[ad_1]

Southwest Airways Tails

Jon Tetzlaff/iStock Editorial by way of Getty Photos

Southwest Airways (NYSE:LUV) has had a tough couple of years and but I’ve written on a number of events, most lately simply three months in the past, that “Southwest Airways is Set to Soar Once more” and gave the inventory a BUY ranking. Quite a few occasions have taken place each within the business and at LUV over the previous three months and but Looking for Alpha analysts have maintained a collective purchase ranking on the inventory in a disconnect from each Looking for Alpha’s extremely regarded quant system in addition to Wall Road analysts, each of which now price the inventory as a maintain. In actual fact, the SA Quant system has rated LUV a maintain for many of 2024 with a couple of transient stretches of a purchase ranking. Collectively, Wall Road analysts haven’t had a purchase ranking on LUV for nearly a 12 months. In mild of business and company-specific updates and occasions over the previous three months, it’s price evaluating if LUV nonetheless deserves a purchase ranking from me.

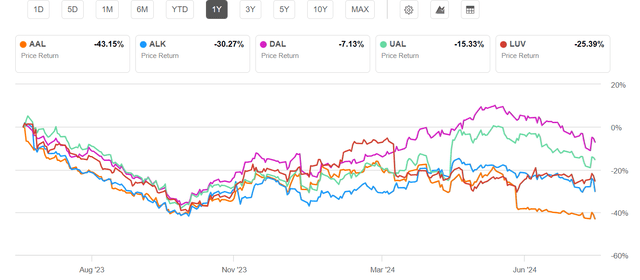

large 5 1 yr chart (Looking for Alpha)

An Eventful Quarter for Southwest

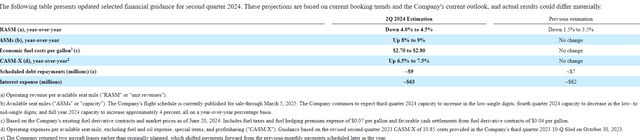

Probably the most notable latest occasion that has taken place is that Southwest revised its investor steering on June 26, 2024 to scale back its income expectations. The corporate beforehand guided for its income per obtainable seat mile, or unit income – a regular measure of airline income producing effectivity – to be down 1.5% to three.5% within the 2nd quarter however its revised steering narrows the vary whereas decreasing its RASM decline to 4.0 to 4.5%. All of LUV’s gasoline price, non-fuel unit price, and non-operating monetary metrics have been unchanged. Southwest famous that the rationale for the RASM decline “was pushed primarily by complexities in adapting its income administration to present reserving patterns on this dynamic surroundings.” Including that “Regardless of lowered expectations, the Firm continues to anticipate an all-time quarterly document for working income in second quarter 2024.”

LUV revised 2Q2024 steering (southwest.com)

As a part of upgrading its info techniques, Southwest introduced a number of years in the past that it might be shifting from a decades-old pc reservations system to the Amadeus (OTCPK:AMADF) platform for its reservations and different back-office techniques. Amadeus operates one of many world’s largest journey distribution techniques on the planet or the pc techniques that airways and different journey suppliers use to promote their merchandise and to handle reservations for the journey service supplier. LUV additionally selected Amadeus not only for a brand new era income administration system however for an origin and vacation spot income administration system – a considerable technological bounce from LUV’s earlier income administration system. Income administration techniques are the back-office packages that airways and another journey suppliers use to optimize income by promoting the very best variety of seats on every flight at the very best value factors given that almost all airways have a number of fares in each market. Through the use of intensive historical past of demand for flights up to now and with human enter, income administration techniques are capable of enhance income efficiency by optimizing the variety of seats which are offered at every fare stage.

