complexity of a custom-made BTO course of.

SDHC

One of many largest hurdles in building is lack of communication, and this is applicable to the house constructing trade as effectively given there are a number of gamers within the ecosystem (completely different companions construct completely different elements of the house). This is a matter that Rteam fixes as a result of it improves manufacturing effectivity by streamlining communication amongst SDHC companions. Primarily, there’s real-time communication between all events concerned, with an emphasis on optimizing productiveness and using standardized processes to enhance effectivity. Each commerce companion is accountable for seeing a job via to completion earlier than passing it on to the subsequent commerce companion, and no social gathering could start work on a venture until the crew has verified that the specs are correct (this mainly means extra checkpoints, and this reduces the prevalence of main “errors” on the later a part of the venture which will likely be arduous to amend).

The SMART Builder system is an ERP database that provides customers entry to information like venture begins and closings, commerce scheduling, job web site costs, and lot-by-lot workstream standing. This permits SDHC to schedule workflow effectively, which improves utilization, and this interprets to larger margins given the fastened value nature of the labors concerned.

Valuation

Could Investing Concepts

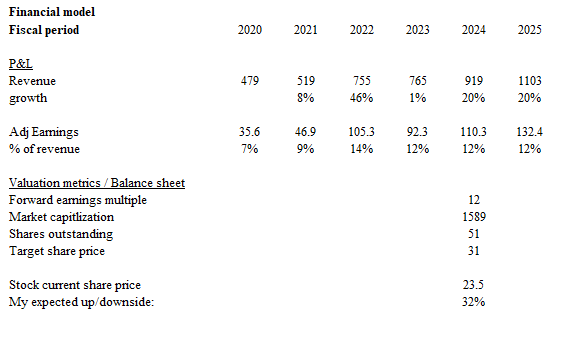

Based mostly on my analysis and evaluation, my anticipated goal value for SDHC is $31.

Income progress ought to proceed to profit from the present macro tailwinds, supported by SDHC’s differentiated enterprise mannequin. My progress goal for FY24 is predicated on administration FY24 steerage (items offered and pricing), and for FY25, I’ve extrapolated the identical progress power as I don’t see the macro scenario resolving anytime quickly. I stored the earnings margin flat for the subsequent two years. I acknowledge that pre-covid SDHC margins are at excessive single-digits, however due to the present macro scenario the place demand outpaces provide, I imagine SDHC can maintain these elevated margins for the subsequent two years. SDHC is at present buying and selling at 12x ahead PE, which is close to its all-time low. Whereas I don’t assume this is smart given the expansion outlook, I imagine the upside is engaging sufficient even with out multiples going up.

For the full-year 2024, we reiterate our prior steerage of projected whole house closings between 2,600 and a pair of,800 properties, and now anticipate our common promoting value to vary between $338,000 and $343,000. Firm 1Q24 earnings

Threat

If the economic system continues to stay sturdy and inflation stays sticky, it might set off wages to develop a lot quicker than SDHC can elevate its costs. This may damage margins, thereby dampening earnings margins. Administration plans to broaden into adjoining markets, and whereas this will drive progress, an absence of native data (experience) could trigger SDHC to see slower consolidated progress as these new markets develop slower than anticipated.

Conclusion

I give a purchase score for SDHC. SDHC ought to see sturdy demand as a consequence of restricted current house stock, because of the excessive charges and decrease properties provide scenario. SDHC differentiated enterprise mannequin that allows it to attain quick construct occasions and excessive customization also needs to enable them to seize this demand successfully. Lastly, SDHC valuation can also be engaging as it’s buying and selling close to all-time-low.

[ad_2]

Source link