[ad_1]

Alistair Berg

Symbotic’s (NASDAQ:SYM) second quarter outcomes have been fairly sturdy, with strong progress considerably undermined by a deterioration in margins. GreenBox seems set to start contributing although and Symbotic continues to develop its product portfolio. Whereas the narrative hasn’t actually modified in latest quarters, Symbotic’s inventory has been below strain, which could possibly be as a consequence of moderating progress and poor margins.

I beforehand advised that elevated provide chain investments and demand for automation would help Symbotic’s enterprise within the near-term. Though the corporate’s progress is declining, I proceed to suppose Symbotic’s enterprise will carry out nicely in coming quarters, however the firm’s valuation shouldn’t be justified by fundamentals.

Market Situations

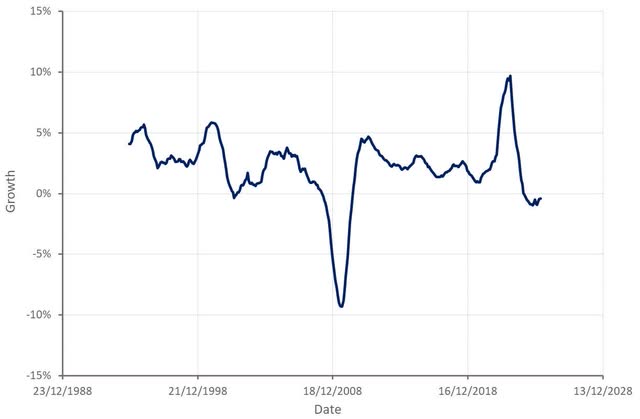

At a macro degree, demand for Symbotic’s merchandise is probably going closely depending on the price of capital and retail gross sales. Whereas demand remains to be at present extraordinarily strong, this could possibly be because of the giant backlog created through the pandemic. The longer that present situations persist (weak retail gross sales progress and excessive rates of interest), the upper the chance that demand for Symbotic’s merchandise will falter. Symbotic has additionally presumably been aided by its publicity to bigger organizations who’ve the monetary power to speculate via short-term weak spot.

Determine 1: Actual Retail Gross sales Development (supply: Created by writer utilizing information from The Federal Reserve)

Symbotic Enterprise Updates

Symbotic continues to improve its bots, lately bettering its time house routing algorithms, permitting it to extend switch capability and bot density. The introduction of GPUs has additionally elevated computational energy, enabling bots to acknowledge deformed bins utilizing imaginative and prescient programs and AI. Round 40% of Symbotic’s bots are vision-enabled. Any such functionality can also be probably an vital pressure multiplier for Symbotic, serving to the corporate to deal with the lengthy tail of demand that exists outdoors of bigger clients.

Perishables will probably be one of many subsequent enlargement areas for Symbotic. The corporate has began testing and doesn’t consider that perishables require considerably modified capabilities. Symbotic believes that it’s going to have a compelling resolution, if for no different cause than perishable warehouse capability is pricey (2-3x ambient) and Symbotic’s programs will help clients to extra successfully make the most of house. Perishable warehouses weren’t included in Symbotic’s TAM estimate. Whereas the perishable TAM is probably going lower than the ambient TAM, it’s nonetheless anticipated to be giant.

Symbotic was planning on starting its second breakpack set up this summer time. Symbotic hasn’t said who that is for, however the buyer could possibly be Walmart, as breakpack is taken into account a part of the Walmart backlog. Walmart makes use of Breakpack for something that goes into the shop that isn’t full circumstances. Symbotic believes that this resolution may change into an vital a part of omnichannel warehouses, offering each case and every dealing with capability. Greenback shops are one other potential supply of demand that Symbotic will likely be focusing on.

Symbotic lately completed the restructuring and outsourcing of its manufacturing operations, which may assist to help the corporate’s enlargement going ahead. Symbotic has been provide constrained previously because it has tried to scale its provide chain and manufacturing operations. In consequence, deployments may now fairly be anticipated to start rising in coming quarters. Whether or not this simply ends in a brief surge as Symbotic works via its current backlog is much less clear, although.

Whereas GreenBox remains to be being established, the JV lately signed its first logistics-as-a-service buyer. Symbotic will start recognizing GreenBox income in Q3. GreenBox will automate and function a brownfield warehouse for C&S Wholesale Grocers. Partnering with GreenBox permits C&S to speed up its transition to an autonomous provide chain in a capital environment friendly method. Whereas this can primarily be a C&S web site, there will likely be additional capability that could possibly be used for different clients.

Monetary Evaluation

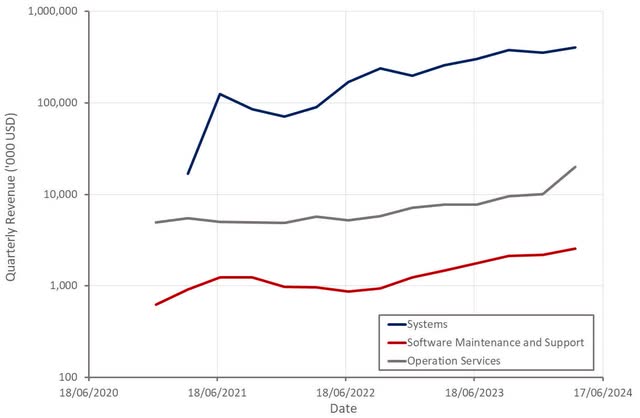

Symbotic generated 424 million USD income within the second quarter, a rise of 59% YoY. Three new system deployments have been initiated through the quarter and three have been accomplished. Whereas that is considerably tender, Symbotic expects system begins to speed up throughout the remainder of the yr. Symbotic now has 18 absolutely operational programs, which is supporting recurring income progress. Recurring income was up 145% YoY, though this was pushed by a number of one-time occasions that gained’t be repeated going ahead.

