[ad_1]

Are you able to earn money buying and selling?

What does it take to make constant earnings?

What’s the best possible approach to get began?

Should you’re a newbie dealer or simply seeking to get began, you’re doubtless asking these questions. And you need to be. I understand how it feels. There isn’t any established road-map to turning into a profitable dealer, so it may be troublesome to know the place to start.

At one level, certainly not too way back, I used to be in your footwear. I didn’t perceive the fundamentals of buying and selling. Heck, I didn’t even know what “the tape” was, one thing I now watch each single day. I needed to dig to search out what I actually wanted to grow to be a dealer. And happily, I had the assistance of SMB Capital, which has constructed its agency instructing new merchants the basics of buying and selling and the steps to take with a purpose to grow to be profitable.

So should you’re asking these questions, this text was written for you.

For over a century, individuals from all walks of life have devoted their lives to producing earnings from the Inventory Market. A lot has modified over time by way of expertise and the way in which merchants function, however the basic truths about provide and demand stay the identical.

Current occasions just like the GameStop inventory saga together with the surge in AI-driven expertise have sparked a rising curiosity in inventory buying and selling, making this a well timed topic to discover.

Navigating this world takes nice ability. Fortuitously for us, these are abilities that may be taught. Whether or not you’re beginning with a small financial savings account, a major funding, or striving to earn a spot on knowledgeable buying and selling desk, everybody begins on the identical place – the fundamentals.

I’m a senior dealer at a proprietary buying and selling agency in New York Metropolis. The truth is, it is among the longest enduring and most profitable proprietary buying and selling companies on the market. I commerce discretionary methods in addition to develop algorithmic buying and selling methods for the agency.

You may comply with me on Twitter @GarrettDrinon.

I’ll lay out on this article what I find out about getting began, so that you simply don’t need to dig like I did. And should you discover that we return to sure matters plenty of instances, it’s as a result of there are explicit issues about buying and selling which are simply that essential. We need to drive them dwelling. On this article we’ll cowl:

… so let’s get began!

Buying and selling Terminology

Identical to in some other medium, inventory buying and selling has its personal language. So let’s break down a few of this terminology so as to sit on a buying and selling flooring and know precisely what these individuals are speaking about.

It’s fairly easy as soon as it’s laid out for you. And should you don’t get it at first, that’s okay – we’ll go into better element on many of those matters later within the article. Listed below are a dozen of an important phrases a dealer makes use of each day:

1. Inventory: Often known as shares or fairness, a inventory is a kind of funding that represents possession share in an organization. While you purchase a inventory, you’re buying a chunk of the corporate.

2. Market Capitalization: That is the overall market worth of an organization’s excellent shares of a inventory. It’s calculated by multiplying the corporate’s shares by the present market value of 1 share. Firms with a excessive market capitalization are sometimes called giant caps; these with medium market capitalization are known as mid caps, and people with small market capitalizations are known as small caps.

3. Bull Market / Bear Market: A bull market refers to a market situation the place costs are rising, and widespread optimism typically sustains the upward development. Conversely, a bear market refers to a market situation the place costs are falling, and widespread pessimism typically sustains the downward development.

4. Bid and Ask: A bid is an order to purchase shares of a inventory at a sure value. An ask (often known as an “supply”) is an order to promote shares of a inventory at a sure value. Identical to at an public sale, the best bid and the bottom ask characterize the within market the place a lot of the enterprise is being executed.

5. Unfold: That is the distinction between the best bid value and the bottom ask value. It represents a value related to buying and selling. With wider spreads, merchants are required to pay extra to exit their place instantly.

6. Quantity: That is the variety of shares of a safety traded throughout a given time period. Excessive quantity typically suggests excessive curiosity in a selected inventory.

7. Liquidity: This refers to how simply a inventory could be purchased or bought with out impacting its value. Excessive liquidity means the inventory could be traded simply, and vice versa. A good unfold and excessive quantity are two elements that may contribute to excessive liquidity. A large unfold and low quantity are two elements that may contribute to low liquidity.

8. Volatility: This refers back to the value actions of a inventory or the inventory market as an entire. Extra particularly, volatility is the magnitude of value strikes per unit of time. Extremely risky shares are ones with excessive up and down actions and vast intraday buying and selling ranges.

9. Elementary Evaluation: That is the analysis of something associated to the corporate itself or total market narratives. A basic analyst research an organization’s financials, business, and common financial elements to attract a conclusion concerning the inventory and make buying and selling choices.

10. Technical Evaluation: That is the analysis of something associated to the precise buying and selling exercise of the inventory or motion of the general market. A technical analyst research statistical traits in value motion and quantity and makes use of charts as a key device.

11. Cease-Loss Order: That is an order positioned with a dealer to purchase or promote a inventory when it reaches a sure value. It’s designed to restrict a loss on a place.

12. Lengthy and Quick Positions: In buying and selling, should you’re “lengthy” a inventory it means you’ve initiated a place by shopping for the inventory with the expectation that the worth will go up with a purpose to promote at increased costs. Conversely, should you’re “quick” it means you’ve initiated a place by promoting the inventory with the expectations that the worth will go down with a purpose to purchase again the inventory at decrease costs. At first, the thought of promoting a inventory to make a revenue can appear slightly backwards, however we’ll cowl the idea of short-selling in additional element later on this information, and it’ll grow to be second nature very quickly.

What’s Inventory Buying and selling?

Have you ever ever seen information tales of inventory costs going up and down and questioned how individuals earn money from these actions? It’s an exercise that requires technique, techniques and an understanding of market dynamics.

Merely put, inventory buying and selling is the shopping for and promoting of shares in publicly listed firms. Merchants goal to revenue from the fluctuations in inventory costs by shopping for at decrease costs and promoting at increased costs.

There are two kinds of positions a dealer can provoke: lengthy and quick positions.

Merchants can get lengthy a inventory by initiating a purchase order, seeking to revenue from a value improve by promoting the inventory. To visualise this, think about going to a storage sale and discovering a baseball card of your favourite participant. Projecting this participant can have an awesome season, you purchase the cardboard with the concept that you could have a excessive chance of promoting the cardboard at a better value to collectors on-line in a number of months.

Conversely, merchants can get quick a inventory by initiating a promote order, seeking to revenue from a value lower by shopping for again the inventory, which known as “masking” your place. This may occasionally appear unusual at first – how will you promote one thing you don’t personal? Effectively, quick promoting is made attainable by the act of borrowing shares earlier than promoting them after which returning them to their rightful proprietor after shopping for again the shares.

To place quick promoting into context, think about borrowing your good friend’s uncommon comedian e-book and promoting it to a purchaser. Later, you discover the identical comedian e-book at a reduced value, purchase it, and return it to your good friend. The distinction between your promoting and shopping for costs is your revenue. With inventory buying and selling, in our fashionable age, this course of is streamlined – it’s all executed with the press of a button.

The act of shopping for and promoting is just the tip of the iceberg. So as to have a shot at turning into worthwhile over the course of many trades, we should first perceive what to purchase and promote, and what makes these shares transfer.

Understanding Shares

What’s a inventory?

After I purchase a inventory, do I actually personal something?

Shares characterize a fraction of possession in an organization. While you purchase a inventory, you do in reality personal a portion of the corporate.

Think about you’ve opened a lemonade stand. By issuing shares, you’re primarily inviting individuals to purchase small components of your lemonade enterprise. These shareholders now have a stake in your lemonade stand’s success, simply as you do.

As a shareholder, there are two methods you could see returns in your funding: dividends and capital positive aspects.

Dividends are generated from firms sharing a portion of their earnings with shareholders as a “thank-you” for his or her funding. Dividends are a gradual stream of earnings, related largely to traders and long run holders of a inventory.

Capital Positive aspects are generated from promoting shares at a better value than you paid. Lively merchants focus totally on producing earnings from capital positive aspects, as that is what buying and selling is all about, capitalizing on the fluctuations within the inventory value.

An organization’s efficiency influences its inventory value. In case your lemonade stand begins promoting essentially the most scrumptious lemonade on the town and earnings soar, those that personal your inventory will doubtless see their worth improve. However, in case your lemonade begins tasting bitter and other people cease ingesting it, the worth of your shares may drop. These earnings are reported quarterly to the general public.

In the end, and this is essential to recollect – the worth motion of a inventory depends upon the provision and demand dynamic current out there. If demand for a inventory is overwhelming provide, the worth will rise and if provide is overwhelming demand, value will fall. It is a truth. Simply as your Uber experience value will go up when it’s raining as a result of now everyone needs to name a automotive, a inventory value will go up if everybody needs to purchase it.

Have you ever ever watched the information and heard the reporter rave about an organization’s earnings solely to see the inventory tank the subsequent day?

That is when it’s essential to recollect the provision and demand dynamic at play. If a really giant participant needs out of a inventory, there doesn’t have to be a basic motive or information story behind the transfer. If there may be promoting strain, the inventory will go down.

As merchants, we use this dynamic to our benefit. We study to learn the shopping for and promoting strain and we love volatility as a result of it helps us earn money.

The Inventory Market

If you wish to purchase and promote one thing, you want a market. The inventory market acts as a market for consumers and sellers of shares, similar to an public sale home.

Simply as you may bid for a treasured piece of artwork or a classic automotive at an public sale, merchants bid for shares. The buying and selling of those shares is facilitated by exchanges such because the New York Inventory Alternate and the NASDAQ, which listing the shares of hundreds of firms.

Have you ever ever been mystified by the tons of of tickers flashing on monetary information channels and questioned, how can I comply with all this chaos?

