[ad_1]

Robert Method

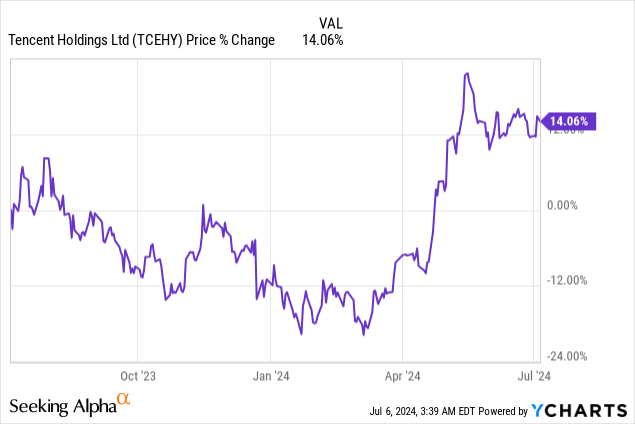

Shares of Tencent Holdings Restricted (OTCPK:TCEHY) maintain buying and selling at an undeservedly low price-to-earnings ratio regardless of the Chinese language know-how firm reporting respectable Q1’24 outcomes. Tencent represents good worth, for my part, as a result of the communications agency is rising, particularly in internet advertising. The firm’s concentrate on controlling prices is paying off within the type of surging gross income and Tencent continues to generate a ton of free money circulate. In my view, an funding in Tencent displays a excessive security margin and U.S traders are too hesitant to purchase into promising Chinese language large-cap!

Earlier score

I rated Tencent a powerful purchase in April 2024 attributable to a fast-growing internet advertising enterprise in addition to sturdy core enterprise profitability. Whereas I additionally referenced Tencent’s low valuation on the time, shares of the tech agency are nonetheless extensively undervalued given the corporate’s favorable enterprise traits. With Tencent additionally seeing sturdy free money circulate within the final quarter and posting free money circulate margins in extra of 30%, I consider Tencent is enticing as a capital return play going ahead.

Stable development in Q1’24, surging gross income

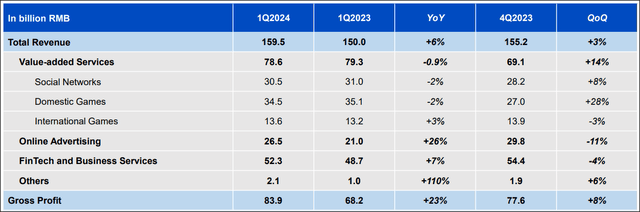

Within the first fiscal quarter, Tencent noticed a 6% improve within the prime line and quarterly revenues of 159.5B Chinese language Yuan ($22.5B). Tencent is likely one of the prime three Chinese language massive caps and owns numerous on-line and social media companies. Tencent is doing particularly effectively in internet advertising proper now, with the Q1’24 earnings card exhibiting a 26% 12 months over 12 months development charge on this important enterprise. Whereas Tencent’s prime line development has moderated within the final couple of years attributable to slowing development in China’s economic system, partly attributable to COVID-19, the trajectory in gross income appears promising.

Tencent

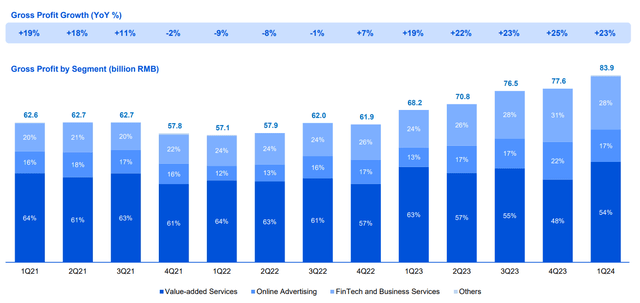

Tencent’s gross income are in an upsurge (+23% Y/Y) and hit 83.9B Chinese language Yuan ($11.8B) within the March quarter. Driving this development is a stricter concentrate on prices and a revisit of strategic priorities. For instance, to focus extra on profitability, Tencent simply determined to close down its on-line schooling platform which has about 400M customers.

The choice to close down the web schooling enterprise is pushed by a want to refocus consideration on the corporate’s core companies, resembling communications. Tencent, which is usually referred to as China’s FaceBook, is the proprietor of Weixin, often known as WeChat, which is the most important communications app in China with 1.4B month-to-month lively customers.