Up till this previous 12 months, Southwest’s income administration system labored by optimizing the efficiency of every particular person flight the corporate operates – over 3000 flights/day which are obtainable on the market months prematurely, which means that Southwest wanted a system that might handle over a million flights which are on the market in its reservation system at anyone time. As a part of the change to the Amadeus platform, Southwest additionally made the choice to improve its know-how to an origin and vacation spot income administration system; in that sort of system, the demand is forecast and stock ranges within the reservation system are managed on the origin and vacation spot stage – somewhat than on the particular leg or phase stage. As an illustration, if a passenger buys a ticket from Orlando MCO to Phoenix PHX, his origin and vacation spot is MCO-PHX whatever the routing he takes. That MCO-PHX passenger might fly on one in all LUV’s nonstop flights in that market (so the leg or phase could be MCO-PHX) however they may additionally make a connection in quite a lot of cities similar to Nashville (BNA) or Dallas DAL or Houston (HOU); if the passenger makes a connection, their origin and vacation spot continues to be MCO-PHX however the system has to resolve the worth of taking a passenger from Orlando to Phoenix together with the worth of taking passengers from Orlando to Nashville in addition to Nashville to Phoenix along with all the connections that is also carried on every of these flight segments. An Orlando-Phoenix passenger on a nonstop flight between these two cities is likely to be connecting in Phoenix to Burbank or San Francisco or Seattle whereas a passenger from Nashville to Phoenix might need originated their journey in Baltimore or Boston or Pittsburgh and merely modified planes in Nashville. An origin and vacation spot income administration system has to think about all of these a whole lot of hundreds of combos that may fly on each one in all LUV’s flights and make the very best resolution to maximise income.

Though Southwest made the choice to change to the brand new Amadeus origin and vacation spot income administration system a number of years in the past, it’s common within the airline business to run two income techniques in parallel throughout a transition with solely the older system controlling the stock within the reservation system whereas the brand new system screens the community and reserving patterns and begins to construct forecasts. Whereas Southwest didn’t say when the brand new income administration system cutover happened, their commentary signifies that it has taken place throughout the previous few months. It additionally didn’t say the particular drawback however mentioned that each the income administration system itself and the human inputs weren’t correct and have been liable for the income miss.

It ought to be clear that trendy income administration techniques at airways as giant as Southwest are terribly complicated they usually must handle enormous quantities of information with the enter of people which have up to date and present info that differs from what occurred up to now. As an illustration, if a competitor added vital quantities of capability right into a market and fares at the moment are weaker than they have been earlier than, it might be needed for an analyst to offer inputs to the system in order that the present actuality is forecast somewhat than an older actuality which not exists. People have to offer any variety of market particular inputs whereas system directors may enter macroeconomic components similar to rates of interest which an airline is aware of will have an effect on ticket gross sales. Adjustments to income administration techniques are extremely dangerous and plenty of different airways have reported income shortfalls throughout transition from one system to a more moderen, extra subtle system with a lot worse outcomes than LUV is reporting for the 2nd quarter. Income administration techniques and the people that function them study from forecast errors and the influence is often minimized inside one 12 months and sometimes in a a lot shorter timeframe. Whereas diminished income due to the transition to a brand new income administration system just isn’t useful for Southwest proper now, it isn’t more likely to be repeated on the identical diploma – if in any respect – and the brand new system is an funding that can improve LUV’s skill to optimize its income sooner or later.

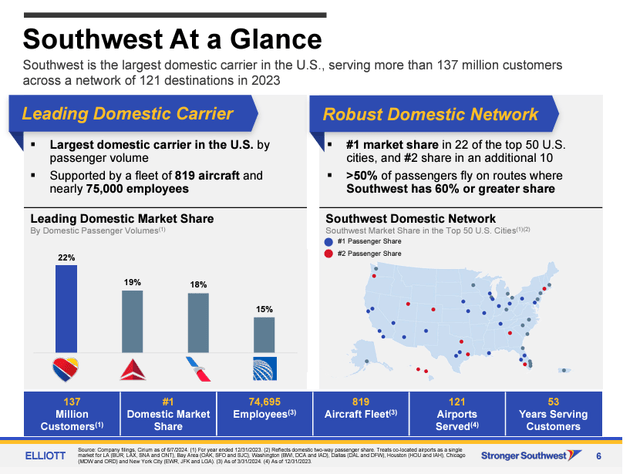

Southwest at a Look (strongersouthwest.com)