Effectively, we will group shares into broad market averages with a purpose to simply digest all this data.

To do that, we glance to indices just like the Dow Jones Industrial Common, S&P 500, NASDAQ 100, and the Russell 2000 which supply snapshots of the market’s efficiency. They observe a number of firms, every with a distinct focus.

Consider these indices because the inventory market’s pulse, very important barometers of total well being and financial traits. If these indices are on the rise, the financial system is commonly seen as doing properly. If they’re falling, it’d recommend financial downturns.

The Dow Jones Industrial Common, historically known as “the Dow”, is made up of 30 of the most important publicly owned U.S. firms. Consider the Dow because the spotlight reel, representing a pattern of a few of the greatest and most influential firms within the U.S. We will commerce this index by way of the ticker DIA.

The S&P 500 contains 500 of the most important U.S. firms throughout numerous sectors, providing a complete snapshot of the U.S. financial system’s well being. As a result of its deal with a variety of industries and huge market capitalization, the S&P is commonly seen as essentially the most correct illustration of the U.S. inventory market as an entire. We will commerce this index by way of the ticker SPY.

The NASDAQ 100 contains 100 of the most important home and worldwide non-financial firms listed on the NASDAQ alternate. With expertise making up a good portion of its roster, this index serves as a dependable barometer of the tech sector’s efficiency. It’s value noting {that a} inventory could be listed on a number of indices concurrently. As an example, Apple options on the Dow, the S&P and the NASDAQ 100. We will commerce this index by way of the ticker QQQ.

The Russell 2000 Index, in contrast to its counterparts, hones in on 2000 smaller, up-and-coming U.S. firms. As a result of these small capitalization firms are sometimes riskier investments, the Russell is commonly seen as a barometer for hypothesis and danger urge for food inside the inventory market. We will commerce this index by way of the ticker IWM.

The place to Commerce Shares

It is a subject that I get tons of questions on. As a brand new dealer, there are such a lot of choices between brokerages and buying and selling platforms that it may be overwhelming.

However relaxation assured, that is one thing that may grow to be very comfy when you study the choices. And bear in mind, you possibly can at all times experiment with numerous platforms earlier than you choose one.

Inventory buying and selling can happen by means of a number of avenues:

On-line brokers will aid you arrange a buying and selling account and so they supply platforms with instruments for unbiased commerce administration, comparable to charts and watchlists. Listed below are a number of common on-line brokers that many merchants use:

ThinkorSwim

TradeStation

Interactive Brokers

E-Commerce

Robinhood

Buying and selling charges are a key part. Commerce execution, quick locates, margin curiosity, and different charges will all be particular to the dealer you select. As you acquire expertise you might search out brokers for top quantity, lively, superior day merchants comparable to:

Lightspeed

CenterPoint Securities

Cobra Buying and selling

SpeedTrader

Full-service brokerage companies, then again, supply a collection of complete companies together with personalised funding recommendation and portfolio administration, however could not not present the options that an lively dealer is in search of.. A couple of common full-service brokerage companies embody:

Constancy

UBS

Morgan Stanley

JP Morgan Wealth Administration

Charles Schwab

Every choice carries its personal set of execs and cons regarding value, companies, and the diploma of management you could have over your investments.

Charting software program packages supply charting and analysis instruments with out the flexibility to put trades. It’s possible you’ll need to examine different charting choices or you might search extra superior buying and selling instruments after you acquire expertise. That is the place stand-alone charting software program can come into play. A couple of common choices embody:

TradingView

TC2000

eSignal

Stockcharts.com

MarketSmith

Bloomberg

Simply because an organization costs a payment for a stand-alone charting platform doesn’t imply it’s essentially higher than a platform that comes with an internet dealer account, comparable to ThinkorSwim or Tradestation. Many on-line brokers and charting software program packages supply incredible charts, indicators, customized scripting, watchlists, inventory alerts, and monetary evaluation.

In the end, your selection ought to align together with your buying and selling targets, type, and your required degree of involvement.

At SMB Capital, we make the most of our personal proprietary buying and selling platform and instruments to handle trades, conduct analysis, and develop algorithmic buying and selling methods. Some merchants complement these instruments with charting platforms from ThinkorSwim, TradeStation, TradingView or TC2000s to call a number of.

There are many free choices on the market that supply greater than enough assets.

By the way in which, should you’re actually inquisitive about entering into inventory buying and selling, we’re at the moment operating a free on-line coaching the place you’ll uncover:

The easy excessive chance buying and selling technique that we train all new merchants on our desk (this alone might make you a worthwhile day dealer)

One among our agency’s most worthwhile and constant proprietary commerce setups (you gained’t see this wherever else)

The distinctive technique that turned certainly one of our merchants right into a 7-figure elite dealer (which is surprisingly simple to study and execute)

Easy methods to get funded with giant danger capital and commerce our cash with ZERO danger to you (all from your individual dwelling)

Reserve your free spot now. (Should you’re an entire newbie, be certain that to learn this text earlier than attending, so that you’re utterly up to the mark and may rapidly and effectively study the methods we train).

Easy methods to Commerce Shares

So that you perceive the several types of brokerages and charting platforms; you’ve executed your analysis and determined to strive one out that is smart to you. You may be asking your self, how do I make a commerce?

These brokerage accounts are like your private command heart, providing you with management over your trades. Right here, you possibly can place several types of orders:

Market Orders: These orders execute instantly at one of the best obtainable value. Suppose again to the public sale analogy. If somebody is bidding for the inventory at 60 {dollars}, you possibly can take that bid to purchase the inventory at 60 {dollars} by putting a market order.

The important thing factor to know with a market order is that whenever you place the order, there isn’t any restrict to the precise bid that you’ll truly take. If liquidity is low or the bid drops to a lower cost, the dealer will fill you at no matter one of the best obtainable bid is, no matter value. That is the quickest approach to purchase or promote a inventory since you are assured to get stuffed, however you’re topic to the liquidity degree of the market.

Restrict Orders: These orders set a particular value at which you’re keen to purchase or promote the inventory. In contrast to market orders that execute instantly at one of the best obtainable value, restrict orders solely fill when the inventory hits your predetermined value or higher.

For instance, if you wish to purchase a inventory, however not for greater than 50 {dollars}, you’d place a restrict order at 50 {dollars}. In our public sale analogy, your order will grow to be a bid at 50 {dollars}. Any such order is just not assured to execute, however when it does, you’re assured of getting stuffed at 50 {dollars} or higher.

Cease Orders (or Cease-Loss Orders): These orders set off a market order to purchase or promote a inventory as soon as it hits a sure value, referred to as the cease value. As an example, in case you are lengthy a inventory at the moment priced at 40 {dollars}, and also you need to restrict your potential loss to five {dollars} per share, you would place a cease order at 35 {dollars}. If the inventory falls trades beneath 35 {dollars}, your cease order turns into a market order to promote, getting you out of the place.

Nonetheless, if the inventory’s value falls quickly previous your cease value, the precise promoting value could possibly be decrease – as a result of bear in mind, on this case, your order turns into a market order the place there isn’t any restrict to the worth at which you get stuffed.

Cease-Restrict Orders: These orders are a mixture of cease orders and restrict orders. As soon as the cease value is reached, the stop-limit order turns into a restrict order to purchase or promote at a specified value or higher. This offers you extra management over the worth at which the commerce is executed, however simply as in a traditional restrict order, there’s the danger that the order could not fill in any respect if the inventory’s value strikes away from the required restrict value after the cease value is hit.

For instance, let’s say you set a cease value at 55 {dollars} with a restrict value at 54 {dollars}. On this case, the order will flip right into a restrict order as soon as the worth trades beneath 55, filling you wherever from 55 right down to 54, but when the worth continues to fall and skips over 54 {dollars}, the restrict order could not execute.

Now you could visualize the distinction kinds of orders and their results, suppose again to our authentic definition of liquidity:

A extremely liquid inventory probably offers you a greater likelihood of getting stuffed. A extremely illiquid inventory may require looser restrict costs on stops or may trigger you to get “slipped” on a market order, which is a time period used to explain the occasion wherein the market strikes previous your supposed execution value.

And bear in mind, similar to any enterprise, buying and selling comes with a cost-of-business, which may embody commissions and transaction charges, in addition to the unfold, which as you now know, is the worth distinction between the best bid and the bottom ask value. Should you pay the ask to get lengthy, the one approach you’re assured to exit instantly is by hitting the bid with a market order, so the bigger the unfold, the extra it prices a dealer to execute a commerce.

Should you’re inquisitive about how these particular order varieties come into play when buying and selling real-world setups, I made a video about it on the SMB Capital YouTube channel.

Forms of Inventory Buying and selling

Now that you simply perceive the fundamentals of what the inventory market is and the way we will take part in it, you might be asking your self…

What sort of dealer ought to I grow to be?

There are numerous types of inventory buying and selling every tailor-made to completely different danger profiles and life-style decisions. As an example, some types may go well with those that can commit their complete day to buying and selling, whereas others could also be extra appropriate for individuals who can solely dedicate a number of hours every week.

A simple approach to break down the completely different types is by timeframe, which is a measure of how lengthy a dealer is seeking to maintain a inventory place. There are 4 primary timeframes a dealer may make use of: intraday buying and selling, swing buying and selling, place buying and selling, and investing. On this article we’ll deal with the previous three varieties, as a result of investing falls outdoors the scope of lively buying and selling.

Intraday buying and selling is like being a sprinter in a race. An intraday dealer enters and closes out a commerce all inside a single day. These could be scalp trades, that are very fast trades based mostly on quick time period indicators, or they are often move-to-move trades, meant to capitalize on intraday swings out there.

