[ad_1]

Rpsycho/E+ by way of Getty Photographs

A shocking yr for the S&P 500 (SP500). The one option to describe it. Small-caps? Who cares? Passive market-cap weighted indexing has labored in a historic vogue. And for all we all know, that might proceed. Perhaps we’re in one in all these historic intervals the place volatility simply does not need to rise, and we maintain making data of latest all-time highs getting hit.

If that is the world we’re in, then it might be value *buying and selling* the ProShares Extremely S&P500 ETF (NYSEARCA:SSO). I say buying and selling purposely as a result of such a world of consecutive optimistic returns which profit leveraged ETFs like this one tends to not final, and when the flip comes, it may be vicious.

SSO is a 200% leveraged ETF, which successfully signifies that, earlier than charges and bills, its return for the day is roughly double (2x) that of the S&P 500. The technical time period for that is “gearing,” which suggests SSO achieves its 2x every day return by means of the usage of securities and monetary derivatives to successfully multiply the return or danger of the underlying asset or portfolio to which they’re associated.

The fund is designed to ship returns linked to a every day aim. Nevertheless, traders who know what they’re doing would possibly purchase and maintain SSO shares for substantial intervals, so long as their danger tolerance and funding goals correspond to the underlying traits of the fund. Over the very long run, the compounding impact of every day returns can produce substantial departures from the fund’s 2x goal – typically optimistic, typically detrimental, relying completely on volatility and total path conduct.

The latter level is necessary. In low volatility intervals, the every day 2x reset means the fund is leveraging on high of levered positive factors from the day prior. The compounding potential of that for extended streaks in market path conduct might be important. By the identical token, although, in excessive volatility intervals the place shares are up huge sooner or later after which drop the subsequent, the 2x reset erodes efficiency. It is because you are successfully, by means of SSO, magnifying returns on the precise incorrect time simply earlier than a flip decrease. Please fastidiously assessment the SEC Bulletin on leveraged ETFs earlier than inserting any trades.

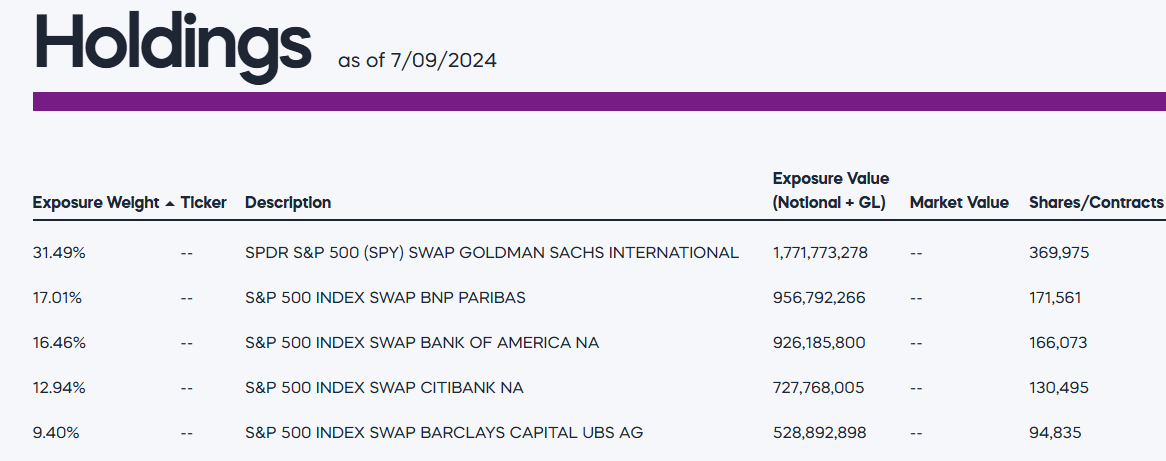

A Look At The Holdings

Basically, SSO’s holdings are constructed to appear to be the S&P 500 Index’s – all whereas being leveraged. Its high positions are pushed by the mega-caps of the index of shares representing America’s largest and best-known firms in numerous enterprise and business sectors.

proshares.com

We are able to see a 3rd of the fund is completely made up of swaps to attain the leverage. What this implies is it is not truly proudly owning shares within the S&P 500 – simply return streams with numerous huge financial institution counterparties.

Sector Composition and Weightings

The sector composition of the ProShares Extremely S&P 500 is similar in monitoring because the S&P 500 itself, simply with leverage. The implication after all right here is that this has heavy Tech sector publicity, leveraged clearly by means of the 2x conduct. If there have been a motive to be bearish Tech, this is not precisely the fund you’d need to be bullish on in consequence.

Peer Comparability: Leveraged ETF Alternate options

SSO is clearly not the one ETF on the town angling for your online business, providing leveraged publicity to massive‑cap US equities. One competitor is the Direxion Day by day S&P 500® Bull 2X Shares ETF (SPUU). After we examine the 2 to one another, we see that regardless of doing the identical factor, SPUU has truly outperformed by practically 300 foundation factors. My guess as to why? It could possibly be the every day monitoring and compounding results right into a leveraged return stream inflicting the cumulative efficiency to vary. I’m not certain if that is a motive to favor SPUU over SSO, however value holding at the back of your thoughts.

StockCharts.com

Execs and Cons

There are advantages and dangers to investing within the ProShares Extremely S&P500 ETF that clever traders will weigh thoughtfully. Like most leveraged funds, the fund presents traders an opportunity to extend their publicity to the asset they’re monitoring. SSO does this by leveraging its holdings utilizing derivatives and swap agreements. Traders can doubtlessly improve returns on their investments if their asset class of selection will increase in worth (on this case, US large-caps).

However as a result of the fund is leveraged, any losses – say, as a result of a bear market – are magnified within the leveraged lengthy place. It’s a must to be comfy with that danger. Furthermore, the compounding development of every day returns can result in important deviations from 2x publicity on very long time horizons. Once I submit on X saying “path issues greater than prediction,” I am particularly speaking about how the sequence of returns impacts the precise vacation spot when it comes to the endpoint of whole return.

Alongside operational complexity, the fund additionally has counterparty danger. That is as a result of some property of the fund are held in derivatives and swap agreements that should be revalued at every time the fund is priced. Right here, the worth that can seem within the fund depends on the creditworthiness and stability of its counterparties – the funds which have entered into these spinoff and swap agreements, corresponding to Goldman Sachs, BNP Paribas, and so forth.

At face worth, the fund’s expense ratio of 0.91 p.c is low in comparison with utilizing conventional leverage. Nevertheless, due to the compounding results of leverage on these prices over time, these bills may eat into the returns and doubtlessly hamper the fund’s efficiency.

Conclusion

For these traders who need to crank up the efficiency of the market-cap benchmark that tracks the largest firms within the US, the ProShares Extremely S&P500 ETF looks as if a superb wager. Having stated that, I might be nervous given this stretch in market efficiency to make use of a fund like this right here. It clearly can proceed to work and carry out, however there’s a actual vulnerability that the longer term path of markets seems totally different from the latest previous. And if that is the case, that path will not be one you need to leverage every day.

[ad_2]

Source link