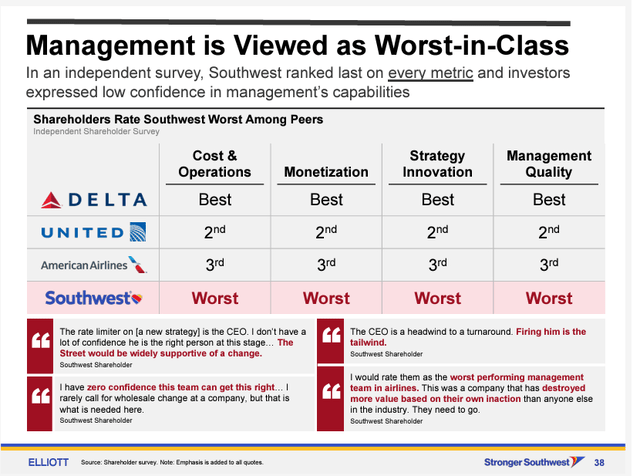

Enter Elliott

The second main occasion that occurred was Elliott Funding Administration’s buy of a low double digit share of LUV shares in early June. Elliott accompanied its buy of LUV shares with a biting commentary on LUV’s monetary and inventory efficiency in comparison with LUV’s opponents with accusations of an inbred board and administration and assertions that LUV’s product is not viable within the present market. Southwest administration had mentioned previous to Elliott’s involvement that the Dallas-based airline was taking a look at its product providing and supposed to offer extra particulars on enhancements at Southwest’s investor convention in September. Elliott’s level about Southwest’s underperformance relative to its friends can’t be overshadowed even when its administration understands the necessity for LUV’s legendary service to evolve. Elliott acknowledged that it surveyed quite a lot of stakeholders together with different shareholders though the biggest U.S. airways are largely held by the identical institutional buyers.

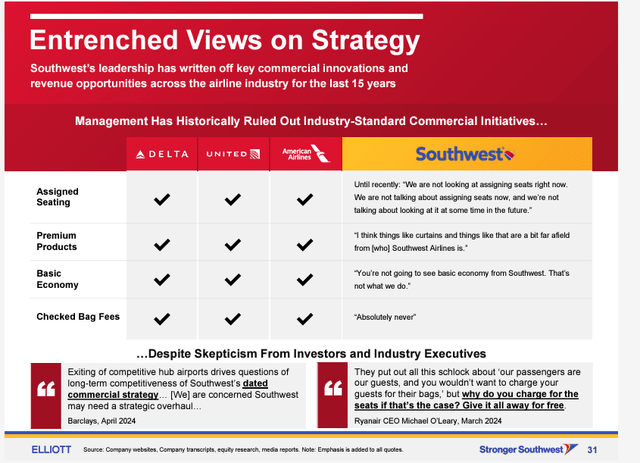

LUV product Elliott (strongersouthwest.com)

Southwest administration says it intends to remain the course and adopted shareholder rights plan that it believes will be certain that detrimental influence to Southwest is not going to happen. The airline’s administration mentioned it has been prepared to work productively with Elliott however the funding firm has not been glad with Southwest’s appointment of a brand new outdoors director or LUV’s clarification for degraded 2nd quarter income efficiency.

LUV mgmt comparability (strongersouthwest.com)

The basis of LUV’s underperformance is in appreciable dispute. Elliott believes that LUV has underperformed due to its product providing whereas the corporate believes that supply delays from Boeing (BA), the only provider of the 737 jets which make up the whole lot of Southwest’s fleet, has had a big detrimental influence on its revenues. Boeing was alleged to ship the primary MAX 7 plane, the smallest model of the MAX household, in 2019 however the certification course of for that mannequin is now anticipated to occur in 2026 with earliest deliveries at the very least one 12 months from now. Southwest has been very cautious to not badmouth Boeing however has repeatedly mentioned that it’s having to carry onto older plane for longer durations of time than it deliberate which will increase upkeep prices and reduces deliberate gasoline financial savings. It is usually pushing its total fleet more durable, beginning its schedule earlier within the day and ending it later at evening which diminishes income efficiency and will increase labor prices as airport personnel work longer. As well as, LUV has needed to take supply of the bigger MAX 8s which places much more stress on fares since LUV has to fill as much as 17% extra seats on the bigger plane than it must fill with the MAX 7.

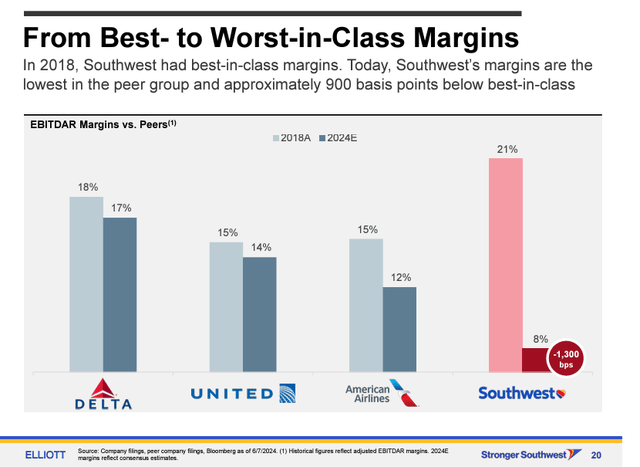

LUV margin comparability (strongersouthwest.com)