Should you’re inquisitive about studying extra about these several types of intraday trades – scalps, move-to-move trades, and trades to carry – I made a video about them right here on the SMB Capital YouTube channel.

As a result of intraday trades are supposed to seize quick value fluctuations, intraday merchants typically make the most of a considerable amount of capital, or leverage, with a purpose to execute these trades, and so they sometimes set shut stops, which means they plan to promote the inventory if its value drops a small quantity, to restrict losses.

Because of the fast turnover of trades, intraday buying and selling requires fixed consideration, fast decision-making abilities, and a deep understanding of short-term market actions. Intraday merchants are sometimes required to take a seat in entrance of the display all day.

Essentially the most elite intraday merchants on our desk possess the flexibility to course of data in a short time.

Swing buying and selling could be considered a middle-distance race. A swing dealer holds a place for a number of days and even weeks, aiming to revenue on short-term value swings, and infrequently has a number of positions open directly. Merchants using this type must anticipate market traits and time their strikes to optimize earnings.

Whereas swing buying and selling doesn’t name for fairly as a lot velocity as intraday buying and selling, it calls for endurance, strategic foresight and a knack for understanding market momentum. A swing dealer should nonetheless spend a lot of their time in entrance of the display and be continuously conscious of their positions.

The highest swing merchants on our desk possess the flexibility to multitask and analyze plenty of data directly.

Place buying and selling, then again, is the marathon of inventory buying and selling. A place dealer holds a place for months and even years, with the goal of taking advantage of long-term value traits. A place dealer sometimes permits extra room for his or her commerce to work and bases their evaluation on “big-picture” concepts.

Place buying and selling requires far much less display time and each day consideration to cost fluctuations. A place dealer won’t have to observe quotes all day, however they need to nonetheless discover time to develop a sound technique and acknowledge high quality buying and selling indicators.

High place merchants possess the flexibility to research data in a deep and multidimensional approach.

Inside every of those buying and selling timeframes, a dealer can make the most of each basic and technical evaluation to make choices. And a dealer can make use of plenty of completely different setups to make trades.

A setup is a statistically repeatable sample that informs a dealer {that a} commerce is on the horizon. We are going to dive into extra element on buying and selling setups later on this article.

However one of the simplest ways to study the highest buying and selling setups is to study them straight from a agency like ours. Why? As a result of we now have 50+ skilled merchants and we’ve been profiting constantly from the markets for a few years, by means of all types of market situations. Our merchants are the actual deal, and the methods they commerce have stood the take a look at of time. So head over to TradingWorkshop.com to say your free spot on our in-depth workshop.

Dangers and Rewards of Inventory Buying and selling

The dangers and rewards of buying and selling might very properly be an important part on this article for a brand new dealer. At its core, inventory buying and selling comes right down to danger, rewards and chances. The mix of those elements is what offers us an edge out there.

After all, similar to any enterprise, buying and selling shares doesn’t come with out dangers. Market volatility can whip the worth of a inventory backwards and forwards, and within the blink of a watch, potential positive aspects can morph into vital losses if the inventory value takes a nosedive.

Because of this we commerce with safeguards. Savvy merchants are answerable for their danger and equip themselves with danger administration instruments like cease orders. They usually place these cease orders in strategic ranges with a purpose to decrease danger whereas additionally giving themselves a excessive chance of success within the commerce.

Some merchants set revenue targets to assist handle their potential returns. A easy approach to set a revenue goal is by putting a restrict order to promote the place above the market, at a value at which you’d be completely satisfied to exit for a revenue. Different merchants may set trailing stops, which, for an extended place, rise together with the inventory value to guarantee that if the inventory reverses a significant quantity, the place is exited at a revenue.

So you might be questioning, how do I steadiness these dangers and rewards in order that I come out worthwhile?

Effectively for one, a robust self-awareness is a key consider efficiently implementing a buying and selling technique that fits you. You need to have a sound understanding of your danger tolerance and your targets.

Sizing your trades is an important consider buying and selling efficiently. Your share measurement and cease degree ought to at all times mirror how a lot you’re keen to lose on a single commerce. Merely multiply your share measurement by the worth distinction between your entry and your cease and you’ve got your danger. To get your share measurement, merely divide your required danger quantity by the worth distinction between your entry and cease.

That is the sort of math we do in our heads when buying and selling.

Let’s say you purchase a inventory at 80 and suppose it will possibly go to 86. You place your cease at 78 since you suppose it shouldn’t commerce beneath 78. You need to danger 100 {dollars}. Since you could have a 2 greenback cease (80 – 78 = 2) you now know you could purchase 50 shares at 80 to danger 100 {dollars} (100 / 2 = 50). And now you realize that, with a 6 greenback goal, if the inventory trades to 86, your reward might be 300 {dollars} (50 x 6 = 300).

Within the above instance, this 3 to 1 (risking 100 to make 300) relationship between reward and danger is one thing merchants will deal with. Let’s outline two key phrases:

Revenue-Loss Ratio: It is a measure that compares the common revenue of a buying and selling system to its common loss. As an example, if on common we both lose 50 or make 100, our profit-loss ratio might be 2 to 1. In different phrases, our common winner is 2 instances the dimensions of our common loser.

Win Fee: It is a measure of the variety of worthwhile trades relative to the overall variety of trades. It’s expressed as a proportion. For instance, if a dealer makes 100 trades and wins 60 of them, their win charge could be 60%.

In case your profit-loss ratio may be very excessive, you possibly can afford to lose extra typically. Give it some thought, should you’re realizing a 3 to 1 profit-loss ratio in your trades, you solely must win greater than 25% of the time to eek out a small revenue, bearing transaction prices. For each 3 instances you lose, you want one winner to cowl the losses.

However, In case your win charge may be very excessive, you possibly can afford to lose extra in your losers than you make in your winners. Think about you win 68% of the time. Since you are successful greater than twice as typically as you’re shedding, you solely want a 0.5 to 1 profit-loss ratio with a purpose to eek out a small acquire.

This isn’t an opinion, it’s simply math.

The profit-loss ratio and win charge collectively can decide if a technique is worthwhile or not. Because of this merchants are at all times occupied with danger, reward, and chances when executing and growing methods.

As a dealer demonstrates edge and robust efficiency in a selected technique, she or he will incrementally improve the danger, and subsequently the share measurement, with a purpose to develop the technique. And once more, these increments ought to mirror your understanding of your individual danger tolerance and targets.

Alright, now that we’ve laid out the groundwork for buying and selling shares, let’s dive into a few of the instruments merchants use to achieve a bonus out there.

Technical Evaluation

By now you realize that technical evaluation is the research of any data that comes from historic value actions and quantity. This data can come within the type of value patterns, statistical indicators or relative energy and weak point.

Since most technical evaluation is centered round value charts, let’s study learn a candlestick chart, the commonest chart type utilized by merchants.

The Fundamentals of Candlesticks

What’s a Candlestick Chart?

The Candlestick Chart is a extremely visible device that’s a part of nearly each dealer’s arsenal. Merely put, a Candlestick Chart is a kind of value chart. It differs from a standard line chart in that it affords far more details about value motion.

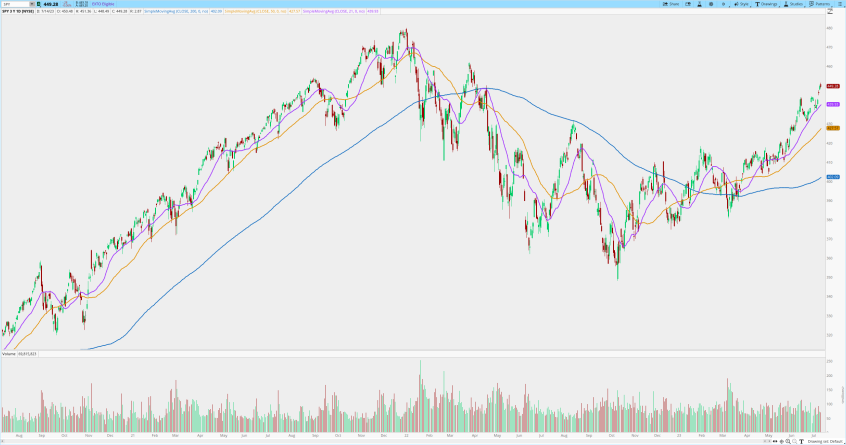

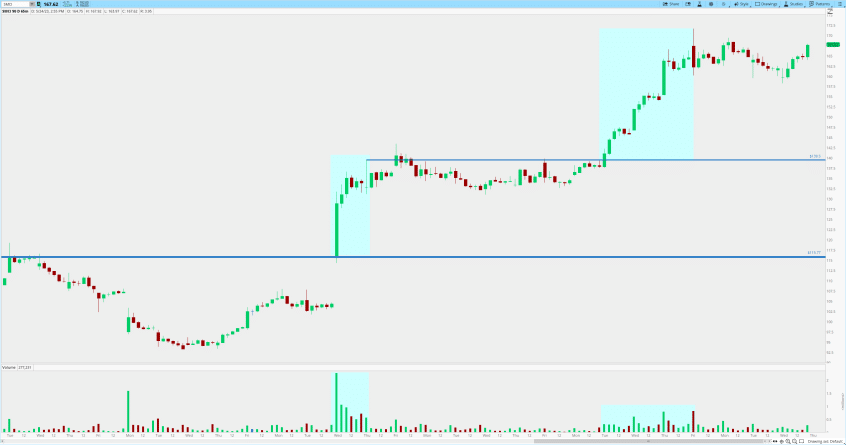

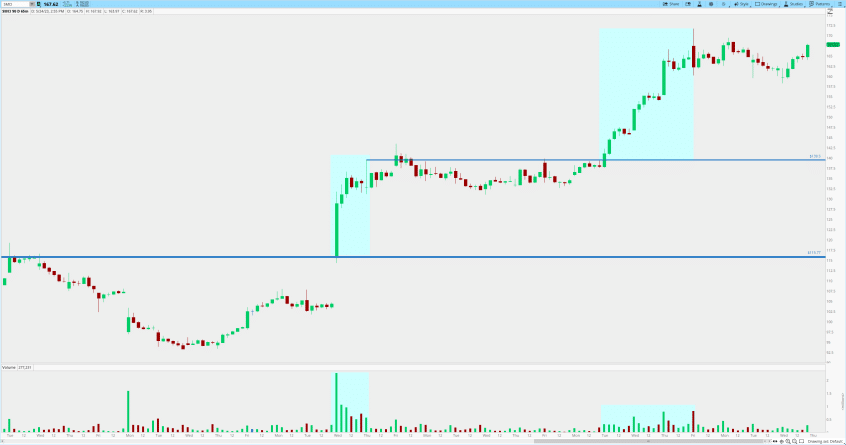

Above is an intraday chart of SPY. On this instance, every candle represents 5 minutes. The chart begins at 9:30 am and ends at 4 pm.