Symbotic’s backlog declined barely to 22.8 billion USD on the finish of the second quarter. That is value monitoring as excluding GreenBox, Symbotic’s backlog has been pretty flat for a number of years.

Symbotic expects 450-470 million USD income within the third quarter, which might symbolize 47% YoY income progress on the midpoint. GreenBox and larger provide capability may drive upside, however Symbotic has struggled to beat steering in latest quarters.

Determine 2: Symbotic Income (supply: Created by writer utilizing information from Symbotic)

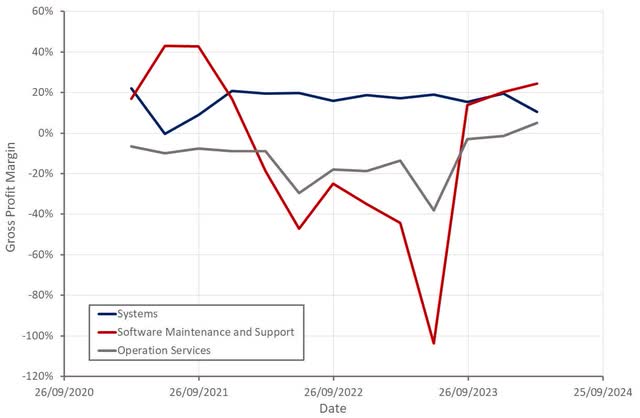

Methods gross margin was down within the second quarter, with innovation initiatives weighing on margins. Symbotic has said that a few of these decrease margin initiatives will attain completion within the second half of the yr. Symbotic additionally acknowledged a 34 million USD cost within the quarter associated to the outsourcing of bot meeting and part stock administration. A part of the restructuring cost was additionally associated to updating older programs in order that all the pieces is standardized going ahead.

Recurring income gross margins at the moment are progressing in the direction of Symbotic’s 60% goal. The advantage of this will likely be pretty restricted within the short-term although, as programs deployment dominate income. Gross revenue margins may transfer into the low to mid 20% vary over the subsequent 2-3 years, pushed by income combine and bettering recurring income margins.

Determine 3: Symbotic Gross Revenue Margins (supply: Created by writer utilizing information from Symbotic)

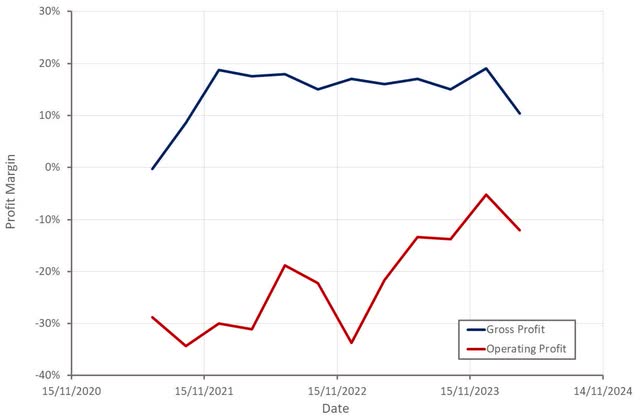

Symbotic’s working margin declined within the first quarter, pushed largely by the drop in gross margin. Inventory-based compensation was elevated although as a consequence of January vesting. Margins ought to bounce again within the third quarter, with the absence of restructuring fees and normalized SBC prices, bringing Symbotic near breakeven. Losses aren’t significantly at this cut-off date although, as a consequence of Symbotic’s typically constructive money flows from working actions and 951 million USD of money, money equivalents and marketable securities.

Determine 4: Symbotic Revenue Margins (supply: Created by writer utilizing information from Symbotic)

Conclusion

Symbotic’s enterprise continues to carry out nicely, with progress remaining strong and margins and money flows typically bettering. The introduction of breakpack and perishable options, together with the dimensions up of GreenBox, must also guarantee fundamentals stay sturdy within the near-term.

There’s trigger for concern, although. Exterior of GreenBox, Symbotic’s backlog has been stagnant for a number of years and the corporate’s income progress is moderating. A softening macro setting additionally creates the chance of consumers pulling again on warehouse investments.

Impartial of this, Symbotic’s valuation stays obscure. Symbotic’s EV/S ratio remains to be near 10, which is extraordinarily excessive given the corporate’s comparatively low gross margins and the non-recurring nature of most of its income. From a technical perspective, if Symbotic’s share value does not maintain close to present ranges, there could also be little help till the low 20s and even excessive teenagers.

[ad_2]

Source link

![[WEBINAR] Exploring Options Volatility: Key Properties, Trading Strategies & Backtesting](https://equitytracknews.com/wp-content/uploads/https://dt99qig9iutro.cloudfront.net/production/images/meta-images/Options-Volatility-Tradng-Webinar.png)