Southwest has confronted repeated guarantees that certification for the MAX 7 would come quickly and but deliveries of that mannequin have been repeatedly pushed again with some plane already constructed however unable to be delivered. It has been exhausting for LUV to know the way to adapt its marketing strategy because of the altering supply timelines from Boeing. Low-cost carriers depend on the power to develop as a way to preserve prices in test as decrease paid new staff are added to the payroll. Thus, it’s inconceivable to separate Southwest’s income underperformance from Boeing’s manufacturing and certification points – however Southwest administration has no alternative however to enhance its income efficiency, one thing it appeared ready to do even earlier than Elliott turned concerned with the airline.

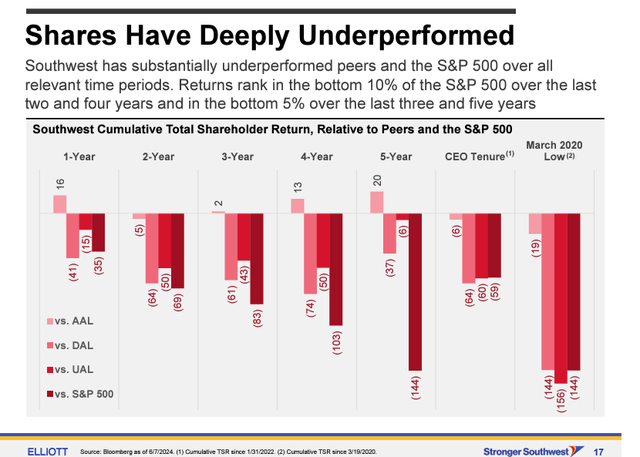

LUV inventory underperformance Elliott (strongersouthwest.com)

A Difficult Airline Atmosphere

Southwest’s underperformance must be seen inside the context of the big financial system and of the efficiency and commentary of different airways. Though the U.S. financial system is usually thought of to be in fine condition, there are rising indications that prime rates of interest and better costs which have persevered at the same time as inflation has calmed are negatively impacting center to decrease revenue Individuals greater than these in larger revenue tiers. As an all coach/financial system airline and with no longhaul worldwide routes, Southwest is being hit more durable with the weak spot within the decrease tiers of the U.S. financial system than international carriers together with Delta (DAL) and United (UAL) each of that are seeing sturdy efficiency on their worldwide networks and likewise with premium passengers.

The second quarter earnings season is underway. Final week, Delta reported weaker 12 months over 12 months earnings regardless of sturdy revenues however famous that there’s overcapacity within the home financial system market. United reported its earnings on Wednesday and had comparable efficiency and commentary with energy famous in worldwide and premium markets – the place these two carriers usually see comparable efficiency. United additionally anticipated weaker third quarter earnings than analysts anticipated because of the identical home overcapacity that Delta famous though United mentioned that capability ought to turn into extra balanced halfway by way of the quarter. Lastly, Spirit (SAVE) revised down its 2nd quarter investor steering primarily based on decrease non-transportation or ancillary income.

The implications for Southwest from all of those different airline earnings studies is evident. The market that Southwest caters to – home coach journey – is having the toughest time and is populated by airways which are struggling essentially the most. It could actually’t be misplaced that American, the weakest of the massive 3 international carriers, is the least international service of the massive three whereas Southwest competes within the home market with a number of low price and low-cost carriers that do poorly. In actual fact, Alaska Airways (ALK) is the one primarily home airline that’s reporting sturdy financials – in keeping with my expectations that their return to being a top-tier service is underway. Notably, ALK is including premium cabin home seats in keeping with findings from AAL, DAL and UAL that there’s energy even on the entrance of home plane.

Elliott has made a number of noise concerning the quantity of income that Southwest leaves on the desk due to their egalitarian philosophy of promoting a ticket with all the identical parts for everybody. Certainly, the legacy carriers generate appreciable quantities of income from all types of ancillary providers – baggage, numerous ranges of seat assignments, and loyalty program tiers that incentify upselling which will increase income. It is extremely doubtless that Southwest will tackle a few of Elliott’s issues that are echoed by some LUV prospects; alternatively, Southwest has a really loyal following for whom the airline’s product because it exists now could be what retains them loyal. Southwest has to determine the way to enhance its income efficiency whereas incorporating no matter adjustments it feels it may well implement with out alienating its most loyal prospects – and, if the foundation subject of LUV’s income underperformance is said to Boeing’s points with the MAX 7, Southwest has no alternative however to develop methods that can overcome Boeing’s points which aren’t going to be resolved for at the very least a 12 months.