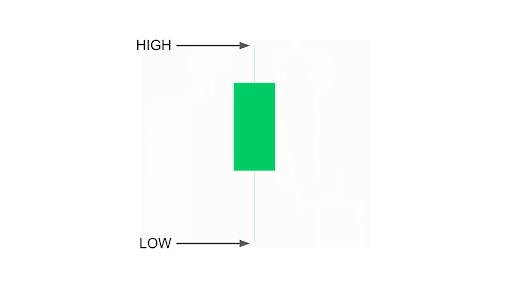

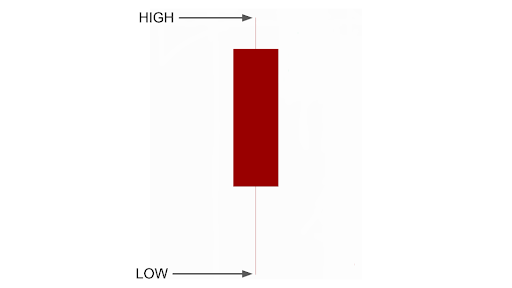

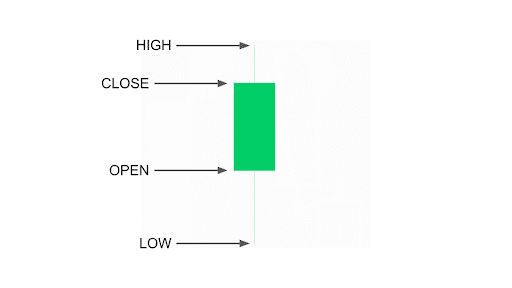

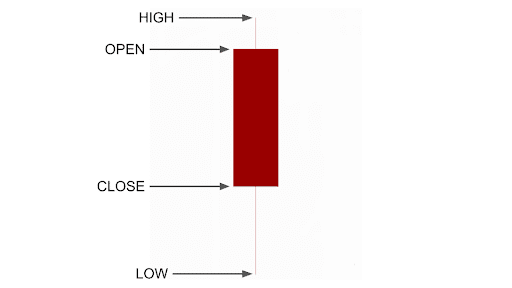

For each candlestick chart, every “candle” represents a particular time interval referred to as the “timeframe”, and illustrates 4 vital value factors inside its respective timeframe: the open, the excessive, the low, and the shut.

The Anatomy of a Candlestick Chart

Let’s break down a single candle in order that we will study to interpret value motion from a Candlestick Chart. Every candle has two main elements: the physique and the wick.

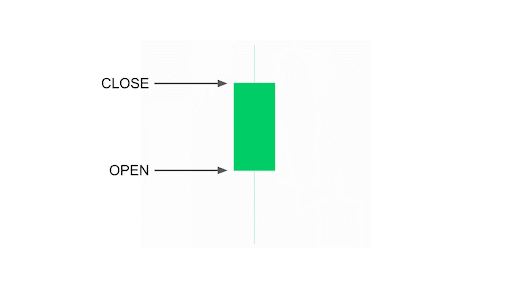

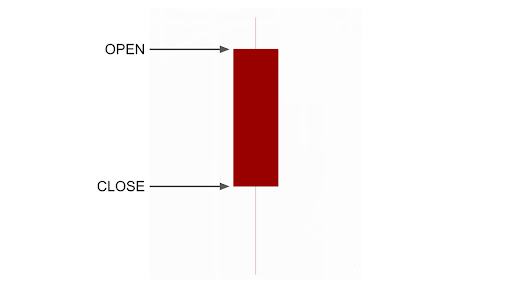

Physique: The physique of a candle is the oblong part inside the candle. It represents value motion between the open and the shut of the candle’s time interval.

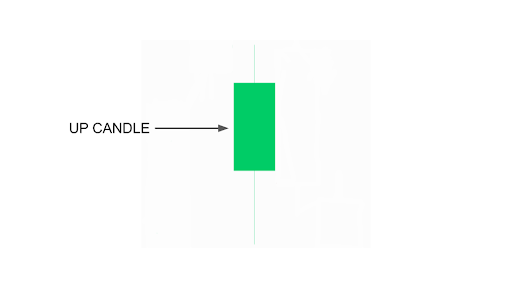

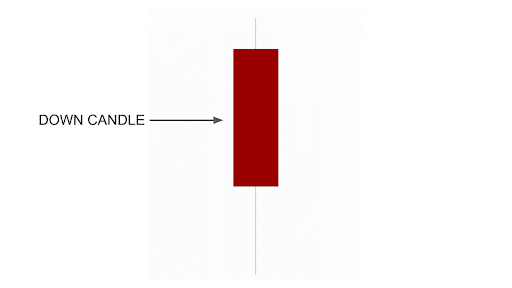

To find out the worth course of the candle we should perceive the coloring of the physique. Most frequently, an up candle physique might be coloured inexperienced whereas a down candle physique might be coloured purple. Often, particularly when colour is just not an choice, an up candle physique might be hole whereas a down candle physique might be filled-in.

The colour designations of the physique rely upon private desire, as most charting platforms permit for personalisation.

The place is the open and shut of a candle?

The open is the worth at the start of a candle’s time interval and the shut is the worth on the finish of a candle’s time interval. As a result of the physique represents web change from open to shut, the open and shut might be positioned at every finish of the physique.

To seek out the open, pinpoint the underside of a inexperienced physique, or the highest of a purple physique. To seek out the shut, pinpoint the highest of a inexperienced physique, or the underside of a purple physique.

Wick: The wick of a candle, generally known as a “shadow”, is the skinny line prolonged from both aspect of the physique. The extremes of every wick characterize the worth extremes of the candle and include the excessive or low of the candle’s vary.

The place is the excessive and low of a candle?

Naturally, to search out the excessive, we pinpoint the best value level of the candle, which could possibly be an higher wick, the open, or shut. To seek out the low, we pinpoint the bottom value level of the candle, which could possibly be a decrease wick, the open, or shut.

In every of those instances above, the excessive and low could be discovered on the extremes of the wicks on both finish.

Now we will see why they name them “candlestick” charts! After we mix the oblong physique with a skinny wick, we get the form of a candlestick. And by decoding the construction of the candle, we will simply determine the open, excessive, low and shut of every candle’s time interval.

A Candlestick Chart is extra informative than a line chart, which solely illustrates the shut of every time interval, and that’s why candlestick charts are extra useful when assessing value motion.

Deciphering Candlestick Charts

Now that we perceive how every candle is constructed, let’s deliver them to life and study a few of the methods we will use Candlestick Charts to learn value motion. We are going to study the vary of the candle together with the size of the physique and wicks, after which check out what it means to make use of completely different timeframes.

Candle Value Motion: The vary of the candle can inform us one thing concerning the volatility of the market. The size of the physique and the wicks can inform us much more details about the worth motion inside every candle.

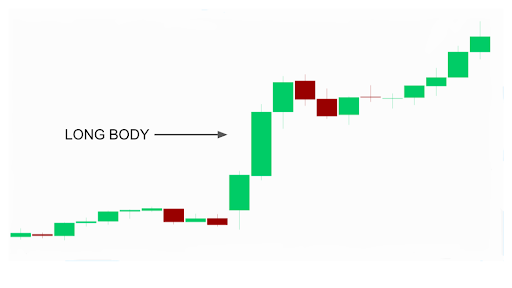

A candle with an extended physique signifies a robust directional value transfer inside its time interval. A collection of consecutive giant directional up or down candles can characterize vary enlargement and a robust development.

A candle with a slim vary signifies minimal value motion inside its time interval. A collection of consecutive slim vary candles at related costs or inside the vary of the earlier candle can characterize volatility contraction and value consolidation.

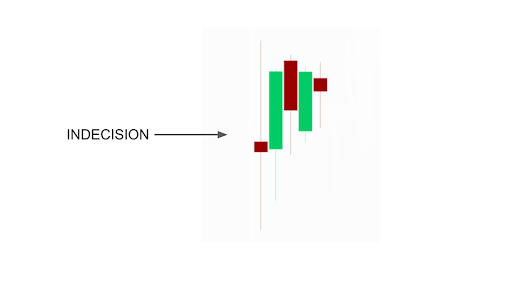

A brief physique with lengthy wicks on each ends signifies minimal web change between the open and shut inside a wide range. These candles typically characterize indecision by market members.

