[ad_1]

Up to date on August twenty sixth, 2024 by Bob Ciura

Beer shares, identical to different beverage shares, are available a number of completely different types. Firms which are engaged within the beer business provide direct publicity by means of manufacturing and distribution of beer, whereas different corporations in adjoining industries provide oblique publicity by means of fairness stakes in beer corporations.

The beer business is engaging for long-term earnings traders. Beer corporations take pleasure in great recession-resistance and constant income, that are used largely to pay dividends to shareholders.

With this in thoughts, we created a downloadable spreadsheet that focuses on beer shares. You possibly can obtain our full Excel spreadsheet of beer shares (with essential monetary metrics like dividend yields and payout ratios) by clicking the hyperlink beneath:

This text will talk about the highest 5 beer shares, every of which provide traders sturdy aggressive benefits and first rate long-term progress prospects.

Consequently, they could match properly within the diversified long-term dividend progress portfolios.

The next shares had been chosen in accordance with the Certain Evaluation Analysis Database. The 5 beer shares are ranked in accordance with their 5-year anticipated annual returns, in ascending order from lowest to highest.

Desk Of Contents

You should utilize the next hyperlinks to immediately leap to any particular inventory:

Beer Inventory #5: Constellation Manufacturers (STZ)

5-year anticipated annual returns: 2.5%

Constellation Manufacturers was based in 1945 and has grown into a worldwide alcoholic beverage big, producing and distributing over 100 manufacturers of beer, wine, and spirits, together with Corona, Modelo Especial, Modelo Negra, Pacifico, Ballast Level, Funky Buddha Brewery, SVEDKA Vodka, Casa Noble Tequila and Excessive West Whiskey.

Constellation Manufacturers declared a $1.01 quarterly dividend on April tenth, 2024, which represented a 13% enhance.

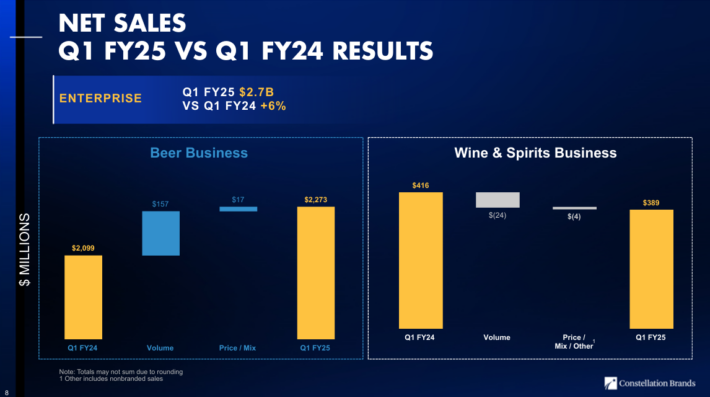

On July third, 2024, Constellation Manufacturers reported first quarter fiscal 2025 outcomes for the interval ending Could thirty first, 2024.

Supply: Investor Presentation

For the primary quarter, the corporate recorded $2.66 billion in web gross sales, a 6% enhance in comparison with the identical prior 12 months interval. Beer gross sales improved by 8% year-over-year, whereas wine and spirits gross sales declined by 7%.

Comparable earnings-per-share equaled $3.57 for the quarter, which was a 17% enhance in comparison with Q1 2024, and 12 cents forward of analyst estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on STZ (preview of web page 1 of three proven beneath):

Beer Inventory #4: Anheuser-Busch InBev SA/NV (BUD)

5-year anticipated annual returns: 6.2%

Anheuser-Busch InBev SA/NV is the most important brewer on the earth because of the 2008 merger of InBev and Anheuser-Busch and the 2016 acquisition of SABMiller.

The corporate produces, markets and sells over 500 completely different beer manufacturers around the globe and owns 5 of the highest ten beer manufacturers. These embrace Budweiser, Stella Artois and Corona.