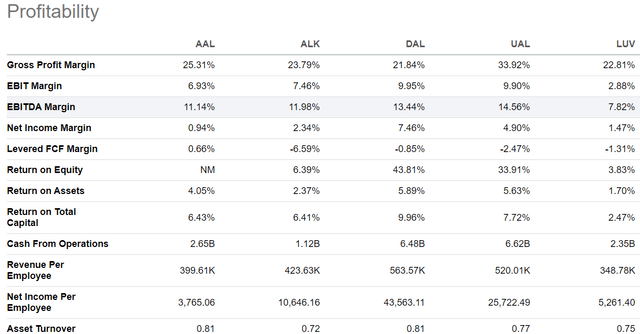

large 5 profitability 18jul2024 (Looking for Alpha)

Let’s additionally not overlook that there’s significantly fragility amongst a few of Southwest’s opponents. Extremely discounter airline Spirit’s downward revision of its steering raises additional doubt about SAVE’s viability. That airline is within the midst of delicate negotiations with collectors who’re deciding whether or not to push again the due date on a big quantity of debt that SAVE can not afford to pay on its present schedule. Despite the fact that SAVE is affected by sturdiness issues with the Pratt and Whitney (RTX) Geared Turbofan engine that has grounded scores of planes, creditor selections might restrict SAVE’s skill to attend for these engines to be fastened – with the potential that a number of the capability that a number of carriers say must be faraway from service is likely to be faraway from the ultra-low-cost service mannequin for the long-term. JetBlue (JBLU) is also struggling to restructure its enterprise. Southwest may benefit from restructuring amongst smaller low-cost carriers.

A Sturdy and Confirmed Enterprise Mannequin

Whatever the present state of affairs during which Southwest finds itself, buyers flocked to LUV as top-of-the-line airline investments ever as a result of the corporate basically has a stable observe document. Whereas LUV has to navigate its present turbulence, it has demonstrated up to now that it may well adapt to altering markets. Whereas Southwest began service with a fast 20 minutes on the bottom between flights on plane that seated round 100 passengers, LUV has tailored to bigger plane – needed to enhance effectivity – and longer floor time between flights. The rise within the “airport problem issue” has made brief haul flights much less fascinating and but LUV has tailored to supply extra medium and longhaul flights. LUV’s workforce has turn into extra senior and different airways have gotten extra environment friendly, narrowing the effectivity good points between Southwest and legacy airways, and but Southwest continues to be essentially the most environment friendly of the massive 4. LUV began as a predominantly level to level airline (didn’t provide connections) and but its community now helps giant percentages of connections in some cities, typically as a lot as legacy airways provide of their hubs.

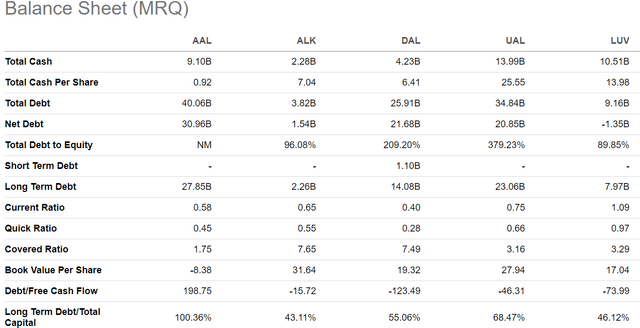

Southwest’s best benefit is its sturdy steadiness sheet which might assist years of weak income progress – and but that’s extremely unlikely to occur. Few different airways on the planet have a steadiness sheet as pristine as LUV’s.

large 5 steadiness sheet 18jul2024 (Looking for Alpha)

And Southwest is working exhausting to re-engage its workers who’ve been not solely disheartened by the decline of Southwest’s business management however have been financially harmed as revenue sharing has been dramatically diminished, impacting Southwest worker pensions – information that Elliott has been solely too eager to focus on. Nonetheless, Southwest adopted a contract settlement with its pilots with a settlement with its flight attendants. Whereas the labor marketplace for pilots and mechanics is completely different from cabin crew and passenger contact workers, Southwest, like most airways, is cautious to not upset the historic wage relationships between workgroups. LUV’s settlement with its flight attendants got here on the second try however was nonetheless the primary of the massive 4’s unionized flight attendant workforces to see wage will increase; Delta’s flight attendants usually are not unionized and that firm moved early after the pandemic to extend salaries. LUV has lengthy had good relationships with its workers who’ve delivered above common ranges of service to Southwest prospects. As the corporate struggles to search out the appropriate income formulation, it’s dedicated to holding its workers on its aspect and will definitely do all it may well to extend the earnings that can additional cement the great relationship with its workers.