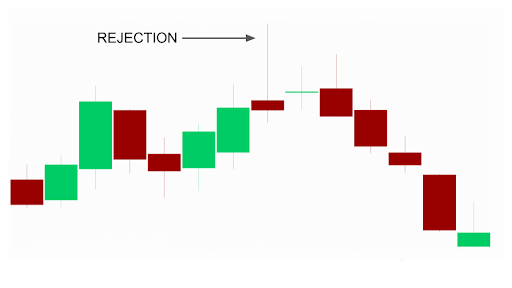

A really lengthy higher wick and an in depth close to the low of the candle tells us that value tried to rally and was rejected, all inside the time interval of the candle. A collection of lengthy higher wicks or one very aggressive higher wick at a key value degree can characterize rejection at potential resistance.

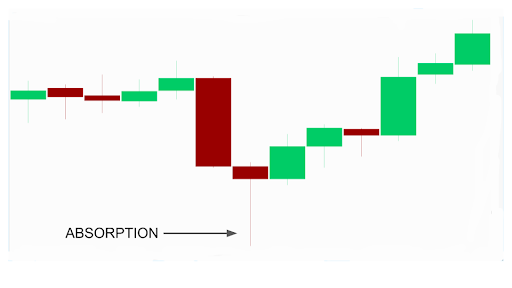

Conversely, a really lengthy backside wick and an in depth close to the excessive of the candle tells us that value tried to drop and was purchased, all inside the interval of the candle. A collection of lengthy backside wicks or one very aggressive backside wick at a key value degree can characterize absorption at potential assist.

The weather of every candle are constructing blocks that inform us a narrative as they print on the chart. The whole story instructed by means of the cumulative impact of the candles on a chart is far more essential than anyone candle in isolation.

We will use completely different timeframes to zoom out and in with a purpose to see all the image.

Timeframe: As you now know, every candle represents a time interval known as the “timeframe”. On a 1 minute timeframe, every candle represents one minute of value motion. On a 30 minute timeframe, every candle represents thirty minutes of value motion. On a each day time-frame, every candle represents someday of value motion from the 9:30 am open to the to 4 pm shut. And so forth.

A brand new candle will begin printing for the present time interval after the earlier candle closes.

1 MIN CHART

30 MIN CHART

DAILY CHART

A “increased timeframe” refers to longer time intervals comparable to a each day or weekly chart and offers a extra zoomed-out perspective. A “decrease time-frame” refers to shorter time intervals comparable to a 5 or 1 minute chart and offers a extra zoomed-in perspective.

I like to make use of a 2 minute or 5 minute chart to have a look at 1 or 2 days of value motion. I like to make use of a 15 minute or hourly chart to have a look at something from 5 days to a month of buying and selling. And I like to make use of each day and weekly charts to look again over the course of 1 / 4, a yr, or longer.

While you begin to use candlestick charts, mess around with the timeframes to visualise which period body represents your buying and selling type and the way in which you want to take a look at the market. It’s a greatest apply to make the most of a number of timeframes to get a multi-dimensional view of the market.

The Fundamentals of Quantity

Now that we perceive learn candlesticks, we will add quantity bars to our chart, which present up as a subgraph on the backside of our chart.

Every quantity bar represents the quantity of shares traded through the corresponding candle’s timeframe.

As we learn the chart, we will affiliate the amount traded with every candle’s value motion. This may be useful when assessing vital strikes. Discover how the amount will increase within the above chart on this hole down and continuation. There was clear curiosity in promoting this inventory on today.

Merchants take a look at quantity to research the participation behind a value transfer. What number of shares had been traded right here? What number of shares had been traded in comparison with its common?

We are going to cowl this dynamic in additional element later within the article.

Technical Indicators

Every thing in technical evaluation is pure math. It is because every little thing’s a operate of time, value and quantity. The candlestick chart is a graphical illustration of value factors over time. The amount bars beneath the candlesticks are pure quantity, variety of shares traded. This could definitely be sufficient for some merchants to research the technicals. Nonetheless, there are additionally issues referred to as technical indicators that break down the maths of time, value and quantity in numerous methods.

Let’s dive into 4 of my favourite technical indicators so as to get a really feel what this stuff are and the way they might help us commerce:

Transferring Averages

A transferring common is the common value of a inventory over a specified time interval. The explanation it’s referred to as a “transferring” common is as a result of this specified time interval rolls forward as new bars print, so the bars used to calculate the common transfer together with time. We will plot a transferring common on our value charts like this:

Widespread transferring averages on the each day chart utilized by merchants and traders are the 21-day MA, 50-day MA and the 200-day MA – all proven above on the chart.

Suppose again to how these indicators are simply math. These transferring averages are common costs. They characterize the imply on numerous timeframes.

For instance, the 21-day transferring common (proven in purple) is the common value over the past 21 buying and selling days (a couple of month). The fifty-day (proven in yellow) is the common value over the past 50 days. And the 200-day, our longest transferring common on the chart (proven in blue), exhibits the common over 200 days.

This above chart exhibits each day candle information for the final 3 years. Discover how through the first half, roughly July of 2020 into the tip of 2021, the transferring averages are stacked and orderly, demonstrating a clear uptrend. Then, when the bear market begins in 2022, this sample breaks and the transferring averages grow to be a lot much less orderly.

We will use transferring averages to see if value is trending on that timeframe, and assess how prolonged it may be from its imply. Most merchants use transferring averages as guides quite than particular value ranges.

VWAP

Quantity Weighted Common Value (or VWAP) is a cumulative common of value from the primary bar of calculation, every bar weighted by quantity. Identical to a transferring common, we will plot it on our value chart like this:

Most merchants use an intraday VWAP, anchored from the primary bar of the day, as proven above on this 1 minute chart of NVDA. Some merchants anchor their VWAPs freely, and use them on increased time frames.

VWAPs characterize the common transaction value for the interval wherein it calculates.

Merchants use VWAP to visualise the connection between provide and demand over that specific interval. If value is holding above VWAP, it’s thought that consumers are in management. If value is holding beneath VWAP, it’s thought that sellers are in management. If value is above and beneath VWAP, there could also be indecision or a battle happening between consumers and sellers.

ATR

Common True Vary (or ATR) is the common vary of the worth bars over a specified time interval. Identical to the transferring common, this time interval is rolling.

ATR measures the volatility of the market.

Many merchants on our desk take a look at the each day bar ATR of the inventory they’re buying and selling regularly. This metric represents the common each day vary of the inventory and could be tremendously useful in assessing, on relative phrases, how far a inventory has rallied intraday.

Let’s say TSLA’s each day ATR is 12 {dollars}. As a substitute of claiming, “TSLA is up 6 bucks within the first hour of commerce!” a dealer will say, “TSLA is up half an ATR within the first hour!”. This offers a greater understanding of it’s typical value motion, as we will see on this instance that 6 bucks is a giant transfer for TSLA to make in an hour.

RVOL

You may bear in mind RVOL from our Inventory Choice part. It is because Relative Quantity (or RVOL) is essential to discovering lively shares, shares which are “in play”.

If a inventory sometimes trades 2 thousands and thousands shares by 10:30 am, however at this time it has traded 6 thousands and thousands shares by 10:30 am, we contemplate this inventory to be doing 3 RVOL. That’s 3 instances its common quantity. This means that there’s appreciable curiosity within the inventory at this time.

Typically, if information you suppose is important is reported on a inventory, you possibly can try the RVOL to substantiate your suspicion. If the inventory is doing regular quantity, it’s extremely doubtless the market doesn’t care concerning the information. But when the inventory is doing 3, 5 or 10 instances its common quantity, then you realize this transfer has generated vital curiosity.

Be aware: if you wish to study (in step-by-step element) 3 of our high methods which have a sturdy, confirmed edge, head over to tradingworkshop.com now. You gained’t get higher schooling than from a agency with over 50 skilled merchants who pull in thousands and thousands from the markets month in and month out. And it’s 100% free so that you can be a part of, so should you’re severe about buying and selling, you possibly can’t afford to overlook it.

Why Technicals Matter (idea of a Quick Squeeze)

Why can we analyze the motion of a inventory itself when actually, the inventory value is meant to be a mirrored image of how properly the corporate is doing financially?

The actual fact is, that’s not at all times the case.

Suppose again to our dialogue of provide and demand and the way it’s the shopping for and promoting strain of the inventory itself that strikes the market.

Effectively, oftentimes this shopping for and promoting strain transcends any basic reasoning across the high quality of the corporate.

And there’s no higher instance for this than a large quick squeeze in a inventory.

A quick squeeze is an aggressive transfer increased in value brought on by an amazing quantity of quick masking within the inventory.

Give it some thought. Sentiment within the inventory may be very bearish and positioning is skewed to the quick aspect. Sentiment, on this case, is a contrarian indicator. An excessive amount of quick positioning creates plenty of potential demand within the inventory.

Now we now have a dynamic the place there may be an abundance of quick sellers who sometime must cowl their positions by shopping for again the inventory – therefore, potential demand.

What if value begins to rise, inflicting these merchants to cowl as their stops begin to get hit?

This creates a suggestions loop. Value can rise sooner and additional than one may count on on this scenario. Everyone seems to be a purchaser!