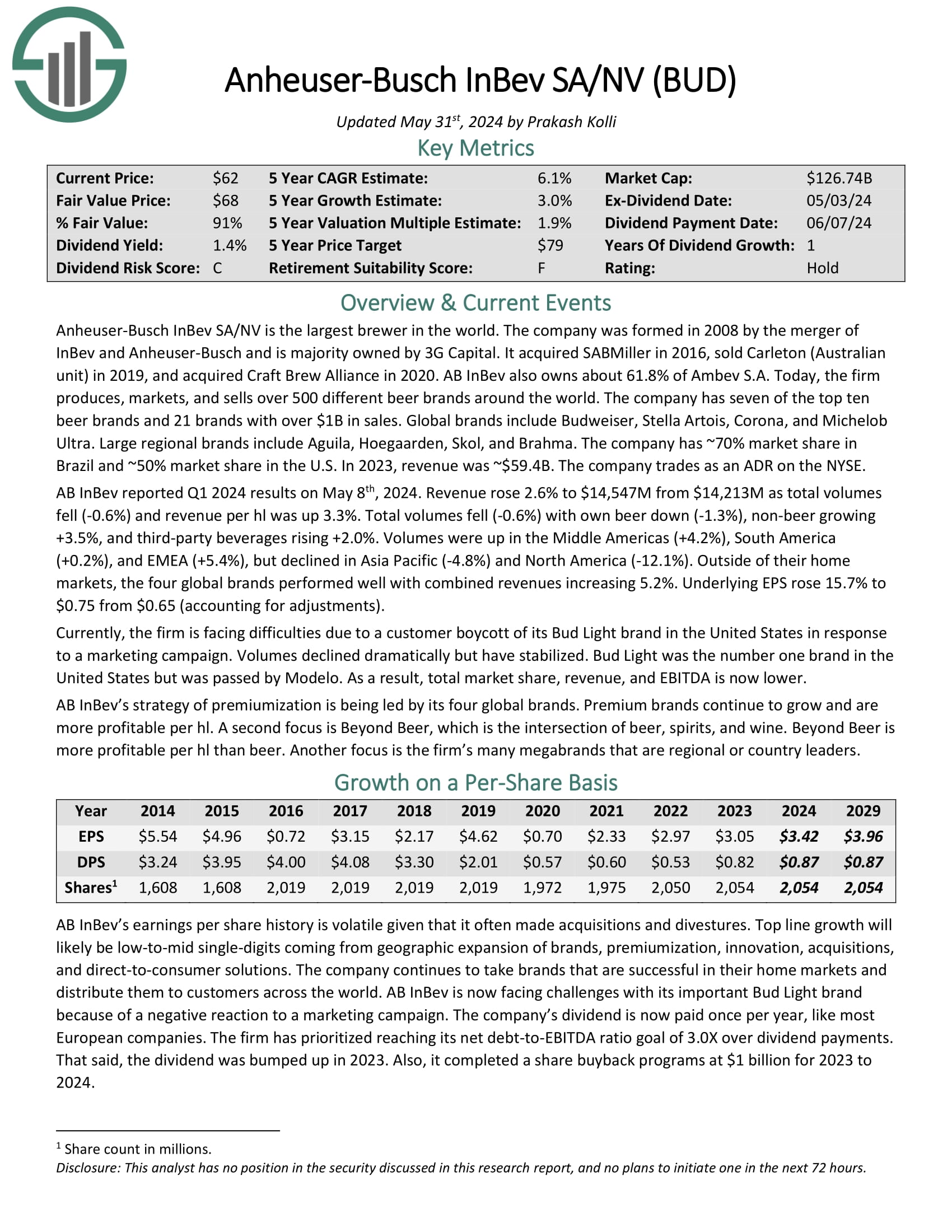

AB InBev reported Q1 2024 outcomes on Could eighth, 2024. Income rose 2.6% as complete volumes fell 0.6% and income per hl was up 3.3%.

Supply: Investor Presentation

Beer volumes declined -1.3% year-over-year, with non-beer volumes rising 3.5%, and third-party drinks rising 2.0%. Underlying EPS rose 15.7% to $0.75 from $0.65 (accounting for changes).

The corporate’s dividend is now paid as soon as per 12 months, like most European corporations. The agency has prioritized reaching its web debt-to-EBITDA ratio purpose of three.0X over dividend will increase. That mentioned, the dividend was bumped up in 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on BUD (preview of web page 1 of three proven beneath):

Beer Inventory #3: Altria Group (MO)