As Southwest evaluates its income mannequin, it’s more likely to search for progress markets together with its house market of N. Texas – the Dallas/Ft. Price metro space. For the reason that day Southwest started service, it has been concerned in authorized battles to freely serve N. Texas – rooted within the space’s resolution 50 years in the past to require all airways to serve the newly opened Dallas/Ft. Price Worldwide Airport. Southwest fought to serve Dallas Love Subject, the earlier major airport for the Metropolis of Dallas, since LUV wasn’t in existence when the agreements for different airways to maneuver to DFW have been signed. American Airways operates an enormous hub at DFW and the 2 N. Texas airways have fought countless authorized battles which have resulted for the previous ten years in a truce which has stored American at DFW (additionally on account of American’s merger with USAirways) whereas Southwest solely serves Love Subject. The ultimate restrictions apart from capping the dimensions of Love Subject’s operations and limiting Southwest’s house airport to home flights finish subsequent 12 months and it’s sure that LUV will increase to different N. Texas airports – probably together with close by DFW or probably together with different N. Texas airports.

And the ultimate piece of excellent information that Southwest desires to listen to in 2025 – and which is able to doubtless come – is Boeing’s certification of the MAX 7. Boeing has very doubtless come to the underside of its manufacturing and certification points and can give you the ultimate fixes to the MAX engine anti-ice system which is able to enable certification of the MAX 7 after which the MAX 10 after that with the latter mannequin ordered by all different U.S. MAX prospects. Certification of the MAX 7 and starting of deliveries of the MAX 7 shall be a key a part of LUV’s efforts to repair its income issues because it places the appropriate dimension plane on the appropriate routes. As well as, LUV’s gasoline effectivity will enhance and upkeep bills will fall because it retires older 737-700 plane that it has needed to preserve in service. Lastly, LUV’s flight schedule shall be retimed to attenuate very early and really late flights.

However all of these enhancements is not going to come till MAX 7 deliveries start which is not going to doubtless occur for at the very least a 12 months and certain into 2026. Within the meantime, Southwest must give attention to transforming its product choices as a way to shut the income hole with the massive 3 international carriers – and esp. Delta and United that are producing substantial quantities of premium income together with on their home networks.

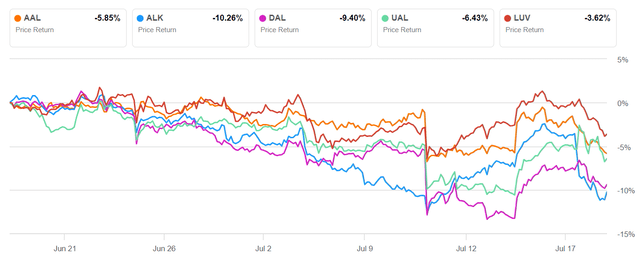

large 5 1 mo chart 18jul2024 (Looking for Alpha)

Lastly, we’ve to think about LUV inventory relative to the remainder of the business. Buyers have soured on airline shares over the previous month as home income weak spot has turn into obvious all through the business. On condition that worldwide revenues shall be comfortable by way of the winter, airline shares as a gaggle usually are not more likely to see substantial appreciation for the following six months till airways give perception into their 2025 income outlook and esp. for Spring Break and summer season. Additional, whereas airways carried out effectively relative to different sectors for numerous durations of time within the post-covid period, they’re settling again due to the energy of different sectors esp. tech-related sectors. Whereas there shall be some airways that can outperform their sector, on the whole, airways as a gaggle shall be much less aggressive as investments.

LUV Inventory Appreciation is Caught on the Gate

It’s subsequently applicable to downgrade Southwest Airways to “maintain” pending additional readability about its plans to enhance income and of Boeing’s efforts to get the MAX 7 licensed and into Southwest’s operations.

[ad_2]

Source link