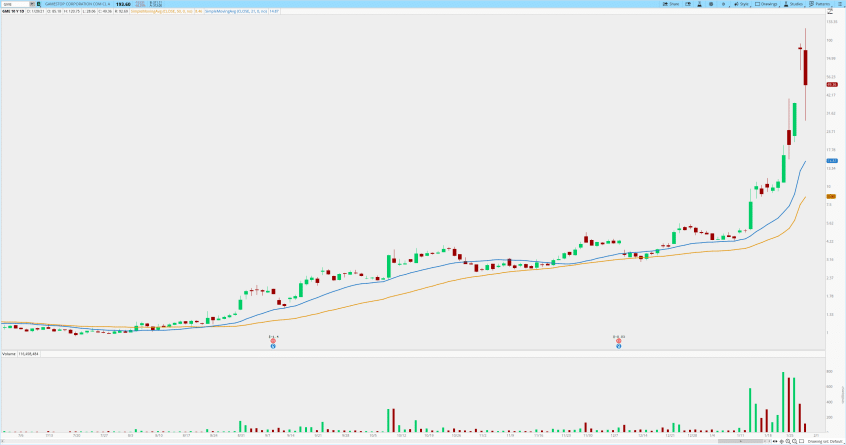

At first of 2021, GME, the notorious chief from the “meme inventory” period, squeezed from sub 20 to 500 in a single month, practically 190 instances the low of two.57 reached 9 months earlier in April of 2020. This was an unbelievable quick squeeze on large quantity. And the corporate itself was generaly shedding cash.

Should you learn the technicals of the inventory, you’d have been in a position to determine the quick squeeze and witness a number of technical breakouts on eleveted quantity alongside the way in which.

Elementary Evaluation

In contrast to Technical Evaluation, Elementary evaluation is the research of knowledge that comes from the efficiency of the corporate itself quite than the motion of the inventory. This might embody steadiness sheets, a monetary report or a information catalyst that will change the way in which the market sees the corporate. In spite of everything, by buying and selling shares, we personal shares of the corporate, and a dealer may need to perceive if the enterprise is rising or not.

When taking a look at fundamentals, it’s at all times essential to consider what may be a shock to the market versus what may already be priced in. Simply because an organization has a robust steadiness sheet and super development doesn’t imply that it’ll commerce increased within the close to future.

But when we will discover cases the place the elemental image modifications and forces the market to rethink the inventory, then we now have a scenario the place the provision and demand relationship within the inventory may shift dramatically.

Suppose again to our baseball card instance. Should you purchase the baseball card of your favourite participant anticipating him to have a superb season, however the consensus of all the baseball nation is that he can have an awesome season, then he might need to win league MVP or win a championship this yr for him to shock the market and for that card to considerably rise in worth within the close to future.

Earnings season, which occurs 4 instances a yr, is the time when public firms report quarterly earnings. These studies can supply incredible alternatives to commerce lively shares with shifting fundamentals. For some merchants, earnings season is their playoffs.

Personally I like to mix technicals with fundamentals to make buying and selling choices. However when the rubber hits the highway, the worth of the inventory is what we’re buying and selling and the provision and demand dynamic for the inventory is what strikes the market. That is a crucial truth to recollect.

What You Want To Turn out to be Profitable

Many people grew up taking part in sports activities or studying a musical instrument. Have you ever ever studied the masters (or perhaps you’re a grasp your self in such a subject!) and questioned how these individuals get so good?

After all, there’s a lot that goes into it. And buying and selling isn’t any completely different. These are all excessive efficiency endeavors, and so they require routine apply and a excessive degree of focus.

Buying and selling Fundamentals

After I was child, my dad was a basketball coach. He helped coach a youth program that developed high-level division one athletes, in addition to one profession NBA participant. There have been sure issues that he required his gamers to apply on a regular basis – issues like footwork, dribbling drills, and foul pictures. These are fundamentals.

In buying and selling, we too have fundamentals that we must always grasp if we need to have an opportunity at turning into elite. Issues comparable to inventory choice, chart studying, tape studying, and danger administration are all fundamentals that SMB teaches its new merchants.

Inventory Choice

Mike Bellafiore, an SMB Capital accomplice and somebody who’s been an important mentor for me over time, wrote in One Good Commerce, “You’re solely pretty much as good because the shares you commerce.” That is true! Should you’re buying and selling the improper shares you’ll not earn money.

Think about you’re the greatest live performance pianist on the planet. Simply earlier than your live performance begins you’re given a really written piece of music to play for the viewers. Regardless of who’s taking part in it, it simply sounds terrible. Your fingers are tied – you gained’t be capable to sound good. Buying and selling is similar. The shares are our autos. Now we have to decide on those that may transfer properly.

The inventory you select will largely rely upon the technique that you simply commerce, however usually, some common issues I search for embody:

Recent Information Catalyst: A information catalyst that catches market members off guard will gas participation within the inventory and create provide and demand imbalances that might generate alternative for merchants. This may be as quick as breaking information, or as gradual as a big basic shift that fuels the inventory for weeks.

Relative Quantity (RVOL): Wanting on the quantity of quantity the inventory is buying and selling relative to how a lot it often trades is usually a incredible approach to measure the extent of elevated participation and curiosity in a inventory. This may be measured intraday or over the course of plenty of days.

Relative Power and Relative Weak spot: Discovering a inventory that’s considerably stronger than its friends or considerably weaker than its friends could be a good way to filter for shares which have uncommon buying and selling exercise.

Technical Catalyst: A inventory with an A+ technical setup can current nice danger/reward buying and selling alternatives. This could possibly be a maintain of a major value degree or a spot prolonged considerably from it’s imply.

Respecting Ranges: If a inventory is respecting value ranges and “buying and selling properly”, then this turns into a candidate, particularly if different elements are aligning. The cleanliness of how a inventory is buying and selling typically displays vital energy or weak point, one thing I need to gravitate in direction of. If a inventory is buying and selling erratically and unpredictably, I don’t need to be concerned.

We are saying {that a} inventory is “in-play” if it’s exhibiting any of those behaviors that exhibit an uncommon quantity of exercise and curiosity within the inventory. In the end, as merchants, we wish vary, liquidity and course within the inventory we’re buying and selling. Buying and selling “in-play” shares will assist us discover higher danger/reward alternatives.

Chart Studying

Chart studying is the research of the historic value motion and quantity of the inventory you’re buying and selling.

Technical Evaluation, one thing we outlined briefly in our terminology part, is any sort of data gleaned from the worth actions and quantity of the inventory. Naturally, merchants take a look at charts to visualise these technicals.

The value motion of a inventory is brought on by the shopping for and promoting from market members. Recall the provision and demand dynamic that we spoke about earlier. We will use value charts to see this dynamic at play.

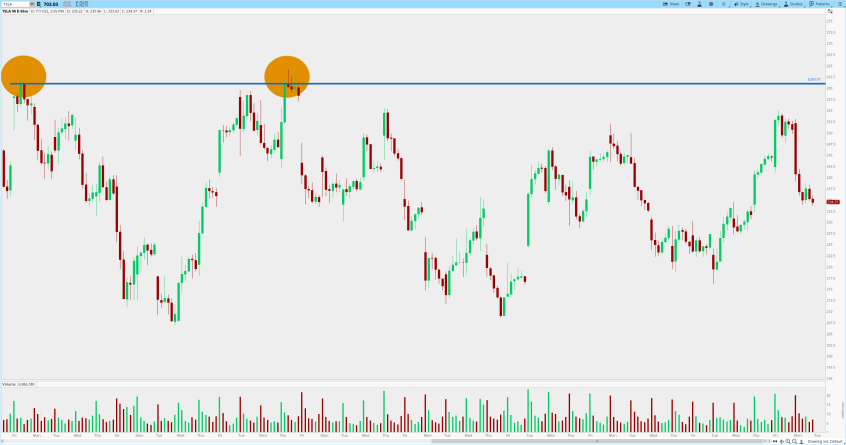

We would determine demand at a sure value degree the place consumers have stepped in and pushed the inventory increased. We regularly name this potential assist:

The above chart exhibits TSLA getting purchased twice on the identical value degree.

Equally, we’d see provide at a sure value degree the place sellers have stepped in and pushed the inventory decrease. We regularly name this potential resistance:

The above chart exhibits TSLA getting bought twice on the identical value degree.

These turns into vital ranges of curiosity. When the inventory trades again into these ranges, we’ll watch it intently.

Help and resistance ranges sometimes reveal themselves when the inventory has developed a buying and selling vary. The 2 examples above had been each taken from the identical TSLA chart. Let’s zoom out slightly to determine this buying and selling vary in TSLA.

The blue rectangle represents our buying and selling vary. On the fitting aspect of the blue rectangle, we will see that value lastly broke the vary to the upside, got here again and retested, held, and traded increased. That is referred to as a breakout, a robust setup that we’ll cowl later on this article.

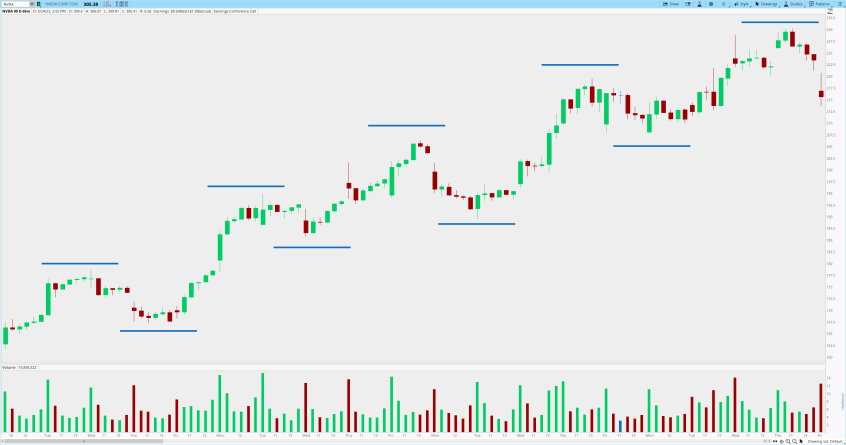

When a inventory is just not caught in a spread, there may be an uptrend in place, established by increased highs and better lows and an upward sloping value path:

The above chart exhibits NVDA in a transparent uptrend, with the upper highs and better lows marked on the chart.