5-year anticipated annual returns: 6.8%

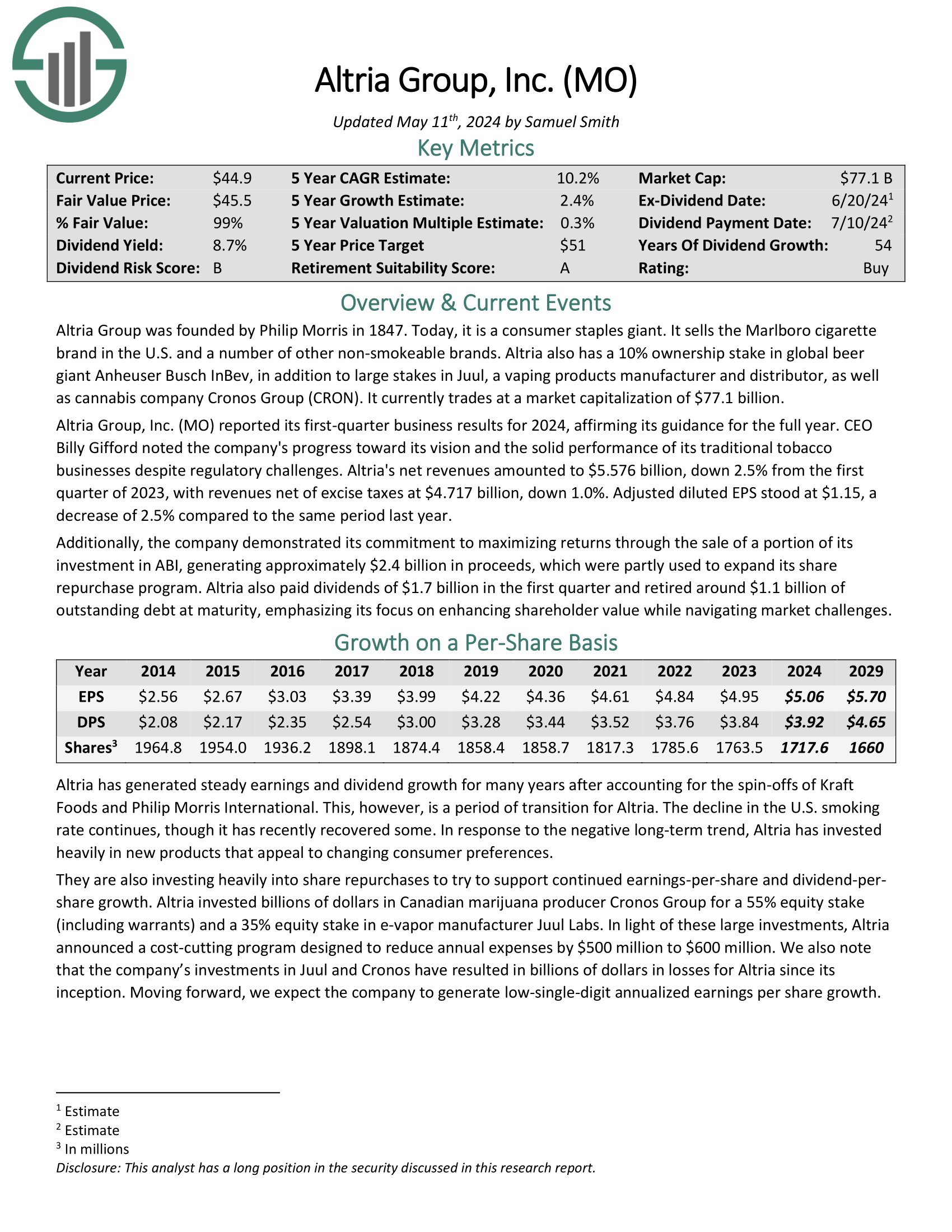

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra underneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

Altria has a sizeable funding in beer by means of its fairness stake in Anheuser-Busch InBev. Altria owned roughly 10% of BUD, however lately introduced it’s going to promote a portion of its funding.

Within the 2024 first quarter, Altria’s web income of $5.576 billion declined 2.5% from the primary quarter of 2023, with income web of excise taxes at $4.717 billion, down 1.0%.

Adjusted diluted EPS stood at $1.15, a lower of two.5% in comparison with the identical interval final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

Beer Inventory #2: Molson Coors Brewing Firm (TAP)

5-year anticipated annual returns: 11.1%

Molson Coors Brewing Firm was based all the best way again in 1873 and has since grown into one of many largest U.S. brewers, with quite a lot of manufacturers together with Coors Gentle, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, in addition to the Miller manufacturers together with Miller Lite.

On February thirteenth, 2024, the corporate introduced an 8% enhance to the quarterly dividend to $0.44 per share.