Tencent’s ‘Worth-Added Providers’ which incorporates the agency’s social networking enterprise is accountable for greater than half (54%) of the corporate’s gross income… with one other 17% contributed by internet advertising. The internet advertising enterprise, which I discussed in April as underpinning my bullish outlook for Tencent, is by far the fastest-growing core enterprise for the Chinese language firm.

Tencent

Capital return potential

Apart from gross revenue momentum, a refocus on core enterprise actions, resembling social media and internet advertising, Tencent may doubtlessly grow to be enticing as a capital return play for traders.

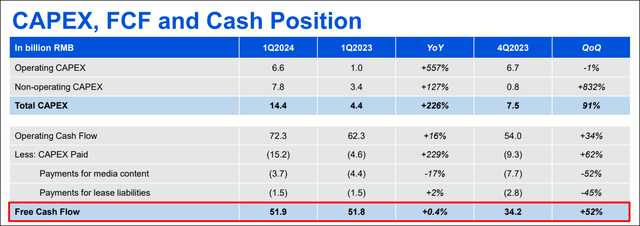

The explanation behind that is that Tencent is producing fairly a bit in free money circulate and the rebounding internet advertising enterprise paired with strategic price cuts has led to vital free money circulate tailwinds within the final quarter. In the latest quarter, Tencent generated 51.9B Chinese language Yuan ($7.3B), exhibiting 52% quarter over quarter development.

The free money circulate margin expanded as effectively and was a powerful 33% in Q1’24 in comparison with 22% in This fall’23. A big a part of this free money circulate may get returned to shareholders sooner or later and Tencent may subsequently grow to be rather more enticing for traders from a inventory buyback perspective. For the present fiscal 12 months, Tencent has introduced plans to purchase again 100B Hong Kong Greenback ($12.8B) value of its shares. In Q1, Tencent repurchased 51M shares in Hong Kong for a complete consideration of 14.8B Hong Kong Greenback ($1.9B).

Tencent

Tencent’s valuation

Like Alibaba (BABA) and Baidu (BIDU), Tencent is buying and selling for an unreasonably low price-to-earnings ratio. Tencent is valued at a 13.9X P/E ratio, primarily based off of FY 2025 earnings estimates, in comparison with 8.1X for Alibaba and seven.6X for Baidu. All three Chinese language large-caps are low cost primarily based off of earnings, for my part, and Alibaba and Baidu clearly symbolize even deeper earnings worth than Tencent does. Particularly Alibaba may be thought-about a capital return play in addition to the e-Commerce agency not too long ago introduced a particular dividend and is about to purchase again extra shares going ahead.

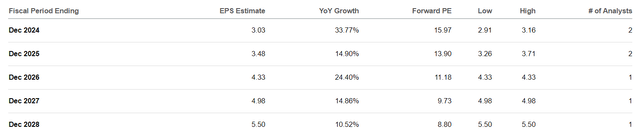

Tencent has deep earnings worth as a result of its earnings per-share are rising quicker, nevertheless: each Alibaba and Baidu are anticipated to generate adverse EPS development this 12 months whereas Tencent is projected to see 34% earnings per-share development, attributable to a complete price restructuring and continuous momentum in internet advertising.

Given the power of Tencent’s free money circulate and gross income, stronger EPS development and momentum in internet advertising, I’m elevating my honest worth P/E ratio from 15X to 15-16X which means a good worth vary of $52-56. It is a dynamic quantity and will lower or improve primarily based off of Tencent’s core enterprise momentum, free money circulate margins and progress by way of shopping for again discounted shares available in the market.

Searching for Alpha

Dangers with Tencent

The largest danger for Tencent is that the corporate may see slowing development in its on-line adverts enterprise… which is the place all of the motion is true now for the corporate. As I stated previously, a possible Taiwan invasion might be a danger issue for Chinese language equities typically. What would change my thoughts concerning the tech firm is that if it noticed moderating prime line development in its social media companies or a deterioration of its free money circulate (margins).

Last ideas

Tencent has rather a lot to supply and presumably rather more than traders are keen to confess. Whereas Tencent has been extensively out of favor with U.S. traders — as have Alibaba and Baidu — the corporate is rising its gross income shortly, seeing sturdy underlying free money circulate and shares are low cost. Alibaba additionally not too long ago stepped up its inventory buybacks and paid a particular dividend… strategic selections that had been at the least partially directed at making shares extra enticing to traders exterior of China. Tencent’s core enterprise is doing effectively, particularly internet advertising which along with a extra severe concentrate on price controls has led to improved profitability. Shares are nonetheless low cost and the valuation, for my part, displays a excessive security margin!

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link