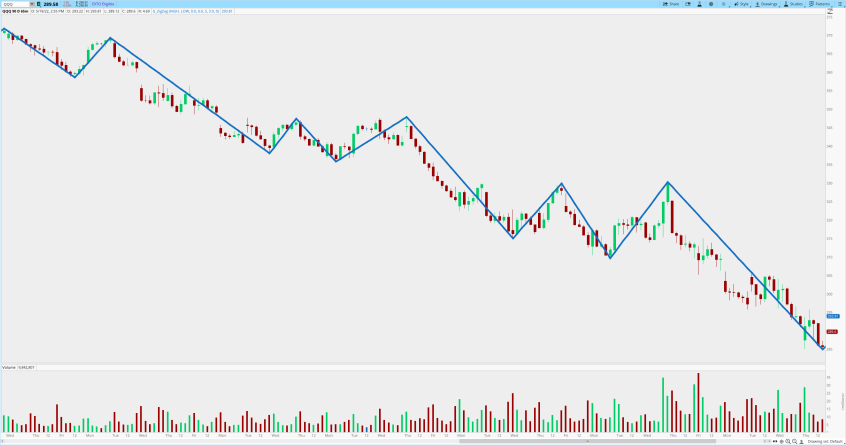

A downtrend, then again, is established by decrease lows and decrease highs and a downward sloping value path.

The chart above exhibits QQQ in a clear downtrend, this time with value swings inside the downtrend marked on the chart.

We would see a giant quantity surge on a break of a key value degree, signifying elevated curiosity and participation within the value transfer.

The chart above exhibits SMCI escape above a key value degree on vital quantity. You may see the surge in quantity on the preliminary breakout, after which once more, a pickup in quantity on the secondary breakout.

These are all easy examples of how merchants use charts to have a look at historic value and quantity patterns to assist body the present market and the dangers, rewards and chances round their trades.

If you need a short-cut to studying commerce profitably utilizing all of those ideas and instruments, we invite you to attend our free, intensive buying and selling workshop, the place we’ll train you the precise ins and outs (in step-by-step element) of our 3 high performing buying and selling methods. You’ll study the particular guidelines of entry and exit in much more element than we will present right here. Reserve your free seat right here.

Tape Studying

Tape studying is the research of the “order movement” of the inventory you’re buying and selling. The tape is a device that enables merchants to see the orders which are getting executed on the bids and affords. The tape consists of two elements, the “degree 2” and “time & gross sales”.

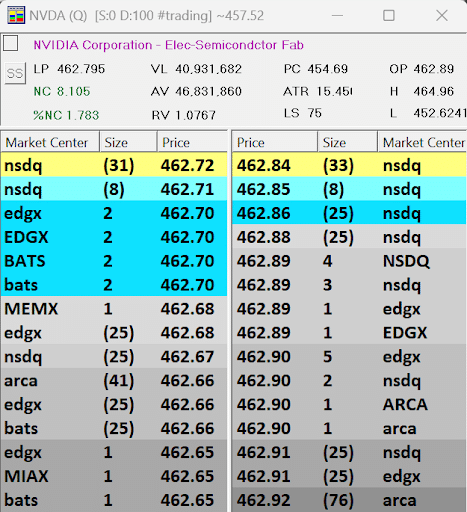

Degree 2: That is the order e-book. It exhibits the bids and affords for the inventory you’re watching. The very best bid and the bottom supply comprise the within market, and whenever you’re putting a market order, it is possible for you to to see the bid or supply that you’ll be taking, and the dimensions that it’s displaying.

Within the instance above, the within market is on the high, highlighted in yellow. NVDA is displaying 31 shares at 462.72 on the bid and 33 shares at 462.84 on the supply. The bid aspect is on the left with the best bid on the high and so, after all, the ask aspect is on the fitting with the bottom supply on the high. On this case, the unfold is 12 cents which we get by subtracting the best bid from the bottom supply – if we pay the 462.84 to get in we now have to promote the 462.72 to get out.

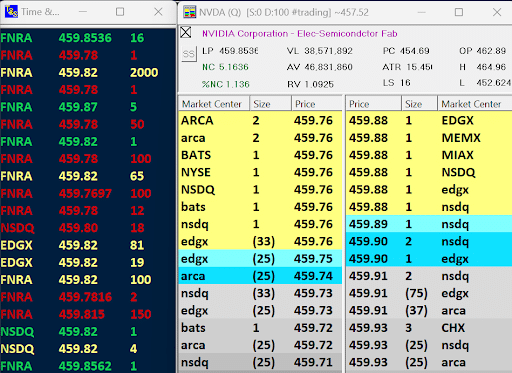

Time & Gross sales: Often known as “the prints”, it is a document of real-time transactions which are going off within the inventory you’re watching. These transactions characterize aggressive orders which are hitting the order e-book and taking shares from the bid or the supply.

Within the instance above, we will see the orders which are getting executed on the time & gross sales for NVDA. On this instance, the newest order that hit the tape was the purple sale of 10 shares at 460.19 proven on the high. All different prints are buys as indicated by inexperienced coloring.

On my field, I don’t present the precise time of day as a result of these orders are zooming by rapidly in realtime, so for me this data is pointless. What I do care about is the velocity of the tape, the colour indicating if it’s purple for a sale or inexperienced for a purchase, the worth and the dimensions. The market heart can also be proven on the left.

Merchants watch how the Time & Gross sales work together with the Degree 2. That is how we see the order movement.

Within the instance above, the time & gross sales is proven together with the extent 2 for NVDA. That is my tape. That is how I watch the inventory that I’m buying and selling.

We will see that the final transaction that befell was a purchase of 16 shares at 459.85. We will additionally see that the present highest bid is 459.76 and the present lowest supply is 459.88. After we go to put a market order to purchase NVDA, we will count on to get stuffed at 459.88 till these affords are all taken or pulled. When our order will get stuffed, it can flash throughout the time & gross sales. On this case there are a complete of 600 shares provided at 459.88 – that’s as a result of “1” represents 100 shares and there are 6 of those 100 share affords at 459.88, all at numerous market facilities. As soon as these affords disappear, the market will transfer to the subsequent supply at 459.89.

Let’s say your inventory is buying and selling at 60.80 and also you passively publish a restrict order to promote 100 shares at 61. Your order, if it doesn’t instantly get stuffed, will now be seen sitting within the order e-book on the Degree 2. Your 100 shares might be there at 61 ready for some aggressive dealer to return by and pay the supply at 61 and take your shares.

Now let’s say you see on the Degree 2 that the best bid is at 60 {dollars} and it’s displaying 1,200 shares to purchase. You determine to aggressively ship a market order to promote 100 shares. While you promote 100 on the market, your 100 shares at 60 will flash throughout “the prints” display in purple letters because it hits that 1,200 share bid. Now you should have bought 100 shares at 60 and the bid will now present 1,100 shares, since you took 100 of the unique 1,200.

That is how the Time & Gross sales interacts with the Degree 2.

In real-time, there are a lot of trades going off directly. Merchants use the tape as a approach to visualize order movement, and see shopping for and promoting strain at sure value factors. It might appear overwhelming at first, however the extra you watch it, the extra it is smart.

While you watch the tape, think about the prints on the time & gross sales as water strain and the bids and affords on the Degree 2 as a river dam. With sufficient strain, the aggressive orders can take all the dimensions on the bid or supply, and if the rattling is just not sturdy sufficient, the aggressive orders will push by means of the rattling to the subsequent value degree. That is how markets transfer.

Whether or not you’re an intraday dealer seeking to play off explicit bids and affords, or whether or not you’re a swing dealer seeking to assess the character of the tape and see the order e-book as you’re executing a commerce, studying the tape is a beneficial ability for any dealer to have.

The tape is a key a part of my buying and selling setup, which I describe in a video about my setup right here on the SMB Capital YouTube channel.

Danger Administration

Danger administration is essential to know earlier than you begin buying and selling with actual cash. It’s what is going to hold you within the recreation so as to proceed to study and construct your craft.

At SMB Capital, every dealer, and every account, has a “each day loss restrict”. Because of this there’s a certain quantity we’re allowed to lose earlier than our account is not in a position to placed on danger for the day. This may occasionally sound imply, nevertheless it’s truly doing us an awesome service.

Some days the market is tougher than others. Some days we simply don’t have it as merchants. It turns into essential to acknowledge as of late and let your foot off the gasoline, and wait for less than one of the best setups.

We mentioned earlier the way it’s attainable to predefine our danger in a single commerce. Effectively, this particular person commerce danger turns into a operate of our “each day loss restrict”, and so we will set our danger per commerce to gracefully work together with our loss restrict and commerce inside our danger tips.

After we develop, when our methods develop, we improve our each day loss restrict and our danger per commerce.

While you begin out buying and selling, determine how a lot you’re keen to danger per day and design your commerce danger round that quantity. This may hold you inside your individual guardrails and guarantee that you simply survive as you develop in direction of turning into a worthwhile dealer.

Buying and selling Course of

So that you’ve educated your self on the basics of buying and selling. Now, how will you guarantee that you simply’re doing every little thing it’s worthwhile to do to develop and advance your talents each day?