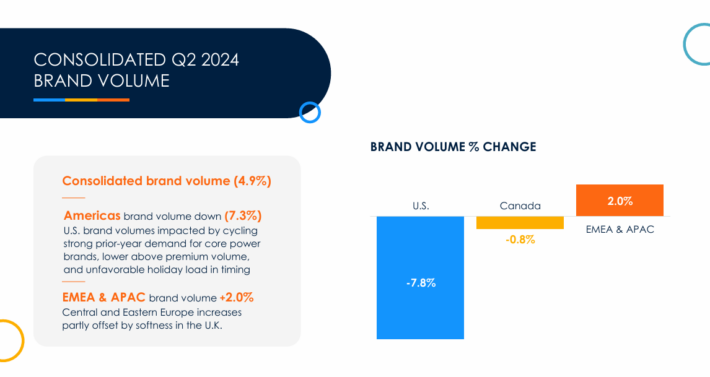

On August sixth, 2024, Molson Coors reported second quarter 2024 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate generated web gross sales of $3.25 billion, a 0.4% lower in comparison with Q2 2023.

Supply: Investor Presentation

Internet gross sales declined 1.7% in Americas, however improved 5.3% in Europe, the Center East and Africa, and Asia-Pacific.

Reported web earnings equaled $560 million or $2.03 per share in comparison with $441 million or $1.57 per share in Q2 2023. On an adjusted foundation, earnings-per-share equaled $1.92 versus $1.78 prior. The corporate repurchased $375 million of its shares in H1 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on Molson Coors (preview of web page 1 of three proven beneath):

Beer Inventory #1: Diageo (DEO)

5-year anticipated annual returns: 11.6%

Diageo is among the oldest and largest alcoholic drinks corporations. It dates all the best way again to the seventeenth century and at this time owns 20 of the world’s high 100 spirits manufacturers. Diageo producers well-liked spirits and beer manufacturers, similar to Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and plenty of extra.

On July thirtieth, 2024, Diageo launched earnings outcomes for fiscal 12 months 2024 for the interval ending June thirtieth, 2023. For the 12 months, the corporate earned $6.91 per share, which was 5% above the prior 12 months’s consequence, however properly beneath estimates. Internet gross sales decreased 1.4% whereas natural progress was decrease by 0.6%.

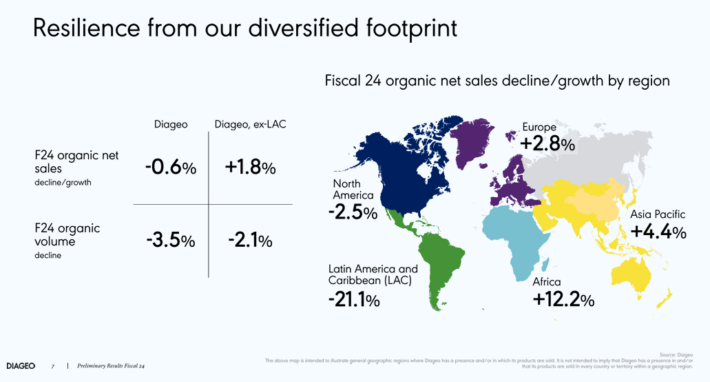

Supply: Investor Presentation

A small profit from pricing and blend was greater than offset by a 3.5% lower in quantity. Most areas carried out properly. Natural income progress for Africa, Asia Pacific, and Europe totaled 12%, 4%, and three%. North America was down 3% whereas Latin American and Caribbean was down 21%.

The lower in North America was as a consequence of a cautious shopper market and difficult comparable intervals. Whole market share grew or held regular in 75% of the portfolio, which in comparison with 70% in fiscal 12 months 2023. Premium-plus manufacturers accounted for almost all of web gross sales.

Click on right here to obtain our most up-to-date Certain Evaluation report on Diageo (preview of web page 1 of three proven beneath):

Last Ideas

The beer business has quite a few gamers with world diversification and robust aggressive benefits. Every provides traders a singular angle in the marketplace. Some focus closely on particular person geographies, similar to Molson Coors within the U.S. market and Ambev in Latin America, whereas Altria provides oblique publicity to the beer business by means of its stake in AB InBev.

Firms that function in beer broadly take pleasure in sturdy revenue margins, and the power to face up to even the deepest recessions. Beer ought to proceed to see regular demand every year, and the most important beer shares take pleasure in excessive revenue margins because of their capacity to boost costs over time.

These beer shares have constructive progress prospects and return money to shareholders by means of hefty dividends. Danger-averse earnings traders searching for regular dividend payouts ought to take a more in-depth have a look at beer shares, significantly in unsure financial occasions.

Additional Studying

In case you are all for discovering high-quality dividend progress shares, and different earnings investing alternatives, the next Certain Dividend sources shall be of curiosity to you.

Blue Chip Inventory Investing

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link