When my dad was teaching our basketball group, it was not sufficient that we realized the basics. We needed to apply them daily and construct our arsenal of strikes and game-time consciousness. We might have a course of for this – half-hour of dribbling drills, 500 pictures a day, tape overview, team-building workout routines, and weight coaching.

In buying and selling, our course of is what retains us growing and adapting to altering market situations. We are going to focus on issues just like the Playbook, overview work, analysis, expertise, gameplanning, private care and buying and selling guidelines.

Playbook

When an NFL quarterback takes the sector, he’s not simply winging it. He has particular performs that he and the coach name relying on the gametime scenario. This enables them to comply with a course of and ensure they’re maximizing their edge on each possession. How do the QB and the coach hold observe of those performs, refine them, and research them? They’ve a Playbook.

Buying and selling isn’t any completely different.

A Playbook is a doc compiled by a dealer that catalogs his or her setups, with particular examples damaged down with charts, commerce variables, and market statistics.

As a brand new dealer, you begin with out a Playbook. So you have to develop one.

And as an skilled dealer, you’ll need to refine and add to your Playbook.

Begin by reverse-engineering profitable performs that make sense to you. Mark up the charts. Take screenshots. Report the variables that make this play actionable and repeatable. Report market situations that coincide together with your setup. And categorize these examples into clearly outlined setups.

And don’t fear about making errors. As you add commerce examples to your Playbook, you can find that you simply’re bettering at figuring out A+ trades, and also you may select to remove older, much less highly effective examples as they grow to be much less related.

After I look again to a few of my authentic Playbook entries, I can’t consider how muddled and naive they had been, however we now have to begin someplace, and it is a greatest apply that may assist you determine what sort of dealer you’ll grow to be.

Now when the opening bell goes off, and also you begin watching the market, you’ll be armed with particular variables that may aid you make calculated choices, similar to the NFL quarterback.

Guide of Charts

Identical to within the worlds of historical past and science, there are patterns within the inventory market that are likely to repeat themselves. A profitable dealer builds a eager understanding of those patterns. As we’ve mentioned, charts assist merchants make sense of historic patterns which may repeat themselves sooner or later.

We need to hold a Guide of Charts as a approach to decide to reminiscence these repeatable patterns.

A Guide of Charts is a list of charts. It differs from our Playbook in that it’s extra casual. A single entry could possibly be a screenshot of a chart that features a sample that you simply discover attention-grabbing – one thing you might need seen repeat out there sufficient so that you can document it.

Overview Work

When our NFL quarterback finishes the sport, win or loss, he doesn’t simply neglect about it and transfer on. He watches movie of the sport. This enables him to study from errors and make changes for the subsequent recreation.

The identical goes for merchants. We need to overview intimately our trades, particularly the largest alternatives, together with how properly we’re following our course of.

Overview work can are available many alternative kinds, and this largely depends upon your studying type and character.

Some merchants on our desk hold a journal the place they jot down every little thing from execution errors and milestones to how they had been feeling that day.

Some merchants document their screens, and just like the quarterback, overview movie of the tape after every buying and selling session.

Some hold a Every day Report Card (DRC) the place they grade themselves on a set of standards that they’ve outlined for the month.

The widespread thread I discover amongst efficient overview strategies is element. Buying and selling is all about making changes, so we need to be detailed about issues that we’re doing properly and need to repeat, and issues that we have to alter and the methods we’ll take motion to make these changes.

I’m a numbers man. I like specializing in issues which are clearly definable. So I discover maintaining a spreadsheet round every of my buying and selling companies is essentially the most useful to me. Every day I document the variables that issue into the standard of my trades, the danger that corresponds to the standard of those setups, the executions, and the setting which informs me of which performs to make.

This enables me to see rapidly, and intimately, which components of my buying and selling wants consideration.

I name my each day spreadsheet the “Commerce Log” and I did a video about it right here on the SMB Capital YouTube channel.

It’s possible you’ll be beginning to discover how these processes are linked collectively and the way essential, for instance, having a clearly outlined Playbook might help us overview our trades relative to our clearly outlined performs.

Analysis

The market is at all times altering. Environments shift backwards and forwards between bull and bear markets, quick and gradual markets, momentum and ranging markets – and essentially the most profitable merchants on our desk haven’t solely been in a position to develop a setup with edge, however they’ve been in a position to broaden their Playbook to incorporate a number of performs for numerous environments.

This breadth will let you earn money constantly.

Think about you’re a guitar participant who can rip a guitar solo in addition to anybody on the planet. However you are feeling that your finger selecting chops are poor. You need to have the ability to get referred to as for these jobs the place intricate rhythm taking part in is essential, particularly if guitar solos exit of fashion.

How will you go about this? You’re going to look at one of the best examples of finger selecting types, study them, apply them, and spend a yr determining apply this to your individual taking part in.

In buying and selling, we now have the chance to do the identical, and far of that is executed by means of market analysis.

I spend a superb chunk of my time conducting analysis. This work doesn’t repay instantly, however in the long term it may be extremely highly effective. And that’s why we need to construct analysis into our course of.

You might need an concept. You may discover 100 examples of this concept. You may extract statistics from these 100 examples and research them, refine your concept, and provide you with a setup that’s not only a idea, however has the statistics to again it up.

A few of my greatest performs have come from this apply. It’s artistic. It may be enjoyable. And it’s undoubtedly enjoyable when it will possibly make you cash.

So on the weekends, or when the market is gradual, take an concept and look into it. Let that course of take you down a rabbit gap. And also you may discover extra edge in an current play. You may add breadth to your Playbook. This type of curiosity and in-depth work is a standard thread all through essentially the most profitable merchants on our desk, and is paramount to fostering longevity on this enterprise.

Should you’re inquisitive about listening to extra concerning the course of we take when growing a play, I made a video about it right here on the SMB Capital YouTube channel.

Know-how

Know-how is not only a device. It’s a ability.

In buying and selling, we will use expertise to our benefit. We will create market filters that alert us to tickers which are buying and selling a sure approach. We will create indicators that alert us to particular market situations. We will write scripts that commerce shares for us based mostly on particular standards. We will backtest methods as a part of our market analysis.

The extra we perceive use the expertise, the extra highly effective we grow to be as merchants.

Because of this I construct technology-work into my course of. I guarantee that every week I’m spending time both creating expertise that may give me a bonus, or growing my abilities in order that I’m in a position to do extra with expertise.

And albeit, the extra abilities I receive, the extra time per week I discover myself spending on expertise, as a result of it’s simply that highly effective.

The world is evolving rapidly, and the buying and selling world is evolving proper together with it. It’s my recommendation to any new dealer to begin early and start growing tech abilities.

This may be so simple as attending to know your platform in and out, or as superior as studying code.

You don’t need to end up taking part in the PGA Tour with a wood driver. That labored within the 1970’s, however at this time you’d be at an awesome drawback with the titanium golf equipment obtainable.

There was a time when merchants operated on the buying and selling flooring, studying the vitality of the pit and shouting over one-another, passing items of paper to get their orders stuffed. When the world modified, and expertise allowed merchants to function upstairs on computer systems, it was merchants like Linda Raschke who tailored, realized new expertise and had been in a position to survive and flourish.

I attempt to be like Linda and construct into my course of methods to remain one step forward of the competitors.

Sport-Planning

Each day out there is completely different – with completely different flows, completely different shares in play, and completely different market narratives.

Simply as a basketball coach will cater his or her strategy to a particular group, with particular matchups and techniques, a dealer will design a game-plan earlier than every buying and selling session.

Relying in your type, this may embody particular shares that you simply’re watching, key value ranges, recent catalysts out there, and any financial information that may be launched through the day.

As merchants, we regularly function with “if-then” statements. If my inventory does this then I’ll do that. Basing your game-plan on if-then statements is a strong approach to focus your pre-market preparation.

And similar to the basketball coach, you’ll probably be compelled to switch this plan with “gametime choices” as soon as the market opens. That is okay. Beginning with an overview of what we’re in search of helps us streamline our efforts and keep targeted. After which we keep versatile and open minded.

Buying and selling Guidelines

Now we have our Playbook. We perceive our setups in and out. We all know what market variables have to be current for us to enter a commerce, and we now have outlined execute these trades. To place it merely, we now have buying and selling guidelines.

The market could be tough. Jesse Livermore, the nice inventory dealer from the 1920’s, as soon as stated, “The inventory market isn’t apparent. It’s designed to idiot the general public, more often than not.”

Because of this we now have buying and selling guidelines. With out guidelines, it can grow to be very troublesome to do the fitting factor. Instilling these guidelines as a part of our course of will assist us keep in-line with our buying and selling system.

And in our commerce overview, we will grade ourselves on how properly we’ve adopted our guidelines. Should you’ve clearly outlined your buying and selling system, there isn’t any excuse for not following your guidelines. Should you discover a flaw in your buying and selling system, it’s higher to switch your system in a calculated approach than it’s to interrupt your guidelines.

Think about you’re an algorithm that takes trades solely based mostly on particularly predetermined situations. Would you be capable to define this logic from entrance to again and comply with the system? I might wager that almost all struggling merchants could be shocked to search out that they’re unable to stipulate the logic of their system, with no holes, from entrance to again.

Private Care

Think about being a live performance pianist at Carnegie Corridor or a tennis participant within the last spherical on the US Open. Consider the strain these performers should overcome regularly. These performers typically have bodily trainers in addition to psychology coaches to maintain themselves in gear and able to face the challenges of peak efficiency.

Buying and selling is a efficiency too. Subsequently, our personal psychological and bodily well being is essential.